When you get a credit card, you enter into a contract with the issuer. That means you have certain rights, just like any other customer. But to protect yourself, it’s important to read the terms and conditions of your credit card contract very carefully before signing on the dotted line. After all, that’s where many of the sneaky tricks tend to hide out.

If your future employment prospects or credit score stand to suffer because of a new piece of plastic in your wallet, take some time to do some research before applying for a credit card. To help you get started searching for the perfect card, here is our list of the best credit cards in February 2026.

Best Cashback Credit Cards

Cashback credit cards are a great way to make your everyday spending work harder for you. These cards reward you with cash back on certain purchases, which means you get money back from your card issuer on things like groceries, gas, and even everyday monthly expenses like Netflix subscriptions and cell phone bills.

Some cards have special bonus categories, such as gas stations or grocery stores, where you get more cash back on those purchases. Other times, the rewards are less obvious. Here’s what makes cashback credit cards stand out from other financial products and why they may be right for you.

Scotia Momentum® Visa Infinite* Card

Visa Infinite from Scotia Momentum® is designed to be an everyday payment tool. However, you’ll get even more rewards if you enjoy traveling and adventuring. Furthermore, it offers cashback (4% for groceries, drugstores, gas stations) and subscription services (5% for Netflix specifically).

With an annual fee of $120, this card is perfect for those who want to travel the world without breaking the bank. The interest rates are 20.99%-22.99% variable APR, so pay your bill in full each month to avoid surprises. The first-year annual fee is waived to get started without hassle.

Best of all, this card comes with extensive travel insurance, so you can rest easy knowing that you’re covered in case of a travel accident or injury. Plus, this card comes with a concierge service, so you can always get help with any questions you have while traveling.

SimplyCash™ Preferred Card from American Express

With the SimplyCash™ Preferred from American Express, you’ll earn 5% cash back on purchases across three categories. Depending on your financial situation, there may be better cash-back products available. This American Express option might be attractive if you manage your money responsibly.

Cash back rewards start when you sign up, with a welcome offer of up to $400. Plus, with an interest rate of up to 21.99%, you can pay off your purchases quickly and easily. With a wide acceptance rate, this credit card is perfect for anyone who wants the best of both worlds.

While the SimplyCash™ Preferred has no flashy perks, it offers a high cash rewards rate (10%) on commonplace spending categories like groceries and gas. The downside is you have to spend $2000 before the bonus rate is applied, and Amex isn’t as widely accepted as Visa, for example.

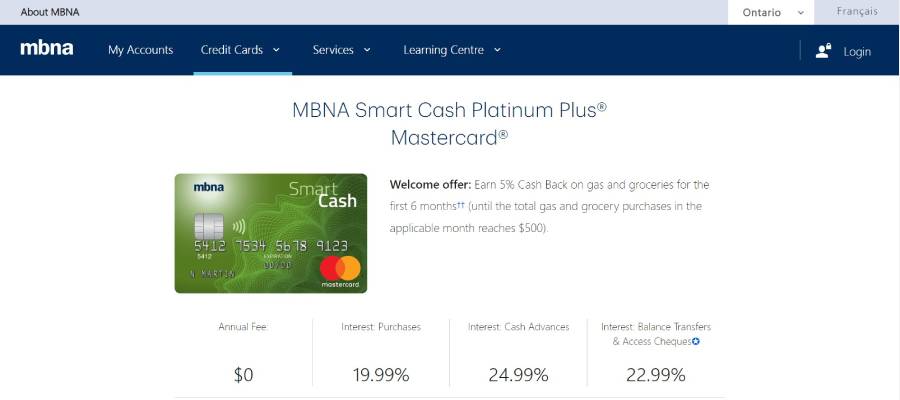

MBNA Smart Cash Platinum Plus® Mastercard®

The MBNA Smart Cash Platinum Plus® is the perfect mix of function and fun! This sleek little number is packed with features to make your life easier and more enjoyable. With an annual fee of $0, you can use it all year round without worrying about the cost.

Plus, the interest rates are variable (19.99%- 24.99%), so you can pay them down at your own pace. And if that wasn’t enough, the sign-up bonus of 5,000 points is sure to put a smile on your face. During the first six months of membership, you can earn 5% on gas, groceries, and drugstore purchases.

For the first 21 months, it offers 0% introductory APR on selected net purchases and revolving credit. But the 5% rate drops down to 2% after that. The 0.5% on all other purchases is relatively low, though, and specific points categories are annually capped.

Best Credit Cards For Businesses

You need access to cash for essential business expenses to run a business. In addition, if you want your company to grow, you’ll need capital for expansion, equipment, or other business ventures. Financial institutions offer business credit cards as an alternative way for small businesses to get capital when an operating line of credit from the bank is impossible.

If you operate a small business and are looking for ways to manage its finances responsibly while reserving cash for future growth opportunities, getting a business credit card may be just what you need. Read on to learn more about some of the best options out there right now.

American Express® Aeroplan®* Business Reserve Card

When it comes to ensuring their travel expenses are covered in an emergency, American Express’s® Aeroplan® Business Reserve is a great choice. The annual fee is $599, and you get 110,000 welcome points, but it’s worth every penny for frequent travelers. This card is perfect for those who want to earn rates and rewards on their flights, hotels, and rental cars with Air Canada.

Among its premium features are access to over 1,200 Priority Pass airport lounges worldwide, Aeroplan points that can be redeemed in various ways, and more. This card offers excellent interest rates (16.99%-21.99% variable APR), making paying back your travel expenses easy.

This card may be a good fit for those who don’t mind the relatively high annual fee, can meet spending thresholds, and don’t mind not receiving rewards for everyday expenses. Considering the potential charges (based on credit score) for late payments is also a good idea.

Business Platinum Card® from American Express

A premium American Express product, Business Platinum offers many benefits, including accelerated access to over 1,200 airport lounges worldwide. Having a premium credit card when you travel frequently for business or spend a lot on business-related expenses can help you maximize your money without compromising your finances.

As part of Business Platinum, you’ll get access to a number of valuable benefits and perks that can help you manage your company’s finances. Although it comes with a $695 annual fee, this card offers plenty of benefits to make it worth the price. Although the 16.49%-24.49% variable APR may seem high, the automatic elite status and transfer partners make this card worthwhile.

Plus, the welcome bonus of 120,000 points makes it easy to earn rates and rewards and enjoy some free perks. With a high annual fee, this card is best suited for those with good or excellent credit.

