A visit to the dental school dentist can be costly if you suddenly find yourself in urgent need of some kind of dental procedure. It’s good if you have health insurance. It will cover some dental costs. But you will most likely have to pay the main cost of services in the dentist’s office. Fortunately, there is a good way to cover the costs – a dental credit card.

Credit cards for dental work are widely used these days. This is a type of medical personal loan that allows you to quickly and easily pay for the necessary dental services. These can be both cosmetic dentistry and medical dentistry.

Getting a dental credit card is not difficult at all. The credit approval rate is high. The procedure for obtaining dental loans is similar to the procedure for obtaining any other type of personal loan. Dental credit cards are unsecured.

You do not have to provide any collateral to get such a card. At the same time, your statement credit history is checked and considered.

Credit Cards For Dental Work: 7 Best Offers

Credit cards for dental work are a fast and reliable way to get money for medical care. Customers are usually offered a convenient system of interest payments with no hidden fees. The advantage is that the credit card can be used again and again. There is no need to apply for a new personal loan every time.

Before choosing a dental credit card, it is recommended to pay attention to several important aspects: whether a bad credit score is allowed, whether a monthly fee is charged, whether there is extended warranty protection, when the promotional period ends, etc. Try to choose a card with an eligible delivery service and a grace period.

Usually, the interest free period is from 30 to 62 days. During this period, you can use borrowed money without any interest.

Be sure to clarify which operations are included in the grace period and which are not. Find out all the channels for paying off dental credit card debt. Write down the number of dental students support services.

If you find it difficult to choose among a wide variety of dental credit cards, carefully consider the list below. We have selected good credit cards for dental work. You just need to look through and choose the one that suits you best.

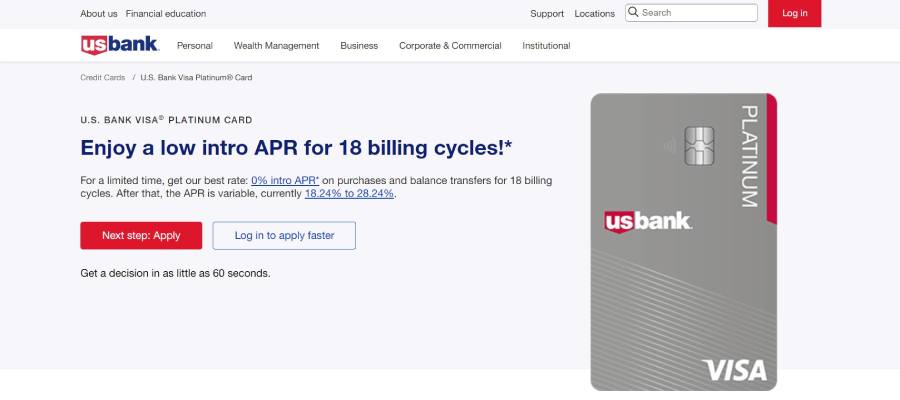

1. U.S. Bank Visa® Platinum Card

This dental credit card is chosen by many since it has many advantages over others. It is best for people who want to save money on accruing interest when paying for dental services over a long period.

The US Bank Visa® Platinum Card offers 0% starting annual dental interest for 18 billing cycles. This is followed by a variable annual interest rate of 18.99-28.99%. There is also a balance transfer fee of $5. There is no deferred interest. The annual fee is $0. As for the required credit score, it must be at least 670.

US Bank Visa® Platinum savings accounts provide contactless and fast dental financing transactions. These are the main advantages of the card. Other pros include:

- Solid annual interest rates on dental services;

- 0 intro apr;

- Regular annual percentage rate of 18.99-28.99% is below average;

- Secure transactions.

Cons of US Bank Visa® Platinum:

- There are no dental school rewards programs;

- There is usually a fee for transferring the entire balance.

