In Oregon, payday is often on the 31st day. As a result, payday loans online in Oregon State are generally within the next 31 days. For example, if you get one on the 1st of August, you are expected to pay it off by the 31st of August.

Best payday loans in Oregon

We’ve sourced some of the best payday lenders in Oregon, and you can find some of our top picks below:

PayDaySay

PayDaySay is a platform connecting people who want to borrow from where they could get the loans. It was founded in 2013. The company’s address is 8 The Green, Suite #5876, Dover, DE 19901. Usually, it deals with small personal loans. Interestingly, you can use the PayDaySay app right from your smartphone.

You only need to provide your basic details, and you will have access to numerous financial institutions. However, you should check whether the conditions suit you. The amount you can get is between $100 and $5000. With any credit score, it is possible to get a personal loan of around $5000, depending on your current aims.

There are no specific charges from them. However, you must write personal contact, link your bank and provide employment details. For Oregon Payday loans online, the repayment process is dual. You could either allow the direct bank deduction or postdated Check. In all, you should consider using this app when you want to connect to top financial institutions for loans.

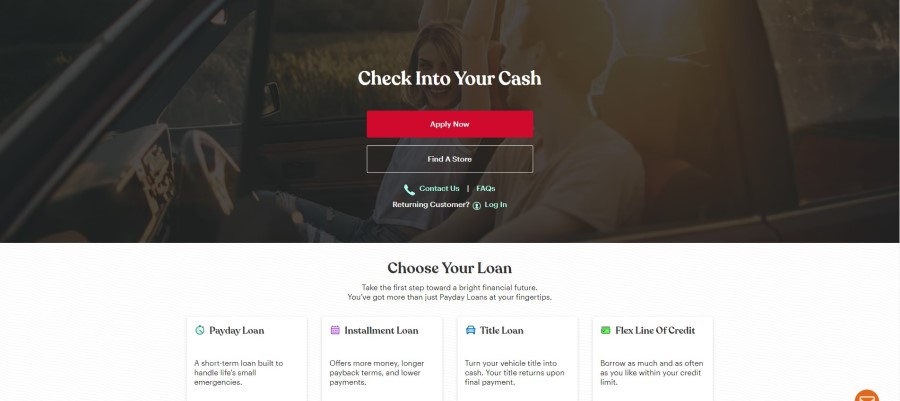

Check Into Cash

Check into Cash was founded in 1993. It is a leading Oregon payday loan online, with over 700 stores in different states. The Oregon office is at 2053 Woodville road, OR. It is a payday loan online that uses credit load to determine whether a loan amount would be given.

The credit score is set at a minimum of 300 before borrowers can get money. The APR for getting credits depends on the long term. Typically, the APR is usually between 261 to 782 percent.

The loan amount is between $50 and $1000, and the term is 14 to 30 days from the day you get the money. Once a borrower initiate funds, the money is dropped into the account almost immediately. Based on the fact that it uses credit load, many people do not rate the company well.

Quick Check

Quick Check was established in 1994. It is a small owner-operating business located at 13987 Holcomb Blvd, Oregon City, OR 97045, United States. The small size is a unique factor that differentiates it from other loan lenders. One of their primary goals is to provide the best lending conditions and first rates for borrowers.

The loan amount is between $50 and $1000, and the term is 4 to 31 days from the disbursement. It does not use any form of credit score. This means that new and returning customers are treated the same way in providing the best payday loan.

This company operates a convenience fee of $2 for all users. It has an APR of 547.5%, and the approval process is instant, but the fund disbursement varies. The issuance could be online or with a card deposit.

When it is online, it is between 1 to 2 working days, while card deposit is instant. In all, It is a good platform that many people recommend. However, one downside to this platform, among other online payday loans, is that it is unavailable 24/7.

Rapid Cash

Rapid Cash is a subsidiary of the Speedy Company located at 12131 SE Powell Blvd, Portland, OR 97266, United States. It is found not only in Oregon but also in 11 other states.

It is a veteran among payday loans online Oregon State companies. Rapid Cash prides itself on its core value of ensuring fair treatment and proper observation of all the rules in lending services. It also operates online lending services apart from its storefronts. In Oregon alone, there are 3 stores of rapid Cash.

The APR is 153% of the principal amount, which is between $100 and $300. It has a term of just 31 days, and there is no minimum time to pay. However, there is a limit to the number of days borrowers could go without paying. The fund is approved instantly but available within 24hrs. It does not use credit load to determine the amount borrower could get.

CashNetUSA

CashNetUSA is one of the leading online payday loan companies with great reviews. It is notable for its over three million partners. Apart from being in Oregon, it is also present in seventeen other states.

The amount you can get ranges from $100 to $1,500 for new customers. Interestingly, it does not use credit load to determine the amount you can get. The initiation approval is instant, and the funds are available the same day it was initiated. The APR depends on the loan term, between 208 and 520% of the principal amount.

The term is usually between 14 and 35 days. Its physical office is 200 West Jackson Suite 400, Chicago, Illinois. This lender has top reviews, and it’s easily one of the best among online payday loans in Oregon.

Are payday loans legal in Oregon?

Payday loans are legal in Oregon, online and offline. Nonetheless, lenders in Oregon must have a license. However, some organizations do not need a license to provide payday loans. Credit loan unions and Banks are some of those; you can get a payday loan from them anytime.

Getting money lenders is easy in Oregon online. However, it would help if you were sure they were licensed. Therefore, be sure to meet all the conditions surrounding the process and collect all documents you might need.

Why might you need Oregon payday loans?

