In the era of information technologies, many issues that were difficult in the past are solved in a matter of minutes. This also applies to a wide variety of financial transactions. It is now possible to transfer money, pay for a purchase, and even take an instant payday loan online.

Access to the Internet, an active bank account, and a constant source of monthly income – that’s all you need for this.

A payday loan is a small amount of money ($100 – $5,000) that must be paid back within a month. Compared to bank lending, it has some important advantages:

- The loan is issued online. So the customer does not need to go anywhere to get emergency cash;

- High speed of application processing. Filling out the application takes about 10-15 minutes. The decision on loan approval or refusal is made almost instantly. Money is issued on the day of approval or on the next business day;

- Transparency of loan agreement conditions. Using the loan calculator, the applicant knows in advance how much money needs to be returned. There are usually no hidden fees;

- Loyal conditions. Any person who has reached the age of 18 and lives in a US state where loan services are available can get a payday loan online. Each online payday loan lender has its own terms, so even those with a bad credit score are often approved.

Read this article in more detail about the advantages, disadvantages, and features of payday loans, as well as about the lending conditions of the best online payday lenders.

Best Payday Loans Online

The abundance of financial services offers can confuse any borrower. Therefore, it is advisable to study the credit conditions of various financial institutions carefully. The following tips will help you make the right choice:

- The direct payday lender must provide complete information about its activities. Everything must be described in detail on the lender’s website;

- Online registration should not take more than 30 minutes;

- Loan money must be provided immediately after loan approval;

- It should be possible to apply without certificates and other additional documents;

- Short term loans for applicants with poor credit scores should be provided;

- Technical support must be available 24 hours a day, 7 days a week.

The best payday loans online are described below. Each payday loan company is trustworthy and provides loans on acceptable terms. Carefully study the information about each and choose the one that suits you the most.

Upgrade

Upgrade is great for those with a FICO credit score of 560. It is usually chosen by people who want to rebuild their credit history. Upgrade is also a good choice for borrowers with higher credit scores (for example, 570-800 FICO).

But not every applicant is satisfied with the high annual payday loan interest rates of the loan provider. There are online payday loan companies with lower APRs in the financial services market.

General Description

The loan offer from the American fintech lender Upgrade includes various online loan products. The company was founded by Renaud Laplanche and Lending Club collaborators in August 2016. The headquarters is located in San Francisco, California, United States. The payday loan company is licensed and operates legally.

Upgrade is accredited by the Better Business Bureau (BBB). It has an A+ rating.

Details of The Loans

The lender issues online personal loans ranging from $1,000 to $50,000. The available payday loan amount is $50-$1,000. The repayment period for a secured personal loan can be up to 72 months, but only 31 days are allotted for payday loan repayment.

The required credit score is 560. But payday loan borrowers with lower or higher credit scores can also apply. APRs for personal loans are 7.96%-35.97%. APRs for instant payday loans often reach 400%. Upgrade charges an origination fee of 2.9%-8% of the loan amount. Payments over 15 days late are subject to a $10 fee.

How to Apply

Applying for a short term loan is easy. You just need to fill out a simple form on the website or use the mobile application. Requirements for borrowers:

- Residence in the USA;

- Age from 18 years old;

- Provide a valid bank account;

- Provide valid contacts (phone number, email address).

Features of The Lender

The main advantage of Upgrade is a mobile application that makes the application process as fast and convenient as possible. The disadvantage is high payday loan rates.

Upstart

Upstart offers fast funding and is a good option for those with a low credit score or thin credit history. Requirements for poor credit candidates are soft and credit conditions are favorable.

General Description

Upstart is the leading artificial intelligence (AI) cloud lending platform. It was founded in 2012 by Dave Girouard. This poor credit company has all state licenses and registrations related to consumer lending, credit brokerage, and servicing. Therefore, getting an Upstart payday loan is completely safe today.

The Better Business Bureau has accredited Upstart with an A+ rating.

Details of The Loans

Like Upgrade, Upstart offers loan amounts of $1,000–$50,000 for 3 and 5 years. APR is 7.8% – 35.99%. As for instant payday loans, Upstart usually gives out small amounts ($200, $300, $500) for a period of 14-31 days. Origination fee: 0%–12%. The minimum required credit score is 300.

How to Apply

To get an online payday loan from Upgrade, you need to visit its website and submit your application. It is recommended to provide true information about yourself in order not to be rejected as a result. As soon as your application is approved, you will receive emergency cash to the specified bank account.

