Life can be unpredictable with sudden costs. Facing a financial crunch and thinking, ‘How can I get $200 now‘? turn to online loan providers. Fill out a loan request form for a payday loan, auto title loan, or other options. Bad credit lenders consider your request. Get the cash you need on the same day. No need to check your credit with credit reporting bureaus. Skip the hassle; get the funds now!

I Need 100 Dollars Now

What can you do to stay financially afloat in hard times when you have thoughts like “I need $100 now”? Acquiring a 100 dollar payday loan online may be a savvy solution only if you are a reasonable borrower. Here is what you need to consider and keep in mind.

How Can I Acquire a Quick One Hundred Dollars Loan?

Experts advise searching for a hundred loan programs or several lenders of emergency $100 loans to compare their rates and conditions. Consumers often don’t spend enough time researching. They are in a hurry and want to get the needed guaranteed $100 loan online the same day.

However, applying to a few direct lenders can help you take out a small $100 instant loan with more reasonable rates and terms. Also, trying your luck at several lenders will boost your chances of finding a payday app.

Do you need a loan quick until the next paycheck?

Some multiple places and payday loan companies are ready to issue such a small-dollar loan to you for any purpose.

What Is a Fast 100 Dollar Loan?

Consumers should consider that there is no special description of such a 100 dollar pay day loan. Issuing small amounts of $100 direct lenders offer quick and easy financial decisions to borrowers who need hassle-free service with the least paperwork and no phone calls.

Short term $100 loans are typically payday loans that should be repaid within two or three weeks in a lump sum. Payday lenders work for a certain fee they charge you apart from the principal amount.

How Does Emergency Loan Application Work?

A loan instant app is a mobile platform that offers financial services with lightning speed. They provide quick cash without paperwork and exhausting credit checks.

It means that you can borrow money even with a bad credit score. All you need to get the cash the next day is to prove you have a regular source of income.

Let’s consider how instant loan apps work. Firstly, you must choose a banking app you like and find it on the App Store or Google Play Market. After you install the application, you need to credit an account.

To get your loan funds, a borrower has to complete the online loan request form and wait for the lender’s decision. If possible, you must sign a loan agreement and wait for funds. You will get a loan you need via direct deposit in your bank account.

Remember that a loan instant app may charge a subscription fee and high interest rate.

What Are Types Of 100 Dollar Loans?

100 loan instant apps provide various financial products and services. It is pivotal to find the most beneficial instant loan option in terms of charges and payback period.

You may think that such a small amount of cash as $100 can’t do any harm to you, but it is not true. If you fail to repay the loan in time, you may get trapped in huge debts.

To help you make a well-informed choice, we have prepared the most popular lending decisions offered by instant loan apps.

- Personal loans

Personal loans allow borrowers to repay the loan amount in equal and regular contributions. You can borrow $100 and return this amount per pay period defined by a lender. A personal loan app offers instant cash with lower rates when compared to 100 cash advance and payday options. However, check your bank account balance before the due dates to avoid late payment penalties. People with poor credit can also borrow large amounts of money and use their real estate as collateral. - Payday loans

Payday advance apps provide short-term loan solutions until the next paycheck. You can take the money you have already earned but haven’t received yet as an emergency fund. A payday loan offers an opportunity to get paid without any credit checks. However, be aware of high APR, interest, and an overdraft fee. - Cash advance

A cash advance allows you to get an even $50 loan instant cash. A poor credit score won’t spoil your plans to receive the money you need. You can apply for a small loan amount and get it on your debit card via a direct deposit within one business day. Note that apart from an instant app, you may receive a $100 cash advance from the credit card issuers. Customers can borrow against credit card limits for various purposes, mostly for debit card purchases or ATM withdrawals.

How to Get a 100 dollar Loan?

100 payday loan fast apps let you borrow money without paperwork and queues. Generally, to qualify for small loan amounts with no hassle, a consumer should start by completing the loan application form. To get instant cash, you must specify private (phone number, email address, ID) and basic bank account details (checking or savings account data). Instant loan apps say that all rights are reserved.

You may also want to ensure you meet the eligibility requirements of the chosen loan app by visiting its website and checking the appropriate information. It will help you assess your chances of receiving extra cash.

The majority of direct money apps ask to have a valid checking bank account and give proof of steady employment. Are you unemployed at the moment? Again, check if you qualify for instant money. Get responses from several financial service providers and compare their offers to go for the most affordable one.

Most platforms provide funds within three days. Sometimes, a loan app decides within a few minutes. Cash app services are faster than loans offered by traditional lending institutions.

Remember that the state law regulates loan terms and conditions and may have various restrictions and limitations regarding the $100 loan.

Can I Get 100 Dollar Loan With Bad Credit and Instant Approval?

Loan apps allow cash advances and other loan types without a hard credit check. In such a way, no matter your credit score, it doesn’t mean you can’t qualify for an emergency fund and get 100 loan approval.

