Life happens, and we sometimes look for emergency means to make payments. While an app like MoneyLion should be ideal for an average borrower, it could be more suitable for some. Some users aren’t comfortable with its monthly fee, and others prefer interest rates.

Sometimes you might need to apply for a loan with miniature figures. Other times, you’re seeking thousands of dollars to fix your finance. Either way, several other apps like Moneylion can serve your purpose. And if you’ve decided to use one, you can check out the 12 alternative apps and platforms below.

MoneyLion Alternatives: Best Choices

MoneyLion is a great financial institution with varieties of services. However, different users have varying demands. So, you might only get some of your needs fulfilled with this money-lending app.

So, here are some of the best MoneyLion alternatives on the market. Each item on this list offers the most competitive fees, lowest rates, and satisfactory loan amounts. With these platforms, you can save money and even build your credit score. Check them out below:

| Lender | Loan Amount | Fees | Interest Rate | Waiting Period |

| Dave | $5-$250 | $1 subscription fee. An optional express fee of $1.99 to $5.99 for faster funds within eight hours | None | 1-3 days (8 hours for Express payment at additional cost) |

| PayDaySay | $100-$5000 | $15-$30 on every $100 borrowed | 400% APR | 1-3 days |

| OppLoans | $500-$4,000 | N/A | 59% – 160% | 1-5 days |

| Empower | $10-$250 | $8 monthly subscription after a 14-day trial. Express payment fee of $2-$8, depending on the loan amount. 20% optional ticket allowed if the user pays for express delivery | None | 1-3 days |

| Branch | $50- $700. Varies between countries | None | Up to 400% | 1-5 days |

| Klover | $10-$100 | $1.99 to $9.99 for instant delivery | None | 1-3 days |

| Affirm | $50-$17,500 | None | None. Up to 30% for monthly payments | 1-5 days |

| AfterPay | $200-2,000 | $8 late payment fee | None | 1-5 days |

| Brigit | $50-$250 | $9.99 monthly subscription fee | None | 1-3 days |

| Chime | $50-$200 | $5 on $100 loans. Up to 30% for three-month payments | None | 1-3 days |

| Avant | $2,000 – $35,000 | 0%-4.75% origination fee. $25 on late payments. $15 for returned check fee | 9.95% – 35.95% | 24 hours or next business day |

| Daily Pay | 100% of earned wages | $1.99-$2.99 per withdrawal transaction. Deducts tax and other withholdings | None | 24 hours or the next business day |

Dave – Best For Low Fees

Dave is one of the best cash advance apps. The company was launched in 2017 to help consumers reduce or eliminate overdraft apps fees. It provides users with an advance on their paychecks for emergency needs.

For example, it’s one of the best ways to pay for gas or groceries. It also has a non-overdraft account that charges no fees. Rather than accumulate interest on loans, Dave uses monthly subscriptions.

Details

Service: Cash Advance, Budget, Credit Building

Loan Amount: $5-$250

Fees: $1 subscription fee.

An optional express fee of $1.99 to $5.99 for faster funds within eight hours.

Interest Rate: None

Waiting Period: 1-3 days (8 hours for Express payment at additional cost).

Credit Check: Minimal

Pros

- A better alternative to bank app overdrafts.

- Incurs low or no fees on borrowed funds.

- Offers quicker loans.

- Great for emergency payments.

Cons

- May cultivate borrowing habits.

- Needs access to your bank account.

PayDaySay – Best For Small Personal Loans

PayDaySay is a reliable loan app ideal for small and big-time lenders like Pockbox. The app is available to consumers 24/7 and has excellent customer service. Anyone can sign up and receive a loan on the same day. So, the company boasts of fast processing time. Although it has high-interest rates, this is complimented by the huge loan amounts available for consumers.

This loan app is very big on credit scores and limits. So, defecting due payments may affect your credit score. Nevertheless, it’s an excellent option for consumers interested in debt consolidation. It doesn’t lend itself but connects you with a reliable lender like Pockbox does.

Details

Service: Personal Loans, Installment Loans, Debt Consolidation, Cash Advances

Loan Amount: $100-$5000

Fees: $15-$30 on every $100 borrowed.

Interest Rate: 400% APR

Waiting Period: 1-3 days

Credit Check: Yes

Pros

- Offers higher loan amounts on multiple apps.

- Fast loan approval process.

- Good customer support service.

Cons

- Requires high credit scores for higher loans.

- High-interest rates.

OppLoans – Best For Bad Credit

OppLoans is another reliable lender with minimal rules. It extensively offers short-term installment loans without credit checks. The amounts compete with many alternatives, but it has a high rate. The rate can be as high as 160%. However, the perks are zero credit checks, high loan amounts and no fees. So you don’t get charged origination, late or repayment fees on OppLoans.

