With the high inflation rate and bad economy of different countries across the globe, it is no longer news that people borrow money to sustain their lifestyles. Today, people turn to federal loans, personal loans, and loans from credit card companies.

A good way for companies to entice cardholders to get loans from them is to give a 0% APR. It simply means that these companies give out loans without interest for some time. There are also some side attractions to convince cardholders to pick their company over a large pool of others. For quick financial needs, an advance payday loans app can provide immediate funds and help manage short-term expenses.

This article will give you in-depth knowledge of a 0 APR credit Card, some top companies to consider, the advantages and disadvantages, and other things to look into before going for a 0% APR credit card.

0% APR Credit Cards: Best Offers

With the multiple number of 0 APR credit card offers available, finding the one that suits you best can be tasking. The process can be overwhelming, from looking for a flat rate to finding one that you can pair with another.

Also, because each company has other benefits that make it more appealing to choose over other companies, comparing and deciding the best company can be exhausting. We’ve taken our time to evaluate some of the best companies to consider. Below are the companies, their advantages, disadvantages, and other details you’ll need.

Wells Fargo Reflect® Card

The promotional period is 18 months. You can also get a 3-month extension for the no-interest rate period if the required minimum payment is paid consistently and on time. You can leverage this time to pay off debts or make a large purchase.

You can also get a cell protection fee of about $600 against theft and repairs if you sort out your monthly cell bill payments with Wells Fargo Reflect®. But, after the18 months, you no longer have access to all the benefits that come with it.

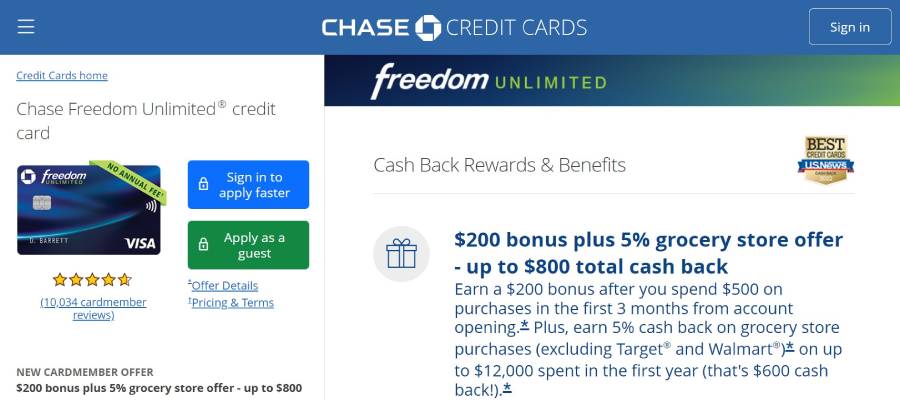

Chase Freedom Unlimited®

The chase freedom unlimited card is suitable for those who want to make an expensive purchase because the Chase Freedom Unlimited® card offers cashback. You are charged 0 interest in the first 15 months; subsequently, an interest rate of between 17.99% and 26.74% is charged.

They offer different cashback plans on purchases (3% cash back on every drug and restaurant purchase, 5% cash back for every trip booked with Chase, and a cashback of 1.5% on other purchases made). You also get a $300 cashback bonus on the condition that you spend up to 20,000 dollars in the first year of using chase freedom unlimited.

On the other side, you need a minimum score of 670 to access this card. It also attracts a transfer fee of 5% and a 3% fee on foreign transactions.

Wells Fargo Active Cash® Card

This credit card is suitable for people that want flat-rate cash rewards. You attract no interest for 15 months, after which they charge a regular APR of either 17.99%, 22.99%, or 27.99%.

One good thing about owning this Wells Fargo Active Cash® is that you get up to $600 for cell protection against theft and damage if you make your cell bill payments monthly with Wells Fargo Active Cash®. In addition, they charge a 0 annual fee, which allows you to keep the card even when it is not being used, and you get a 2% cashback anytime you make any purchase with this card.

The disadvantage of possessing this card is that you attract a 3% charge with foreign transactions. You will also be charged at least $5 for every balance transfer made. In addition, the credit score requirement for this Wells Fargo Active Cash® is at least 670, which is a bit high.

