A little emergency or miscalculation in your budget can cause financial stress. An average person panics in search of a huge loan to fix the situation. But apps like Brigit have made things quite easier. These platforms have solved half of the borrowers’ problems by providing small-time funds with the lowest possible fees.

So, instead of applying for huge loans, which have higher interest and are difficult to get approval for, you can opt for various low-fee alternatives. These mobile apps are the perfect way to access the money before your next paycheck. Some even have additional services that help track your spending habits, build your credit and save more funds.

Cash Advance Apps Like Brigit: Best Offers

The Brigit app is one of the most used lending platforms across the United States. However, there are alternatives with features that might meet your demands better. Even though finding them isn’t impossible, it can be daunting.

1. PayDaySay – Best For Emergency Loans

PayDaySay is a suitable cash app for different loans. You can collect small personal loans or go higher with different apps. So, mortgage and payday loans are available for users with high credit scores. PayDaySay connects borrowers with the best lenders in its database. You can submit a request and get your 500 personal loan the same day you apply.

For small amounts, you can provide a little information.

Service: Bad credit installment loans, Mortgage and Emergency loans

Loan Amount: $100-$5,000

Fees: Varies between $15 to $30 fees per $100 borrowed

Interest Rate: Up to 400%

Waiting Period: 24 hours or the next business day

Credit Check: Yes

Pros

Cons

2. B9 – Best Banking App

The B9 banking app is a financial management tool that is built to help people navigate the demands of day-to-day financial transactions. With this app, users can enjoy flexible banking options that include no-fee advances ranging from $30 to $500, Visa debit cards with up to 5% cashback, and money transfer services. These benefits come with two membership plans, Basic and Premium.

Pros

Cons

Service:

The B9 banking app offers a range of services that include no-fee advances, cashback, and money transfer services. Users can choose between Basic and Premium membership plans and enjoy different benefits based on their needs.

Loan Amount:

The B9 banking app provides advances of up to $500 to users who meet the basic requirements.

Fees:

There is a monthly membership fee attached to both Basic and Premium plans, with costs ranging from $9.99 to $19.99 a month. However, users can enjoy no-fee advances, ACH transfers, and instant transfers to other B9 members.

Interest Rate:

There is no interest rate associated with the B9 banking app. Instead, users pay a monthly membership fee to access different services and benefits.

Waiting Period:

Users need to set up their payroll direct deposit to their B9 Account before they can access the benefits of the app. Once the funds are credited to the account, maxes and cashouts can be managed instantly.

Credit Check:

To qualify for a B9 pay advance, users must have a social security number or an individual taxpayer identification number, a government-issued photo ID, and a residential mailing address in the US. The app also provides credit reports, credit scores, and a credit score simulator for users on the Premium Plan. These features are meant to help users manage their finances and improve their credit score over time.

In conclusion, the B9 banking app is a modern financial management tool that offers flexible banking options to users who need them. With no-fee advances, cashback, and money transfer services, this app is perfect for anyone looking for a hassle-free banking experience.

In addition, the credit reports, scores, and simulator make it a great choice for those looking to improve their credit score and overall financial health. The only downside is the monthly membership fee attached to both plans, but the benefits of the app make it a worthwhile investment.

3. Dave – Best For Personal Loans

This lender allows users to access small amounts between paychecks. It’s an ideal source of an emergency fund when you need to sort minor bills. The maximum amount of money you can get on this app is just $100. However, you won’t be charged an interest rate or late payment fee. The monthly fee is agreeable, too, so the $1 caters to your account maintenance.

Service: Instant Loans

Loan Amount: $100

Fees: $1 for every month’s usage

Interest Rate: None

Waiting Period: 1-3 days

Credit Check: Soft

Pros

Cons

4. Branch – Best For Instant Loans

This is another cash app to safely and securely get extra funds. This alternative targets many countries with its services. There aren’t many apps like Branch targeting these areas. So, the loan amounts vary for different countries. But the average amount is estimated to be $700.

The company doesn’t require credit checks or a credit history summary. Instead, you need to provide basic details. Then it automatically calculates your eligibility, annual percentages, etc.