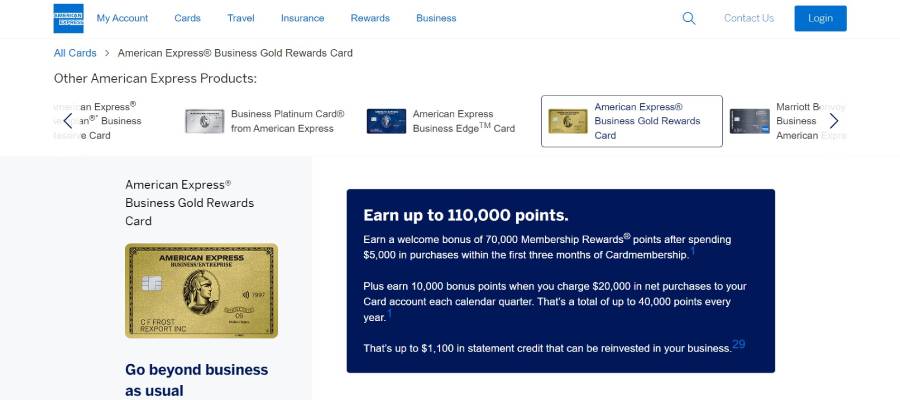

American Express® Business Gold Rewards Card

Take advantage of the American Express® Business Gold Rewards Card if you frequently spend on business expenses. It can be used to pay for office supplies, employee expenses, or other business expenses.

There are several exclusive benefits available to American Express business card holders. Members can redeem cash rewards, membership points, specific streaming services, and access to personal concierge services.

With interest rates of 16.49%-24.49% variable APR, the Amex Business can be a bit risky, but those reward points make it worth it. Plus, with welcome points of 60,000, this card is perfect for those with a busy lifestyle who want to earn rewards quickly. With an annual fee of $295, it’s cheaper than most, but if you’re not concerned about a lack of lounge benefits, then this one is for you.

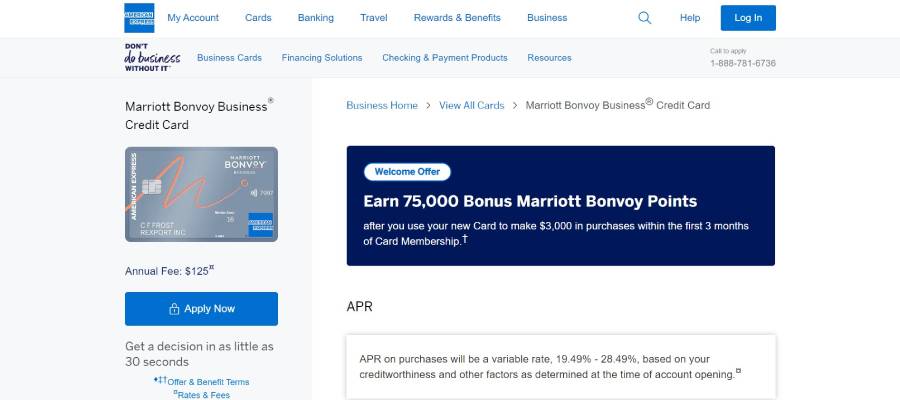

Marriott Bonvoy™ Business American Express® Card

Marriott is one of the world’s most popular hotel chains – and now guests can earn points and rewards when they stay at Marriott hotels. Traveling for business often could make Marriott Bonvoy™ Business American Express® an ideal choice for you.

With a bonus of 75,000 points after spending $3,000 in three months, it will appeal to professionals and business owners who don’t want to spend much on the annual fee ($125).

For those who stay at Marriott frequently, Marriott Bonvoy™ Gold Elite Status offers priority access, as well as four points per $1 at dining outlets, gas stations, and phone expenses.

This card will suit those who want to travel and spend without bells and whistles; there is no luxury lounge access or other premium perks. The variable interest rates of 17.99%-26.99% and no foreign transaction fees make it a useful business card for minimalist travelers.

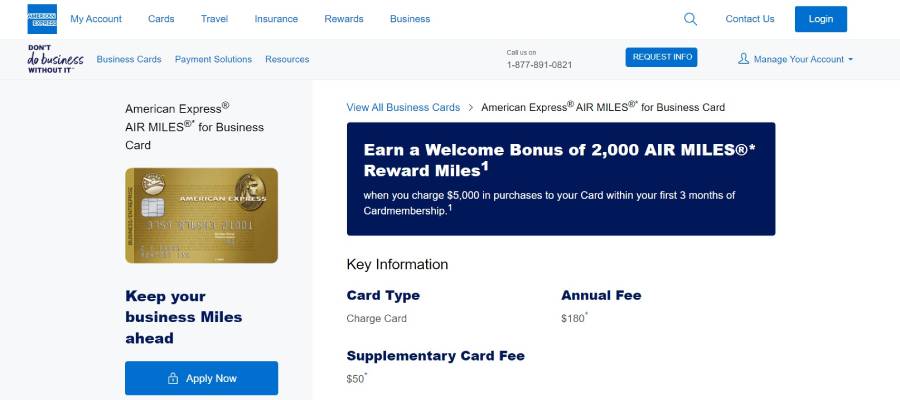

American Express® AIR MILES®* for Business Card

Air Miles® and American Express® have partnered to offer a product that combines both advantages. You can’t go wrong with no late payment fee and a 150 AIR MILES bonus after spending $1,000 in 90 days. Plus, with interest rates between 19.99% and 22.99%, you’ll have plenty of time to pay off your balance.

This product offers the perfect opportunity to earn miles and purchase without worrying about interest or fees. Plus, with no late payment fee, you can pay your bill on time and keep your miles in your pocket. The only downside is that the foreign transaction fee makes using the card if you travel abroad a costly expense.

These two products will help you save money on everyday purchases to get more for your business spending. You can earn AIR MILES in many ways, but those seeking comprehensive insurance coverage or cash back should look elsewhere.

