A stable salary is a confidence in the future. Even if it is not very high, but enters the family budget regularly, it allows you to plan your expenses. This is what happens in ideal cases.

However, real life always makes adjustments to our plans. In general, it would be boring to live according to a strictly designed scheme, and therefore it is good when unplanned events break into our days. You need to be able to enjoy them, and any sudden expenses can be covered with payday loans online Colorado state.

This is a special type of consumer loan that is issued in a few minutes. Due to it, borrow money before the salary even without numerous documents. Such loans are issued by commercial credit firms, and the basis for them is only a passport. You can use it when the need arises, but it is important to know about all the terms. Read more about this in the sections below.

Best Payday Loans in Colorado

Today, the best payday lenders in Colorado online are PayDaySay, Brigit, Advance America, Check Into Cash, and Cash America. Review brief information about each.

PayDaySay

PayDaySay is a money loan app that was created by a team of enthusiasts in 2013. Address: 4819 Clark Street, NY, Bethpage, United States, 11714. It offers clients to take out a loan in the amount of 100 to 5000 dollars. You can apply for a loan for almost any purpose, such as home improvements, car repairs, medical expenses, unforeseen situations, etc.

APR rates vary depending on which PayDaySay partner lender you choose and typically range from 5.99%-35.99%. Nevertheless, you can quickly get a loan at 10%-15% per year if you have a steady job and a good credit history.

As for PayDaySay’s requirements, the borrower must have a good credit history, credit rating, and steady employment. Self-employed persons most likely cannot get a loan from a company.

According to customer reviews, PayDaySay is a reliable lender, so it is trustworthy. It helps people solve their urgent financial problems. The advantage is that you can apply and receive money online without leaving your home. Therefore, PayDaySay is a really good place to get a payday loan.

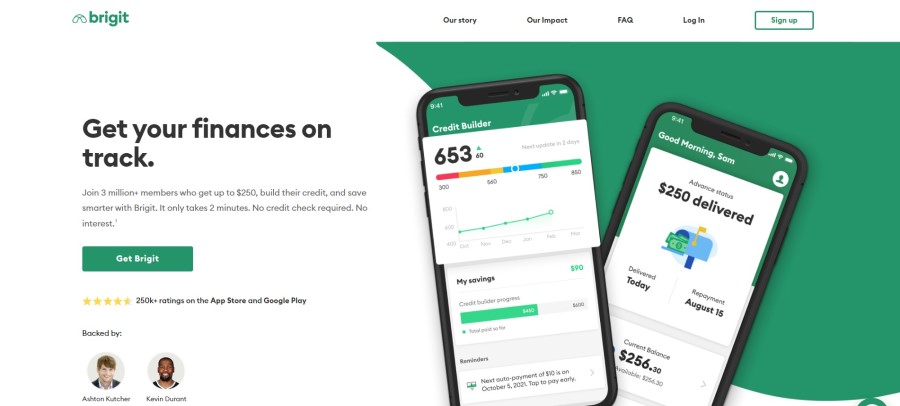

Brigit

Brigit is a socially responsible company involved in ensuring the financial well-being of individuals. Its goal is to provide financial security net through access to responsible funding, as well as effective personal finance education. Office address: 36 W 20th Street New York, NY 10011.

The Brigit app allows you to borrow between $50 and $250. As for the rates, they are 9.99% per month. Loan terms vary. Requirements include a bank account active for at least 60 days, a balance above $0, and an average minimum balance on the day of payment.

Brigit is trusted by over 3 million people and boasts an excellent 4.7-star rating even after 250,000 reviews. This indicates that the company is trustworthy.

The advantages of using the Brigit application are a simple and fast application process, and the availability of functions that help track payments, budgets, savings, etc.

Advance America

Founded in 1997, Advance America is the leading payday lender that offers loans in 26 states including CO. It has over 2100 centers. Address: 135 North Church Street, Spartanburg, SC 29306, United States.

The company’s loan amount starts at $100 (this varies from state to state) and goes up to $50,000 (up to 50% of the client’s balance). Rates directly depend on the client’s credit score, loan amount, and repayment terms and range from 3.49% to 7.99%.

