In March 2026, when it comes to getting instant cash, Dave has been a leading app, allowing you to obtain a quick advance amount with 0% APR. However, it’s important to note that Dave has certain limitations, including a relatively small limit. To help you explore the best apps like Dave that offer similar features, we’ve compiled a list for your convenience.

Our selection features 12 apps that allow you to get a cash advance. Some of these apps operate on a subscription model, granting you access to instant cash advances at a 0% APR, typically for a monthly fee ranging from $1 to $12.

Others offer a diverse array of lenders, enabling you to select the one that best suits your needs. No matter your preference, this article will guide you to the ideal cash app borrow, much like Dave, that aligns with your requirements.

Many apps have features like managing your money effectively, offering a limit that suits your needs, and even cash-back incentives.

They can serve as a valuable alternative to traditional banking services, helping you avoid overdraft fees while providing convenience. So, if you’re seeking an app with cash advance features similar to Dave’s, you will find a suitable option among the recommendations in this article.

Loan Apps like Dave: Best Choices in March 2026

You should know a few things if you’re looking for the best apps for 500 cash advances. While Dave is a well-known cash advance service, it does come with some significant limitations:

- Cash Advance Amount: Dave allows you to borrow a maximum of $500 if you’ve been using the app for a while. New users, however, typically start with a more modest $25-$50 limit on their first loan.

- Repayment Period: One drawback is that you can’t choose your repayment period for the cash advance. Dave automatically deducts the amount you owe from your next payday or the following Friday after you’ve taken the advance.

- Transfer Speed: When it comes to receiving money, be prepared for some waiting. The free transfer of money to your account can take several business days. You can pay an express transfer fee if you need the funds within an hour.

Given these limitations, it’s essential to consider options that do not share these disadvantages when exploring loan apps like Dave. This list comprises apps that function much like Dave, employing a similar model. They aim to help you manage your money effectively while offering interest-free cash advances.

MoneyLion – Best For Existing Customers of the App

MoneyLion is a financial management and credit-building application. Its main products are investment accounts, financial tracking, and credit-builder loans, so if you use them and have a MoneyLion checking account, you can request a cash advance on favorable terms.

The application works as follows:

- The maximum loan amount is $250.

- Time of payment – until your next payday or next deposit to the account (money is automatically withdrawn).

- Speed of receipt of funds – about two days if you use free withdrawal and up to several hours if you pay an express transfer fee of $0.49 to $8.

- The application provides a 0% interest rate loan, but you can pay an optional tip.

An excellent alternative to consider is using apps like Dave to get cash advance, and the best part is you won’t have to commit to a monthly subscription. However, like Dave, these apps have certain drawbacks, including an express transfer fee, a short repayment term, and a relatively modest loan limit.

These apps do not perform any checks when granting you an advance, but they do require you to link your checking account, specifically one that regularly receives funds. The maximum loan amount available to you is determined based on the data from your connected account and your history of using the application.

Users generally express satisfaction with the app, but it’s worth noting that some reviews suggest the support service may not consistently provide accurate responses to inquiries.

PayDaySay – Best For Wide Lenders Base

For those seeking cash through apps like Dave for small cash advances, PayDaySay is an excellent option. Here’s how it works:

- Quick Prequalification: To get started, you’ll need to complete a prequalification form with basic information such as your first name, last name, loan purpose, and Social Security number.

- Instant Soft Credit Check: PayDaySay performs a swift, soft check in just minutes and presents you with a list of numerous lenders willing to provide you with the cash you need, along with their terms and conditions.

- Freedom of Choice: You have the flexibility to review all the offers and select the one that aligns best with your needs and preferences.

With PayDaySay, you can secure a loan ranging from $100 to $5,000, with terms spanning from several weeks to several years. However, it’s essential to note that some lenders, particularly those accommodating individuals with lower credit scores, may charge relatively high-interest rates.

The advantages of this alternative are numerous:

- Speedy Fund Transfer: The majority of lenders accessible through the application can transfer funds to your account within one business day.

