The financial landscape has undergone significant changes in recent years, with the emergence of new direct lenders offering more lucrative options. The attitude towards online loans Texas on the part of the population has changed and become more positive.

In California, the 255 payday loan stands out as a popular choice. It’s a short-term loan that can be obtained online without the need for a hard credit check. Payday loans online no credit check instant approval allows you to meet your financial needs instantly.

No longer must you gather extensive documentation, seek out guarantors, or wait for finalizing your application. Obtaining a 255 online payday loan in California is a straightforward process. You can apply directly on the lender’s website whenever the need arises.

Once approved, the borrowed funds are swiftly deposited into your card. What’s remarkable is that individuals with bad credit scores can still access same-day direct deposits.

The primary criteria for applicants typically include US citizenship, being over 18 years of age, and having an active checking account. If you want to borrow money, read this article carefully and find out whether you should apply for $255 payday loans online same day deposit.

Best 255 Payday Loans Online Same Day in March 2026

Payday loans online Washington state distinguish themselves from traditional banking products and secured offerings due to their smaller sums and relatively brief repayment periods. Completing an application and receiving a response from the lender typically takes only 5-7 minutes on average.

The swiftness of processing plays a crucial role in the accessibility of payday loans, making them significantly more convenient than securing funds through a bank. All that’s required is internet access, whether from a personal computer or a mobile device.

Nevertheless, the responsible selection of a $255 payday loans direct lender is paramount, as various companies impose different lending terms, such as conditions for loan requests and penalties for missed payments. Below, we present an overview of the most reputable tribal lenders in March 2026.

Viva Payday Loans — Best For Quick Online Payday Loans

Viva Payday Loans takes first place in our ranking. It provides same day payday loans to those who need emergency cash. This lending company is not a direct lender. It is a matching service that helps borrowers find reliable direct lenders, even when you need $700 loan with bad credit instantly.

The registration process is straightforward. You can get a loan principal from $100 to $5,000 under APR from 5.99% to 35.99%. The payday loan repayment period varies from 90 days to 6 months. As for the origination fee, Viva Payday Loans charges 20% for loans under $2,000 and $400 for loans over $2,000. Basic requirements for the borrower:

- Age 18 years and over;

- Regular monthly income of $1,000 or more;

- Having an active checking account.

Credit checks are soft. There are no credit score requirements. Therefore, those with a bad credit record can contact the service without any worries.

The main advantages of Viva Payday Loans are a user-friendly website interface, unsecured payday loans up to $5000, 100% online application, and bad credit approval. Among the disadvantages, one can single out the fact that this is not a direct lender.

Moreover, 200 cash loan bad credit is not available in all US states, and a high origination fee is charged. Many Viva Payday Loans lenders report to credit bureaus. This is a great opportunity for people with a low credit rating score to rebuild their credit by creating a history of timely payments.

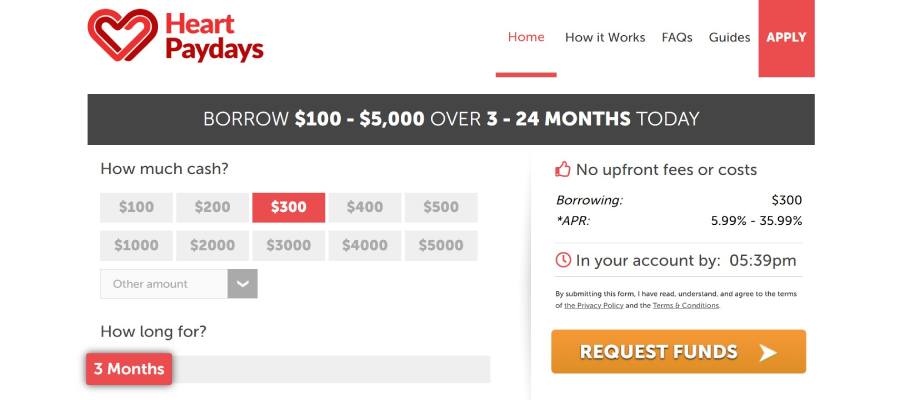

Heart Paydays — Best for People with Bad Credit

Heart Paydays specializes in providing short term loans for residents of different US states. Like Viva Payday Loans, Heart Paydays offers loans from $100 to $5,000. Annual interest rates range between 5.99% to 35.99%. Such terms are from 3 to 24 months. The origination fee varies from 0.5% to 1% of a loan request amount.

Requirements for borrowers are clear and include residence in the US, age 18, monthly income of $1,000, and an active bank account. There is no minimum credit rating score set. Applicants with low scores usually get approved.