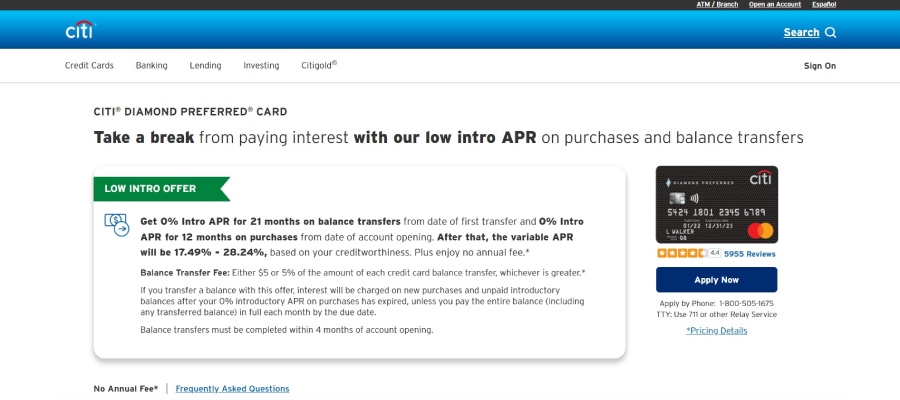

2. Citi® Diamond Preferred® Card

This is another dental financing card that will allow you to pay for any dental procedure. Many people use it to pay off or consolidate high-interest debt. It is also beneficial if you want to access the introductory annual percentage rate on purchases over time.

Regular APR ranges from 17.49% to 28.24%. The balance transfer fee is $5 or 5% of the amount of each transfer, whichever is greater. Deferred interest is not charged. The annual fee is $0. A good credit score is 670 and higher.

The main feature of the Citi® Diamond Preferred® Card is an initial annual interest rate of 0% for 21 months on remaining balance transfers from the date of the first transfer. The advantage of the card is its affordable regular APR. The disadvantages are that there is no premier rewards program, and a 3% origination fee is charged for a foreign transfer.

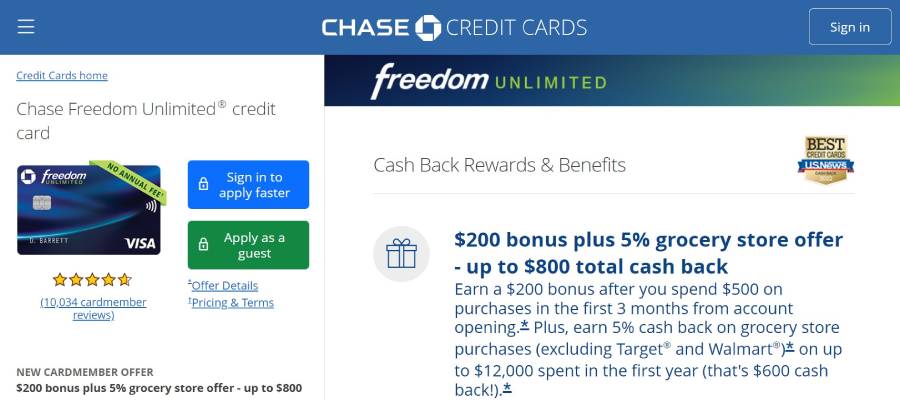

Chase Freedom Unlimited®

Chase Freedom Unlimited® is a great choice for dental procedures and everyday expenses. It refunds 5% cash on trips booked through Chase, 3% on purchases at restaurants and pharmacies, and 1.5% on other purchases.

Practice shows that a 0% introductory annual interest rate is charged on purchases and balance transfers during the first 15 months of using the dental financing card. After the introductory period, the variable annual rate ranges from 19.24% to 27.99%.

Compared to U.S. Bank Visa® Platinum Card and Citi® Diamond Preferred® Card, only those with a credit score of 690 or higher can become Chase Freedom Unlimited® users.

The pros include:

- Sign-up bonus;

- Cashback program;

- No annual fee;

- 0 intro apr.

Among the cons are the following:

- Potentially high regular APR;

- Foreign transaction fees are charged.