Features of The Lender

The main advantages of Upgrade are fast funding and non-strict requirements for borrowers. The disadvantages are that an origination fee is charged and there is no mobile application that would allow customers to manage a payday loan.

PersonalLoans

PersonalLoans is good for those who have urgent unexpected expenses in small amounts. The money can be used to pay utility bills, appliances, vacations, home repairs, training courses, etc.

General Description

PersonalLoans is a company with a large database of direct lenders that you can contact to get an online payday loan. Each online payday lender has its own requirements for the borrower, but in general, they are not very strict. The platform works legally and has all the necessary licenses.

The BBB has given PersonalLoans an A+ rating for high-quality financial assistance.

Details of The Loans

PersonalLoans offers its clients personal cash advance loan amounts ranging from $1,000 to $35,000. The minimum APR is 5.99% and the maximum is 35.99%. The repayment period varies from 3 months to 72 months.

As for the payday loan, PersonalLoans gives out amounts not exceeding $500. Return period: from several days to 1 month. The average installment loan rate is $10-$30 for every $100 borrowed. Thus, for example, if you want to borrow $500 and the fee is $20, then you will have to pay back approximately $600.

PersonalLoans does not set strict requirements for an applicant’s credit score. There are lenders willing to cooperate only with those who have a credit score of 650 and higher. However, you can still find payday lenders who can provide support even if you have a bad credit rating.

How to Apply

You need to go through 4 simple steps to get a deposit from PersonalLoans:

- Submit a request for an online payday loan;

- Choose the most suitable loan provider;

- Provide all the necessary information about yourself (proof of age 18, US residence, regular monthly income, social security number, etc.);

- Receive loan funds to the specified bank account.

Features of The Lender

The advantages of the payday loan company are a simple and straightforward application form, round-the-clock customer support, and disbursement of funds the next business day after loan approval. The disadvantage is that small amounts are available to borrowers and annual rates are quite high.

VivaLoan

VivaLoan`s loan offer is the best choice for people who are interested not only in payday loans online but also in other types of loans. The list of its services is quite wide and includes:

- Best payday loans;

- Personal loans;

- Short-term online loans;

- Installment loans;

- Unsecured online loans, etc.

General Description

Vivaloan is an online payday loan marketplace that connects borrowers of all credit profiles with direct lenders. But try to be careful when contacting the company. Loan terms and rates vary from lender to lender, so you won’t know for sure until you get feedback from the chosen creditor.

Vivaloan was founded in 2006. It operates legally and offers its services in the US states covered by the license. Those who live in Washington, West Virginia, or New York cannot use the company’s services.

Details of The Loans

The Vivaloan personal loans amount is $100-$15,000. Annual rates on personal loans are up to 40%. Any loan amount below $1,000 is considered a payday loan and must be repaid within one month. The annual interest rate on a payday loan ranges from 350% to 450%.

It depends on your state of residence and the online payday loan lender you choose. There is no fee for submitting an application.

Vivaloan states that a high credit score is not a key factor in applying for an online payday loan. There are no minimum credit rating requirements.

How to Apply

If you want to borrow money from Vivaloan, you need to follow three simple steps:

- Fill out an online form;

- Sign for your short term loan;

- Collect your loan funds.

The company has two main requirements for borrowers: the age of 18 years and a stable source of monthly income.

Features of The Lender

The main feature of the online payday lender is that it provides a fairly extensive list of lending services. The available loan amount is quite high. The downside is high payday loan interest rates. In addition, the services are not available in all US states.

ZippyLoan

ZippyLoan is the best choice for people who are looking for reliable lenders with competitive interest rates. The company does not specify the purpose for which the emergency cash is taken. You can borrow funds for home renovations, debt consolidation, food shopping, or any other need.

General Description

ZippyLoan is another legally operating platform that allows payday borrowers and lenders to find each other for mutually beneficial cooperation. It was founded in 2015 and is headquartered in New York, NY. The company’s services are provided in 47 US states.

Details of The Loans

ZippyLoan offers $100 – $15,000 personal unsecured loan amounts. Annual rates are 7.04%-35.89%. They are lower than other loan companies offer. Personal loan terms vary from 6 months to 6 years.

Online payday loans are also issued on good terms. The amount available is $100-$500. The return period is up to 31 days. The average APR is 380%. All credits are welcome. There is no minimum credit score requirement.

How to Apply

The procedure for applying for a loan from ZippyLoan is standard. You just need to fill out the application form on the site, study the conditions of several personal loan lenders, and choose the most suitable one.