Pros

- User-friendly site interface

- Fast processing of applications and instant approval

- Affordable interest rates.

Cons

- Some direct lenders do a more serious credit check

- Sometimes, the processing of an application takes more than one business day.

Thus, the Heart Paydays lender network is a great choice if you have a low credit rating score. The same day cash advance is issued at favorable interest rates, allowing borrowers to solve financial emergencies.

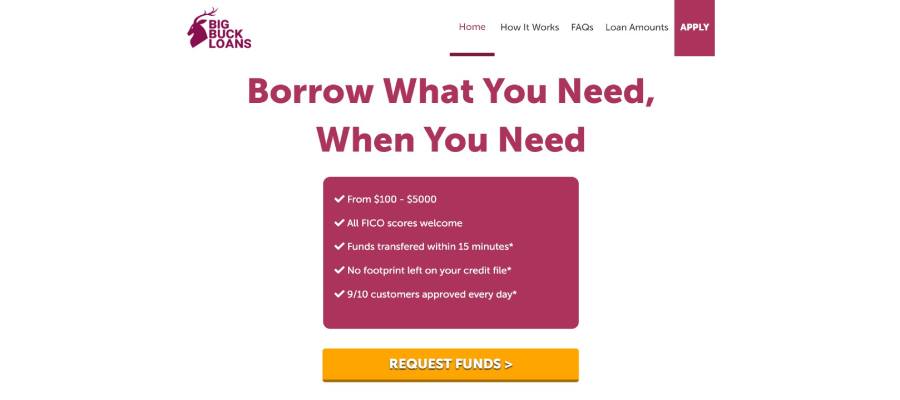

Big Buck Loans — Best For Those Who Want to Get Loans Online on Favorable Terms

Big Buck Loans is another online service with great loan offers and long term financial solutions. You can borrow money there until the next payday on favorable terms. The available loan amount is $100 – $5,000. Funds are issued almost instantly, after 15 minutes after the loan request. Credit checks are not strict. All FICO scores are welcome.

Annual interest rates range from 5.99% to 35.99%. Loan terms are 3-24 months. The service is easy to use. Among the advantages of this lending company, users note an automated application process and approval for borrowers with negative credit rating.

The disadvantage is that same day approval 255 payday loans are available to residents of only a few US states, including best payday loans in Texas, Florida, California, Alaska, Hawaii, Georgia, Washington, Massachusetts, New Jersey, and Ohio.

Requirements for applicants are standard. These include age 18+, US citizenship, and a valid bank account.

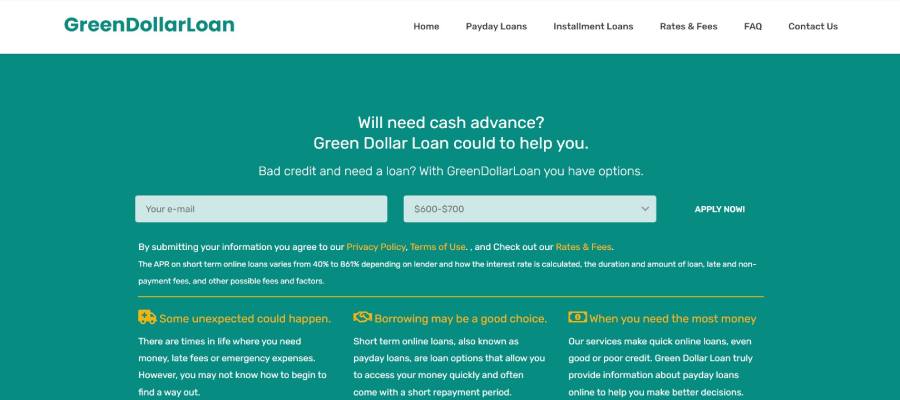

Green Dollar Loans — Best For Getting Large Payday Loan Amounts

When contacting Green Dollar Loans for a payday loan online, keep in mind that the minimum loan offer is $500 loan, and the maximum is $10,000.

Money is issued on the day of applying for a loan or the next day. Rates vary from lender to lender and range from 5.99%-35.99%. The term of personal loans reaches 3 years. An origination fee is not provided.

The requirements for borrowers are slightly wider than those of competitors. To get personal loans from Green Dollar Loans, you need to have proof of government-issued ID, be a US or Canadian citizen, have a regular income, and be at least 18 years of age.

Some Green Dollar Loans lenders work with credit reporting bureaus. However, even a borrower with a bad financial history has the opportunity to receive a direct loan payment on a bank card. The advantages of Green Dollar Loans are a convenient website and fast processing of a borrower’s request.