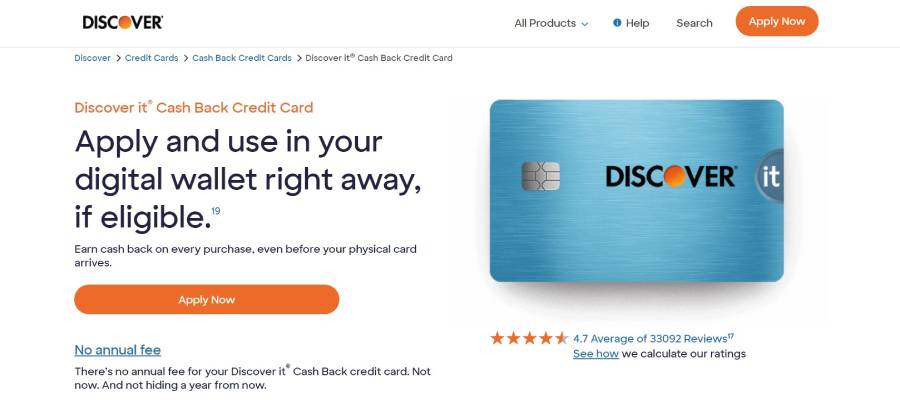

Discover it® Cash Back

This Discover it® Cash Back is advisable for people who do not mind the changing cashback curriculum. Discover gives a category for their cashback quarterly; if you can plan and keep up with the constantly changing plans, this card is one to have.

There’s no interest on purchase for the promotional period of 15 months and a regular APR of about 14.99% to 25.99% after the introductory period.

The Discover it® Cash Back card offers a 5% cash back daily in places allocated during the quarterly plan. The place you’re getting the 5% cashback differs every three months. In addition, there’s an automatic 1% cash back on other purchases made in places different from the required plan for the quarter. They do not charge any annual fee.

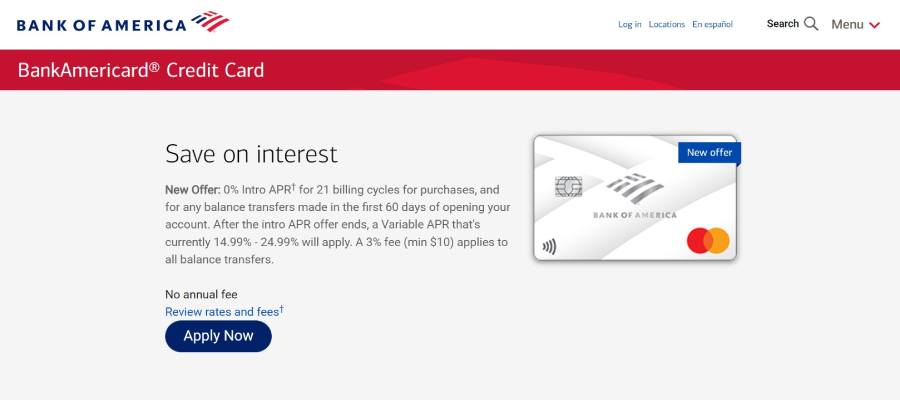

BankAmericard Credit Card

The BankAmericard Credit Card is good for paying off huge loans. They charge 0 interest in all balance transfers in the first six months. After this period, they charge a 3% fee and a minimum of $10 for every other transfer. They charge no interest for the first 21 billing cycles of making purchases, after which they start to charge a regular fee of about 14.99% to about 24.99%. You also do not have to pay any annual fee.

There are no side benefits to owning this card; they do not offer any cashback or welcome offers. You need a credit score of at least 690 to qualify for this card. If you have a good credit score, a loan to pay, and do not mind getting any cashback for your purchases, you should try BankAmericard.

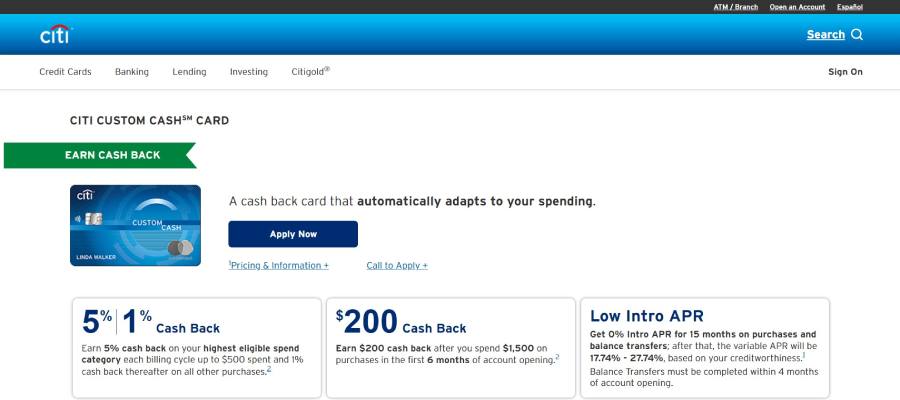

Citi Custom Cash? Card

This card is best used with other cards (preferably a more rewarding Citi card). They charge no interest for the first 15 months, after which they charge 16.99% to 26.99%. The interest rate on this regular charge depends on how credit-worthy you are.