Details

Service: Installment Loans, Overdraft

Loan Amount: $500-$4,000

Fees: N/A

Interest Rate: 59% – 160%

Waiting Period: 1-5 days

Credit Check: Minimal

Pros

- Suitable for credit building.

- Helps find better rates.

- Flexible repayment date.

- No credit checks.

Cons

- High-interest rates.

- Requires minimum monthly income for approval.

Empower – Best For Cash Advances

The Empower app is one of the best apps like Moneylion that allows users to access cash advances by connecting their bank accounts. It offers additional features such as savings and budgeting but focuses on advance funds.

The app boasts of improving the financial health of Americans. Hence, its cash advances would serve as a means of emergency. It will allow members to avoid financial stress between their paychecks. Rather than interest rates, Empower charges users a subscription fee. There is also an option to pay a fee for instant delivery.

Details

Service: Personal Loans, Automatic Savings, Budgeting

Loan Amount: $10-$250

Fees: $8 monthly subscription after a 14-day trial. Express payment fee of $2-$8, depending on the loan amount. 20% optional ticket allowed if the user pays for express delivery.

Interest Rate: None

Waiting Period: 1-3 days

Credit Check: No

Pros

- Cheaper alternative to overdraft apps.

- Additional budgeting tools.

- Lower cost of borrowing.

Cons

- Requires a checking account for approval.

- Consumers need to choose amounts to borrow.

Branch – Best For Instant Loans

Branch is another mobile lending app that can give you fast funds. It’s a viable MoneyLion alternative for anyone who is borrowing less. The platform uses its AI system to assess individuals and recommended maximum amounts based on the results. So, there is no fixed amount you can expect from here.

However, the average amount across various countries is $700.

Branch is particularly interested in aiding the finance of people in developing economies. So its apps are available in countries like Nigeria, India, and Kenya. There is no credit history required for registration. The annual percentage varies depending on the individual.

Details

Service: Personal Loans

Loan Amount: $50- $700. Varies between countries

Fees: None

Interest Rate: Up to 400%

Waiting Period: 1-5 days

Credit Check: None

Pros

- No membership subscription fees on its apps.

- No origination fees.

- Zero interest charges.

- Cheaper than overdraft apps.

Cons

- Available amounts are determined by the company.

- A debit card is required for approval.

Klover – Best For Small Cash Advance

Klover app is another MoneyLion alternative with similar features. This lender was founded in 2013 and offered a quick fix for your finances before your next paycheck. The app collates your data and uses them to connect you to financial products and services. Once you verify your paycheck info, you can start using the services.

Payment takes about 1 to 3 days, but you can pay express fees to get it within 24 hours. Consumers are not charged interest fees either. You can make extra money from reward points. This option also applies fees for expedited cash advances.

Details

Service: Cash Advance

Loan Amount: $10-$100

Fees: $1.99 to $9.99 for instant delivery

Interest Rate: None

Waiting Period: 1-3 days

Credit Check: None

Pros

- No interest rates on borrowed funds.

- No credit check is required.

- Fast payments after application.

Cons

- Requires personal information.

- Requires bank account linking.

Affirm – Best For Split Repayments

Affirm is popularly known for its “Buy Now, Pay Later” model. It allows users to pay online and offline using borrowed funds. However, you can only do this with partners like Amazon, Nordstrom, Walmart and Best Buy. One of its benefits is the zero interest charges on loans. It also allows borrowers to pay four times on its apps.

So, it can come in handy if you’re shopping for something important but short of funds. There are no fees charged too.

Although, you might be charged up to 30% interest if you opt for monthly payments. Affirm might also help you boost your credit score with its credit reporting feature.

Details

Service: Cash Advance, Credit Purchases

Loan Amount: $50-$17,500

Fees: None

Interest Rate: None. Up to 30% for monthly payments

Waiting Period: 1-5 days

Credit Check: Yes

Pros

- Doesn’t charge you interest on borrowed funds.

- No hidden fees.

- Reports to the three bureaus for some loans.

Cons

- Uses a monthly payment model.

- Users can’t reschedule payments.

AfterPay – Best For Credit Purchases

Afterpay is a similar app compared to Affirm. This platform allows you to make payments online at popular retailers. For example, you can earn credit payments at Bed Bath & Beyond, Nordstrom and Old Navy. This BNPL model allows you to split your costs into chunks.

Hence, you can borrow funds to pay if you need more money. You should ensure you make payments on time. Otherwise, you risk getting charged 8% of the borrowed fund as a late fee.

Unlike many apps, this one lets you reschedule your payments. It also locks your account if you miss a payment. In addition, a loyalty program rewards you if you make prompt payments. So, you can get more extended plan repayment after leaving a positive repayment history on the app.

