In the realm of finance, the landscape has evolved, offering the best instant approval credit cards like never before. The fusion of technology and innovation has streamlined the application process for loans, credit cards, and financial products, rendering it swift and uncomplicated.

Gone are the days of enduring long lines, waiting to discuss your financial prospects with a credit card issuer. Instead, you can initiate the process online, completing it within minutes and gaining access to instant approval virtual credit card bad credit that come with immediate usability.

The best virtual credit cards are renowned for their widespread acceptance, reliability, affordability, and an array of enticing features. Nonetheless, the plethora of prepaid debit cards available in the market may initially appear perplexing. It’s imperative to delve deeper into why acquiring multiple of these cards can prove invaluable in the future.

Instant Approval Virtual Credit Cards: Best Offers

The virtual credit card represents a modern and secure financial tool that offers users the flexibility to manage their transactions with ease and peace of mind. Unlike traditional credit cards, a virtual credit card is not a physical card; instead, it is a digital representation of a credit account that can be used for both online and offline payments.

What sets virtual credit cards apart is their unique ability to offer instant approval and instant card number issuance upon application, making them an attractive choice for individuals seeking a convenient and fast solution for their financial needs.

One of the significant advantages of virtual credit cards is that they do not require a credit check upon application, making them accessible to a broad range of individuals, including those with bad credit or poor credit histories.

This feature opens up opportunities for those who may have struggled to obtain approval from traditional credit card companies. Additionally, virtual credit cards often come with guaranteed approval and instant access to a credit line, which can be a lifeline for those in need of financial support.

However, virtual credit cards are not that common. In this guide, we will delve deeper into the world of virtual credit cards, exploring their benefits, applications, and how they can be instrumental in improving your financial well-being, regardless of your credit history or current financial situation.

Whether you’re in search of a rewards credit card, a business credit card, or a solution to rebuild your credit, virtual credit cards may offer the instant, secure, and flexible option you’ve been looking for. Read on to discover how you can leverage this innovative financial tool to regain control of your finances and achieve your financial goals.

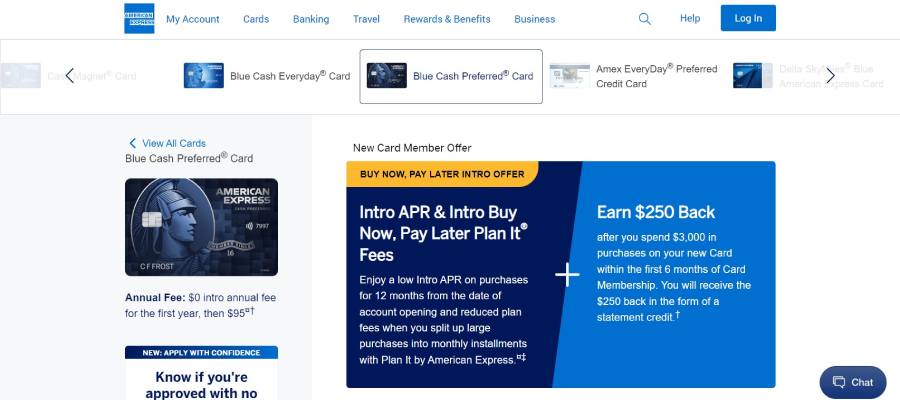

Blue Cash Preferred® Card from American Express

The Blue Cash Preferred® from American Express is one of the best low-fee ($95) virtual cards on the market today. It offers 6% cash back at U.S. supermarkets and steaming services, 3% back at U.S. gas stations and selected U.S. department stores each time you make a purchase, plus 1% cash back for all other purchases.

Like most cash-back options, the Blue Cash Preferred® from American Express is a great choice for folks who aren’t paid to put money into savings accounts every month. But it also makes sense as a basic card if you regularly spend at least $3,000 in a three-month period and want to earn a little bit of extra cashback along the way- $350.

Keep in mind that this Amex APR isn’t competitive with many other products on the market today (16.24%-27.24% variable). But it’s still worth considering if you’re in the market for an instant card that comes with some additional perks like travel insurance or a free credit score update each year.

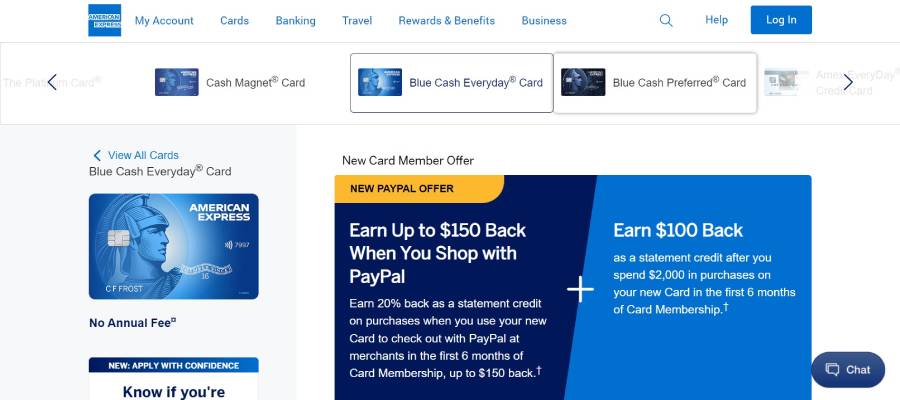

Blue Cash Everyday® Card from American Express

If you’re in the market for a new credit card but concerned about approval odds due to your credit history, consider the Blue Cash Everyday® Card from American Express. This secured credit card offers an excellent opportunity for those with good to excellent credit, providing an instant use card upon approval. With a potential credit limit, this card allows you to make purchases immediately within the first six months.