- No Employment Proof Required: You aren’t obligated to provide proof of employment or income level to secure a loan.

- No Minimum Credit Requirement: PayDaySay doesn’t impose a minimum credit rating for its users, making it accessible to over 95% of those in need of a loan.

- Wide Lender Network: PayDaySay boasts an extensive network of lenders, with over a hundred of them at your disposal.

- No Hidden Costs: The app is free to use, and there are no monthly subscriptions or extra fees.

Users have expressed their satisfaction with PayDaySay, praising its ability to provide quick and reasonable access to the extra cash they need. So, if you’re looking for apps like Dave that offer an array of cash advance options, PayDaySay is a promising choice.

OppLoans – Best For Bad Credit Loans

Opp Loans is a well-established app for those seeking cash, much like Dave, offering users the ability to access up to $4,000 in their bank account within a single day. Notably, Opp Loans stands out for its approach in that it doesn’t delve into your credit history or set any minimum credit score requirements before presenting you with lending offers.

Here’s a breakdown of the terms and conditions associated with loans through this application:

- APR Range: Opp Loans provides loans with an APR range spanning from 59% to 160%.

- Repayment Term: Borrowers have the flexibility to choose a repayment term ranging from 9 months to three years.

- No Hidden Fees: The application ensures a transparent borrowing experience by steering clear of prepayment, origination, or late fees.

- Free Services: Opp Loans distinguishes itself further by not imposing any monthly subscription fees and offering its services entirely free of charge.

Among the standout features of this app, users frequently commend the swift transfer of funds to their bank account, typically occurring within just one business day. Another noteworthy advantage is that Opp Loans reports borrower activity to all three credit bureaus, which can positively impact your credit history.

However, it’s essential to be aware of certain limitations:

- Income Requirements: Opp Loans does require a minimum monthly income of $1,500, which can be a drawback for some potential users.

- Interest Rates: The interest rates, starting at 59% APR, may be relatively high, and borrowers should consider this factor when seeking extra cash through the app.

If you’re on the hunt for one of the best cash advance apps, much like Dave, that doesn’t delve into checks and offers speedy access to funds, Opp Loans is a robust choice. While it has its conditions and interest rates to consider, its ability to provide quick access to much-needed cash without credit score restrictions sets it apart in the world of apps similar to Dave.

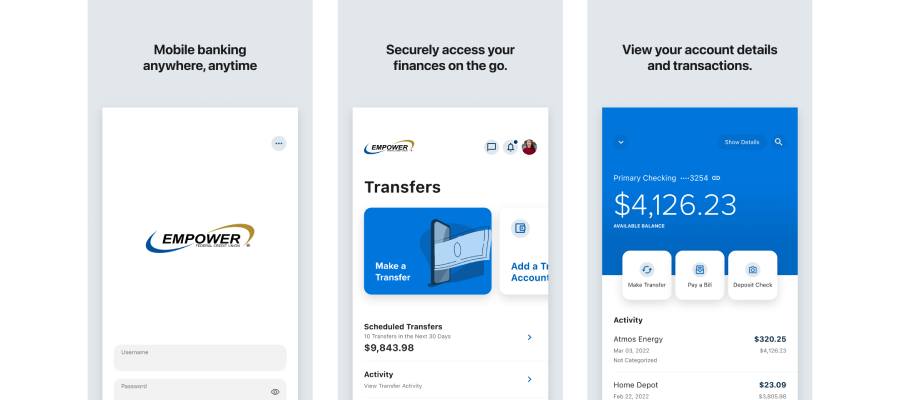

Empower – Best For Fast Cash with 0% APR

Empower is an instant loan application that runs on a monthly subscription business model. In it, you can get from $10 to $250 if you pay an $8 monthly subscription fee.

Payment of credits received in Empower occurs on the next payday. A significant advantage of the application is that you can change your repayment date if you write to support. In addition, the APR on loans is 0%, which can be obtained by a borrower with any credit score, as Empower does not conduct any checks.