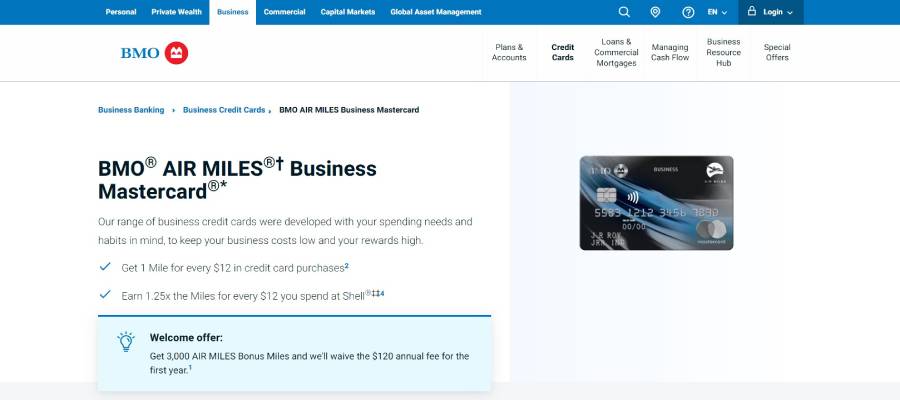

BMO AIR MILES®† Business® Mastercard®*

MBO AIR MILES® offers all the basics without the hassle. This easy-to-use card comes with no annual fee and a fair to good credit score, making it perfect for consumers with average credit. Small businesses can earn exciting loyalty rewards through the BMO AIR MILES® Business program.

This is one of the best no-fee air miles products due to its extremely low fees and 800-mile sign-up bonus. The card also offers rental car discounts and no interest rate, so you don’t have to worry about using it. With BMO AIR MILES®, users get the best basics a business card can offer.

Although there is no access to premium airport perks, reward miles can be redeemed for travel expenses with more than 200 partner brands through the AIR MILES program.

Best Credit Cards With No Foreign Transaction Fees

In today’s global economy, you might travel abroad for work or pleasure more often than ever. While this may seem inconvenient initially, it can also allow you to see new places and explore different cultures.

If only travel weren’t so expensive! Even a short trip abroad can cost much money if you’re unprepared. The good news is that there are ways you can reduce your expenses when traveling abroad by using credit cards wisely. Getting a credit card with no foreign transaction fees can go a long way toward ensuring that your next trip is both affordable and stress-free.

Keep reading to learn more about why getting the best credit cards with no foreign transaction fees is beneficial and how they can help save you money on international trips.

Scotiabank Platinum American Express® Card

Scotiabank Platinum American Express® is one of the most valuable cards in today’s market. This is the perfect credit card for those who want to build their credit history or travel frequently. Besides offering mobile phone insurance, this card also provides priority access to airport lounges.

A frequent traveler can take advantage of this product’s benefits, including free foreign transactions, a 10% discount on cash-back redemptions, a 25,000-point sign-up bonus after spending $1,000 within the first three months, and points for dining, hotels, and gas.

With an annual fee of $399, this card is certainly not for everyone, but those who are looking for a way to build their credit may find it worthwhile. With very competitive interest rates of 9.99% variable APR, this card will likely only be available to those with an excellent credit score.

Among the most rewarding plastics on the market is the Scotiabank Platinum American Express®. Whether you want to build your credit history, get cash-back rewards, or just have peace of mind while traveling. With an annual fee of just $399, it is worth it if you want the perks.

And with interest rates of just 9.99%, you get everything you need, including 25,000 points after spending $1,000 in the first three months. With membership, you get exclusive perks at more than 1,200 partner locations, twice as many points for gas, dining, and hotel stays, and 10% off cash-back redemptions. This card is best for those who travel frequently.

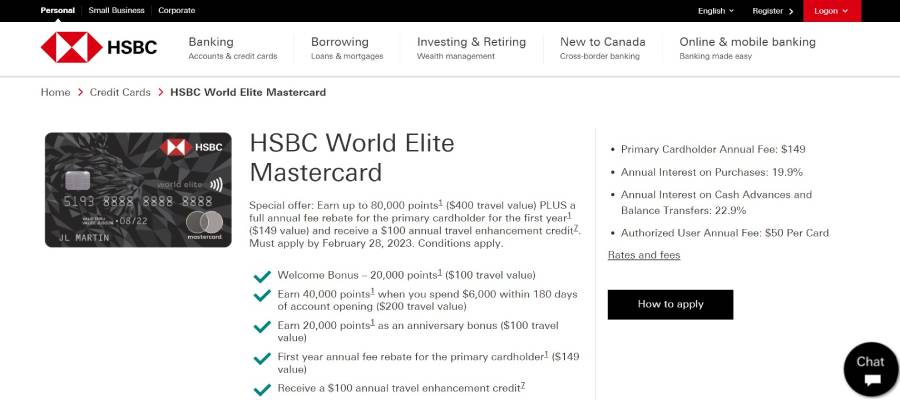

HSBC World Elite® Mastercard®

Only those who are currently customers of HSBC will be eligible to join the HSBC World Elite® program. Its terms for qualifying include a high income and other undisclosed requirements. Nonetheless, it’s especially useful for frequent travelers due to its travel perks.

With an annual fee of $395, this card isn’t for everyone. But this is it for those who want the best of the best. With unlimited points that don’t expire and extensive benefits and travel perks, this card is a must-have for frequent travelers. With interest rates starting at 17.24%- 21.24% variable, this card will be available to those with an average FICO score.

Scotiabank Gold American Express® Card

The Scotiabank Gold American Express® is designed for golfers who enjoy playing abroad.

For those who travel abroad frequently and don’t mind the lack of cash-back rewards, spending on golf will earn bonus points instead. Spending on golf greens, utilities, and services earns 2 points per 1$ spent, and spending on everything else is worth one point.

This card has no annual fee for the first year, which is great if you’re just starting to build your credit history. It comes with an interest rate of 19.99%-22.99%, so make sure to pay your balance in full each month to avoid any costly penalties.

Plus, the Gold American Express® has no balance transfer fee, so you can easily transfer any existing debt and pay it off. But if you’re looking for cash-back rewards or a card to help you consolidate your debt, this card might not be the best choice.

Scotia Passport™ Visa Infinite* Card

With Scotiabank Passport™ Visa Infinite, you can access an insurance package that compares favorably with most other top-end travel cards. This card is perfect for anyone looking to build their credit history or just looking for a simple way to earn some (but not a lot) of cashback rewards.

The Scotia Passport™ offers an annual fee of $139, interest rates of 19.99%-22.99% variable APR, and provides some impressive travel perks. Among them are medical insurance, trip cancellation, lost baggage claims, lounge access, and travel booking convenience.

Its attractive welcome bonus and ongoing rewards also offer some impressive travel medical insurance benefits. This card isn’t the best for cash-back rewards, but it’s probably the most extensive in terms of travel insurance in the market today.