They charge a 5% fee for a balance transfer (at least $5). Some benefit of getting this credit card is that you get a 5% cashback in any category you spent the most for each billing cycle (but you have to spend at least $500 in this category).

You also get a cashback of 1% on other purchases. Like other cards discussed earlier, they do not charge any annual fee. They also have a welcome offer of 20000 ThankYou points, approximately $200 in value.

On the other hand, they charge a high amount for foreign transactions. Also, you may not be eligible for some everyday rewards. Finally, you need a credit score of at least 670 to be considered for this card.

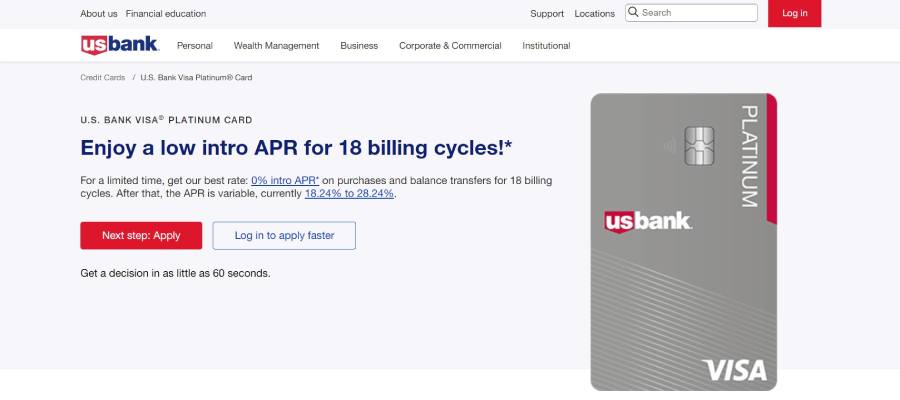

U.S. Bank Visa® Platinum Card

Like other cards discussed earlier, the U.S. Bank Visa® Platinum Card does not charge an annual fee. However, their intro period is more extended than most credit card companies. They offer an intro period of 18 billing cycles, after which you start paying a regular of between 18.24% to about 28.24%.

Suppose you want to make a significant purchase and are not concerned about getting cash back for your day-to-day activities. In that case, the U.S. Bank Visa® Platinum Card is one to consider. It helps to divide expensive purchases into monthly payments.

You can get up to $600 for phone protection if the card is used to settle your monthly bills. But, you have to have a credit score of 700 minimum to be eligible for the U.S. Bank Visa® Platinum Card.

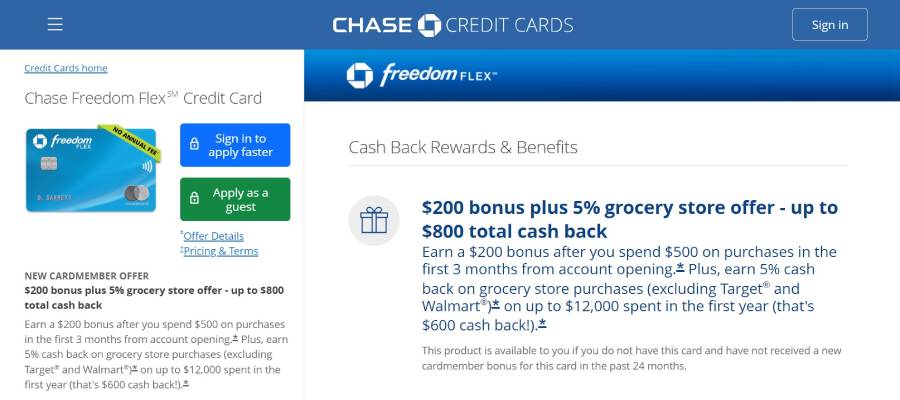

Chase Freedom Flex?