ZippyLoan’s requirements for borrowers are simple and straightforward:

- 18+ age;

- Residence in one of the US states;

- Valid checking account;

- Regular source of income.

Features of The Lender

The main advantage of the ZippyLoan online platform is its affordable annual rates. The downside is that services are not available in Western Virginia, Oregon, Nyc, Arizona D.C.

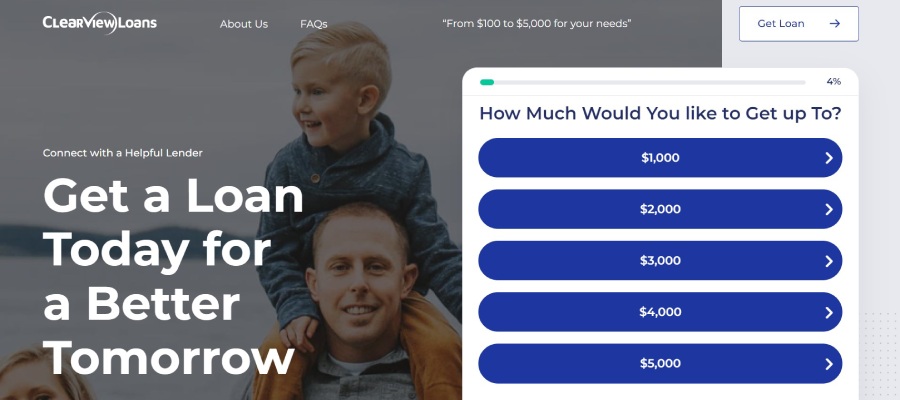

ClearViewLoans

ClearViewLoans offers very fast funding. Therefore, it is best for covering emergency expenses.

General Description

ClearViewLoans is another popular online lending service. It allows payday borrowers to find reliable lenders and receive emergency cash to cover any expenses (purchase of household appliances, car repairs, payment of medical bills, etc.).

The company operates legally. It complies with the law and has all the necessary licenses. However, it is still not BBB accredited.

Details of The Loans

ClearViewLoans specializes in short-term online personal loans ranging from $100-$5,000. APRs are 6%-36%. The repayment period is up to 84 months.

The available amounts of best payday loans are $100-$1,000. Annual rates often reach 400%. Loan terms are up to 31 days. ClearViewLoans has no minimum credit score requirements. Therefore, the services of the company are used even by those who have a poor credit score.

How to Apply

To borrow money from ClearViewLoans you need:

- Be aged 18+;

- Be a temporary resident or US citizen;

- Have a regular monthly income of more than $1,000;

- Have at least 3-months job history with your current employer;

- Provide a valid mobile phone number and email address.

If you meet all of the above requirements, submit your request on the website and expect direct payment on the same day.

Features of The Lender

By giving preference to ClearViewLoans, be sure that you make the right decision. The company is trustworthy. It has simple and transparent lending conditions. There are no hidden fees. The only drawback is that the requirements for applicants are more serious than competitors usually put forward.

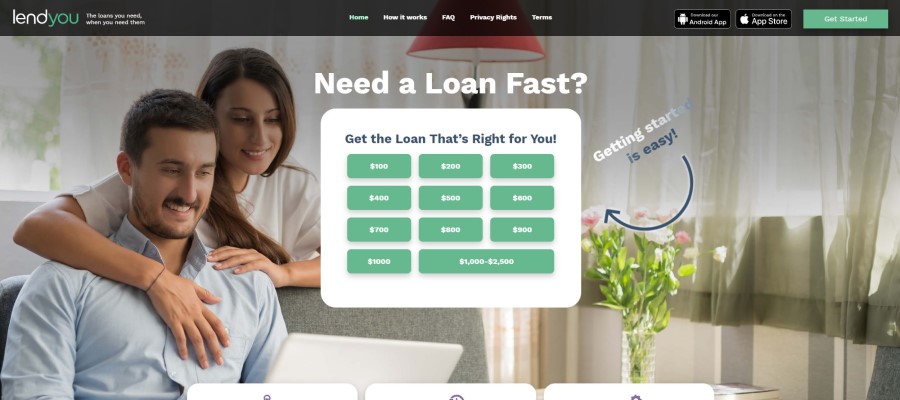

LendYou

LendYou is the choice of those who want to cooperate with a reliable payday lender, receive instant best online payday loans, and do not pay extra fees.