Best Student Credit Cards

College is expensive, and even the best students struggle to pay student loans on time. To help you avoid the stress and embarrassment of missing payments or the pitfalls of defaulting on your loan, many credit card companies have introduced student credit cards with more favorable terms for young users.

These student credit cards tend to have lower interest rates, smaller initial deposits (or no deposit at all), and flexible payment plans – all things that are usually more beneficial for students who are just beginning their adult financial journey. The trick is finding a student credit card that meets your needs as a user and doesn’t come with any strings attached.

Discover it® Student Chrome

The Discover it® Student Chrome is a great cash-back card for students who want to build their credit. This card has no annual fee, a rotating rewards system, or a foreign transaction fee. Plus, the interest rates are pretty good too!

With no annual fee and a 0% APR for the first six months, this card is an excellent option for students who are looking to build their borrowing power. The Discover it® Student Chrome card offers 2% cash back at food outlets and gas stations and 1% on all other purchases.

But it does come with a few downsides. The reward earnings are capped at $1,000 in purchases per quarter, with a balance transfer fee of 3%. But if you can overlook those drawbacks, then this card is perfect for you.

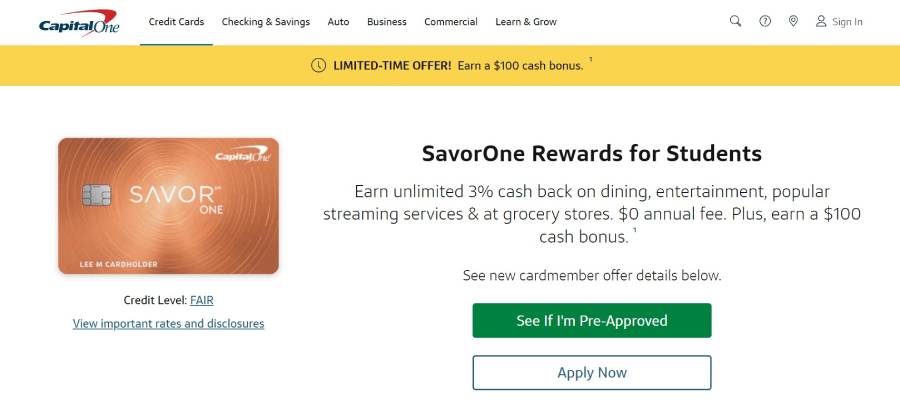

Capital One SavorOne Student Cash Rewards Credit Card

The SavorOne is student-personified, with entertainment and dining-out benefits galore. It allows you to earn a cash reward of 0% APR for up to 12 months. You can pay your balance in full at the end of each billing cycle or carry a monthly minimum that will automatically apply to your account.

There are no fees for this card, and there’s no annual fee either. You’re also not required to make any payments if you don’t have enough funds available. When you sign up, you get a $15 cash-back bonus after making $500 in purchases within the first 3 months of opening your account.

Discover it® Student Cash Back

One of the best cash-back rewards programs is Discover it® Student Cash Back. Students can earn additional rewards with this program, which uses a tiered rewards system. The highest cashback tier is offered for the first six months after enrollment, followed by reduced cashback.

Keeping your account active and in good standing is the key to qualifying under this program. To qualify for rewards, you must have a $1-$49.99 balance at the end of each billing cycle.

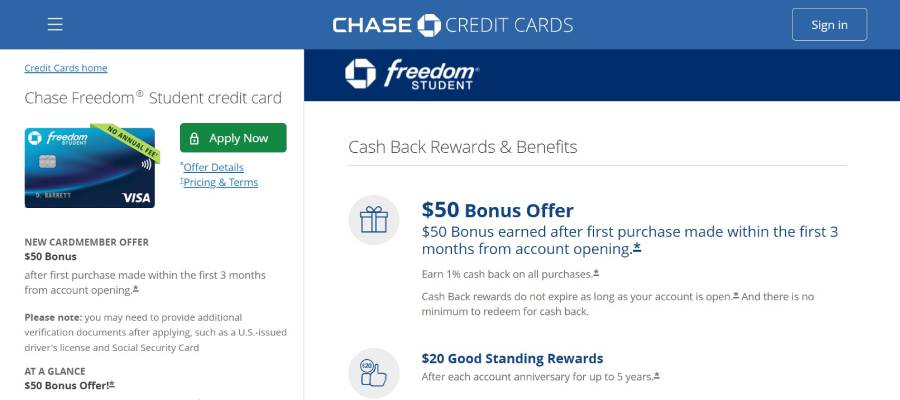

Chase Freedom® Student credit card

Chase Freedom® is a cash-back credit card from Chase that has a $0 annual fee and a 1% cash back on purchases. Once you’ve reached the minimum spending threshold of $1,500 in 90 days, you earn an additional one percent cash back. If you carry a balance from month to month, the 1% cash back can add up quickly.

The card is best for students with good credit who are looking for a low-cost way to earn cash back on their purchases. In addition to earning 1% cash back on all your purchases, you can also get a 50% bonus cash back at restaurants, gas stations, and select retail outlets in the first year of account opening.

Best Rewards Credit Cards

Rewards credit cards are not just about traveling for free but also about getting other perks, such as cashback, frequent flier miles or points, and other goodies. They’re almost like a hybrid of a standard credit card and a loyalty program from an airline, hotel chain, or retailer.

And in case you aren’t aware, these types of credit cards have grown in popularity recently. In fact, according to the American Consumer Council (ACC), the number of rewards credit cards has almost doubled since 2016.

That being said, if you don’t currently have one and are looking for ways to get more bang for your buck when making purchases, then now is a great time to apply for one of the best rewards credit cards that you can qualify for.

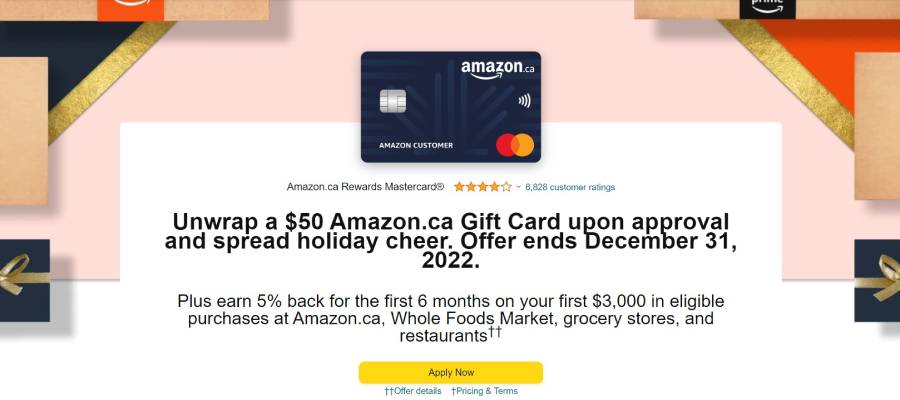

Amazon.ca Rewards Mastercard®

If you’re a Prime member looking for a no-frills credit card, this is the one for you. The Amazon Prime card has an annual fee of $0, and it offers some great benefits to those who frequently shop with Amazon.