This card is on the list because of the great rewards that come with using the card. You get both long-term and short-term rewards as well as both fixed and variable rewards. Asides from the public benefit of paying no interest for the intro period of 15 months and the no annual fee charges, you get a welcome bonus of $200 for spending at least $500 in your first three months.

You also get a 5% cashback capped at $1500 on purchases at different categories that change every three months, a 3% cash back on dining and drugstore purchases, and 1% cash back on all other purchases. You also get a 5% cash back on travel purchases with Chase Ultimate Reward. Your cashback rewards are fixed as long as you own the account.

After the intro period, you pay a regular interest of around 17.99% to about 26.74%.

The disadvantages of using this card are that you have to monitor the different categories to get the maximum cashback for the quarter. You also attract a 3% for every foreign transaction. You must have good credit and want this card because you need at least a credit score of 670 to be eligible for this card.

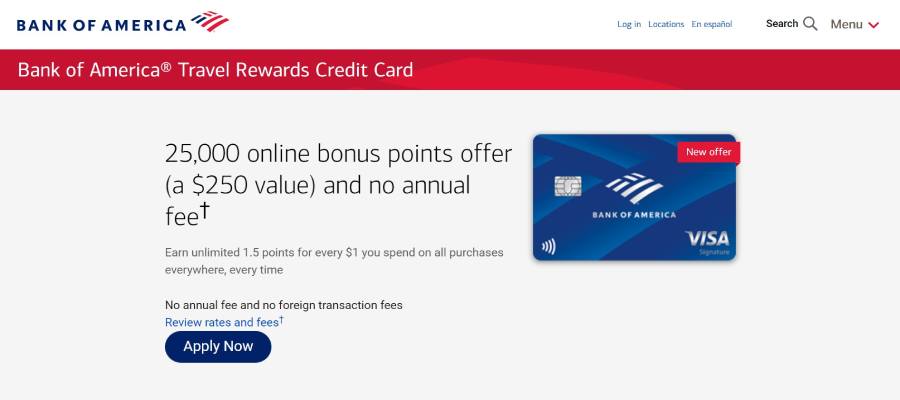

Bank of America® Travel Rewards Credit Card

This card is advisable for people who travel frequently, want flexible rewards, and want to avoid being charged an annual fee.

After the 0% introductory APR of 18 billing cycles, you pay a regular interest of around 16.99% to about 26.99% on purchases. You also pay 3% with a minimum of $10 on balance transfers.

You get 1.5 points for every $1 spent on purchases. In addition, you are not charged for foreign transactions, and no annual fee is attracted for keeping the card.

You get a bonus of 25000 points when you spend up to $1000 within the first three months after opening an account. You can convert these points into $250 that can be used for travel purchases. In addition, if you are a preferred Reward Member, you can get up to 75% more points on purchases.

But it would be best if you had a minimum credit score of 670 to qualify for this bank. Also, before you can recover your points to cash or for travel purchases, you must have at least 2500 points.

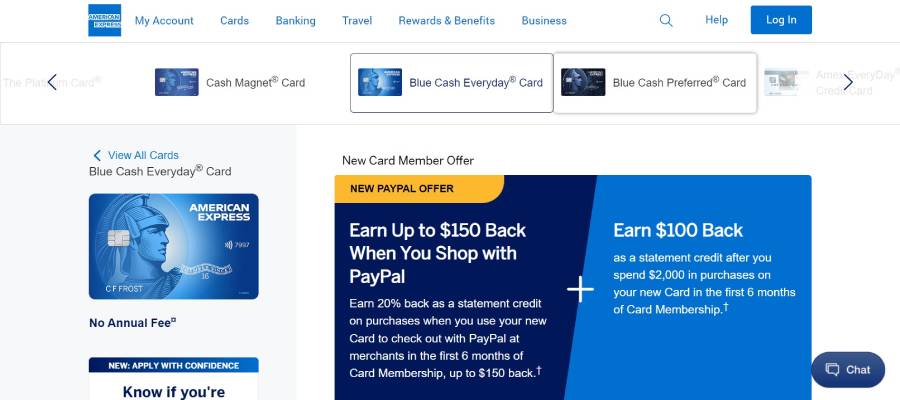

Blue Cash Everyday® Card from American Express

If you are always shopping for groceries and gas, or you are always on one streaming platform or another, or transport takes a large percentage of your purchases in a month, you might want to consider this credit card. Asides from the no interest rate for the first 12 months, and no annual fee, you get a 3% cashback for making any of the above purchases in a U.S. store.

