Speed

Receive payments quickly, without any hassle or delays.

No more waiting in long lines or filling out paperwork.

Your data is secured with 256-bit encryption.

Funding in as little as a business day.

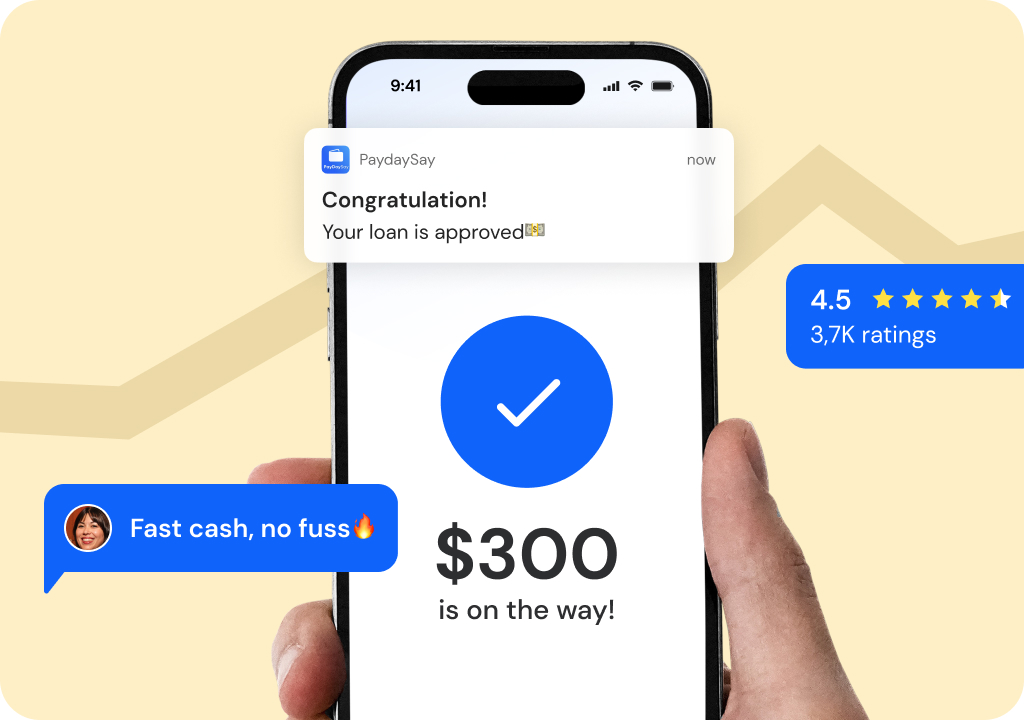

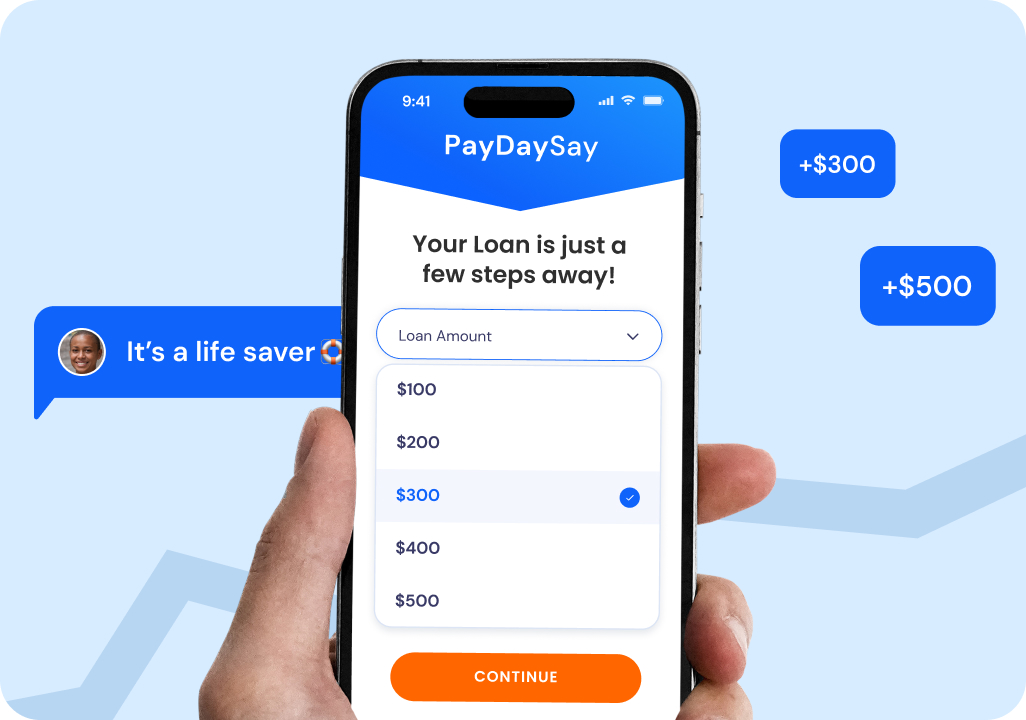

Using the PayDaySay app, you may get from $100 to $5,000

Personal loans are issued to qualified requestors and can be used for a variety of needs and purposes. Simply fill out the online form and you could receive a loan for up to $5,000!

