When you search payday loans online same day deposit, the biggest question is simple: how fast can the money hit your account? The honest answer is: it depends. Some lenders can approve quickly, but deposit timing also depends on verification steps, cutoff times, weekends/holidays, and your bank’s posting rules. This guide explains what “same day” can realistically mean, what to check before you apply, and which alternatives may cost less.

Payday Loans Online Same Day: Best Decision

You may suddenly find yourself in a tough financial situation, with little to nothing in your checking account or on your credit cards. When you don’t have any cash set aside for an emergency, you may need additional support, such as personal installment loans or fast cash loans online same day deposit.

It can be a smart option to take out a payday $200 loan instant approval to cover urgent cash needs, especially when you have bad credit. Remember that this solution works only for the short term due to the higher rates of this loan.

Usually, consumers utilize a payday loan only for immediate money disruptions and when they need no credit check for long term installment loans no credit check. You may withdraw the funds in this way when you need to cover urgent medical bills, pay for rent or utilities, buy groceries, etc.

If it isn’t a sudden emergency and you may postpone the purchase or payment, it’s better to avoid getting extra debt. Taking out a payday loan same day deposit means you also take risks. The repayment term for these online loans utah is short and the cash advance funds should be returned on the next salary day.

Before applying, read the lender’s disclosures for: APR, total cost, fees (origination/late/NSF), repayment schedule, and how the lender collects payments. If payments are taken by debit/ACH, also confirm how re-attempts work and what happens if your account has insufficient funds.

Remember that various financial institutions, such as credit unions, provide alternatives to traditional payday loans, often with more favorable terms. These payday alternative loans can offer relief without subjecting you to the risks associated with high-interest payday loans.

What Are Same Day Payday Loans?

Some online lenders can review an application quickly. Same-day deposit may be possible when funds are sent early enough through eligible payment channels, but timing depends on verification, cutoff times, and your bank.

It’s an attractive offer with a short application process, particularly for customers with a pressing financial need that can’t wait. Where can you obtain best payday loans online? Here!

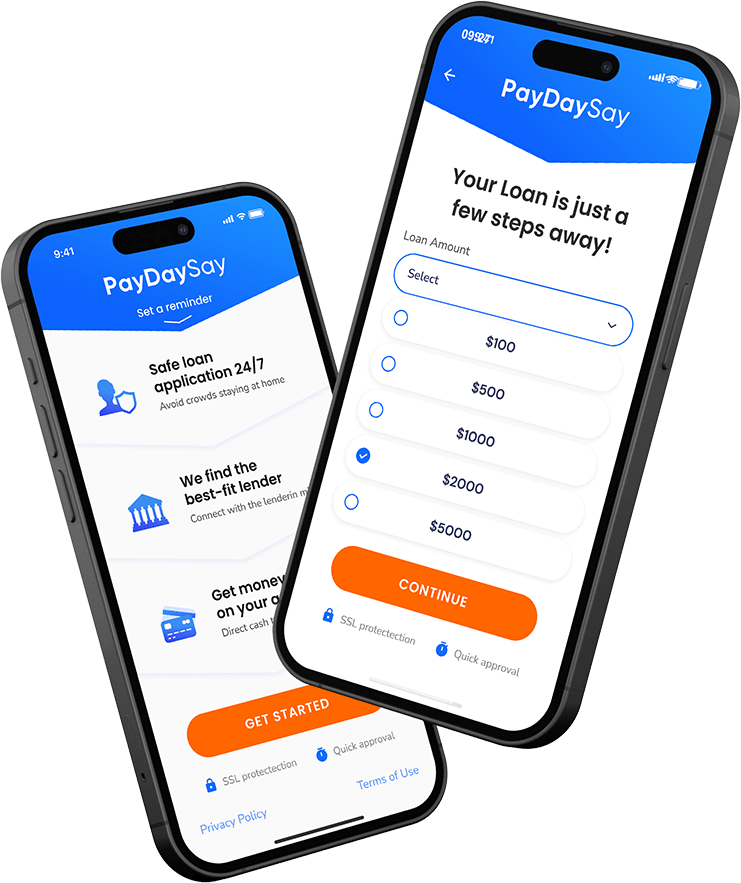

We work directly with online payday app lenders like 15M finance and 1F cash advace. Many borrowers see deposits the same day or within 1–2 business days, depending on identity/income verification, lender processing, and bank posting policies.