Different circumstances warrant getting a payday loan. Primarily, the goal is to pay off some dues that can’t wait. Emergencies are never planned, and they constitute greater reasons for taking a payday loan.

So this helps the borrower pay for unforeseen circumstances and essential things. Every loan is due on the next payday, usually 31 days in Oregon. Do you have something you need to pay for urgently? Then, you may need this.

The reason you may want the payday loan might not be clear to you on the surface, but if you think deeply, you may see more reasons to get it. You must ensure you understand the conditions. They vary by lender. You are responsible for reading and understanding everything. At the same time, the lenders must openly provide all the details, including charges.

Terms of payday loans in Oregon

Apart from the condition of having a license to be a money lender, there are terms to payday loans. There is a limit on Advanced Pay Rate (APR), which cannot exceed 153.77%.

Also, there is a limitation on the percentage orientation fee, which is 10% and up to $30. Another thing is the possibility of a rollover, which can’t be more than two months. Once you have two months, there is no more renewal, but you should pay up.

Loan Amounts

The loan amounts are the actual money that the borrower wants. It is essential to know the terms by requesting that the lender provide a written document for you. It is possible to get up to $50,000 loans in Oregon online. Sometimes, the lender may calculate the amount based on your annual earnings.

When this is the case, the pay is 25% if you earn less than $60,000 annually. While taking a loan, the amount should depend on your earnings and how urgent you need the money. You can easily calculate your loan by the amount of what you earn. If your earnings are $300, you should not borrow up to $200. It may be challenging to give up such a big chunk of your money at a time.

Loan Terms

The loan term is the repayment days. The term is fixed at a minimum of 31 days and a maximum of 60 days. There is a period called cooling-off in Oregon, which is 7 days. So, if you borrow and have to pay it back, you must wait seven days before getting another one. The same applies to a payday loan online.

There are instances where you cannot pay up within the stipulated time. What you can do is roll over your pay. With this, you are only working with 60 days payday. Anyone that could not pay within this period would face heavy fines. During this period, the best thing to do is to calculate your earnings and deduct the loan amount and other charges. Sometimes, you should ensure that what you borrow is just half of what you earn.

Loan Rates

The orientation fee is 10% of the money for new person borrowing. It could be up to $30 for someone that had been borrowing well. Your credit score could also serve as a way of knowing how much you could get.

As such, your rate may increase, even as a first-timer. Other times, you could get credit without a good credit score. This is common to online payday lenders. The origination fee is always added to the interest.

So, if you borrow $100 with 10%, and you have an interest rate of 3%; your origination fee and interest will be $13. So, you will be paying up $113. Note that different companies operate at different rates, but the benchmark usually follows a minimum of $10 and a maximum of $30.

Pros and Cons of payday loans in Oregon

There are different advantages and disadvantages of getting payday loans in Oregon. You may have personalized ones based on various circumstances, but some of the general ones we can think of are given below:

Pros:

- Ease of Access

You would get a payday loan with just a few documentation and steps. It is considered one of the most accessible loans to acquire

- Less Reliance on Credit Load

You do not need a good credit history to acquire a payday loan. Since it is mainly on the amount and other company-specific rules, credit load is less determiner of getting a payday loan in Oregon.

Cons:

- Predatory in nature

Payday loan has some terms that are difficult to meet. This could be because companies have different conditions. Loans with this kind of condition are called predatory.

- Cumbersome Payment

It could be costly to pay back. This is common because the companies will add the orientation and interest rate to the loan amount. It could keep accumulating, especially when you have a rollover.

What will Oregon payday loan cost?

The payday loan in Oregon is pegged at a maximum of $50,000. This means that the benchmark by any lender is not to give more than that amount within a cycle of payday, usually 31 days. Though this is the general written law, many companies do not provide more than $300 in practice.

Another law that limits the number of payday loans in Oregon is that the law dictates that for every $100, the lenders can only charge $10. Not only that but also the fact that the charge could only be up to $30. This means that the principal amount that any lender could give is $300 because that is when the maximum charge of $30 is achievable.

The average percentage is usually calculated by the interest rate of the principal loan multiplied by 365 days. The lender primarily determines the interest within Oregon’s maximum and minimum terms. This way, you can easily calculate how much it will cost to get a loan.

Oregon payday loans if the Credit Rating Is Poor

If you are in Oregon and have a poor credit rating, it does not outrightly stop you from borrowing. The amount you have used on your credit card does not say much about whether a lender would give you money. Generally, credit load is not a criterion for the payday loan amount.

Lenders consider using credit load because it shows transaction details. Sometimes, this can assure them that you will repay any amount given. However, credit load is one thing some lenders sometimes consider before lending any money to anyone.

What are alternatives to Oregon payday loans?

Different alternatives have been created for payday loans based on difficulties, such as an increase in the interest rate and average pay rate. The primary reason is because of the short repayment scheme and a high refund rate.

The best time to choose payday loans is when you know that you can afford to pay quickly and that the charges that come with them are affordable. Alternatives provide longer time yet reduce charges on every amount you get. Also, they do not use any form of credit load. If you fulfill these criteria, you should get an alternative payday loan. Here are a few options:

Cash Advance

With the growth of fintech companies, cash advance app has been used for loans. It works by providing a way to access your salary scale over some time before the paycheck.

Credit Union

Since many states have discovered how bad payday loans could be for consumers, Credit Union has been created as part of alternatives. Here, you don’t need a credit record but the federal credit union membership that offers it. Usually, the repayment duration is within 12 months, and the AVR is within 28% without any form of rollover.

on your homescreen

on your homescreen