General Description

LendYou is not a direct payday lender. This is a referral service that has all the required licenses. It connects customers with creditors and allows them to benefit from cooperation with each other. The company was founded in 2008. LendYou is headquartered in Glendale, California, USA.

To date, the company has helped more than 3 million people solve their pressing financial problems.

Details of The Loans

LendYou loan amounts are $100-$35,000. The minimum APR is 4.99% and the maximum is 450%. Loan terms vary between 2 weeks and 5 years depending on the type of loan.

As for online payday loans, available amounts are $100-$1000. Annual rates are up to 450%. Repayment period: 2 weeks-1 month. There is no required minimum credit score. The company issues bad credit loans.

How to Apply

LendYou requirements for candidates:

- Have a monthly income of at least $1,000;

- Provide a valid checking account;

- Meet the minimum age requirement in the state of residence (in most states this is 18 years);

- Be a temporary resident or US citizen.

The application process is simple. The company’s website describes in detail what steps to go through to receive loan funds online.

Features of The Lender

The advantage of online payday loan provider LendYou is its user-friendly website. The client can quickly submit applications without any difficulty. The company provides funding on the same day or the next business day.

Requirements for borrowers are clear and understandable. There are no hidden fees. 24/7 support is provided.

The disadvantage of LendYou is high interest rates.

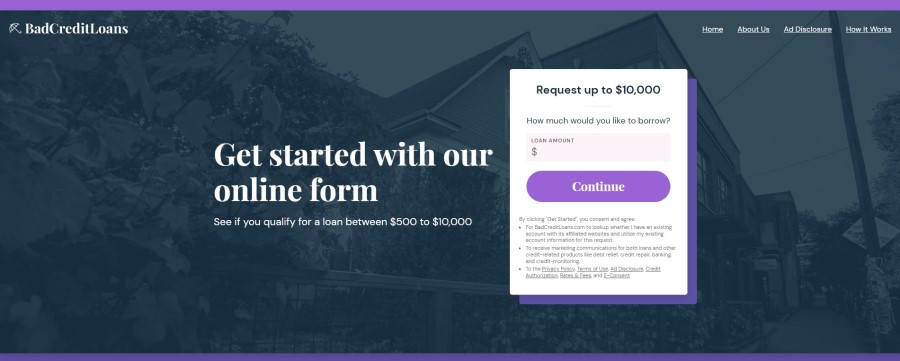

BadCreditLoans

BadCreditLoans is best for people with a bad credit score (300-579) who need money urgently.

General Description

BadCreditLoans has a large network of lenders who provide bad credit loans on fairly reasonable terms. It was founded back in 1998 and is headquartered in Seattle, Washington. The company does not have BBB accreditation. Nevertheless, it is trustworthy, as it works legally and has no complaints from clients.

Details of The Loans

The minimum personal loan amount available to BadCreditLoans customers is $500. The maximum installment loan amount is $10,000. APRs range from 5.99%-35.99%. BadCreditLoans states that the minimum repayment period is 90 days, and the maximum is 72 months (that is, 6 years).

The conditions for issuing online payday loans are slightly different from the conditions for issuing personal bad credit loans. Thus, the online payday loan amount is $ 500-$ 1000. The average APR is 421%. The repayment term is up to 31 days.

The service is completely free to use. There are no hidden fees. The required minimum credit score of applicants is 300.

How to Apply

To receive a direct deposit from BadCreditLoans to your bank card, you need to fill out a simple form and see if you are connected with the payday lender. Then you need to compare different options and complete the application process. After that, you should expect payments within 1-2 business days.

The requirements for applicants are simple:

- Age 18+;

- Residence in the US state where the company’s services are available;

- A valid bank account.

Features of The Lender

The advantage of BadCreditLoans is that there are no fees for using the online service. Clients get access to a wide network of reliable lenders. 24/7 support is provided. So, this is an excellent choice for both people with bad credit scores and people with high scores.

The disadvantage of the platform is its high interest rates.

