If you have a bad credit history, you may likely feel your funding request cannot be granted because of the poor credit report. However, one of the few ways to still get emergency funding is through payday loans online South Carolina. Citizens and Residents of this state can apply for a payday advance and get the money within a short time. Hence, a payday advance is a good place to look if you’re facing a financial crisis and need some money to settle the bills.

Best payday loans in South Carolina

If you need payday advance to settle some of your emergency bills in SC, here are some lenders you can check out.

PayDaySay

Sometimes, unexpected expenses could spring up, and you have no cash to settle them. This is where this money loan app comes in. PayDaySay saves borrowers the stress of running around and looking for where to get money. Instead, they connect borrowers with creditors, and the entire process can be completed within a short time.

Most of these creditors know that the money is urgent, so they demand fewer requirements to speed up the process. However, you might have to submit details like contact details, bank details, a verified source of income, and a Social Security number. On PayDaySay, you can request up to a $550 overdraft and a minimum of $100.

Advance America

Advance America is a notable lending company that provides clients with an overdraft advance, including the online payday loans option. Usually, their overdraft term ranges from two to four weeks depending on how much you’re getting. Additionally, the annual percentage rate also varies from 231-495%.

You can decide to visit their physical store or send your application online. Either way, you’re guaranteed to get a swift response and approval within a short time. All credit levels are encouraged to apply, so if you have a poor credit history, you still stand a good chance of getting an overdraft. The requirements for sending an application are basic. All you need to do is fill out the application form on their website to get started.

Greenlight Cash

Greenlight Cash connects borrowers with prospective creditors. All credit scores are accepted and have a chance of getting fast approval. Hence, even if your credit history is poor, you still stand a good chance of getting the needed funds.

Regarding the requirements for using this platform, you must submit your basic information online and verify if you’re a legal resident in SC online. You also need to ascertain that you have a regular source of income. The lowest amount you can apply for is $200, and if you don’t like the offer you receive, you can always turn it down and request another.

Maggie Loans

On Maggie Loans, you can connect to several lenders willing to give you overdraft offers irrespective of your credit score or history. The processing time for an overdraft on this platform is very fast. You can complete your application within a few minutes and receive a response.

If everything goes according to plan, you can get your check that same day. To begin your online application on this platform, you need to select the credit amount alongside your email address and name. So if you don’t have cash reserves and there’s an urgent financial burden, you can start with this company.

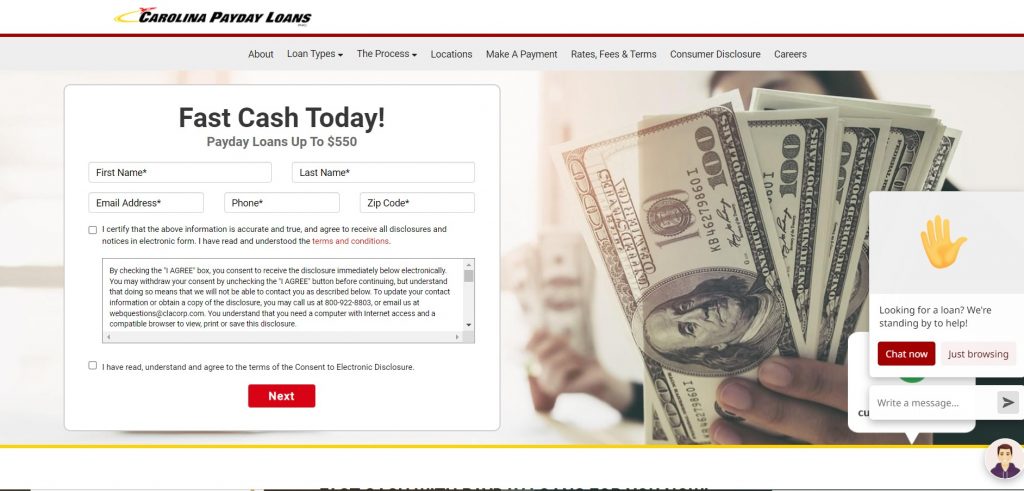

Carolina Payday loans

You can get an advance with a low credit score to help you settle that emergency expense. This company helps you get an overdraft up to $550 with a seamless and convenient application and approval process. You can either go to their physical location or send your application online. The required items before applying for funding are a Valid ID, your contact information, and other details on the online request form. This company is a good bet to access short-term cash with a convenient repayment plan.

Are payday loans legal in South Carolina?

If you have an emergency and need some money, you can get payday loans online South Carolina state, even with bad credit. South Carolina is one of the states where these overdrafts are still legal. Lenders have the autonomy to loan credit accounts to borrowers.

However, some regulations protect borrowers in South Carolina. For instance, there are consumer protections that place a borrowing limit of one cash advance at a time. Borrowers cannot take another credit until they finish paying off the initial one.

When it comes to the repayment plan, if the loan is per 12 months, the borrowers can request an extended payment plan. This allows them to make four equal payments exclusive of interests.

Why might you need South Carolina payday loans?

Anyone can encounter financial difficulties at any time, and if there’s no emergency cash, settling those problems might be difficult. For instance, it could be parking tickets, a loved one being sick, and other bills you might not see coming. Therefore, instead of running helter-skelter looking for people to give you money, you can get these loans online South Carolina to offset those bills.

Before getting this funding, some questions will be asked. Usually, the questions and the application process might depend on the amount of money you need. Hence, if you need some urgent money before your next paycheck, opting for a payday loan seems like a great choice.

You can get this funding from an online lender or a physical branch. When you apply for this overdraft, and it gets approved, you might get a check or cash, depending on the lender. Most times, you will have to return the funds before your paycheck arrives or within 14 days.