Details

Service: Credit Purchases

Loan Amount: $200-2,000

Fees: $8 late payment fee

Interest Rate: None

Waiting Period: 1-5 days

Credit Check: Yes

Pros

- Allows automated payment systems.

- Has a rewards program.

- No interest charges.

Cons

- Not great for credit building.

- Late payment fees.

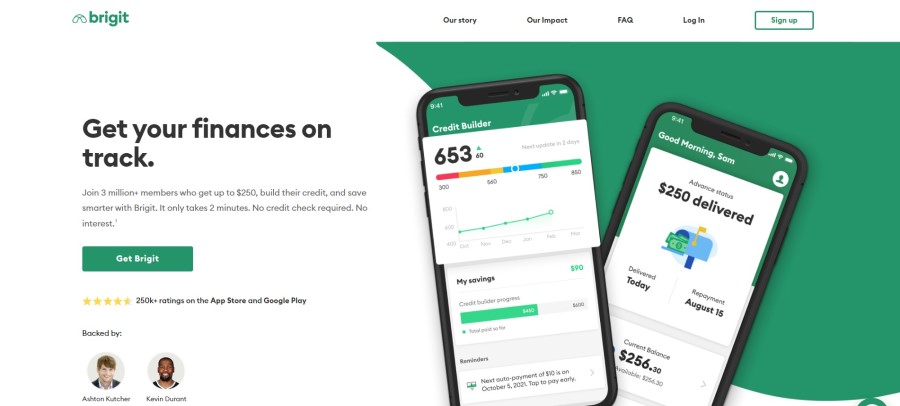

Brigit – Best For Cash Advance

This is another top contender on the list of cash advance apps for small payments. This app allows users to borrow small amounts between paychecks. It also offers budgeting tools to keep track of your credit. According to the CEO, Brigit is on a path to helping everyday Americans manage their finances and alleviate financial stress.

You can get as high as $250 from this lender. It doesn’t charge late fees, so you won’t have to worry about missing a few days. However, this might hurt your credit score. Brigit works with over 6,000 financial institutions. A scoring system (1-100) allows you to access different features on Brigit.

Details

Service: Cash Advance

Loan Amount: $50-$250

Fees: $9.99 monthly subscription fee

Interest Rate: None

Waiting Period: 1-3 days

Credit Check: No

Pros

- Cheaper alternative to overdraft apps.

- Additional tools for credit monitoring.

- Protects users from identity theft.

Cons

- Requires bank account linking.

- It doesn’t help build a credit score.

Chime – Best For Instant Loans

Chime is a financial institution that offers low-cost services to users across the United States. The app is top-rated for lending small amounts to its users. But there are some criteria needed to benefit from this.

For example, only people with a Chime account can receive this extra money.

There are various options available as well. So, you can choose between a variety of products. These include Chime Instant Loans, SpotMe, Chime Credit Builder, and Early Direct Deposit. The SpotMe offer allows you to get a $200 overdraft on your account without extra fees. Meanwhile, the maximum amount on the Chime Instant Loans is $100.

Details

Service: Small Loans, Overdrafts

Loan Amount: $50-$200

Fees: None

Interest Rate: $5 on $100 loans. Up to 30% for three-month payments.

Waiting Period: 1-3 days

Credit Check: No

Pros

- It helps consumers build their credits.

- Short processing time.

- Good for free overdrafts.

Cons

- Offer small amounts.

- Users must link a Chime account.

- High-interest rates.

Avant – Best For Bad Credit

Avant is one of the most easily accessible lending apps out there. It allows both fair and bad credit users to access its loans. The lender boasts of having the majority of its borrowers between 600-700 credit scores. Although the amount obtainable is high, it also comes with its downfall.

Borrowers must be willing to pay origination and late fees. Luckily, this means there isn’t any subscription fee to pay, and there are debt consolidations. Unfortunately, the percentage rate is relatively high, around the same as other bad credit loans.

Details

Service: Personal Loan

Loan Amount: $2,000 – $35,000

Fees: 0%-4.75% origination fee. $25 on late payments. $15 for returned check fee.

Interest Rate: 9.95% – 35.95%

Waiting Period: 1 day

Credit Check: Yes

Pros

- Fast processing time.

- You can reschedule your payments.

- Does a soft credit check.

- Allows bad credit for approval.

Cons

- Charges origination fee.

- High-interest rate.

Daily Pay – Best For Paycheck Advance

The Daily Pay app has a unique model for its operations. This lending platform allows only selected borrowers to use its service. Hence, only those working with Daily Pay partners can access its service. It will enable you to borrow up to 100% of your total wage, which is beneficial if you earn high amounts. In addition, it’s a great app that supports saving and financial coaching.