First, it comes with a $10 Amazon gift card when you sign up. That’s a great way to get started. And with no annual fee, and 19.99%- 22.99% variable APR, this card is a great choice for Prime members who don’t want to pay a lot of money.

As a member of the Amazon rewards program, you can get travel insurance, groceries at Whole Foods, and 1% back on purchases. Get even more money-saving benefits by redeeming the points online.

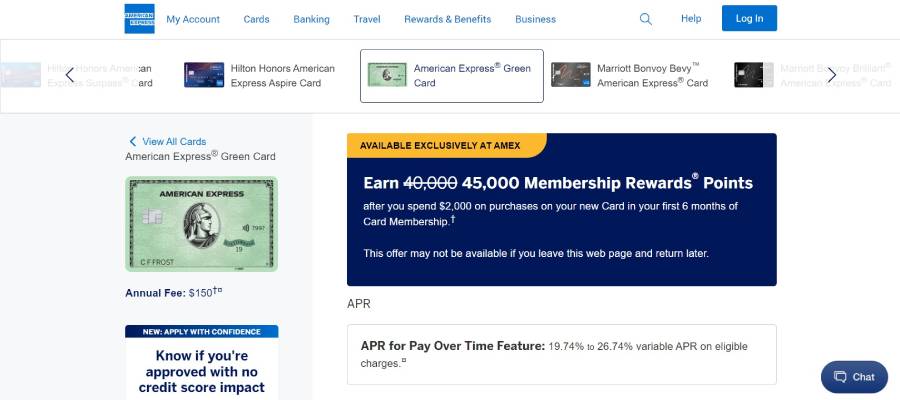

American Express® Green Card

As well as offering a substantial rewards program, the Amex Green card promotes eco-friendly practices (it’s made from 99% recycled plastic). With an annual fee of $0, this card is a great investment for anyone looking to improve their credit score.

Interest rates of 20.99%- 21.99% variable APR may seem steep, but with a rewards rate of up to 10,000 points bonus, this card will surely pay for itself in no time. Plus, with no foreign transaction fee, you can use your Credit Card anywhere in the world without worrying about additional costs. The only drawback is the lack of introductory APR, which makes it less desirable than others on this list.

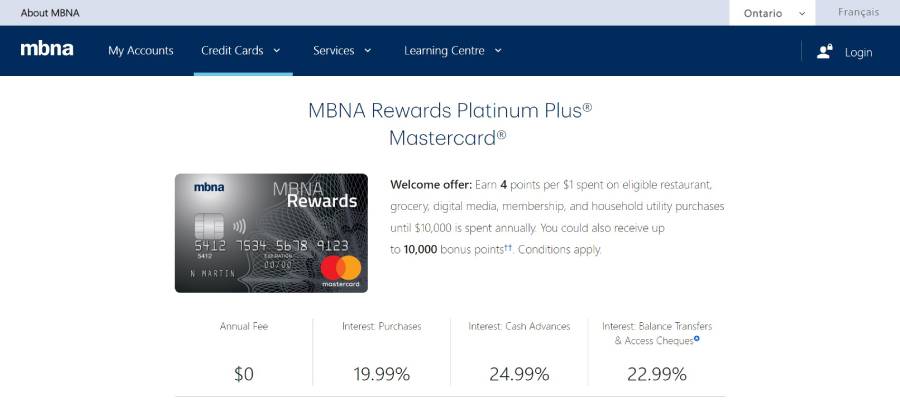

MBNA Rewards Platinum Plus® Mastercard®

There are many ways to redeem your points with this no-fee program, and the value of the rewards is excellent. This is a great option if you don’t want to worry about meeting a minimum income requirement or paying an annual fee.

Whether you’re looking to build your credit or just want to take advantage of some of the benefits, this card offers a variety of them. These include a low annual fee, interest rates that vary depending on your credit score (19.99%- 24.99%), and a $50 welcome bonus.

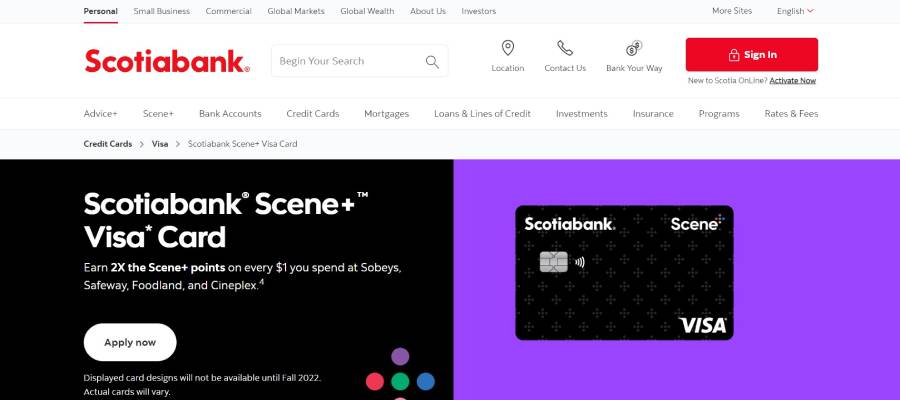

SCENE®* Visa* Card

Among the best movie-going cards, the SCENE® Visa gives you double points and special offers like free popcorn, reserved seating at cinemas, and other entertainment-related activities. The 12-month interest-free grace period on purchases, concert going, and dining out is worth the lack of other perks.

7500 welcome points is a great way to get started, and the interest rates align with the typical market rate (19.99%- 22.99%). Cash-back rewards are limited, and there is no insurance coverage, but this card is perfect for those seeking a convenient, fun, and straightforward way to spend money.

Laurentian Bank Visa Infinite card

The Laurentian Bank Visa Infinite is the perfect blend of features and benefits that will take your spending experience to the next level. With an annual fee of $130, this card is certainly not for everyone, but for those who want Uber benefits, and 3x reward points of selected purchases, it doesn’t get any better than this.