Terms for payday loans in South Carolina

When it comes to taking payday loans online South Carolina, one of the perks that come with this is that your credit report might not be checked. This means that you can get a cash advance with a poor credit score. What most creditors want to verify is your repayment ability.

You need a steady income with a minimum amount of $1000 in some cases before your application gets approved. To prevent approval delay, you need to submit all important details and documents, so your application can get processed faster. Here are some of the terms to know when applying in SC.

Loan Amounts

Payday overdraft amounts are the exact amount of money you need. Usually, it varies between the lender’s requirements and the lendee’s income. In SC online, the maximum amount is $550, but there is no specified minimum amount. Hence, many creditors fix their minimum payday loan figure at $50.

Then, they create their offers in multiples of $10, 15, or even $25 till it gets to the maximum limit. Before you choose an amount, you need to be sure of the expenses you want to use it for. If it is something that can wait till you get your next paycheck, you can be patient and not take the funding offer. Also, if you need more than the maximum amount, you can discuss it with the lender to see the possibility on personal terms.

Loan Terms

Most South Carolina payday loans online come with repayment terms spanning two weeks. However, the maximum repayment length is 31 days. This means that borrowers are expected to pay back within the stipulated period. Similarly, many creditors cannot prolong this repayment period through rollovers.

If it is impossible to repay your credit at the due date, you can reach out to the lender for an extended payment plan. Usually, this payment plan is once every twelve months, and it mandates that you split repayment into four equal parts without attracting extra charges. It is also important that each installment payment falls on the day you get your paycheck or the day after.

Loan Rates

According to the law in SC, the maximum amount that creditors can charge is $15 per $100. This means that if you need $300, you’ll have to pay back around $345.

Similarly, if you want to borrow $100, you will pay back $115. When a lender is processing the overdraft, they need to write the amount they are charging and the Annual percentage rate (APR). If you don’t receive a written contract, the lender has defaulted on the law.

Pros and Cons of Payday loans in South Carolina

It can be challenging waiting for your next paycheck before settling some urgent bills. However, you don’t have to stress yourself much when you can always access payday loans online South Carolina. The primary idea of this type of funding is to provide borrowers with quick cash without many bureaucracies. Before applying, you need to know the pros and cons so that you can make a better-informed decision.

| Pros | Cons |

You can easily apply and get approval within a short time. One of the reasons why this type of funding is prominent is because the requirements are not usually much.

You don’t have to bother about a hard credit inquiry when getting credit. Many payday lenders don’t bother checking credit reports when giving out these overdrafts.

When taking this funding, you don’t have to be afraid of losing your assets when you cannot pay them back. However, you might be handed over to law enforcement agencies. |

Most of these loans in SC online come with high-interest rates that make you pay back much more than what you borrowed.

This credit type doesn’t help you build credit, unlike other types of the overdraft that can improve it. |

What will South Carolina payday loan cost?

It is important to mention that the cost can come with an annual percentage rate. Hence, it is important to know how to calculate the cost of the credit.

Here’s the formula for the APR:

APR: (Interest / Loan) * 365) / term * 100

For example, if you borrowed $200 with an interest of 15% for 14 days, and you cannot repay within the specified period, your debt will accrue to over 195.53%. This does not include the monthly fees on credit.

Before you take any advance, you need to use a loan calculator to know how much you will pay back. With this method, you can compare different creditors to compare the cost and opt for the most favorable. If it is impossible to meet the deadline of repayment, the lender might agree to roll over at a cost. So, even though it helps you with extra time, paying off the overdraft becomes more expensive.

South Carolina payday loans if the Credit Rating is Poor

If you are in SC online, and you want to take an advance with a poor credit rating, you don’t have to worry. Most lenders do not consider the state of your credit report before giving out money. Payday advance financing is usually considered an individual’s last resort when sourcing funds. This is why many lenders do not bother if your credit rating is poor or excellent. However, be sure that the financing would come with high-interest rates and a short repayment period.

What are the alternatives to South Carolina payday loans?

Even though this is a great option for accessing fast cash advances, there are other alternatives you can explore if it is not forthcoming.

- Family and friends: Borrowing money from family and friends is one of the safest methods to avoid high-interest rates. Similarly, if you are lucky enough, you might be able to get the exact amount you need with a longer repayment period. However, if you cannot pay this type of financing, it can incur legal action or strain your relationship.

- Credit cards: You can exceed your credit limit with a cash advance with credit cards. This alternative comes with a lower interest rate and flexible repayment terms.

- Engage in a side hustle: If you have additional time apart from your major job, you can take on a short-term hustle to raise some emergency funds. For example, you can sell off some old clothes and shoes, become a tutor online, take on some freelancing gigs, etc.

- Payday alternative loans: Credit unions give this funding type. They usually come with rules that have fixed restrictions on how much you borrow and the amount you pay back. First, you’ll have to pay an application fee before processing your request.

One of the moments you know it is best to explore alternatives is when you notice that paying back the overdraft will cost you more than you bargained for. Also, you can opt for other alternatives if you think the repayment period is too small.

In Conclusion

It’s evident that payday loans in South Carolina can be a viable solution for those in need of quick cash. However, borrowers must be aware of the potential risks and high interest rates associated with these types of loans. It’s important to only borrow what can be comfortably repaid within the given timeframe, which is typically within two weeks or until the next payday.

Additionally, borrowers should take into account how many pay periods in a year they have and plan their finances accordingly to avoid falling behind on payments and accumulating more debt. In the end, payday loans should be approached with caution and used as a last resort when all other options have been exhausted.

on your homescreen

on your homescreen