IVF is a procedure that can help women realize the joys of motherhood. However, this advanced treatment procedure requires future parents to have great funds. If you’re determined to conceive a child with IVF, start learning about financing options early.

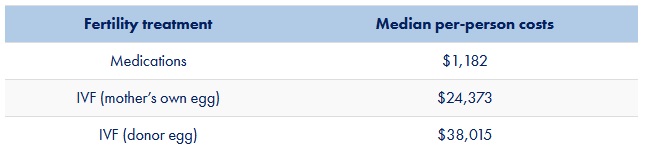

An average, but hardly the biggest cost of such operation is $23000, for a single woman and a single try. You may need to perform more than one cycle of IVF before having a baby.

If you don’t acquire the assets to cover the cost of such intervention and your health insurance doesn’t allow charging it, consider financing possibilities from various funding sources and an IVF medical loan, in particular. How to get such a loan for self-employed? Keep reading.

Get a Loan for IVF When Self-Employed

There are categories of borrowers that require special attention from lenders. These are borrowers with poor credit, without income proof, jobless or self-employed. Rest assured, lenders have developed special loan features for all of these borrowers and issue loans based on various income types or on recent tax returns.

Freelancers or business owners applying for IVF loans or other lending options get more than just financial assistance but also guidance and support through the loan process. After successful cooperation they get access to other credits like business loans or emergency loans online and can learn about investment plans. Partnering alternative lenders pays back immediately.

What Are These Loans?

An IVF loan is a specific type of loan taken by borrowers who want to go through in vitro. The loan giver issues a whole lumpsum of money to either cover one or multiple therapy sessions. In addition to the original loan amount, the borrower also faces the APR which is determined by the borrower’s credit score.

How Do the Loans Work?

Loans that cover medical treatment go under the category of best personal loans. This type of loan is an unsecured one, so there’s no risk of losing assets (on the contrary to home equity loans). The loan for IVF treatment implies fixed installments each month to cover the loan balance with interest.

A quick pre-qualification at a lender’s website can demonstrate the loan amount and interest you can hope for. This feature doesn’t affect your credit. Also, you and lender can agree on different interest and loan terms once you switch to a full-on application process.

How Much Does This Loan Cost?

A loan to pay for IVF may be taken out for many purposes, even if it’s a regular check-up with your OB-GYN. That’s why the sums given out to borrowers range from $1,000 up to $100,000. The loan sum varies among lenders online is mostly determined by the borrower’s repayment abilities.

Some lenders partner fertility clinics and vice versa. This makes it easier for borrowers to transfer money for fertility treatment onto the clinic’s bank account.

In any case, the IVF loan calculator can predict your monthly loan repayments for the sum you qualify for.

How Can I Find the Right Loan for My Needs?

When the future happiness is at stake, borrowers must seize the best loan companies for IVF. To identify those, you must research their medical loan features and terms.

Traditionally, borrowers look at the lender’s:

- Approval rate;

- APR;

- The simplicity of application process;

- The speed of money transactions;

- The variety of loan types;

- The biggest loan amount possible.

Some borrowers will also enquire about IVF loans for bad credit. Poor credit isn’t typically an issue for private lenders, although they will calculate the APR based on it.

How to Apply for This Loan?

IVF loan options as surrogacy loans are all visible online today. You can quickly browse through options for parents to pay for in vitro fertilization via your smartphone and even apply with it.

Lender’s websites are all equipped with an online application form, where you input required personal and banking details and then see estimated loan amount and rates.

If you apply through a financial adviser website with lenders’ reviews, you can receive numerous offers from lenders, compare rates and terms and choose the lender who meets your wishes.

Taking a loan for IVF through online creditors is much more prompt and accessible than at banks or credit unions as you can get assistance with loan management and apply for loan extension any time.

Additional IVF Loan Options

#1 HELOC

Home equity loans can also be utilized to cover in vitro treatment procedures. They are given at a fixed loan period and secured monthly payments. Home equity loans draw the attention of borrowers due to bigger loan amounts and lower rates. These two aspects are secured with collateral, which a borrower might lose if he fails to repay the loan within definite time. Check what credit score needed for IVF loan with collateral before applying.

#2 HSA

Health savings accounts can only cover a part of one IVF cycle as they allow you to draw $2,750 from a high-deductible health plan at best. So, to save the money on interest, you can divide the IVF cost between your HAS and a lender’s loan.

#3 Credit Card

Some credit card companies provide a 0% interest on expenditures within a definite period. You may charge an in vitro cycle with such credit card, but be sure to repay the full balance before the 0% APR period ends. Also, it may be hard to come across a credit card company allowing 0% APR for IVF purposes. So, better find out how to get a loan for IVF with low interest from reliable lenders.

#4 Grants

In order to raise demographic figures, some states will give out fertility grants. The upside to this plan is that you don’t repay the granted sum of money, but not always this lumpsum will match the whole cost of the cost of medical care. Other hospital expenditures can be easily covered by a loan. The IVF loan amount starts from $1000 which can be enough to pay for small medical expenses. Check what score for IVF loan guarantees the lowest APR and how to better your credit score if you have the time.