What sets this card apart is the promise of up to $250 in the form of a statement credit after you spend. You can use your new card for everyday expenses, and these rewards are a bonus that can be used to cover bills, shop at select supermarkets and online retailers, or even withdraw cash from ATMs.

Additionally, the card offers access to your credit information, including a free FICO score and credit report every month, helping you keep track of your financial progress. For an instant approval card that can benefit your wallet, consider the Blue Cash Everyday® Card from American Express.

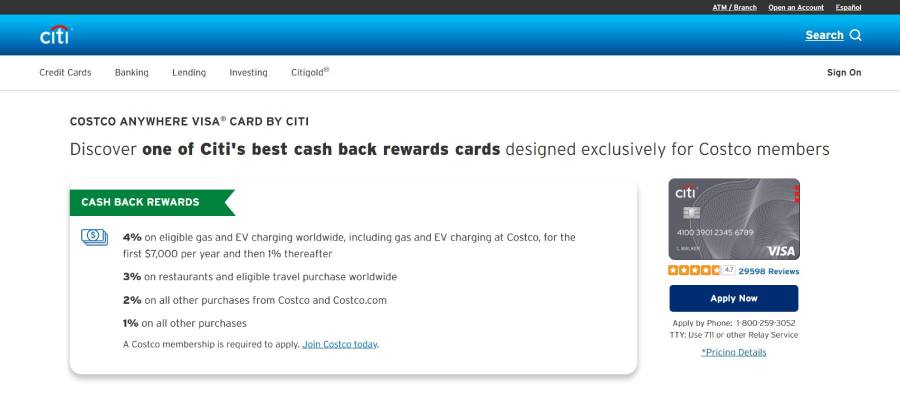

Costco Anywhere Visa® Card by Citi

The Costco Anywhere Visa® by Citi is a virtual card that allows you to make purchases at any Costco warehouse or membership club in the U.S. and Puerto Rico with no foreign transaction or annual fees. Anyone interested can apply on the Citibank website and get an instant decision.

With its 4% cash back on gas stations and EV charging, 3% on travel and restaurants, 2$ on Costco purchases, and 1% on all other purchases. The Costco Anywhere Visa itself is not a bad product to have if you frequently bring items to their stores.

Just remember that you will need to pay the full amount of anything you buy from the store, but it’s also a great everyday spending method.

This instant card is ideal for frequent Costco shoppers, as well as those looking for a no-annual-fee plastic with a healthy amount of rewards. Their 4% cash back on travel makes for a nice reward for vehicle owners, but Costco Anywhere lacks travel rewards for public transportation users.

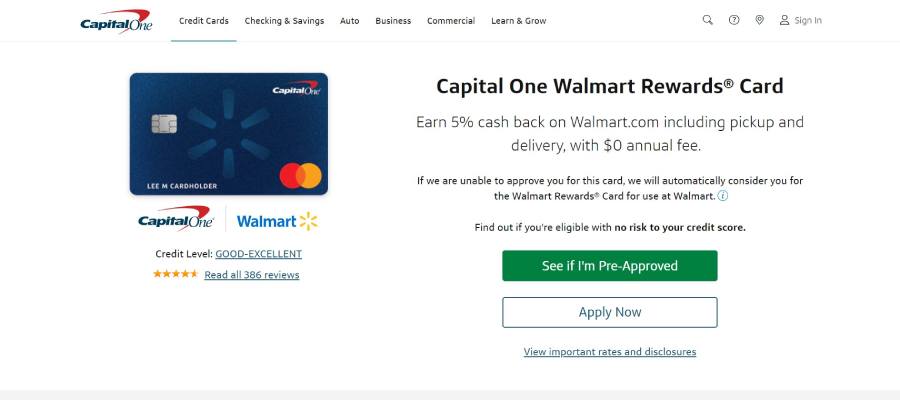

Capital One® Walmart Rewards® Card

Whether you have a good credit score or a fair credit score, Capital One® Walmart Rewards® is one of the best ways to earn rewards while shopping at Walmart by earning cash back on purchases. This instant card offers a generous rewards program that allows users to earn up to 5% cash back for online Walmart purchases.

In addition, users can earn unlimited 2% cash back on all other purchases made at any Walmart store, including restaurants and travel. The competitive rewards rate and generous Walmart rewards (including delivery and pick up) bonus make this one a good choice for frequent Walmart shoppers.

While this Capital One is not a good fit for those who do not shop at Walmart frequently, it is best for those with a lower and average credit score. They can earn extra cashback on everyday spending while making the most of their Walmart purchases. With the correct information, users can apply on the Capital One website and get an immediate decision.