You can find out exactly what rate you will have to pay after you apply for a loan from Advance America. As for loan terms, debt repayment is available in 30 days, 2-34 months, etc.

An online borrowing option is available. To qualify for payday loans online Colorado state, it is necessary to provide proof of identity, proof of income, as well as a bank statement and personal check.

Advance America has many positive customer reviews. According to testimonials, it is not a scam, but a reliable and legally operating company. Therefore, getting Colorado payday loans online from this company is quite justified and profitable.

Check Into Cash

It is one of the largest payday loan companies in the United States that offers loans up to $1,000 even to those with bad credit. Other services available include paying bills, cashing checks, buying gift cards with cash, etc. Address: 201 Keith St SW Ste 80 Cleveland, TN, 37311-5867.

The minimum loan limit is $50 and the maximum is $1000. Rates are very reasonable – 3%-5%. A person applying for a Check Into Cash loan must be at least 21 years of age (19 in Alabama), provide proof of identity and employment, and have a Social Security number.

The online lending function is available, so every eligible applicant can use it at any time.

According to customer testimonials, Check Into Cash loans are provided on favorable terms, so the company is very popular today. If you need money right now, you can go there and be sure that it is not a scam.

Cash America

Cash America is another good place to get the amount of money you need without spending a lot of time. The company is loyal to its customers and issues payday loans online Colorado Colorado state even to those users who have been refused by the bank. Address: 1600 West 7th Street, Fort Worth, TX 76102, United States.

Available loan amounts vary from state to state but typically range from $100 to $1,500. New customers take their first loan at 0.01% per day. For subsequent applications, the rate will be 1.5% per day, which is quite advantageous compared to other payday lenders. On average, the loan fee is $13 – $102.

The loan is issued for a period of 5 to 30 days, but if necessary, you can use the prolongation service. Requirements for a person applying for a payday loan CO include:

- Age at least 18 years old;

- An identity card;

- A permanent income;

- Open current account;

- Working phone.

Cash America has many customer reviews. Most of them are positive. This indicates that it is safe and profitable to use the services provided by the company.

Are Payday Loans Legal in Colorado?

Each US state has its own opinion on payday loans. For example, 27 states use this practice and consider it legal. 9 states partially allow payday loans and impose strict restrictions. 14 states and the District of Columbia prohibit it completely. Strict federal regulation of payday loans is due to a number of important reasons:

- A high bankruptcy rate has been established among those who use loans (this is due to high-interest rates);

- Illegal and unfair methods of debt collection are often used;

- Loans with automatic prolongation are often practiced, which greatly increases the total debt to creditors.

Colorado payday loans online are legit. However, strict regulation applies. The borrower’s total existing loans cannot be higher than $500. Online payday loans are available for a period of 180 days or more. The annual interest rate is up to 36%. Any violations and criminal acts related to payday loans online Colorado state are prohibited.

When taking a CO loan, it is important to pay attention to the statute of limitations. This is the time during which the collector can sue the borrower in case of non-payment of debts. After this period, the court cannot oblige the borrower to repay the old debt. In CO, the statute of limitations for a payday loan is six years.

Why Might You Need Colorado Payday Loans?

Colorado residents usually take online payday loans online Colorado state due to the following reasons:

- Low wages, which do not meet the rising prices. In this case, taking money before a salary becomes the only option to live the rest of the month normally, and not save on food or medicine;

- Lack of regular timely income or job loss. In this case, a bank cannot give a loan before payday, since the unemployed do not have the opportunity to provide a certificate of official employment and income;

- Retirement age and meager incomes force CO older people to look for any sources of income and financing, including obtaining loans that can help with material security until the next pension is received. Pensioners may need to receive money before their next payment of a pension for the urgent purchase of medicines, treatment, payment of utility bills, etc.;

- Education at a university without the opportunity to get a full-time job. Earnings in this case are random, episodic, or it is possible to get a job with a not very large salary on an ongoing basis. Thus, money is often needed.

Terms for Payday Loans in Colorado

Before you draw up a contract for receiving payday loans online Colorado Colorado, you should know all its conditions. The main thing is that you need to live in Colorado, be an adult, and have all the necessary documents.

Even a person with a bad credit history, without a permanent job, a pensioner, or even a student can apply for a loan.