Interest rates of 19.99%-21.99% variable APR are sure to help you build your credit score, and with travel insurance and a generous points system, you can rest assured that your purchases are always in good hands. Whether you’re making a large purchase or just buying a coffee, the Laurentian Visa is great for non-fuss spenders with specific categories of bonuses.

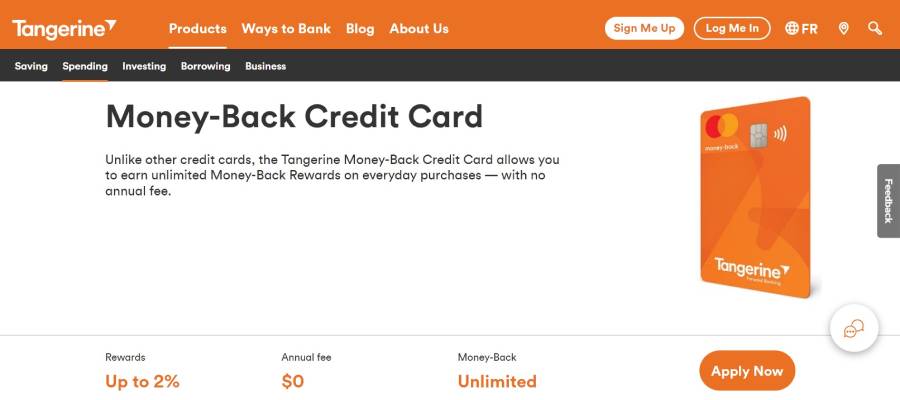

Tangerine Money-Back Mastercard

The Tangerine card is a great choice for people who want a fair credit welcome and a fixed APR (19.95%), so there won’t be any nasty surprises in the long run. Each year, you can earn 5% cash back on your first $3,000 in eligible purchases and 1% after that.

It is a good choice for people who wish to earn cash back on their purchases because it offers unlimited money-back rewards. Those looking to pay off their credit card debt can use the free balance transfer. The best feature of this card is the ability to choose your bonus categories to maximize your rewards and customize them to fit your spending habits.

CIBC Costco® Mastercard®

The CIBC Costco® has limited benefits but will be ideal for those who want a straightforward, simple credit card that earns cash back without an annual fee.

Members who shop at Costco receive excellent benefits, including a fixed 19.75% APR and preferential rates. CIBC Costco® offers a one-year free membership to anyone who is not yet a member.

With 3% cash back on restaurant and Costco gas purchases, 2% cash back on other gas stations and Costco purchases, and 1% cash back on all other purchases, this card will help customers save money on everyday expenses.

Best Credit Cards For Bad Credit

Bad credit card options are among the most challenging to find when needed. If you have a low credit score, it means that something caused your score to dip below a particular threshold. Perhaps you forgot to pay a bill, or maybe there was another mitigating factor. Either way, your credit score is probably not going to jump right back up again in the near future.

Fortunately, there are ways for people with bad credit to get new credit cards. In fact, there are even some tremendously bad credit card options out there. So, what exactly is out there? Let’s take a look.

Neo Card with Credit Builder

Looking for a credit card that will help you build your credit while earning rewards? Look no further than the Neo Credit Builder. This card has no annual fee, which makes it a great value. You’ll also have plenty of time to pay off your balances and build your credit with interest rates as low as 19.99%-24.99%.

Neo also has additional benefits. Users can link their accounts with other lenders to help with repayments. But it isn’t all about building your FICO score.

The welcome bonus of 15% will earn you extra cash back on your purchases, while all other purchases will earn you 5% cashback. In addition, you’ll earn 1% back on other purchases.

Capital One Low Rate Guaranteed Mastercard®

This card is guaranteed to get you started on the path to a better financial future with no hassle and no fuss. With an annual fee of just $79, it’s a small price to pay for all the benefits you’ll enjoy. For the first 20 billing cycles, interest rates of 14.9% variable APR are pretty low compared to the average (14.9%).

Extras include baggage, travel, trip cancellation, and flight delay insurance. You can rest easy knowing you’re covered in case of an emergency. Plus, with guaranteed approval, there’s no risk to you.

Capital One will increase your credit limit by $500 if you pay your bill on time for six months. This rate comes with some trade-offs, however. A past application with Capital One or a bad standing with the company will prevent you from qualifying.

KOHO Premium Reloadable Prepaid Mastercard

With an annual fee of only $9 per month, the KOHO Premium is a great way to build up your credit score while enjoying some useful benefits. With interest rates starting at 19.99%, this card is sure to help you build your credit quickly.

Plus, with no foreign transaction fees, you can use it anywhere worldwide without worry. And with 2% cashback, you’ll be rewarded for all purchases. Finally, this card is CDIC insured, so your deposits are protected up to $40,000. It’s catered towards those with limited borrowing options because it doesn’t have the usual set of restrictions, like a standard credit check to get approved.

Best Credit Cards For Building Credit

Getting a new card can seem intimidating if you’re just starting to build your credit or want to rebuild it. Luckily, there are many great offers out there from reputable banks. Getting a new card not only helps you build credit, but it can also offer other perks such as rewards or additional benefits that will save you money in the long run.

A credit card can be a beneficial financial tool when used responsibly and wisely. A solid credit history is essential to your financial future, making you more eligible for loans, housing leases, cell phone contracts, and insurance policies. Let’s take a look at what’s available for you.

Chime Credit Builder Visa® Credit Card

The Chime Credit Builder offers a 0% intro APR on purchases and balance transfers for 12 months, after which you’ll be subject to a 13.99% – 21.99% variable APR. You’ll also be eligible for a 0% introductory APR on purchases if you have a FICO score of 624 or higher.

The Chime card features no annual fee, no late fees, and no penalty rate for balance transfers made within the first 15 days of opening your account. Plus, they offer free access to your FICO score. The only downside is the $5,000 required to open an account.

Discover it® Secured Credit Card

With its $0 annual fee, the Discover it® accepts bad to fair FICO scores and reports to the three major reporting bureaus, so you can start building your credit history straight away. It also earns rewards so that you can get something back for all your purchases. And new customers can take advantage of their new customer bonus offer – 1% cash back on all purchases for the first 6 months.

For 6 months, it offers an intro APR of 0.99% on balance transfers. Your purchases can earn you cash back without an annual fee. In addition, if you manage your account responsibly, you can receive a refund after 12 months. The APR is high, 25.24% variable, but this is normal, considering they accept lower credit scores.