Details

Service: Cash Advance

Loan Amount: 100% of earned wages

Fees: $1.99-$2.99 per withdrawal transaction. Deducts tax and other withholdings

Interest Rate: None

Waiting Period: 24 hours or the next business day

Credit Check: No

Pros

- Offers 100% of your net wage.

- Doesn’t require credit checking and SSN.

- Support Automatic Savings.

Cons

- Must work with a Dailypay partner.

- Lousy customer service and online reviews.

MoneyLion: What You Need To Know

MoneyLion is a financial company that offers loans. The company was founded in 2013 and has grown its services across the U.S.

Consumers can access its services with a monthly membership subscription. The benefits include cashback, credit building, online banking, savings and investments. Consumers get access to a zero-free checking account and an investment account. This allows them to receive cash advances with zero APR on up to $250. But the loan amounts are a little low.

The credit builder loans are between $100 to $1,000. So it costs around $1.99 to pay the subscription fee for MoneyLion. An added advantage is its credit reporting feature. So, members can build their credit score with on-time payments on MoneyLion.

There are only extra fees incurred if you repay on time, but it might affect your credit score. Due to no credit checking requirements, this loan app might be more suitable for people with bad credit. It’s also a great way to build your credit history.

How to Compare MoneyLion?

MoneyLion is one of the most popular and reputable apps for instant money out there. So, to opt for an app like MoneyLion, there are various factors you have to consider. Choosing an alternative means you wish to change some of the features you’re getting from the current option.

So, you need to pay attention to each of the features of these cash advance apps. Narrow each of them to confirm if your preferred alternative has the edge over MoneyLion. If you can’t make up your mind, you can use apps that connect you to ideal options like Pockbox and PayDaySay. Generally, you can make your comparison with some or all of the features below:

Service

The range of services offered by a loan app significantly impacts the overall usability. Most of these apps provide services that cut across loans and cash advances. Meanwhile, there are others with investment portfolios, credit building, debt consolidation, etc.

With apps like MoneyLion and Dave, you should expect services to include advances, personal and emergency loans, debt consolidation, mortgage loans, etc. Of course, it’s always good news when they offer additional services, but you should be wary of apps that provide overdrafts and cash advances with high-interest rates.

Loan Amount

The loan amount largely influences the loan app you end up choosing. Since consumers often need little extra cash for emergencies, personal loans are the most common. The loan amount on these apps ranges between $50 to $1,000. Therefore, opting for an alternative that offers the amount you need is advisable.

If you want to borrow higher sums (up to $5,000), you can opt for PayDaySay or other similar apps. Otherwise, Dave will do just fine with its $50-$250 loans.

Fees

There are many fees to watch out for when you apply for a loan using an app. Some financial institutions include hidden fees, which consumers only sometimes notice when applying. So, generally, you should always watch out for the following:

- Origination Fee

- Application Fee

- Prepayment Penalty

- Late Fee

- Payment Processing Fee

Most apps charge between 0.5% to 10% as origination fees. Anything above this range is on the high end. Others will charge you an application fee to evaluate your loan applications (usually for higher sums). You might also be charged a penalty fee for late payments.

Interest Rate

Interest is one of the top priorities for comparison because it affects your repayment. Apps that charge minimal interest rates often charge extra fees. But it would be best if you opted for those with lower rates. In addition, your credit score can affect your interest rate.

So, anyone with a score of 740 and above might get less than 8% rates. While anyone below 670 might get as high as 18%. Typically, most loan interest rates are between 5% to 15%.

Waiting Period

Depending on the type of loan app, you might have to wait for different periods. Considering this factor is crucial because it helps you meet the purpose of your loans. For example, personal loans might take longer than emergency loans.

So, you won’t get the extra funds fast enough for an emergency if you apply for personal or other types of loans. A reasonable waiting period is between a few minutes to 3 days.

Credit Check

When you apply for a loan, the apps examine your credit report to understand your financial situation. So, you should pay attention to the range of credit scores a loan app works with before you apply. You can get approved with a score of 560 to 660. Some lenders require up to 690 to get their lowest interest rates. A score of 700+ and above is sound, while 800+ is excellent. You can apply online for a free credit report to get insights into your credit score.

Why To Choose Alternatives To MoneyLion

MoneyLion app is not the best lender out there, so you might be better off with an alternative sometimes. The lender is reliable and requires no credit checks for applications, but only sometimes the right option.

For example, only some users are comfortable with monthly subscriptions. So, opting for an alternative with no such fee might be a great option.

Of course, you can opt for MoneyLion when you want interest-free cash advance apps, cash-back rewards and investment opportunities. However, for higher loan amounts, free membership, shorter waiting periods, and no linked bank accounts, you should consider top MoneyLion alternatives like PayDaySay Afterpay, Branch, Empower, etc.

on your homescreen

on your homescreen