Types of Same-Day Loans Online

If you’re settling for payday loans online same day, you should consider the different loan types available before picking any. These online loans same day deposit no credit check include Unsecured same-day loans bad credit, same-day payday loans for entrepreneurs, and emergency same-day payday loans.

As expected, these online best payday loans online same day come with different features, from loan repayment terms to interest rates. In the following headings, we’ll discuss these loans with bad credit in brief detail, alongside their pros and cons to compare.

Unsecured Same Day Loans Bad Credit

Secure quick cash with unsecured same-day loans for people with bad credit, where collateral is not required for approval. These online payday loans are designed to cater specifically to individuals with bad credit scores.

Given solely based on creditworthiness, these payday loans come with higher APRs, smaller loan amounts, stricter repayment schedules, and additional prepayment fees. Despite these conditions, the funds can be utilized for various needs such as car repairs and home expenses.

Apply for a personal loan online without the need for collateral, and the approval decision is made promptly. While these loans offer fast and easy access to money, borrowers need to carefully consider the terms, including the higher APRs and specific repayment conditions.

The online application process involves an online form, and once approved, the personal loan lender may transfer the funds directly to your bank account. Unlike traditional loans, these lenders often do not perform a hard credit check, making them accessible to individuals with poor credit scores.

Pros

- Loans are accessible round-the-clock

- Quick deposit in 1-2 days

- High loan amount

Cons

- Exorbitant fees and high interest rates

- Short term loans.

3 Steps to Request Funds Online

What to Consider Before Applying For Same Day Payday Loans

When contemplating the option of obtaining the best same day deposit loan, notorious for their occasionally high APRs in certain states, it’s essential to acknowledge them as a last resort. Payday-loan rules come from state law and federal consumer-protection frameworks. The CFPB issued a major rule in 2017, and in July 2020 it rescinded the rule’s ability-to-repay provisions while keeping certain payment-related protections.

For those seeking the best payday loans in California, or at other states catering to individuals with bad credit, critical factors must be weighed on the day you apply. These factors include credit limits, loan amounts, interest rates, loan terms, originating fees, late payment fees, and administration fees.

While these no-credit-check loans offer a lifeline for bad credit borrowers, it is imperative to recognize that the repayment process could potentially exacerbate your credit history if payments are not met as agreed with the borrowers with bad credit.

Legality and rate caps vary widely by state. Some jurisdictions restrict or prohibit payday lending, so check your state regulator before you apply (New York and DC, for example, have strict limitations and specific consumer-protection rules).

In essence, navigating the landscape of best personal loans requires careful consideration, especially for those with a bad credit history. Opt for lenders that offer same-day approval and scrutinize the terms and conditions of the loans meticulously. Make informed choices when selecting a lender that offers emergency cash options, depositing funds directly into your account within a day.

It’s crucial to identify lenders that offer secured personal loans with competitive rates, understanding that some may require a credit check while others don’t. In this financial terrain, choosing the best option for your situation involves assessing the type of credit check, if any, and ensuring the lender aligns with your financial needs and capabilities.

Strong benefits you can use

Same Day Payday Loans Online

To secure an online same-day personal loans, ensure you meet the following eligibility requirements:

- Be a US resident or citizen

- Be over the age of 18

- Have a verifiable steady income source

- Have a valid bank account that’s in your name

- A valid email address and phone number

on your homescreen

on your homescreen