The downside is that the minimum loan amount is $500. So those looking for 255 payday loans online Utah same day are unlikely to be able to borrow money on this website.

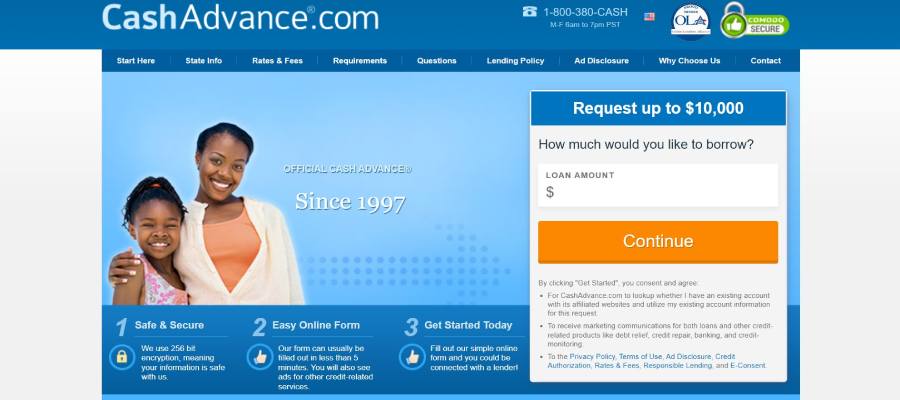

Cash Advance — Best For Small Penalties

Cash Advance closes our review of the best traditional lenders with minimum credit score requirements where you can apply for 255 payday loan online. The minimum amount of personal loans is $200, and the maximum is $10,000.

The advantage of the platform is that its annual interest rates are set directly by the payday loan app lender at the time of issuing the direct deposit. There are no hidden fees. The loan agreement indicates the date when the loan amount with interest must be paid. As a rule, it is 7-365 days.

The company applies soft credit check. The basic requirements for borrowers are having an age of 18 and American citizenship. No minimum credit score requirement has been set.

Therefore, you can get a payday loan even if you have a poor credit score.

Loam application is easy to submit. It only takes a few minutes and an Internet connection. Instant approval is usually provided. But sometimes, customers have to wait until the next business day to receive a 255 payday loan online. This is a small drawback of the service.

What Are $255 Payday Loans Online?

255 payday loans online same day is a type of loan that can be obtained on the platforms with multiple lenders. Unlike traditional loans, which can amount to several thousand dollars, the fast cash for emergency expenses is $255. Repayment terms are usually short (2 weeks – 1 month).

However, some companies in the modern lending industry are ready to issue such loans for longer periods. Interest rates range from 5.99% to 35.99%. Regular customers take part in loyalty programs. The longer you use the loan services, the lower the interest rate and the greater the cash loan available.

The lending process is simple. The loan decision is made quickly, immediately after creating the request. A cash loan is issued on the same day.

In rare cases, you have to wait until the next business day. The loan date determined should not be violated. It is essential to follow the loan agreement terms strictly. This allows not only to improve a negative credit rating but also a credit report in general.

Should I Apply For $255 Payday Loans Online Same Day?

Loan offers from online lenders are great for those experiencing temporary financial difficulties and who need a small amount of money for a short period. In this situation, you can quickly get cash advance online and meet your financial needs.

Personal payday loans will also be an excellent solution in cases where you do not want to go through a lengthy procedure for obtaining a loan from a bank. You will not need to collect documents, arrange insurance, etc. You will receive money quickly and hassle-free.

The only thing to consider is that payday lenders issue small loans. Therefore, if you need to borrow $10,000, it is better to look for an alternative.

What Do I Need to Apply for a $255 Payday Loan Same Day?

Lender requirements for people applying for short term loans are simple and transparent. Strict credit checks are not implemented. The main requirements for borrowers:

- Age 18 years and over;

- U.S. citizenship or temporary residence;

- Monthly income from $1,000;

- An active checking account.

You can apply for a personal loan online if you meet these requirements.

Can I Get a $255 Payday Loan Same Day with Bad Credit?

Most lenders issuing 255 payday loan online conduct soft credit checks. Credit rating score and credit history are often not considered at all. And even if they are considered, they do not play a key role. Therefore, people with poor credit score can use online lending services without any problems.

At the same time, observing the pay date and making monthly payments in accordance with the loan agreement can become a reason to improve your credit rating.