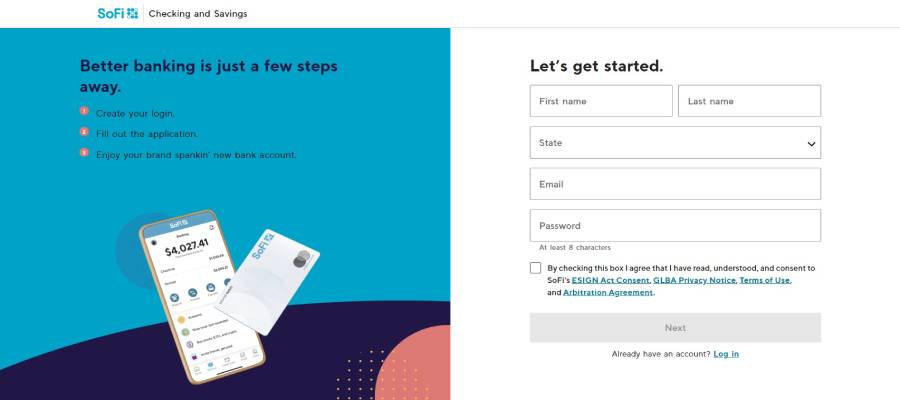

SoFi

SoFi is the choice of those who have a regular source of income and a good credit rating.

General Description

What sets SoFi apart from other online payday loan providers is that it is a direct online payday lender. The company was founded in 2011 by students from Stanford Graduate School of Business. Its headquarters is in San Francisco. SoFi works legally, all required licenses are available and provided on the site.

Details of The Loans

SoFi offers the best online payday loans ranging from $5,000 to $100,000. It is great for people who need to borrow large amounts. The annual rate is 7.99-23.43%. The repayment period is 24-84 months. The minimum required credit score is 680.

On the company’s website, you can get a payday loan in the amount allowed in a particular state. As a rule, it is $100-$1,000. Annual interest rates on the best online payday loans are low, around 300%. The repayment period is up to 1 month.

How to Apply

SoFi requirements for borrowers:

- 18+ age;

- Residence in the USA;

- Credit score 680+;

- Permanent source of income;

- Debt-to-income ratio below 30%.

The company conducts a rigorous credit check. Therefore, after submitting an application, customers usually have to wait 1-2 business days for a response from the lender.

Features of The Lender

The advantage of SoFi is that it lends large amounts at low interest rates. The disadvantages are that services are not available in all US states and only applicants with good scores are approved. Bad credit loans are not provided.

What Is a Payday Loan?

Online banking is becoming more and more popular today and the lending industry is no exception. Bank installment loans have been replaced by various microcredit organizations. They allow you to get online payday loans (small amounts for a short period of time) on favorable terms.

You can apply for a payday loan online in a few minutes and the money is automatically credited to your checking account.

Pay attention that a payday loan is not the best choice if you need a large amount for a long period. Online payday lenders provide financial assistance to solve urgent financial problems that require some expense.

How Do Payday Loans Work?

Online payday lenders are popular due to the simplified lending procedure. You can get a loan without leaving your home. Clients significantly save their energy and time due to the absence of the need to visit instances, collect references, and go through interviews.

Moreover, many companies do not even call back to clarify and confirm information.

To contact an online lender with a personal loan request, you can use any device with Internet access. Then follow these steps:

- Register in your personal account;

- Fill out the application form;

- Choose the amount and term of the personal loan;

- Verify your bank card;

- Send a personal loan request and wait for a decision;

- Receive money on the card after the approval of the application.

Online lenders issue non-targeted payday loans. Therefore, the funds can be spent at your discretion without reporting.

What to Consider Before Getting Payday Loan

There are a few things to consider before taking out a payday loan. Read more about these in the paragraphs below.

Interest Rates

The first thing to consider when taking a loan online is interest rates. Different lenders offer different rates, so be careful not to make the wrong choice. The average annual interest rates on payday loans online are 400%. Some payday loan providers have lower APRs. For example, SoFi rates are 300%. But most companies have APRs over 400%.

Fees

It is also recommended to compare fees. An origination fee of 10%-15% is often charged. There may be a fee for using the service for every $100 borrowed, etc. In addition, there may be various hidden fees. You don’t even know about these, but you have to pay extra.

The most trustworthy are companies that have reasonable fees or do not have them. One such is BadCreditLoans.

Loan Amount

According to US law, online payday loans can range from $50 to $1000. However, the amount is directly dependent on the state of your residence. For example, California residents’ maximum available loan amount is $255. It is important to comply with this requirement and not break the law.

Repayment Terms

Payday loan repayment terms are short. As a rule, they vary between 2 weeks-1 month. You should choose the period in which you are guaranteed to be able to return the money back.

What the Requirements for Getting Payday Loans Are?

You probably understand that the requirements of different lenders vary. However, there are a few common requirements that borrowers must comply with:

- Be over the age of 18;

- Live in one of the US states;

- Have an active checking account;

- Have a regular source of income.

