Several payday loans are available in the state of Nevada online and in-store. Payday loans are short-term loans you can apply for and take out and are usually due on the next payday. Many prefer this kind of loan because the application is typically fast and easy, with only a few requirements.

Not all online payday loans are operational in every state in the US. Some states have strict regulations that in-store and online creditors should adhere to before payday loans can be marketed and offered. The state of Nevada is one of those states with special regulations.

Best Online Payday Loans in Nevada

Not all payday loans online Nevada state are created equal. Some boast of low fees, and some involve applications of only 5 minutes. We listed below the best Nevada payday loan online and in-store that are operational in the state of NV. Please continue reading on to learn more about their rates, limits, and reviews from people who have already tried them!

PayDaySay App

PayDaySay is a money loan app that allows even the residents of NV to take out a loan as long as they are at least 18 years old. For almost a decade now, PayDaySay has been catering to many individuals in urgent need of cash. It is not a financial institution, though. The PayDaySay app pool in online payday lenders and match them to the borrowers.

Because PayDaySay is just a platform, the interest rates, and repayment terms vary per lender. Application is effortless and will take a maximum of 24 hours. No credit check will be done. With PayDaySay, you can borrow up to $5000, and the rate is competitive at an average of 2%. When you install PayDaySay and sign up, payday lenders will send you offers for their loans. Different loan information will be available to you, such as the amount, the rates, and the repayment terms. Once you find a lender that matches what you need, you can apply for this loan, and the application will be reviewed. Once approved, the money will come into the app’s bank account that you used to sign up.

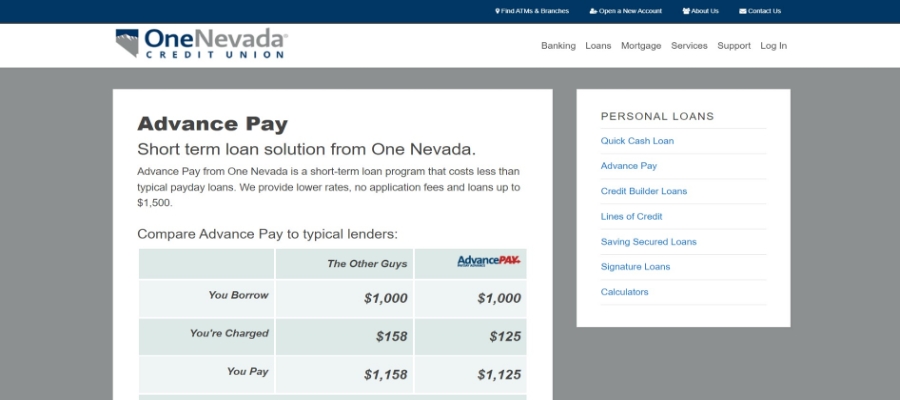

One Nevada Advance Pay

One Nevada is a credit union with more than 70 years of experience in the finance world. They offer cash advances that work similarly to payday loans online Nevada state. Advance Pay is also a short-term loan with lower fees and involves very few requirements.

One Nevada is a credit union with more than 70 years of experience in the finance world. They offer cash advances that work similarly to payday loans online Nevada state. Advance Pay is also a short-term loan with lower fees and involves very few requirements.

Residents of NV are allowed to borrow up to $1500 and have an interest of $187.50 upon repayment. The APR for this loan is 325.89%. For One Nevada, there are no post-dated checks involved. Instead, the amount is deducted from your bank account directly during the due date. Loan repayment ranges from 2-4 weeks.

Since One Nevada is a credit union, membership is required before you can take out any loan they offer. If you urgently need cash, this might not be the best option since taking out a loan will involve several other steps and requirements.

Money Tree

Money Tree is a direct lender with a branch in the NV. To take out a Nevada payday loan online, you can either visit their branch or apply online. To apply for an online payday loan in Money Tree, you just need to fill up the virtual application and upload supporting documents. Within minutes, the Money Tree team will contact you to inform you about the maximum loan amount you can take. Once you finalize the amount, you can go to their branch to collect your cash, or they can deposit the money into your bank account.

Money Tree is a direct lender with a branch in the NV. To take out a Nevada payday loan online, you can either visit their branch or apply online. To apply for an online payday loan in Money Tree, you just need to fill up the virtual application and upload supporting documents. Within minutes, the Money Tree team will contact you to inform you about the maximum loan amount you can take. Once you finalize the amount, you can go to their branch to collect your cash, or they can deposit the money into your bank account.

In Nevada, the APR for payday loans under Money Tree is 430%. The maximum loan amount is up to $5000 but is subject to your income and your history with Money Tree. The maximum loan term is 35 days. If you have late payments, you will be charged with $25 one-time fee.