You also get a 1% cash back for other purchases. However, after the 0% intro period for balance transfers and purchases, you will be charged a regular APR of about 17.74% to around 28.84%.

But, big stores like Walmart and Target are not counted as U.S. stores. Your foreign transactions attract a 2.7% charge. You also attract a penalty fee of about $40 for late payments, and you need a minimum credit score of 670 to access the card.

Bank of America® Unlimited Cash Rewards Credit Card

This card is probably not the best for a random cardholder because it offers a 1.5% cash back on purchases. Compared to other Card issuers, this is relatively small, but if you use the Bank of America® and have a significant number of investment account balances or savings, you’ll get one of the best cashback rates on purchases (about 25% to 75%).

After the initial 18 billing cycles, you will be charged a regular APR of about 16.99% to about 26.99% for purchases and a 3% fee (minimum of $10) for balance transfers. You also attract a 3% fee for foreign transactions. You need a minimum credit score of 670 to qualify for the card.

Capital One Quicksilver Cash Rewards Credit Card

If you want a flat-rate reward on your purchases, this card should be one to consider. Asides from the no interest rate for the 15 months, no annual fee, and no charges for foreign transactions, you also get a 1.5% cash back on almost every purchase. In addition, you also get a cash bonus of $200 for spending at least $500 within the first three months after opening an account.

After the introductory period, your regular APR is between 17.99% to about 27.99% for purchases and 3% for balance transfers. You cannot have bad credit and want this card because you need a minimum credit score of 700 to access this card.

What Is a 0% Intro APR Credit Card?

A credit card has been a great tool that has helped many people make new purchases and consolidate old debts. APR in full terms means annual percentage rate, and it simply refers to the interest rate. The introductory period is a period where every transaction made on the credit card attracts no interest.

All the purchases, balance transfers, or both (depending on the terms and conditions of the credit card company) made during this intro period won’t incur any interest.

This means that a 0% APR credit card is a card with no interest rate during the intro period (usually between 6-21 months).

Pros and Cons of 0% Intro APR Credit Cards

Every good thing has a bad side to it as well. Asides from the no interest rate during the introductory period, there are other benefits to owning a 0 APR credit card. First, it helps you to pay your debt faster. If you owe a bad credit that you’re finding hard to pay, you can transfer it to a 0% APR card; this way, you get to pay your debt faster because you won’t have to worry about paying interest. This can also increase your credit score.

Some providers also reward you with cash back for using their product, this way, you earn for making purchases with your card. It’s also best for making expensive purchases because you focus on paying your bills instead of worrying about the interest.

A disadvantage of using this card is that paying late can reduce your intro period. Also, the intro period only lasts for a while, and you’ll still have to worry about the interest rate in the long run.

How to Choose the Best 0% Intro APR Credit Card

Choosing the best 0% intro APR card can be exhausting and overwhelming. Below are some of the things to consider before choosing one:

- Understand your goals

Highlighting the reason for getting a card will assist in streamlining the companies to the one that suits you best. For example, are you getting one to make a large purchase (and you don’t have all the money yet)? Are you transferring your debts to maximize the intro period? Knowing what you want to achieve will help you choose the right one to solve your problem.

- Think how much time you need

How much time do you have to sort out the goal you have in mind? Knowing the amount of time will help you streamline the companies better and get the best out of your card.

- Know the Requirements

You have to consider what the companies left in your selection require. Do you have the required credit score? Do they approve multiple cards? What restrictions do these companies have in place? Requirements differ from place to place. Make sure you research their requirements and choose the ones you meet to enjoy these cards best.

- Know the Conditions

Know the conditions put in place by the card provider. After getting the card, can you meet their conditions without any hassle? Will the conditions help you enjoy the maximum benefit of owning one?

What Happens When the 0% Intro APR Ends?

It is best to pay up your balance before the expiration of the 0% promotional period. Because after this time ends, the regular APR commences, and interest starts to add up on all unpaid balances (the ones charged or transferred during the intro season and not only new charges).

But, if you can’t pay the balance off early enough, you can get another 0% intro credit card and transfer the balance into it (if it meets their conditions); you can decide to pay it off with a large sum of money or agree to start paying the interest on the balance.

on your homescreen

on your homescreen