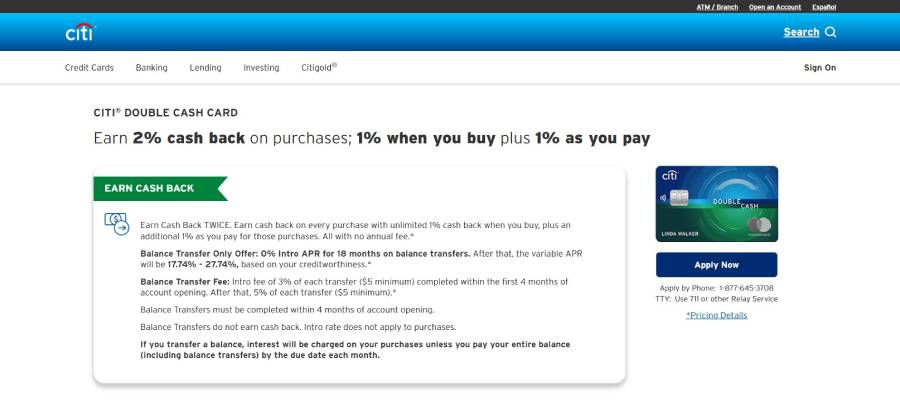

3. Citi Double Cash Card

This card is a great option for people with excellent credit scores. It lets users quickly pay for dental services and transfer high-interest balances from other cards. The minimum acceptable credit score is 700. If you have bad credit, this card will most likely not be a good choice for you.

Regular APR is 18.49%-28.49%. Deferred interest is not provided. An annual fee is not charged. The main feature of the Citi Double Cash Mastercard is that it provides users with cashback rewards. Cardholders receive 2% cashback by earning 1% cashback on purchases.

When paying for these purchases, an additional 1% cashback is returned. Cashback is credited in the form of ThankYou® Points.

Pros of the card:

- Favorable fixed cashback rate;

- 0 intro apr;

- Solid introduction APR offer on balance transfers;

- Capital one’s best prices.

Cons of the card:

- Does not provide a sign-up bonus;

- A 3% foreign transaction fee.

4. Capital One Venture Rewards Credit Card

It is the best option for those who want to pay for dental services while building their own credit. Upgradeability and flexible security deposit requirements make Capital One Venture Rewards one of the best credit cards available today.

Compared to other dental financing credit cards listed above, the regular APR Capital One Venture Rewards is 20.24%-28.24%. This is a fairly high rate. In addition, there is an annual fee of $95. The minimum credit score is 700, but it is better if you have 750 or higher. If you have less than perfect credit, you will most likely be rejected.

What makes this card special is that it earns 5 miles per dollar on hotel houses and rental cars booked through the Capital One Travel service. If you often pair your dental visits with out-of-town appointments or travel for specialized treatments, travel credit cards can help you earn miles and rewards while covering your expenses. Users also get unlimited 2 miles per dollar spent on other purchases. This puts the Capital One Venture Rewards on par with popular flat-rate reward cards.

The key disadvantages of the card are the following:

- Limited bonus categories;

- No cell phone insurance;

- No introductory period on purchases or balance transfers.

5. CareCredit Credit Card

CareCredit is one of the special dental financing options because it allows you to borrow money at favorable terms to pay for emergency dental care. The card is specifically designed to cover healthcare-related expenses. It is accepted by more than 250,000 service providers in the US. The card can also be used for veterinary care.

CareCredit has a fixed interest rate. It is 26.99%. But there is no deferred interest. In addition, the annual fee is $0. The required credit score is 620. However, many customers indicate that they use CareCredit even with a credit score of around 600.

Pros of CareCredit:

- Allows to cover various medical expenses;

- 0 intro apr.

Cons of CareCredit:

- Promotional interest rates are easy to lose if you miss the minimum payment;

- Not variable regular APR;

- Not accepted by all dental providers.

6. Citi Simplicity® Card

If you are planning to visit a dentist’s office but don’t have enough money to pay dental bills, you can choose the Citi Simplicity® Card. It is commonly used by those who have high-interest card debt and are looking for relief in the form of a low-interest balance transfer. But rest assured that it will also be a great option for you.

Regular APR varies between 18.49%-29.24%. An annual fee is not charged. Intro balance transfer APR 0% for the first 21 months. Introductory period purchase APR is not charged for the first 12 months. The balance transfer fee is 5% or $5 of each transfer, whichever is higher.

The good credit score is 700. Applicants with lower credit scores are not considered. These are the main features of the Citi Simplicity® Card.

Citi Simplicity® Card pros:

- Suitable not only to pay for financing dental work but also to make a major purchase or to consolidate debt;

- No annual fee;

- Beneficial intro APR offers.