Many people trust Money Tree because they are licensed direct lenders and guarantee that the information you provide them is safe and secure.

Check City

Check City is a reputable payday lender with more than a hundred branches in Nevada. You can find it in convenience stores in the cities of Las Vegas, North Las Vegas, Reno, and Henderson. You can request a payday loan either online through their website or in their stores.

Check City is a reputable payday lender with more than a hundred branches in Nevada. You can find it in convenience stores in the cities of Las Vegas, North Las Vegas, Reno, and Henderson. You can request a payday loan either online through their website or in their stores.

Check City offers payday loans with a minimum of $100 online and $50 in-store. The maximum loanable amount depends on many factors, including your monthly salary. The loan term is between 4 to 35 days, and an APR of 430% applies to approved loans.

Check City is convenient for many people because of its numerous branches throughout the state. They also allow deferred payments up to 4 times. The main downside is that Check City charges a fee different from the interest, depending on your loan length. As a sample, a $500 loan with a 14-day term will have a fee of $82.50.

EarnIn App

EarnIn is an application that you can access anywhere, including the state of Nevada. This app allows you to withdraw advance payments even if it’s not payday yet. To qualify, you just need to install the app on your gadget, connect your bank account, and upload proof of your employment and salary.

EarnIn is an application that you can access anywhere, including the state of Nevada. This app allows you to withdraw advance payments even if it’s not payday yet. To qualify, you just need to install the app on your gadget, connect your bank account, and upload proof of your employment and salary.

The best thing about EarnIn is that it has no interest rates and fees. The community relies on tips you can make after you repay your loaned amount. Loaned amount is at $500 maximum, depending on your monthly salary, and will be released in 1-3 days. If you have little time and are in a hurry, you can pay a minimal fee to expedite your cash advance.

Overall, EarnIn is a great app to have and is very useful in emergency situations. Loan repayment also lengthens if you repay your loan on time and in full. If you get a community member to vouch for you, you can also increase your loan amount.

Are Payday Loans Legal in Nevada?

Nevada payday loans are legal. There are minimum legal restrictions regarding short-term loans, including payday loans online and in-store. The only limitation is that lenders should look into borrowers’ monthly gross income and allow only 25% of that for the total loan amount. Aside from this, the maximum loan term is 35 days, and there should only be one outstanding payday loan per lender. The state imposes that there should only be two instances of $25 fees for the collection fees. Because there are not many restrictions in this state, the financiers are free to impose whatever interest rates, which often results in high APRs from 200% to 400%. As a reference, personal loans from a bank have an average of 7% APR.

Why Might You Need Nevada Payday Loans Online?

While it is true that it is always better to have sufficient funds to spend on rainy days, sometimes we need financial help to get by. Reaching out to family and friends is always a good option. However, you can always opt for payday loans online Nevada state when it’s unavailable, and you have an emergency needing urgent money. It is excellent for emergencies because application and approval are fast and easy. Suppose you have damaged your credit score and can’t borrow money from banks or other credit unions. In that case, you should opt for payday loans, as most lenders do not check into your credit score. However, remember that payday loans online Nevada state charge higher APRs than personal or other kinds of loans. The repayment term is also quick and not flexible at just 1-4 weeks. In Nevada, most creditors also charge a late repayment fee. Remember to only take out a loan you can repay on time and in full to avoid paying additional charges.

Terms of Payday Loans in Nevada

There are few rules regarding payday loans in Nevada, online and in-store. That is why it is the consumers’ responsibility to know the terms related to the loans they are taking and understand them better to make wise financial decisions. Understanding these terms and their implications can help you choose the right loan for your needs. Lastly, suppose you understand these payday loan terms. In that case, you can spot if a lending company is not adhering to the state’s regulation, and it can help you steer away from those doing it illegally. Doing so will protect and secure you and your hard-earned money.

Loan Amounts

Loan amount refers to the money lent by banks, credit unions, or other financial institutions to the borrowers. This amount is given to borrowers and returned to the lender in repayment terms agreed upon by the two parties involved. In Nevada, the loan amount is capped at 25% of the borrower’s monthly gross income. Gross means that the amount that we are using is the one that is not taxed yet. For instance, if the borrower earns $1000 per month before tax, he can only borrow $250 from payday lenders. This protects consumers from getting a loan that is too high to be repaid and therefore avoids the vicious cycle of debt. The loan amount is where the interest rate is applied. This means that the higher the loan amount, the higher the interest. In conclusion, you should only take out the minimum loan amount that meets your needs, even if you can borrow more.