The decision on whether to give you a loan or not is made online within a few minutes. A special service of the company quickly checks your data, credit history, documents, and data accuracy. As a rule, you can receive money on the same day when the contract is signed. Read about other features of Colorado payday loan online below.

Loan Amounts

As noted above, CO payday lenders can issue a wide variety of loan amounts. Often they reach even 35,000 dollars. However, most often, payday loans online Colorado state are issued in the amount of $500 to $5,000, as they allow a person to solve the problems that have arisen and quickly pay off the debt. And this is very important because, according to the laws of CO, the borrower’s total loans cannot be higher than $500.

Loan Terms

There are no maximum payday loan terms in Colorado. The minimum term is six months. It is worth choosing the term in which you are sure you will be able to pay the borrowed amount. If you fail to pay, you will be charged a penalty. The state also has a six-year statute of limitations. That is, the lender has the right to sue you for non-performance of credit obligations. If more than six years have passed since you failed to fulfill your obligations under a payday loan, then the debt becomes overdue.

Loan Rates

The origination fee is typically 20% on the first $300 plus 7.5% on any amounts over $300. The service fee is $7.50 for every $100 loaned, up to a maximum of $30 per month. As a result, the overall rate does not exceed 36% per year.

To calculate the annual interest rate on online payday loans CO you need:

- Divide the amount of interest paid by the amount of the loan;

- Multiply this by 365;

- Divide the resulting number by the length of the repayment period;

- Multiply by 100.

Pros and Cons of Payday Loans in Colorado

Payday loans online Colorado state is a convenient and profitable service. It is highly valued for its loyalty and speed of registration. Below are its main advantages and disadvantages.

Pros of payday loans in Colorado

- Submit an application and receive money on a card quickly. No bank will offer such promptness.

- The minimum number of documents.

- A borrower with any credit history can take a payday loan. Of course, the list of proposals for persons from the black list is small, but everything is possible.

- You can use the service seven days a week, 24/7. Credits are issued around the clock, immediately after the application, in some cases only during business hours. But the application review process takes no more than an hour.

- Various promotions and promotional codes make the cooperation as profitable as possible. Regular customers enjoy additional benefits, privileges, and save money.

Cons of Colorado payday loans online

- High interest rate. Online lenders often offer high-interest rates, so borrowing from them is not always profitable.

- Availability. Sometimes a borrower, when applying for a loan, does not calculate his own resources and then cannot pay off the lender, which leads to an unpleasant consequence. Therefore, before applying, you need to calculate your credit burden carefully.

- Credit dependence. Having not calculated their own strengths and the family budget, a borrower applies to the lender for a loan for on-lending. This is a dangerous path that can lead to debt.

A payday loan is a good way out of a situation when you need to get a small amount of money before your salary. However, its repayment should be treated responsibly so as not to get problems as a result.

What will Colorado Payday Loan Cost?

Using Colorado payday loan online, it is recommended to calculate its cost in advance. According to the law, for a loan of up to $ 2,000, lender companies can charge no more than 20% of the total amount. For payday loans online Colorado state between $2,000 and $5,000, and the maximum fee can reach $400. If the amount exceeds $5,000, the fee is set at the discretion of the lender.

To calculate the APR of your payday loan, follow these steps:

- Divide the amount of interest paid by the amount of the loan;

- Multiply this by 365;

- Divide the resulting number by the length of the repayment period;

- Multiply by 100.

Colorado Payday Loans if the Credit Rating Is Poor

If you have bad credit, you can still apply for a payday loan. There will definitely be companies ready to give you the necessary amount of money. One such example is Pheabs. The company issues payday loans online Colorado state to people who banks refuse.

What are Alternatives to Colorado Payday Loans?

Perhaps, you have already understood that Colorado payday loan online is issued at fairly high-interest rates. If you are in a difficult situation and need money quickly, a payday loan may seem the only option. But actually, it is not. There are several good alternatives:

- Create alternative ways to make money;

- Borrow at a credit union;

- Form a credit circle;

- Get help with bills through payment plans.

If you understand that you will not be able to pay off the loan on time, you should pay attention to the above alternatives and choose one of them.

on your homescreen

on your homescreen