Citi Simplicity® Card cons:

- No cashback offers;

- No redeem rewards points;

- High balance transfer fees.

7. Capital One Quicksilver Cash Rewards Credit Card

Capital One Quicksilver Cash Rewards is a dental credit card with a good promotional period and a simple payment plan. It is usually used by those who appreciate the ease of getting a flat rate on their purchases. Almost every purchase comes with a 1.5% cashback. There are no spending limits to keep track of. This is the main feature of the card.

Regular APR is variable. It usually varies from 19.24% to 29.24%. The annual fee is $0. The minimum required FICO credit score is 690. Lower credit scores are not permitted.

The advantages of the Capital One Quicksilver Cash Rewards are as follows:

- 0 intro apr;

- No foreign transaction fee;

- No credit limit.

The drawback of Capital One Quicksilver Cash Rewards is its high regular APR.

Summary of Best Credit Card For Dental Work

Here is a summary table of the best credit cards for dental work. Consider it carefully to make the right choice.

| Best for | Regular APR | Annual Fee | Required credit score | |

| U.S. Bank Visa® Platinum Card | Best for people who want to pay interest on dental services and save money | 18.99-28.99%. | 0% | 670 |

| Citi® Diamond Preferred® Card | Best for paying off or consolidating high-interest dental loan | 17.49%-28.24% | 0% | 670 |

| Chase Freedom Unlimited® | Best for paying for dental procedures and day-to-day expenses | 19.24%-27.99% | 0% | 690 |

| Citi Double Cash Card | Best for people with excellent credit scores | 18.49%-28.49% | 0% | 700 |

| Capital One Venture Rewards Credit Card | Best for those who want to pay for dental services while building own credit | 20.24%-28.24% | $95 | 700-750 |

| CareCredit Credit Card | Best for paying for emergency dental care on favorable dental loan terms | 26.99% | 0% | 620 |

| Citi Simplicity® Card | Best for those who chase ultimate rewards | 18.49%-29.24% | 0% | 700 |

| Capital One Quicksilver Cash Rewards Credit Card | Best for people who value the ease of getting a flat rate on their purchases | 19.24%-29.24% | 0% | 690 |

Therefore, the regular APR and promotional period of the described credit cards vary. There are more expensive (for example, Capital One Venture Rewards) and cheaper offers (for example, Citi® Diamond Preferred® Card). The credit score required also differs. Most cards don’t charge an annual fee, but the Capital One Venture Rewards charges $95.

Take into account all lending terms and choose the best dental loans without any difficulty!

Who Should Apply For a Dental Credit Card?

It is recommended to take a bad credit dental loan when there is a need to pay a dental bill, but you do not have enough money. The list of services covered by a dental loan is quite extensive and includes:

- Consultation;

- Cosmetic dentistry;

- Dental treatment;

- Tooth extraction;

- Tooth filling;

- Surgery and implantation;

- Comprehensive hygiene and whitening;

- Anesthesiology;

- Periodontology;

- Bite correction with braces, etc.

Dental practice shows that none of the above procedures is performed in isolation and requires the simultaneous involvement of different types of dental work. For example, a tooth filling cannot be done without cleaning.

In addition, most manipulations require anesthesia, drills, and other equipment necessary for the quality of the procedures. Hence the high overall cost of dental care. Thus, you should choose a payment plan that will allow you to fully cover all dental expenses.

Who Qualifies for Free Dental Work?

People with diseases or medical conditions, children, and those over 65 who do not have dental insurance can qualify for free dental care. It is available from various sources, including nonprofits, local dental clinics, clinical trials, dental schools, and events. Donated Dental Services and Medicaid are some of the most popular payment plans that allow people to pay their bills.

Are Dental Credit Cards a Good Idea for Dental Work?

Bad credit dental loans are a great solution if you clearly understand their features and find benefits in them. Before applying for a dental personal loan, you need to know the amount you are eligible for, the end of the promotional period, and the loan terms. Use credit cards when it makes sense.

Otherwise, consider getting dental insurance or using other lending options such as personal loans, installment loans, etc. Own payment plans may also be helpful.

on your homescreen

on your homescreen