Capital One Platinum Secured Credit Card

The Capital One Platinum Secured has no annual fee and 0% balance transfer, making it an affordable way to build your credit. It also reports to the three major reporting bureaus so that you can track your progress. Plus, it has no foreign transaction fees so you can use it anywhere in the world.

This card is probably the best on the market for no-fuss credit repair. Users need to deposit a $49 minimum security deposit for a $200 line of credit. But, if you use your card responsibly, and pay everything back on time, the deposit amount is refundable.

A grace period of 25 days is also offered by Capital One, as well as a 0% APR for the first six months on purchases. Since no annual fee and flexible security deposit requirements exist, this is a great option for people restoring or building their financial history.

Capital One Quicksilver Secured Cash Rewards Credit Card

The Quicksilver Secured Cash Rewards Credit Card from Capital One is a secured credit card that accepts bad credit scores. Once your account is established, you will accrue cash rewards based on your monthly spending.

The rewards include 5% on travel booked through Capital One and 1.5% on all other purchases, including statement credits, gift cards, and travel expenses. This card is best for people with limited credit history who are looking for a way to start building their credit score.

While this card does not offer any additional benefits or features, it is still worth considering if you need a basic credit card that provides the convenience of automatic payments.

Best Credit Cards For Balance Transfers

There are various reasons why an individual might need to transfer a balance from one credit card account to another. Perhaps you’ve accumulated debt on one card you can no longer afford, or you’ve been issued a new card with better benefits and perks. Whatever the reason, transferring a balance from one credit card to another is something that many individuals need to do at some point in their lives.

However, for most people, transferring balances involves various hidden fees and costs. Many credit cards charge high amounts of interest rates for transferring balances from one account to another. Here, we will explore the best balance transfer credit cards to save money when transferring your debt from one card to another.

BMO AIR MILES®† MasterCard®*

BMO AIR MILES® is a balance transfer card that doubles as a rewards card. This is one of the most competitive account transfer promotions due to its nine-month introductory 0.9% APR.

With no annual fee and interest rates starting at 19.99%, this card is a great choice for anyone looking to transfer a balance and pay it off over time. In addition to car rental discounts, fair to good credit scores are accepted, making it an excellent choice for everyday use, whether you’re shopping for groceries or planning a vacation.

CIBC Select Visa* Card

The CIBC Select comes with no annual fee and offers a 0% interest rate for the first 12 months, so you can pay off your debt without paying any additional money. And, if you qualify for their balance transfer promotions (FICO score permitting), you can get 0% interest on your balance for up to 10 months.

Plus, you’ll get 3% cash back on restaurant and Costco gas purchases, 2% cash back on other gas purchases, and 1% cash back on all other purchases.

If you’re a Costco member, this card is also a great way to get rewarded for your purchases. CIBC Select Visa has no annual fee and is a no-frills product. This is an excellent entry-level card if you want to establish better financial habits by condescending costs.

Tangerine Money-Back Card

An excellent example of a transferable credit card is the Tangerine Money-Back. A 1.95% introductory interest rate is offered on balance transfers for the first six months, followed by 19.95% on subsequent transfers.

This card offers unlimited monthly money-back rewards, and fair credit is welcome, making it perfect for those who can’t qualify elsewhere. In the cashback rewards program, customers earn 1% cashback on everyday purchases plus another 1% back as a refund if the balance does not reach zero by the end of the month.

It isn’t a good fit for shoppers who frequently visit wholesale stores or want a lot of perks, but it’s an excellent option for those who want a low-interest rate and who want to pay off their balance quickly.

President’s Choice Financial® Mastercard®

If you’re looking for a way to consolidate your debt or pay off some high-interest credit cards, President’s Choice is the card for you. Regarding balance transfers, there’s 0% interest for the first 18 months, no annual fee, and interest rates range from 19.97% – 22.97%. Plus, with the interest-free grace period for new purchases, you have some time to pay off those balances without paying any interest.

This option for balance transfers also comes with a family member bonus – if you get the card, your family members can get cards, too, and join the rewards system. This way, you can all earn points towards rewards together. Plus, there are no foreign transaction fees if you travel abroad so you can use your card without worry.

Best Travel Credit Cards

Having a travel credit card is one of the best ways to ensure you can afford your dream trips. First, they tend to offer great introductory rates that can help you save money when you first sign up. Second, they give you access to cashback and other rewards programs to help you earn extra money when you’re not spending.

Third, they can help you build up an impressive credit history that will be valuable when it comes to getting other loans in the future.

There are many different types of travel credit cards out there, and each one tends to have its own advantages and disadvantages. The main thing to remember is that no two cards are created equal, so it’s essential to do your research before choosing one.

Marriott Bonvoy® American Express®* Card

If you love to travel, the Marriott Bonvoy® American Express® comes with a $125 annual fee, but that’s a small price for all its benefits. With no foreign transaction fee, you can use this card anywhere in the world and not worry about additional charges.

Plus, with 75,000 points after spending $3,000 within 3 months, you’ll have plenty of cash to spend on all your vacation expenses. With interest rates starting at 17.99%, this card isn’t for the faint of heart, but if you’re looking for a way to make your vacation a little more luxurious, it’s a great choice.

Your rewards can be redeemed for free hotel stays and additional points for meeting specific monthly spending targets. Travelers looking for a simple way to accumulate travel rewards will find these perks appealing.

American Express® Aeroplan® Reserve Card

The American Express® Aeroplan® Reserve brings with it 115,000 Aeroplan sign-up points, many perks, and benefits, and this card will help you get the most out of your travel experiences. This travel Amex comes with a high annual fee ($599), but it’s well worth it considering all the benefits that come with it ($1,921 first-year value).

Upon spending $6,000 in the first six months, you will receive 65,000 Aeroplan points. In addition, when you spend $1,500 or more within your first statement period, you get 25% more miles.

Plus, the interest rates depend on your FICO score (the higher, the better), so you can easily adjust them to fit your budget. This card is an excellent choice for anyone who loves to travel and wants to get the most out of their experiences. The only downside is that no trip cancellation insurance benefits exist for those over 65.