Branch – Best For Loans up to $150 per Day

This alternative is best for those who need the money offline via ATM. You can get up to $150 per day or up to $500 before your next paycheck through the Branch app at a high APR of up to 360%.

Based on user reviews, the app is straightforward and has many handy features. For example, you can get an advance and choose your payment date (60 to 336%). However, its main drawback is that it takes up to 3 business days to transfer funds to your account as standard and a paid transfer costs $2.99 to $4.99.

The app does not run any checks before giving you money, but it requires access to your primary bank account to see your expenses and income. You will also need to upload proof of official employment, as Branch does not provide loans to remote employees.

Klover – Best For Small Advances with 0% APR

An alternative called Klover offers small loans starting at $100 to anyone, regardless of their credit rating. To get money through this app, you must provide access to your bank account with more than $250 in it and where you receive your basic income (every one or two weeks).

If you see ads on Klover or take surveys, you can increase your possible loan amount to $130. In addition, the app doesn’t ask you to pay an interest rate on a loan. However, it has a few significant drawbacks:

- You can’t choose a payoff date for the loan, as Klover does this automatically by selecting the closest day you’ll receive your paycheck.

- Waiting time to receive funds into your account can be up to three days, and the instant transfer fee is expensive, up to $14.98.

- You cannot request more than one loan at a time. Once you pay off the first one, you can get a new one two days later – and so on every payment cycle.

- You will have to pay a monthly fee of $2.49 to use the application.

Klover users do not rate its service very highly because it takes so long for support to answer questions.

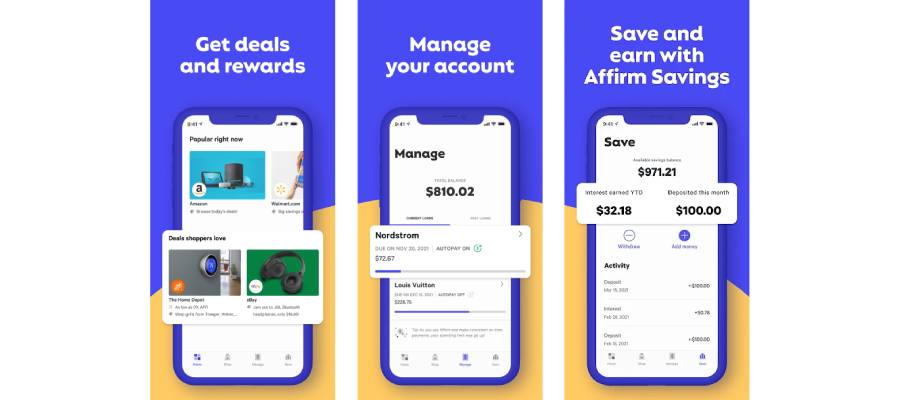

Affirm – Best For Buy Now Pay Later Purchases

This alternative will allow you to make large purchases on credit. Affirm is not very similar to payday loan apps like MoneyLion and Dave; it is more like a bank or financial institution that provides large personal loans.

Affirm will allow you to make a purchase you’ve been dreaming of for a long time and divide the amount into several more affordable payments. The app works with thousands of companies in the U.S., such as Amazon, Walmart, and Nike.

How does Affirm work?

- First, you download the app and sign up for a new account. Next, you provide basic information about yourself so the app can run a soft check.

- The app will assess your creditworthiness and show you what terms you can get.

- When you arrive at one of Affirm’s partner stores (or select an item online), you can use the “buy now, pay later” service. Make your first payment on the spot, and you’re done!

Affirm lets you pay for anything from $50 – $17,500 with 0% APR for three months. In addition, the app has no additional fees and allows you to choose repayment plans (3, 6, 12, and 60 months) at a low APR of up to 30%.

The only drawback of this app that users often talk about is the service. The customer support number is not listed in the app or on the website, so you must communicate with a chat advisor, who often takes a long time to answer. And of course, the problem is that not all stores are Affirm partners, so you can only take advantage of this installment plan in some places.