Receive payments quickly, without any hassle or delays.

Access your funds anytime, anywhere, with just a few taps.

Highly encrypted platform ensures the safety of your financial data.

Eliminate the need for complicated, time-consuming paperwork.

Request funds to have money at your fingertips! Submit an online form anytime from anywhere, and we’ll process your request in no time.

If approved, receive an offer with transparent and fair terms, review the terms, and accept!

Access your funds quickly with our hassle-free process for quick deposits to have your funds, when you need them.

Need money now? You could be steps away from financial relief!

Website has penalty info. Be careful with withdraw amount. Consider waiting, saving to avoid contract.

Explore our comprehensive review articles to compare lenders and gain a clear understanding of their terms and features.

Check credit report for errors. Good Credit = Better Loan Eligibility. Pay bills on time, repay to good credit.

To qualify for a loan from PaydaySay, you typically need to meet certain criteria, such as having a steady income, being at least 18 years old, possessing a valid bank account, and residing in a state where PaydaySay operates. Credit history may also be considered.

Borrowing through the PaydaySay App can affect your credit score. If the loan is reported to credit bureaus and you make timely payments, it could positively impact your score. However, late or missed payments can negatively affect your credit score.

The time to receive money after borrowing from PaydaySay varies, but it’s often quite fast. Once your application is approved, the funds could be deposited in your bank account as soon as the next business day, depending on your bank’s processing times.

To get a $100 loan, you typically need to submit an application either online or through the PaydaySay App, providing necessary personal and financial details. Approval may depend on meeting their eligibility criteria and the verification of your information.

To apply for instant 24/7 loans with PaydaySay, you can use their online platform or mobile app at any time. Complete the application form by providing required details such as your income, employment, and bank information. Instant loans are subject to approval based on your qualifications and the lender’s criteria.

Financial surprises can hit anyone: an unexpected medical bill, car trouble, or a sudden expense can throw off even the best budgets. That’s where the PayDaySay app steps in, providing a quick solution to an age-old problem. This app gives you fast access to request cash to handle urgent costs before your next payday, avoiding the long waits of traditional loans.

PaydaySay is here to make things easy and fast. Our legit payday loan app is available 24/7 on your phone, offering a straightforward way to borrow money. Whether you’re dealing with an unexpected bill or need a little extra cash to get by, PaydaySay is ready to assist.

We streamline the reques process and connect you with trustworthy lenders, ensuring you’re just a few taps away from your needed support. Choosing PaydaySay means more than just securing a loan; it’s about empowering yourself to face financial challenges with a reliable ally by your side.

With PaydaySay, you use a premier online loan app that provides fast and secure financial support. As the preferred money loan app, we’re committed to helping you lend you money quickly and safely. PaydaySay is the trusted choice for those who value efficiency, security, and reliability in financial assistance.

PaydaySay revolutionizes financial emergency management with its 24/7 money request app, making it effortless to get your money swiftly. This service is designed to offer support directly from your smartphone, ensuring that fast cash requests are always within reach.

Ease of Access with PaydaySay

1. Begin with an Online Request.

Launch your journey to financial relief by providing basic details. Whether you’re using a traditional bank account or a modern alternative like Chime with its Spotme feature, our process is streamlined for simplicity. Our mobile app, available for download on both the App Store and Google Play, is crafted for ease, allowing you to enjoy it on your iPhone or any mobile device. The best part? It’s free to download, inviting everyone needing a quick financial boost to get started without delay.

2. Quick Match with Direct Lenders.

Skip the wait and connect with direct lenders through our premier service. Our application facilitates a rapid connecting process, ensuring you can get a cash advance without the usual hassle. With PaydaySay, securing your cash advance request is quicker than ever, reflecting our commitment to providing timely assistance.

3. Secure and Access Your Funds.

Achieve peace of mind with loans deposited directly into your account, including features like overdraft protection. Our app welcomes all users, regardless of credit history, and offers a straightforward way to take an advance. While our app and service are free, we offer the option for users to support us with a voluntary tip, highlighting the value of our assistance.

PaydaySay stands out as not just an app but a reliable partner in navigating financial hurdles, ensuring you can get your fast cash advance efficiently. Whether you’re in a pinch and need a cash advance or are seeking a dependable solution for future needs, PaydaySay empowers you to manage your finances on your terms, stress-free.

When instant money is needed before your next payday comes, the PayDaySay cash app stands out as a reliable and efficient lending solution across the country. This app redefines the ease of borrowing money until payday, eliminating the extensive paperwork often associated with traditional loans.

The PayDaySay app offers a streamlined approach to securing a quick cash advance. For those with an active checking account pondering the maximum they can borrow money without the usual hassle, our platform offers a clear solution. You can access advance amounts from $100 to $5,000, catering to a variety of urgent financial needs.