How to Get $255 Payday Loans Online Same Day: Have an Active Bank Account

You should follow 5 simple steps to get bad credit loans with same day loan approval:

You should follow 5 simple steps to get bad credit loans with same day loan approval:

- Filling out the loan application. You must fill out a short application with personal data, information about income, and contact information. Usually, it takes no more than 5-7 minutes;

- Linking a bank card. To receive money from a lender online, you need to have an active bank account;

- Consideration of the application. Most companies use automatic services, and less often requests are processed manually. The average time for consideration of one loan application is 4-5 minutes;

- Signing of documents. It takes no more than 1 minute to sign the loan agreement. However, it is recommended to carefully read the terms in order to understand whether you can generally fulfill your payday loan obligations;

- Getting cash advance. Money is transferred to the card you specified immediately after signing the agreement.

What To Consider About Best Payday Loans Online Same Day

There are many lenders who are ready to provide you with 255 or even sometimes 500 dollar loan bad credit online same day. However, not all of them are trustworthy. In addition, some offer better loan conditions than others. Therefore, the choice of a lender should be approached very carefully and responsibly.

Lender’s Reputation

When considering online direct lenders for your financial needs, the lender’s reputation should be your primary focus. It is essential to prioritize companies that operate within the bounds of the law, ensuring your rights and interests are safeguarded.

One way to gauge a lender’s reputation is by examining customer reviews available on the internet. If you come across a multitude of negative reviews, it’s a red flag pointing towards subpar loan services. On the flip side, an abundance of positive reviews is a strong indicator of a reputable lending institution. BBB-accredited financial institutions deserve special trust.

Loan Terms and Conditions

Terms and conditions vary from one lender to another, and it’s crucial to review them thoroughly before proceeding with your application. This is especially important when considering payday loans, as the terms can significantly impact your financial situation. Here are some key points to keep in mind when seeking payday loans in California:

- Loan Availability: Loans are available online, and some lenders offer same-day approval and disbursement.

- Credit Check: Many lenders in California offer payday loans without conducting a credit check, making it possible to secure a loan even with a bad credit history.

- Loan Amount: You can typically apply for a payday loan of up to $255.

- Loan Duration: A payday loan is a short-term borrowing option, with repayment usually due within one business day.

- Direct Lenders: Some lenders in California are direct payday loan providers, ensuring a straightforward application process and quick access to funds.

- No Credit Checks: Online loans with no credit checks are available, allowing you to access funds regardless of your credit history.

- Quick Disbursement: Funds are often deposited into your account on the same day as approval, ensuring rapid access to the money you need.

- Credit Impact: It’s important to note that while payday loans don’t typically require a good credit score for approval, they may not positively affect your credit score either.

Remember that terms and conditions can vary, so make sure to thoroughly understand the specific terms of your chosen lender before applying. This way, you can make an informed decision to ensure the 255 loan meets your financial needs and circumstances.

Interest Rates

Online payday loans in California are available with a variety of interest rates. These loans are typically designed for individuals who need quick access to funds, even with bad credit. Lenders may offer loans with interest rates that can range from as low as 5.99% to as high as 35.99%.

Some companies allow payday loans at the lower end of the spectrum, offering them at just 5.99% per annum, while others provide payday loans at the higher end, with a 35.99% annual interest rate. It’s crucial to consider these interest rates when you apply for an online payday loan, especially if you’re seeking loans same day California no credit check.

Make sure to review your options carefully to avoid overpaying, as the approval and no hard credit check feature can be incredibly convenient. You can even apply for a 255 dollar payday loan online, and the funds will typically be deposited into your account within one business day. This means that even if you have bad credit in California, online payday loans are available to help you in your time of need.

Eligibility Terms

Eligibility requirements typically involve an evaluation of the applicant’s creditworthiness, which encompasses factors such as their age, monthly income, and credit rating score. It’s advisable to research this information ahead of time when considering a lender. Certain companies may decline individuals with low credit rating scores, while other platforms may not prioritize this particular criterion.

Security

Another important factor you should consider is the security of the online payday lender. Find out if customers’ personal data is encrypted, if it is not shared with others, how the website is protected, etc.

What Are Alternatives to $255 Payday Loans Same Day?

There are several good alternatives to $255 payday same day loans. Learn about them in the table below.

|

Alternatives to 255 Payday Loans Same Day |

|

| Credit Union Loans | The main advantage is the fastest possible loan processing. In addition, credit unions require a minimum number of documents. |

| Lending Circles | The benefit of lending circles is that they help members build a financial history or improve a low credit rating score. |

| Low-Interest Credit Card | The advantage of this alternative is that the money can be used at any time at a low-interest rate. |

on your homescreen

on your homescreen