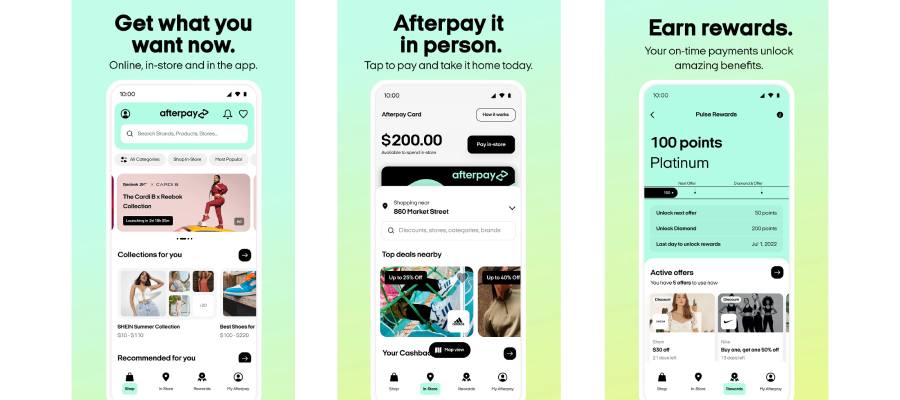

AfterPay – Best For 0% Purchases with BNPL

Another company provides users with small credits for purchases at stores after a soft check. What’s more, credits from Afterpay won’t affect your score because the app doesn’t report to the credit bureau.

Afterpay works on the “buy now, pay later” principle and offers you to divide your purchase amount into four equal payments, the first of which you make while still in the store. The app often offers credit for six weeks, during which you pay ¼ of the purchase price every two weeks. If you miss a payment for ten days or more, you have to pay a late fee of $8.

Overall, this is a great alternative that people often use before the holidays. However, be aware that the customer service at this company is slow to respond, so try to resolve any issues before you’re at the checkout counter in the store.

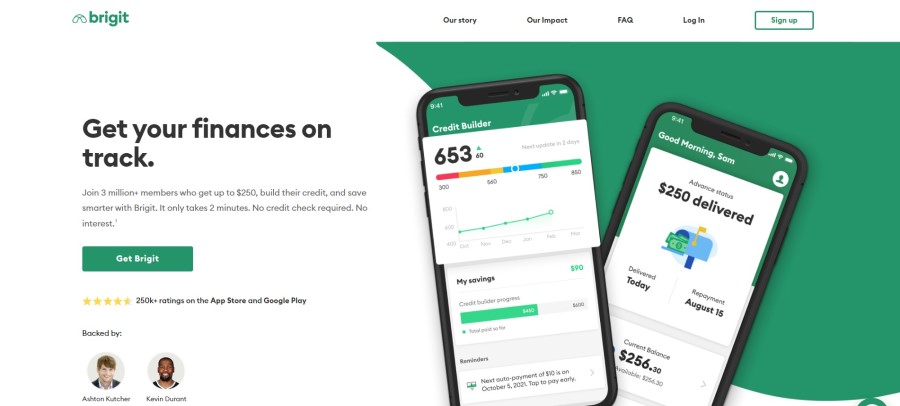

Brigit – Best For Budgeting Tools

This app ranks with Dave in popularity and allows you to borrow up to $250 at any time of the month. The functionality of these apps for instant money is similar – the cash advance apps offer advances at 0% APR for a monthly fee. However, while Dave costs $1 per month, Brigit is priced at almost $10.

This price includes credit monitoring and other budgeting tools, so this may be a good option for those who want to improve their financial literacy. However, if you are only looking for a short-term loan, you may prefer something other than the one that allows you to borrow only up to $250 before your following income.

The good news is that Brigit, unlike Dave, transfers funds quickly to borrowers’ accounts. Even without extra fees, the app transfers money to your bank account the same day if you request it before 10 a.m. or the next business day.

Brigit is also very well-rated on all platforms where it can be downloaded, and users note quick responses from customer support in their reviews.