Service: Personal Loans

Loan Amount: $700 estimated

Fees: None

Interest Rate: Up to 400%

Waiting Period: 1-5 days

Credit Check: No

Pros

Cons

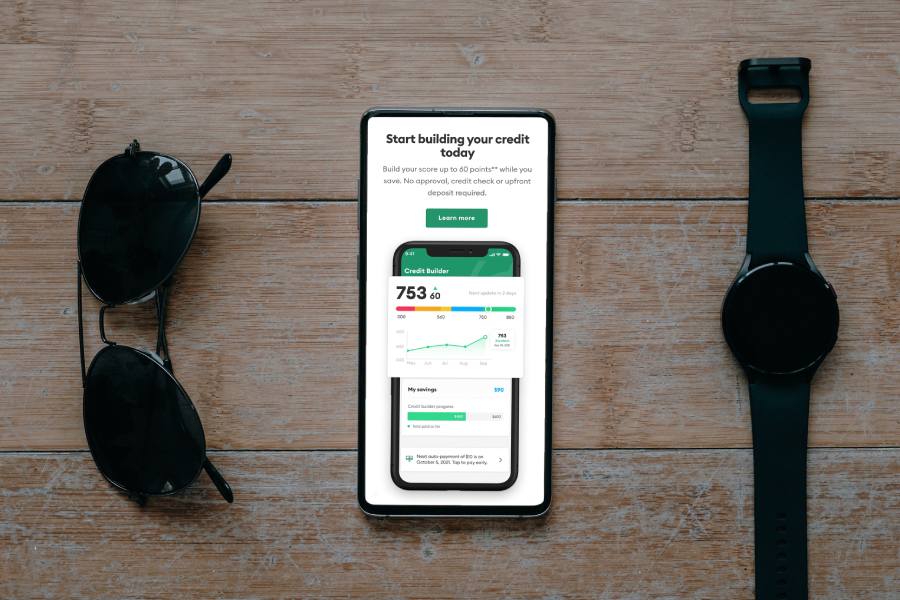

5. MoneyLion – Best For Credit Building Loans

MoneyLion is a financial institution that provides various services. Its services extend across online banking, credit building, money lending, etc. The app allows you to sign up for free. But you’ll have to pay high-interest rates on these basic loans. It also has credit builder membership plans.

Borrowers have to pay $19.99 to access this special package.

Service: Credit Building, Loan

Loan Amount: $250

Fees: $19.99 monthly subscription

Interest Rate: 5.99% to 29.99%

Waiting Period: 1-3 days

Credit Check: No

Pros

Cons

6. Earnin – Best For Low-fee Advance

Earnin app is a financial platform that lets you withdraw from your earned wages before payment. It’s particularly useful for users than earn wages. So, instead of waiting till you’re paid, you can make an early withdrawal. Rather than charge interest, borrowers can give optional tips instead.

So unlike PayDaySay and MoneyLion, Earnin is a middleman between the employer and the employee. The app provides extra funds from your expected wage and deducts them on the next paycheck.

Service: Cash Advance

Loan Amount: $100-$500

Fees: None

Interest Rate: None

Waiting Period: 24 hours or the next business day

Credit Check: No

Pros

- Zero fees are necessary to access the app

- No interest is charged on borrowed funds

- Fast payment delivery time.

Cons

- It may foster poor debt habits

- Borrowers need to link a bank account.

7. Affirm – Best For Credit Purchases

Affirm is one of the best “But Now, Pay Later” (BNPL) apps in the U.S. It allows users to buy extra items and pay later without incurring charges. Borrowing here doesn’t include fees or interests as long as you pay it off within a month. It uses a pay-in-four plan and partners with popular online merchants and stores.

Service: Credit Purchases

Loan Amount: $50-$17,500

Fees: None

Interest Rate: None, but might charge up to 30% for monthly payments

Waiting Period: 1-5 days

Credit Check: Soft check

Pros

Cons

8. Ingo Money – Best For Personal Loans

Ingo Money is similar to payday apps because of its partnership with Kabbage. This financial institution allows users to have their money wherever they want it in the shortest time possible.

It uses an automatic payment processing system for your checks. So you can move funds between multiple accounts as fast as possible. Although InGo Money has a poor reputation with its customers, it’s still a decent way to access your funds faster before your paycheck.

Service: Personal Loans, Mobile Banking

Loan Amount: Varies

Fees: $5 per transaction

Interest Rate: Varies

Waiting Period: 1-5 days

Credit Check: Yes

Pros

Cons

9. Chime – Best For Instant Loans

Chime is a financial platform where borrowers can get low-fee financial aid. It’s a bank institution that offers money lending services for its customers. So you must be an active member to access its extra fund or overdrafts.

The regular offer is the instant advance, where you receive up to $100 and can pay back within three months (interest may apply).

Service: Overdraft, Instant Loans

Loan Amount: $50-$200

Fees: $5 per $100 transactions

Interest Rate: 30% APR for payments reaching three months

Waiting Period: 1-3 days

Credit Check: No

Pros

Cons

ONE@Work – Best For Long-term Loans

Even Financials is a money lending company with secure personal funds for borrowers. It provides various features that allow users to access various funds without incurring fees on its app.

It’s an ideal platform to get extra funds for debt consolidation, vacations, building, medical expenses, etc. It only does a soft credit check for approval, so your credit score is safe.