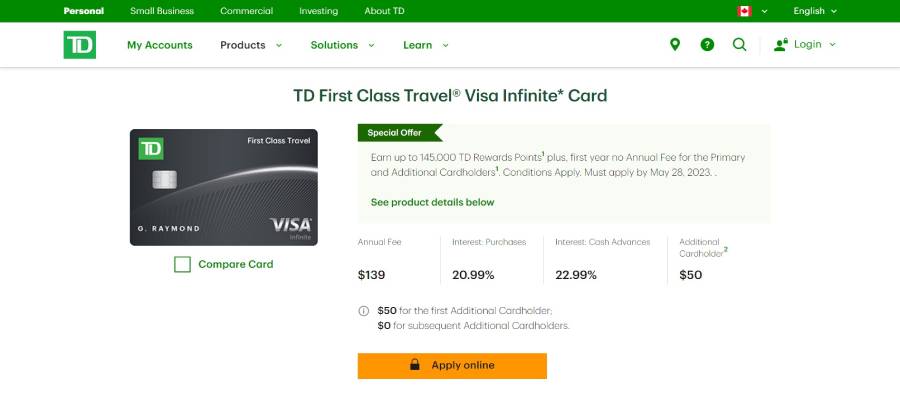

TD First Class Travel® Visa Infinite* Card

The TD First Class Travel® Visa Infinite* gives you privileged access to over 900 airline lounges worldwide. With an annual fee of $120, this card is certainly not for everyone, but it’s a perfect fit for those who want the best of the best. With 143,200 sign-up points, many perks, benefits, and points that don’t expire, this card is an excellent choice for those who want to travel in style.

The Platinum Priority Pass membership includes up to $250 in travel credits each year (for lounge membership or TSA PreCheckTM fee reimbursement), automatic renewal of your Platinum Priority Pass membership, and a $100 hotel credit on your anniversary date (either an Extended Stay voucher or a Choice voucher).

This card is great for the perks, but the slightly above average 19.99%-22.99% APR, and foreign transaction fees, might be a deal-breaker for those on the fence about the additional benefits, such as lounge access and breakdown coverage.

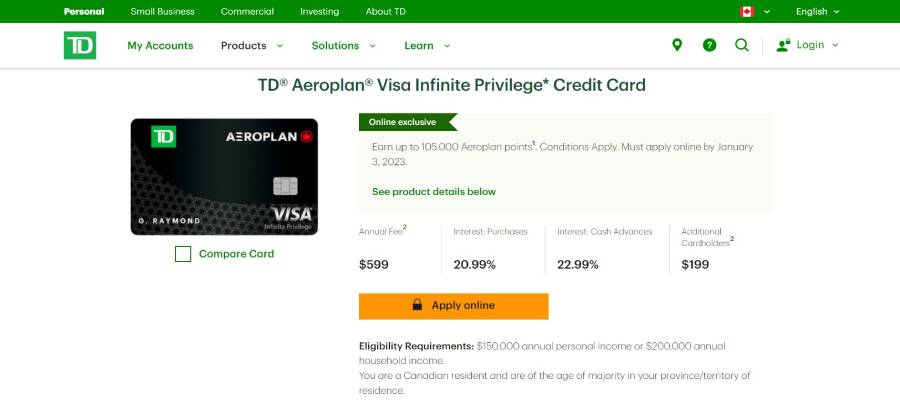

TD® Aeroplan® Visa* Infinite Privilege* Card

The TD® Aeroplan® Visa Infinite Privilege is perfect for extreme travelers. With 20,000 welcome Aeroplan points, this card is the best for those who want to travel in style. The Travel Credit Card also comes with comprehensive travel insurance to protect you while abroad.

With an annual fee of $599, this card is best for those with an excellent credit score and looking for priority check-in at airports. Enjoy front-row seats for special events and concerts and other perks. It also includes roadside assistance services and lost luggage reimbursements for added peace of mind when traveling. It goes without saying this card is subject to good to excellent credit scores.

CIBC Aventura® Visa Infinite Privilege* Card

The CIBC Aventura® Visa Infinite Privilege* will benefit frequent travelers best. With an annual fee of $499, this card has many benefits. First and foremost, you will have access to business class flights, ensuring that you arrive at your destination feeling refreshed and ready to take on the day.

In addition, it provides comprehensive insurance benefits that will protect you in the event of a travel accident or theft. Lastly, benefits include lounge access, bonus points for everyday purchases, and mobile device insurance, covering any damage to your phone or tablet.

In addition to the 21.99% APR, this premium card offers an annual bonus of 10,000 points (equivalent to $200) if you spend $2500 on card purchases in the first 3 months).

Best Low-Rate Credit Cards

There are many great reasons to get a low-rate credit card. First and foremost, it can help you build or rebuild your credit score. Taking advantage of a low-rate credit card makes it easier for your credit report to show that you’re responsibly managing your finances.

Low-rate cards also offer a lot of benefits that higher-rate cards don’t. For instance, they often come with lower rates on balance transfers, which can help you get out of debt faster by lowering the amount paid each month. And in some cases, they can even help you save money. Let’s take a look at some of the best low-rate cards in February 2026.

Scotiabank Value® Visa* Card

Scotiabank Value® Visa* has an annual fee of just $29, making it one of the best interest rates in the industry. And with discounts of up to 20% when renting cars from Avis, they’re a great way to save money on travel expenses.

Scotia Value® isn’t that versatile, though – so if you’re looking for cash-back rewards or other perks, it might not be the right card for you. But it’s a great option if you’re simply looking for a way to reduce your interest payments.

After six months of low introductory interest rates, it reverts to a standard variable rate of 12.99%, which is still below average. Furthermore, Scotiabank rewards points can be redeemed for cash, travel, and merchandise.

Simplii Financial™ Cash Back Visa Card

The Simplii Financial™ is easy to qualify for and has a low introductory rate of 9.99% for the first 6 months of transfers and purchases. With interest rates starting at 19.99, it also offers a pay-with-your-phone functionality, making purchases on the go easy.

For those who won’t spend much on monthly fees, the Simplii Financial™ Cash Back Visa is a great option. A one-time bonus of 10% is included when you activate your card, in addition to 5% cash back on purchases. With an introductory interest rate of 9.99% on net purchases and transfers for the first 6 months, this card is great for anyone looking to earn faster rewards.

The Bottom Line

The world of finance is constantly changing, and so are the best credit cards for consumers. While certain cards have stood the test of time, others have come and gone. It’s important to keep an eye on new offerings and developments to ensure you get the best bang for your buck.

One of the most significant things to keep in mind is that credit card companies are always looking for new ways to turn a profit. As a result, it’s essential to do your research before choosing a card to ensure it’s right for you. Understanding how a credit card works can help you identify potential red flags. For those unexpected financial needs, a quick payday advance app can provide immediate assistance, complementing your choice of credit card.

on your homescreen

on your homescreen