Chime – Best For Overdraft Protection

This alternative is suitable for those who want to protect themselves from overdraft fees of up to $35 per small tip. Chime does not charge you any fees and provides cash instantly and automatically, which is its significant advantage.

The main drawback of this app is that it is not available to everyone. You must have an active Chime account and transfer at least $200 every month into it to use this feature (you will only get access to fast loans after two months of opening this bank account).

Your first loans will be $20-$25, but your credit limit will increase after each payday (typically on your next payday). In addition, Chime does not run a credit check when you sign up for the app and does not have a minimum credit score.

Overall, this app is not just a cash app like Dave but a supplement – install it on your phone to protect you from overdraft fees.

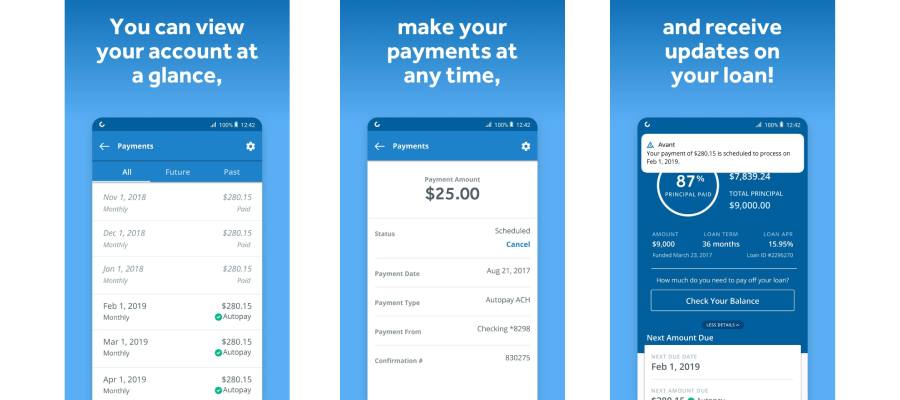

Avant – Best For Personal Loans

Avant is an app for people with bad credit of 550 FICO points or more who want to borrow a large amount of money. Through it, you can get from $2,000 to $35,000 at an APR of up to 36%.

Avant does a credit check before showing you what credit terms will be available. Then, on the app itself, you’ll be able to choose a repayment period of 2 or 5 years and sign a contract with the lender on the same day.

To get the money to your bank account within 1-2 business days of signing the agreement, you will need to provide its details. Getting a big loan through an app like this is easy, but paying it off with all the fees (including origination fees) can be tricky.

Daily Pay – Best For Accessing Your Earned Income

If you’re looking to access your paycheck a few days early without needing to borrow from others, Daily Pay is an excellent option. The primary benefit of this approach is that you won’t incur any APR charges; your only cost is associated with the money transfer.

While this type of app offers a compelling alternative to payday loans, Daily Pay, in particular, has a few considerations to keep in mind:

- Employer Partnership: Daily Pay is usable only if your employer is a partner company.

- Unclear Fees: The app doesn’t clearly specify the exact fees it applies for fund transfers.

- Support Service: Some users have reported concerns about the support service’s response time.

On the flip side, Daily Pay can be a valuable choice for many, as it allows you to access 100% of your earnings before payday. Notably, it doesn’t require a credit check or your Social Security number.

Daily Pay also ensures swift money transfers to your bank account, either immediately or on the same business day. This feature is particularly advantageous if you need cash quickly without going through the hassle of maximum cash advance limits or the complexities associated with traditional borrowing.

Dave For Small Cash Advances: What You Need To Know

Dave is a popular cash advance app that offers easy access to funds without the need for a check or incurring interest charges. In comparison to various alternatives, it boasts a significant advantage: the ability to secure a loan, either online into your bank account or offline in cash via ATMs at a vast network of 32,000 locations.

One of Dave’s key features is its robust overdraft protection through timely notifications, ensuring you avoid unnecessary fees. The cost of using Dave is a mere $1 per month. This app stands out as an excellent choice for those seeking a quick advance for a few days because it offers a single repayment term, aligning with your next payday.