Documents that must be provided to the online lender include identification, proof of regular income, and bank account information.

Pros And Cons Of Payday Loans

Regardless of the specific financing program, the positive and negative aspects of payday loans online are common in each case. Check them out in the table below.

| Pros Of Payday Loans | Cons Of Payday Loans |

| High speed of decision making. Online loan companies check a potential borrower within 5-10 minutes from the moment of filling out the application. | The high interest rate. APRs are often over 400%. |

| Instant receipt of money. After approval, funds are credited without delay. | Small loan amount. Payday lending solves financial problems characterized by urgency and small amounts ($50-$1,000). |

| Possibility to apply from anywhere. You can submit a personal loan request from anywhere and at any time. The main thing is to have a modern gadget and Internet access. | Short repayment period. The payday loan repayment period is usually up to 31 days. |

| Transparency of conditions. Interest rates, fees, and repayment terms are not hidden from the client. | |

| Payday loans for people with bad credit scores. Online lenders are willing to give out short term loans to people with bad credit scores. But the interest rates, in this case, are higher. |

Can I Get a Payday Loan With Bad Credit?

It’s easy to get payday loans online. They are issued on rather simple and transparent conditions. A credit check is often not carried out at all. Therefore, even those who have a bad credit score can borrow money to cover emergency expenses.

However, when choosing a lender, it is important to pay attention to the minimum required credit score. For example, the requirement of BadCreditLoans for the minimum credit score of borrowers is 300. SoFi is ready to cooperate only if the applicant’s credit score is 680 or higher.

Can I Get an Online Loan Without a Credit Check?

You can certainly find online lenders who do not conduct a credit check. But keep in mind that in this case, you will have to pay inflated interest rates for bad credit lending services. It is more reasonable to choose a company that conducts a soft credit check. This will allow you to get competitive loan offers even if you have a low credit score.

Things to Avoid When Taking a Payday Loan Online

There are a few things to avoid when applying for a payday loan online. These include high interest rates, borrowing from unreliable online lenders, and late monthly payments. Read more below.

High Interest Rates

There are companies that lend money only to applicants with a high score. If borrowers with a low credit rating apply there, then most likely they will be refused or approved for a loan at high interest rates.

At the same time, there are online payday loan platforms that specialize in providing payday loans for people with bad credit scores. Their interest rates are quite reasonable.

To avoid high interest rates, it is recommended to choose a lender responsibly and give preference to the one whose loan conditions suit you the most.

Borrowing from Unreliable Lenders

Borrowing from unreliable lenders is the biggest mistake borrowers make. There are many credit companies on the market today; not all work legally. By contacting such a lender, you risk your personal data and can be deceived.

Therefore, it is better to cooperate only with organizations that comply with the law and have all the necessary licenses.

Late Payments

Any loan involves a clear schedule of monthly payments. Late payments lead to serious penalties and greatly reduce the chances of getting a new payday loan.

In the event of an unforeseen situation, it is recommended to contact the online support service of the credit company and get instructions on further actions. A good option is debt prolongation, which most modern lenders offer.

Alternatives to Payday Loans

There are several good alternatives to online payday loans:

- Cash Advance Apps. These mobile applications allow you to deposit previously earned money into your checking account before payday. Cash advance apps are usually free or charge a nominal fee. No interest is charged on payday loans;

- Pawn Shop Loans. Compared to a bank or credit union loan, a pawn shop loan is a type of short-term loan in which the borrower receives money in exchange for some valuable item. One of the advantages of this loan is that you can get such a loan secured by almost any valuable property;

- Peer-to-Peer Online Lending Marketplace. Online lending marketplaces are mechanisms through which retail or wholesale investors invest money (for the purpose of generating income), which is then provided to borrowers (consumers or businesses);

- Auto Title Loans. This is one of the most popular payday loan alternatives. Such a loan is issued against the security of the car. Such a loan is an easy way to quickly receive the necessary amount of money on transparent terms without the risk of being deceived. Such financing does not impose restrictions on the intended use of funds for a potential borrower;

- Credit Union Loans. Many people choose credit union loans as an alternative to payday loans. A credit union loan is a loan from a non-profit organization founded by individuals on a corporate basis. Mutual provision of financial services is ensured through the combined monetary contributions of members;

- Personal Loans. This is a loan provided at an individual’s request for personal expenses. It is issued from $1,000 to $50,000 at an annual interest rate of 5.91%-35.99%. Personal loans are a good choice for those who need large loan amounts.

on your homescreen

on your homescreen