Loan experts say that a loan worth from $4000 to $5000 is the most common loan amount borrowed by financially challenged people. The sum of money as such can be spent in various ways and solve countless problems.

Can you state that your life is predictable? Sudden costs and unforeseen expenses may unsettle you once in a while. Unexpected financial hardships come at the time when you least expect them. Many people aren’t prepared for an emergency at all or have little money in savings to protect them.

It can cover emergency bills, pay for repair works in the house, buy some time till you transfer jobs, help get back on your feet after your business fell apart during the pandemic, etc.

Loans are also a hugely efficient way to gain financial literacy. If you want to work your way around all the aspects of money, you have to try loans. Loans work either for covering holes in the budget or can open new possibilities of investment. Whatever the reason you take a loan, it can affect your current financial standing in a good way.

Get Your $4000 Loan Online

The reasoning is another great way of loans, particularly online ones. When you apply for emergency loans through an online creditor or a payday loan app, you don’t have to justify the cause and your spending patterns. You don’t need to bring documents to the financial advisor and hope for

approval. Online lenders can boast significantly higher approval rates than banks. Plus application and approval take minimal effort and very little time.

So, to find out how a 4000 loan can benefit your financial situation and to get one online, find your ultimate answers here.

What Is Personal Loan?

Personal loans online are an unsecured type of loan. This means that there is no collateral required. You must know that if the loan does have collateral it also has a lower interest rate. In the case of unsecured loans the rates can be slightly higher, but the borrower doesn’t risk losing any assets. Keep that in mind when you choose the loan type and the lender.

How Do Personal Loans Work?

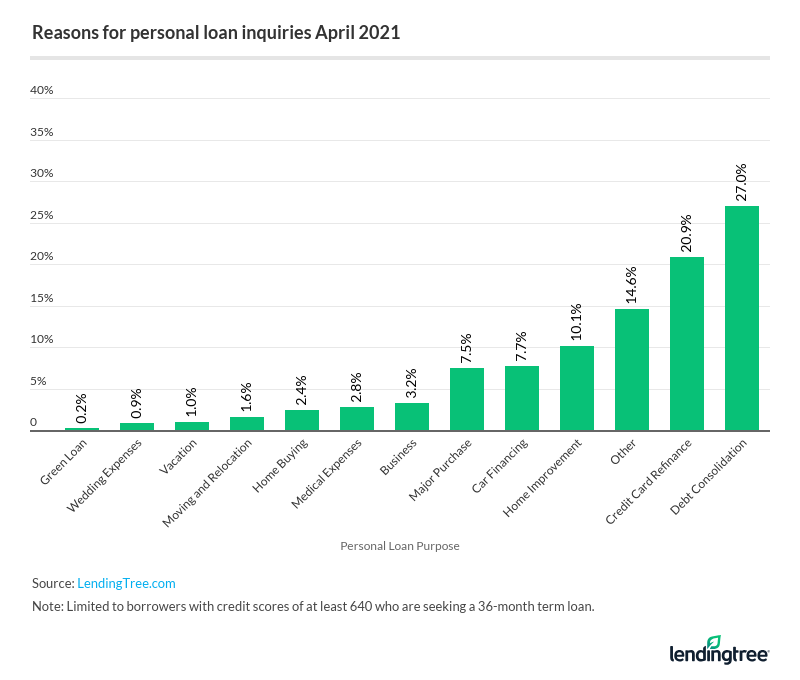

A personal loan 4000 dollars can be utilized in many ways. Borrowers usually take those to cover existing debt (either credit card bills or utility bills) or finance necessary services or purchases. If you have trouble dealing with avalanching debt, find out about $4000 consolidation debt loans to get qualified help with gradually planning debt repayment and finally consolidate payday loans into one.

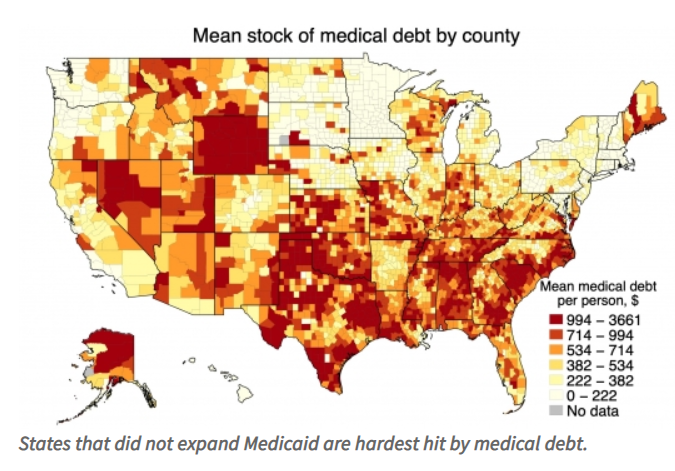

If you’re in need of medical care, you could opt for medical loans. Lenders have created plenty of those types: from LASIK loans to hair restoration loans.

According to the statistics over 17,8% of people with personal loans had medical debt in 2020. An average amount of medical debt was $2,424 last year.

Concerning the loan process itself, the borrower simply fills out an application online, waits for approval, and gets the money as soon as the next business day. The repayment terms are decided early on but can be adjusted within the loan life.

In terms of the credit score figure needed to qualify for the loan, bad credit borrowers don’t have to worry. A credit as big as a 4000 dollar loan with bad credit can be given out to people on nearly the same terms as usual.

How Much Does Personal Loan Cost?

The cost of the $4000 or $3000 personal loan speaks for itself but doesn’t include the interest. Alternative lenders online are known to have lower APR than that at the bank or a credit union. You can see the rate upfront and compare lenders based on this aspect.

To see the predicted monthly payments, you should use the calculator online which is easy to find online, and type your loan amount. The APR will be counted judging on your credit score. If the credit score leaves much to be desired, you should look up 4000 loans bad credit implied. The interest percent for those might be different, but the approval rates are still high.

How Can I Find the Right Personal Loan for My Needs?

A popular question from prospective borrowers is: “I need a 4000 dollars loan. How to find a lender?”. The solution is pretty simple, when you inquire about loan information online, you can see articles and opinions on finance. Some websites will offer their unbiased opinion on where to get great loans and find reliable lenders. Those websites take lenders’ top features and put them in a comparative table for borrowers to observe. This way you could see what lender is the best fit.

How to Apply for Personal Loan?

If you do apply through a lenders’ review website, you may get lucky to receive an array of offers from lenders. You can review them all and choose the least demanding terms.

The qualification terms for loan approval are minimal. You have to be at least 18, have American citizenship, and have a valid email address and phone number.

Creditors online will willingly grant loans even to people under 18 years online and with no proof of income. If you’re interested in those options, search for details in the blog.

Get a 4000 Loan With Bad Credit

It’s been estimated that 11% of Americans have a FICO score less than 550. The figure isn’t that high on paper, but in reality, it can leave millions of people without prospects of getting qualified financial assistance and really help them get rid of the debt.

Some of these people are in desperate need of a loan to unify the existing debt and some only need a momentary push towards a healthier financial standing. In any case, a $4000 loan with bad credit can be applied for with online creditors as credit score isn’t the sole aspect the lenders base their decision on.

In fact, consumers can upgrade their credit history with a disciplined repayment of a new loan.

Hopefully, the information above will help borrowers make the right decisions about getting the fullest of their financial possibilities. A sum of 4000 can be a quick but effective fix of one’s budget or serve as a starting point in one’s independent financial future. Great lenders and easy loans are just a click away.

on your homescreen

on your homescreen