Service: Personal, Emergency, Installment and Mortgage Loans

Loan Amount: $1,000-$100,000

Fees: Varies

Interest Rate: Starts from 3.84%

Waiting Period: Varies

Credit Check: Yes

Pros

Cons

Some of these apps can serve various financial purposes. We’ve compared these alternatives and confirmed their competitive fees and usability. They also have high approval rates, fair APRs, waiting periods, etc. You can check them out below:

|

Lenders |

Loan Amount |

Fees |

Interest Rate |

Waiting Period |

|

Dave |

$100 |

$1 for every month’s usage |

None |

1-3 days |

|

PayDaySay |

$100-$5,000 |

$15 to $30 fees per $100 borrowed |

Up to 400% |

24 hours or the next business day |

|

Branch |

$700 est. |

None |

Up to 400% |

1-5 days |

|

Earnin |

$100-$500 |

None |

None |

24 hours or the next business day |

|

MoneyLion |

$250 |

$19.99 monthly subscription |

None |

1-3 days |

|

Affirm |

$50-$17,500 |

None |

None, but might charge up to 30% for monthly payments |

1-5 days |

|

Ingo Money |

Varies |

$5 per transaction |

Varies |

1-5 days |

|

Chime |

$50-$200 |

$5 per $100 transactions |

30% APR for payments reaching three months |

1-5 days |

|

ONE@Work |

$1,000-$100,000 |

Varies |

Starts from 3.84% |

Varies |

What About Brigit?

Brigit is a money-lending app that offers low amounts for borrowers. This financial company also adds budgeting tools and credit protection features to help borrowers consolidate payday loans and boost their credit scores. One of its most admirable features is its automatic advance lending when it notices you want to overdraw your account.

Anyone can use the app for free with limited access. But many consider the $9.99 monthly fee as a major downfall. The maximum amount you can borrow here is $250. So, it’s most suitable for small-time borrowers who need emergency funds before their next paycheck. The company partners with thousands of other financial institutions. So, it’s a reliable lender you can always count on.

How to Compare Brigit?

Brigit app is a popular lender and one of the best out there. But if you’ve decided not to choose it, there are some important features you must look out for in any alternative you choose. These include some of the major factors determining any lending platform’s usability.

Ensure you find the right balance between four or more of these before you make your choice. You can check them out below:

Service

Checking the available services is pertinent when comparing apps similar to Brigit. That’s because lending platforms offer various types of services. For example, you might be able to get an advance and installment loan on Lender A but only an overdraft on lender B.

So, once you identify your need, only compare alternatives that can offer the solution. Borrowers should stay away from lenders that provide too many services. Also, avoid overdrafts with fees and stick with interest-free personal or payday loans.

Loan Amount

There is no fixed figure to request in your application. But there is a limit that certain companies can give. For example, a small loan company can give between $50-250, while bigger ones can give up to $5,000. It all boils down to what amount you need. Hence, always look for companies with maximum limits that meet your expected amount. This way, you can avoid borrowing from multiple cash advance apps and easily manage all your debts.

Fees

In most scenarios, companies that charge fees don’t collect interest and vice versa. So, keep your expenses lower by opting for companies that stick to one type. While there is no fixed fee, any amount higher than $10 per month or $30 per $100 borrowed is considered too high. So, try to stick with companies with low fees. Also, avoid companies that charge a combination of many fees.

For example, it’s a bad deal if you have to pay a single loan’s origination, application, processing, and late payment fees.

Interest Rate

You shouldn’t pay extra fees while already charged interest rates. So, you compare the interest rate of the alternatives with one another. Many loan apps charge up to 400% APRs or even higher. Most apps charge an average of 24% APR. So, it depends on which type you apply for. But always stay away from apps with interests higher than 100%.

Waiting Period

If you need a quick 200 loan, compare multiple apps for instant money. But you can overlook this factor if you are okay with how long it takes. Some companies offer an instant loan but might require an express fee if you’re in a hurry. For those in the first category, payday quick loans same day should be a maximum of a day or two. So, when you compare an app with Brigit, check for those waiting for one day or the next business day.

Credit Check

When you apply for a cash advance, lenders often review your credit history. So, when a company does a credit check, it tries to assess your financial situation. If you don’t have a high credit score, you can opt for those that don’t require credit checks. Otherwise, find bad credit loans guaranteed approval direct lender that accept low or bad credit.

A credit score below 600 is considered to be bad credit. Anyone between 700-800 is good, while 800+ scores are excellent. You can check your score with any of the three credit bureaus. Visit their official website and apply for a free credit report.

Cash Advance Apps: Scammers

Many victims fall for loan apps annually. These scammers often make huge promises to entice victims. To detect one, there are certain features you can look out for. These are:

- They require credit card details, SSN, or other personal information.

- They charge for services they don’t render.

- They offer high amounts.

- They guarantee loan approval.

- They make outrageous promises to sort your debt profile.

- They ask for upfront payments or use complex payment systems.

To avoid falling victim to these scammer apps, there are precautions to take. First, you should avoid any suspicious lenders. Read customer reviews online. Refuse deals from phone calls and texts. Finally, stay away from companies that pressure you to act immediately.

on your homescreen

on your homescreen