The loan instant app is an excellent alternative for people willing to borrow $100. To get an instant loan on your next payday on a bank account, a borrower must provide a regular income source. Each banking app may set different minimum income requirements. That is why it is pivotal to read loan terms and conditions carefully.

Luckily, you can receive money on a bank account even if you are not officially employed. Social benefits and net profit are also accepted.

Small Cash Loans Affect Health

The latest research by the Federal Reserve Bank of San Francisco reveals an interesting fact – payday loans are closely connected with health matters.

Scientists have found out that almost 35% of American citizens using this type of cash loan as alternative lending don’t have a credit rating. The vast majority of consumers taking out $100 loan direct deposit have low or no steady income, live in rural or urban areas, and such adults are often people of color. Research proves that emergency same day loans online for bad credit seriously affect the health of the borrowers.

The interview of the focus group (128 users of payday loans) revealed that respondents often experience depression, stress, and other physical issues connected with having to deal with the high costs of such loans.

The respondents explained their feelings as “I feel trapped”, “I need 100 dollars now or even 500 dollar loan now but now I can’t afford monthly payments”, “Where to get this amount of money now” or “My account balance is a disaster”.

Many people with little or no income and poor credit tend to opt for immediate no fax money apps to pay for auto repair, rent, utilities, or other emergency expenses but later face the endless debt cycle because of funding fees.

About 85% of borrowers aren’t able to return the debt on time, so they just pay the interest rate every two weeks, together with late fees.

Researchers admit that lowering the number of lending stores in poor neighborhoods and improving transparency with the way rates are calculated are the necessary and important changes that should be done. This way, consumers and potential borrowers will be more educated about the digital banking services they are about to use and will have less stress and health issues.

I Need 100$ By Tomorrow – What Can I Use It For?

If you have bad credit, no one can guarantee your approval. However, your chances will increase considerably if you choose an instant app instead of a traditional financial institution like banks and credit unions.

The quick cash amounts may vary from 100 dollar cash loan to more (or a maximum of $255 in California).

Some consumers worry that the instant app asks where the money goes.

- But you are free to use the loan for any personal needs, to pay for electricity bills, cover urgent moving costs, and other expenditures. This cash can be acquired using desktop and mobile devices, which is rather convenient.

Keep in mind that 100 loan instant approving can be hardly referred to as fast installment loans because they should be returned in one sum from the next paycheck.

What Can a 100 Dollar Loan Be Used For?

Instant loan apps won’t trace your spending account history. In most cases, they allow people to borrow money for any loan purposes. You can spend the money on shopping products, car repairs, health issues, or other financial goals. Nobody is going to track your spending habits.

In such a way, a loan instant app allows you to take the amount you need to deal with financial problems without asking for any details. The only thing they worry about is that you won’t repay your debt. We strongly recommend you take even a $50 loan instant cash seriously because even such a small amount can spoil your life and financial reputation.

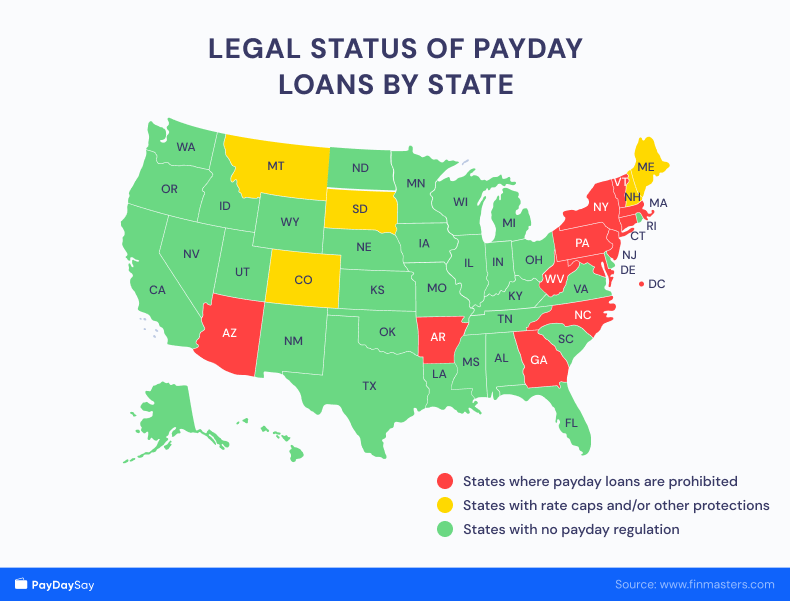

Is Online Cash Advance Legit in Your State?

When you need to borrow 100 dollars direct deposit deposit immediately, you should first get to know if the payday apps are legal and available in your state.

Currently, there are 16 states and the District of Columbia that prohibit paycheck advance options while several other states ban high-interest loan services today.

According to the following map from Responsiblelending.org, the states of Georgia, New York, New Jersey, Arkansas, Montana, New Hampshire, South Dakota, Colorado, Arizona, North Carolina, Connecticut, Massachusetts, Maryland, Vermont, West Virginia, and Pennsylvania cap rates to stop payday debt trap.