Dave also enables eligible users to receive up to three cash advances, making it a practical and efficient solution for those in need of rapid access to money. Whether you’re looking to manage your finances, Dave is a top app on this list, designed to meet your specific needs seamlessly.

How to Compare the Best Apps Like Dave?

In our evaluation of Dave and its counterparts, we conducted a comprehensive analysis that took into account various critical factors. Our approach encompassed a thorough examination of these apps, including their official websites and user feedback and reviews.

Our assessment was based on a combination of objective data, such as specific financial figures and terms (fees, interest rates, repayment periods, and the scope of services offered) and subjective considerations, such as the quality of customer service.

Service

Users evaluate the application significantly positively; it scored 4.4 out of 5 on the Google Play Store, which is an excellent result for more than 430,000 reviews. In addition, more than half a million Americans have left their ratings for Dave on the Apple app store; the final score is 4.8 of 5 stars.

The only place where there are a lot of bad reviews of the app is the BBB rating website; out of 500 reviews, most have 1 star, and the average rating of the app is 1.2 out of 5.

Users generally note that customer service works well and can answer any question. Considering that this is a weakness of most apps, paying attention to this merit is essential.

Loan Amount

The capability to obtain any desired amount is a fundamental advantage offered by instant loan apps, distinguishing them from Dave. Dave’s limitations become apparent when you consider its maximum borrowing limit of $500, with initial loans often capped at a mere $50 or $100. In response to this constraint, we’ve curated a list of alternative apps in this article that provide the flexibility to request substantial cash.

These apps, much like Dave, empower you to receive the money you need without the same borrowing limitations. They offer the convenience of borrowing more significant sums, ensuring you have access to the funds required to meet your financial goals.

If you’re in search of an app, capable of accommodating your unique needs, this article will introduce you to a range of options, including those with credit builder features and the potential for cash back rewards.

Fees

It’s worth highlighting that among the multitude of apps available, Dave stands out with exceptionally favorable terms. No other app on the market can match Dave’s offer of loans without mandatory tips, coupled with a minimal $1 monthly subscription fee.

Of course, users have the option to leave a tip, but it’s not obligatory. Additionally, for those in need of expedited fund transfers to their account, Dave also offers the choice to pay extra, starting at $2.99 and going up to $11.99. This feature is standard practice in most applications of this nature, ensuring that users can receive the money they need with ease and efficiency.

Interest Rate

Considering that alternative payday loans usually have an APR of 300%-500%, Dave is a very inexpensive option, providing loans at 0% APR.

However, it is crucial to understand that additional fees can count as interest. For example, if you get $100 for seven days through Dave and pay $1, $2 tip, and $4 for instant transfer, it’ll cost $7 to borrow $100, which is a 365% APR.

Waiting Period

We understand that sometimes even one day of waiting can be a severe problem, so we’ve found alternatives to Dave that help you get your loan within one business day.

However, if you need to get your money precisely the same day, you’re better off choosing other apps like Dave with a paid transfer option. It’s better to do so because no app can guarantee a free same-day withdrawal.

Credit Check

When a lender requests the credit bureau to get information from your report, this is called a hard credit check. This is because lenders often have specific requirements for borrowers, such as a good credit score, and they do this check to see if you qualify.

However, a credit check can be a barrier to getting a loan if you have a low credit score. That’s why almost all the apps like MoneyLion and Dave lend money without a credit check.

Why Choose Dave App Alternatives

Dave is a good app with favorable terms, but it is not perfect, and sometimes it’s worth trying something else. For example, Dave lets you borrow up to $500, while PayDaySay enables you to borrow up to $5,000. If you don’t want to borrow from an outside app, you can get earlier access to your earnings if you connect Earnin to your bank account.

Also, if you need a loan today and don’t want to pay an instant transfer fee, you can download the Brigit alternative, which offers cash advances up to $250.

There are dozens of reliable companies and lenders in the U.S. financial market today willing to lend you money on various terms. Try their services and determine which suits you best – don’t agree to terms you don’t like.

on your homescreen

on your homescreen