Whether it’s to cover unexpected expenses or to help bridge the gap until money you need arrives, PayDaySay provides the quick money support you require. Our services are designed to be inclusive, allowing you to borrow money without the worry of credit history constraints. This inclusivity ensures that a broad spectrum of needs and objectives can be met, with results for amounts up to $5,000 made simple and tailored to fit your personal financial goals.

With PayDaySay, tapping into the money you’ve already earned is straightforward and hassle-free. We’re not just another cash advance app; we’re your dependable resource for when a quick cash advance is critical. Our mission is to offer you the advance amount you need, providing the essential financial support at the moment you need it most.

In money borrowing apps, users often seek the most efficient way to secure short-term loans. The allure of payday loans has significantly increased, with many opting to allocate their earnings through these platforms rather than focusing on financial discipline. With the rising cost of living and average incomes struggling to keep pace, it’s tempting to turn to money borrowing apps for quick financial relief, especially when expenditures unexpectedly spike.

Using a money lending app like PaydaySay provides a convenient solution, allowing access to funds even before your next pay period, without the stringent requirements of credit card companies that often necessitate a hard credit check—which might affect your credit score. In contrast, the PayDaySay app usually opts for a soft check, which helps in credit monitoring and maintaining a healthy credit score.

A good credit score is essential for securing loans without the burden of hidden fees or high annual percentage rates (APR). When applying for loans, it’s crucial to detail an active debit card or checking account and to borrow mindfully. While these funding apps offer a lifeline during financial shortfalls, it’s advisable to borrow only what you need, keeping in mind the potential for late fees and fees or interest that may apply.

The concern over credit checks should not dissuade you from utilizing these services. Many money borrowing apps perform only soft checks, especially if you maintain enough money in your account to avoid dipping into the negative. Responsible use of these platforms is key, ensuring you’re fully prepared to manage the funds credited to you.

For those living paycheck to paycheck and finding themselves saying, “I don’t have enough money,” it’s crucial to understand the terms, like any applicable monthly fee or annual percentage, to avoid financial strain.

Prompt repayment of any borrowed amounts is essential when dealing with unforeseen expenses to avoid late fees and other financial challenges. With PaydaySay, you’re encouraged to borrow responsibly, leveraging the convenience of immediate funds while staying mindful of your financial health and obligations.

Selecting an app for financial lending services is crucial for a positive borrowing experience. PaydaySay stands apart with several advantages tailored to the borrower’s convenience and requirements. A standout benefit of using PaydaySay is its efficient request process, which simplifies the way users apply and receive loans, promising a smooth experience from beginning to end.

The Payday Say app is renowned for offering competitive interest rates, positioning it as an economical choice among the best cash advance apps for those seeking short-term financial aid. Our flexibility in loan amounts, allowing borrowers to access funds from $100 up to $5,000, addresses a broad spectrum of financial situations, from unexpected bills to making ends meet until the next paycheck.

A key feature of PaydaySay’s service is its dedication to user privacy and security. Employing state-of-the-art encryption and security protocols, the app safeguards personal and financial details, ensuring user confidence. Moreover, PaydaySay’s network of esteemed lenders enhances the chances of loan approval, providing a dependable avenue for acquiring the funds you need within one business day.

Before making your choice, it’s wise to read reviews and compare customer ratings to gauge the app’s performance and user satisfaction. PaydaySay’s ratings and reviews reflect its status as a great app, frequently recommended by those looking for a reliable loan service. Prospective users might also like to explore other features and services based on customer ratings, ensuring they make an informed decision.

To truly understand what sets PaydaySay apart, read customer reviews and see how it compares to other apps. These insights can guide you toward choosing the loan app that best fits your financial needs, ensuring you partner with a service that values your security, offers flexibility, and provides competitive rates.

Discover the best financial solutions and get answers to common questions, empowering you to make informed and confident decisions. Our service, recognized as one of the premier financial aids, has helped thousands navigate through short-term financial hurdles, showcasing the benefits of cash advance apps.

Even if you’re facing a tight budget or dealing with less-than-perfect credit, our platform offers a lifeline with minimal eligibility requirements. We’re here to demonstrate that managing personal finances can be straightforward, offering quick cash advances without the stress of hidden fees or high APR (Annual Percentage Rates).

Understanding the importance of flexibility, we facilitate global money transfers and enable you to easily receive money. Whether you’re considering advances and payday loans for immediate needs or leveraging our services for payday loans to pay later, we ensure access to the funds you need as fast as possible.

Our web platform simplifies the request process, allowing you to connect with multiple lenders with just one request. This means quicker advance and pay options, the ability to let you access your pay, receive your paycheck early, and enjoy delivery of funds. With us, you can borrow money from your next paycheck, pay it back at a convenient time to pay, and even send money to friends and family without undue stress.

Moreover, our cash advance app lets you request your fast funding seamlessly, making it easier than ever to manage your finances without worrying. The app also supports those getting a payday loan, providing a reliable financial backup when you need it most.

Choose us for a smarter way to manage your finances, where fast access to funds meets unparalleled convenience and security.

Get in touch

24/7 We will answer your questions and problemsError

One moment, pulling up that offer for you...