Oregon, Maine, and New Mexico allow low-percentage-rate borrowing online. In the remaining thirty-one states, they acquire the loan money from the direct payday lender. You can apply for 300 or 400 dollar loans even with bad credit.

Before looking for a loan app, check the state laws. It is essential to know what to expect from payday instant app services in your area of living.

Places to Acquire a Safe Loan ASAP

Once you decide, “I need 100 dollars now for free!” or “I want to get 100 dollars now,” it’s time to search for the most suitable and affordable place to turn to. Here are the three major financial institutions where consumers might go to get the cash:

- Credit Unions are one of the widespread places for getting financial help. We are talking about nonprofit places where you can get access to small quick payday loans no credit check no faxing for different purposes. The annual percentage rate here is usually between 18% and 28%.

- In order to begin using the services, you should pay a membership fee of 25 dollars once you become a member of a credit union.

Despite the fact that interest rates are generally fixed, this institution will carry a hard credit check and review account history before they make the lending decision. Hence, the online application might not be approved because of previous debt or bad credit. - Banks are traditional providers that are more eager to give out larger sums. The borrowers who ask for a $100 loan these days won’t benefit from turning to the local bank.

- The minimum loans start from $1,000 here.

Furthermore, if you apply to a bank, it may take a long time to get paid. The application process usually takes up to several weeks and it is obligatory to come in person and hand in your documents. The paperwork is often tedious. So, many consumers who just need a instant loan until the next paycheck opt for alternative solutions. - Payday or cash advance apps are a quick way to get payday loans online. They are the companies that offer same-day loans online, even to consumers with low credit scores. It is pretty easy to get a $100 loan online. However, an instant loan app may have higher interest rates and charge overdraft fees as well as membership fees (irrespective of your account activity). Here you need to choose between small fee options with overdraft protection and the ability to get paid instantly.

- Cash advance apps provide smaller loans for any purpose without defining any balance requirements. They don’t make a hard credit check and issue loans to people with bad credit.

An instant loans app may perform a soft credit check, though, as the creditors still need to find out if the borrower can repay the debt and cover the funding fee. It is recommended to review and compare several guaranteed loan approval for bad credit direct lenders before you choose the most affordable loan app.

Benefits and Downsides of Small-Dollar Lending Solutions

Every lending option has its advantages and disadvantages. Speaking about small $100 loans, there are the following things you should take into consideration.

Pros

- Fast Approval.When you want to get a $100 loan fast and need a quick decision, numerous providers are known for the fast process of getting the request approved

- Turnaround.Consumers need cash desperately and have no time to waste

- Luckily, such services may be processed within a few minutes, and the money may be deposited into the bank account the next business day.Simple Approval.The online instant loan apps offer small, unsecured loans with no guarantor.You can get approved even if you live on welfare benefits and have no job

- Poor Credit Rating.Many creditors deal with consumers with bad credit.Pay attention to the rules of each loan app.

Cons

- Higher Rates.Compared to larger sums, $100, $255, $400, or 500 dollar emergency loans come with higher fees and rates.Lenders can also charge overdraft fees and late payment penalties.Review and compare several lenders to opt for the most reasonable choice

- Scams.There is always a possibility of becoming a victim of fraudulent activity.If the conditions or the instant app seem too attractive and cheap, you might be dealing with irresponsible providers.Always look through the reviews and company feedback.

Short-Term Solutions for Bad Credit

Do you urgently want to fulfill the cash need and get approved for a $100 loan bad credit?

There are numerous options from direct creditors available for borrowers in many states these days. However, if you need a legit cash loan of under 1000 dollars but face unemployment and have

bad credit, you should shop around. Some lenders only offer 100 dollar installment loans with larger amounts for a longer pay period with lower fees.

If you face unforeseen expenses and need to cover the emergency until the next payday, you should be careful and search for the most affordable paycheck advance offer with the lowest rates. It may not be the easiest task as poor credit will outshine other criteria. Remember that creditors don’t want to deal with high-risk borrowers so they claim higher charges to eliminate the possible risks of non-payment.

Get 100 Dollars Now

All in all, every consumer takes full responsibility for their decision. Review the requirements and loan terms before you sign the contract with the 100 dollar cash advance or payday direct lender.

Being careful and responsible will help you avoid an endless debt cycle and eliminate any temporary financial emergencies with a 100 payday loan no credit check.

In Conclusion

Obtaining a $100 loan may seem like a daunting task, but with the right tools and knowledge, it can be a manageable feat. By exploring options such as payday loans or borrowing from family and friends, individuals can find a solution that fits their specific needs and circumstances. It’s important to keep in mind factors such as interest rates and repayment terms, as well as how many pay periods in a year, to ensure that the loan is feasible and can be paid back successfully. With careful planning and budgeting, a $100 loan can be a useful resource in times of financial need.

on your homescreen

on your homescreen