Loan Terms

The loan term is the time the lender gives the borrower to repay the loan. In Nevada, payday loans have loan terms up to 35 days. It means that when you take out a payday loan on March 1, you should be able to repay it in full on or before April 4. The longer the loan term is, the better and more flexible a loan is. This is because the borrower has more time to prepare the money for repayments. Other lending companies offer flexible loan terms, and you only need to reach out to them so they can extend the loan length. Other companies, though, are not that generous. There could be associated fees when you can’t adhere to the loan term, such as late repayment fees and added interests. For Nevada, only two $25 collection fees can be applied to your loan when you cannot adhere to the lending company’s terms.

Loan Rates

The loan rate is sometimes called the annual percentage rate or APR. It is the percentage that is applied to the loan amount being borrowed. For instance, the APR of a loan is at 50%, and you borrowed $100. You need to repay the loaned amount plus interest before the due date, a total of $150. Generally, the higher the loan rate is, the more expensive the loan is. That is why it is essential to look at the loan rates offered by the lending companies and choose the one with the lowest rate. In Nevada, no law limits the loan rates applied by the lending companies. That is why most loaning companies charge incredibly high rates ranging from 200% to 400%. As a consumer, it is best to opt for other kinds of loans with lower APRs if the matter is not urgent. If it is an emergency, remember to choose the lender with the lowest loan rate so you can save on interest fees.

Pros and Cons of Payday Loans in Nevada

If you are still unsure whether to take out a payday loan in Nevada or not, we have summarized and listed the benefits and disadvantages of doing so:

Benefits of Payday Loans in Nevada

- Easy and fast application

- You are still eligible to borrow even if you have a bad credit score

- Applications and websites are accessible 24/7, so you can borrow them anytime and anywhere

- Money is conveniently sent straight to your bank account once approved

Disadvantages of Payday Loans in Nevada

- Interest rate is not capped by the state, so lending companies charge 200% to 400% APR

- The loan amount is capped at 25% of your monthly salary

In conclusion, payday loans in Nevada are expensive loans to take because they charge 200% to 400% in interest. However, suppose you need cash and have no time to file an application for a cheaper loan. In that case, payday loans provide a fast and great alternative that can instantly wire you the money.

What will Nevada Payday Loan Cost?

Nevada payday loan online costs depend on the loan rates set by the moneylenders and on the approved loan amount. For example, suppose a lender charges 400% in the interest rate, and you have a gross monthly salary of $1000. In that case, you can only borrow a maximum of $250. Interest can be computed by multiplying $250 by 400% and dividing by 12 since payday loans are usually repaid monthly. The result is $83. This means that after the loan term, you are to repay the lender a total of $333. If the company has other fees when taking out a loan, you must add them further to the total. In the event of late repayment, the lender can only collect two $25 fees. That adds up to $50, and your total payment will be $383. If you will notice, you paid the lending company a total of $133 for fees and interest when you have only loaned $250. This is 53% of the loaned amount, and the term is too short at 35 days.

Nevada Payday Loans Online if the Credit Rating is Poor

Although payday loans are more expensive than other loan options, many still opt for them because they do not require borrowers to have excellent credit scores. Even if you have a poor credit rating, chances are you will still be able to take out a payday loan if you complete other requirements such as proof of income, bank account, and identification cards. Payday loans do not involve collateral such as home and car titles. However, taking out payday loans can still affect your credit score. Just make sure to always repay the loan on time and in full to improve your credit rating and avoid paying additional fees.

What are Alternatives to Nevada Payday Loans Online

If you feel like a payday loan is not for you, there are other loan options that you can take in Nevada. One is Home Equity Loan. In most credit unions, you can take 75% of your appraised home value in your loan. APR is around 6%, and repayment terms can be up to 10 years. This kind of loan, though, is not instant and not easy. You have to prove ownership of your home, and appraisal can take some time. If you have the time, this is an excellent alternative to a payday loan because of the difference in the loan rates. Alternatively, you can also take a cash advance using your credit card. There is also no application involved, and cash remittance is instant. You just need to go to an ATM and withdraw using your credit card. The interest rate is 9.75%, but the repayment term is roughly a month. This alternative is ideal and practical if you have a credit card that offers cash advances. The downside is that the amount is usually capped, and there might be associated fees such as withdrawal and cash advance fees.

Conclusion

There are not many regulations on short-term loans in the state of Nevada, except for the cap on the loan amount. This results in lending companies imposing extremely high interest rates, ranging from $200 to $400. However, there are online applications that provide great alternatives and charge less on interest and fees. It would be helpful to know and understand more about these apps so that you can choose the best lending company when the time arises. While it’s true that payday loans are not the cheapest loans out there, they provide great alternatives when you have a bad credit score or if you are in a hurry and you need to have the money in about a day or two. Payday loans involve little to no application and zero collateral as well.

on your homescreen

on your homescreen