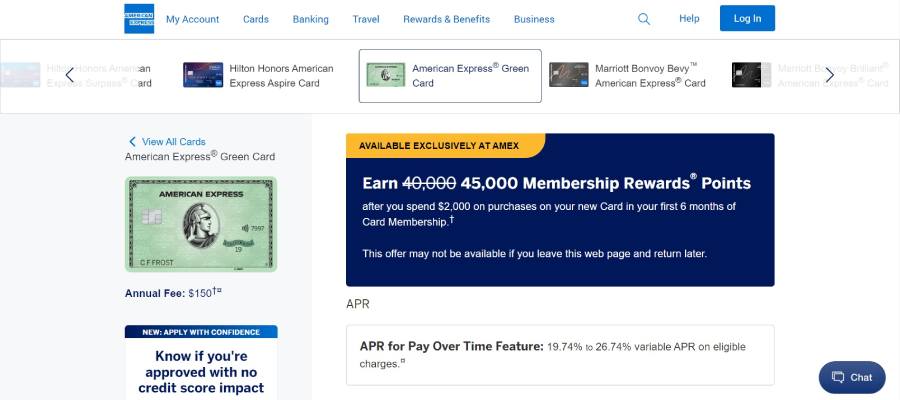

American Express® Green Card

The American Express® Green Card is a top choice for travelers seeking the best credit cards. With this card, you can use your card to enjoy benefits like lounge access, car rental discounts, and travel insurance. Earn 3x Membership Rewards points at global restaurants, and 1 point for all other purchases, redeemable at popular stores like Amex, Amazon, and Ticketmaster.

While there’s a $150 annual fee, the 250 statement credit for travel expenses and absence of foreign transaction fees make it a highly competitive option. Plus, you’ll receive perks like roadside assistance and access to the American Express Customer Service app.

For those wanting a credit card application with instant approval, the Amex Green is a fantastic choice. Apply now for a higher credit limit and expect your new card within the first 6 days!

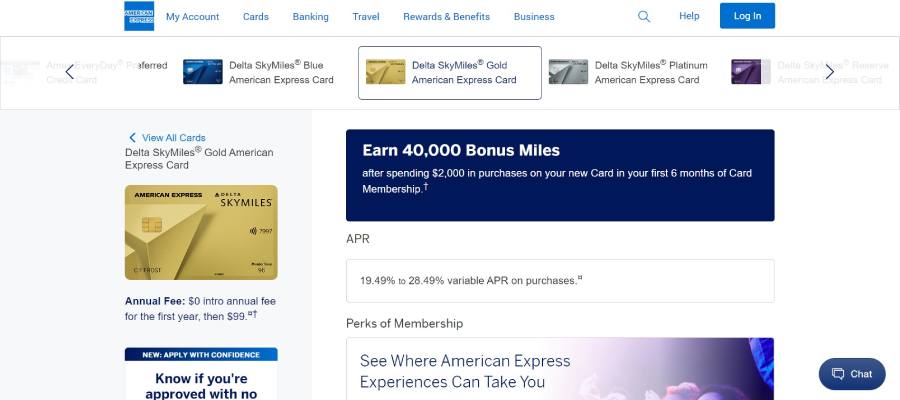

Delta SkyMiles® Gold American Express Card

The Delta SkyMiles® from American Express is a card-based option for earning Delta miles at a relatively low cost. This store card offers instant card numbers and an introductory $0 annual fee for the first year, followed by a $99 charge. Plus, you get a signup bonus of 65,000 bonus miles when you spend $2,000 in the first 6 months.

Additionally, the Delta Amex earns 2x miles on all purchases (including Delta) and 1 mile per dollar spent at gas stations and grocery stores. It also has no foreign transaction fees. The only downside is that this product doesn’t offer any sign-up bonus after the initial 65,000 miles. However, it does have a competitive rate on its annual fee, making it a good choice for those who don’t plan to carry a balance.

If you’re looking for a travel rewards instant card with no foreign transaction fees, then this is definitely worth considering. Keep in mind that Amex doesn’t have an introductory APR offer, so your APR will be based on your creditworthiness when you apply – typically between 19.49% – 28.49%.

Why Would You Need an Instant Credit Card Number?

A reward card, sometimes known as an offer instant credit card, is a convenient financial tool that provides you with a quick and hassle-free way to make purchases.

This virtual card number can be used for transactions online, over the phone, or in person, just like a regular credit card. Instant credit card numbers offer immediate access to credit, making them a valuable resource in various situations.

Instant credit cards are especially handy when you find yourself without your traditional plastic in hand, such as when traveling abroad or enjoying a camping trip. They are also a boon for businesses engaged in online sales who need to swiftly process payments.

With an offer instant card, you can receive a physical card in the mail or instantly access the card number. The best part is that your credit score is not affected because these cards are not reported to the three major credit bureaus.

If you’re looking to build or rebuild your credit, a secured card like the Discover it Secured Credit Card may be a great choice.

While some instant credit cards have an annual fee, they provide a convenient way to make purchases on your new card. Whether it’s for personal use or business transactions, a credit card number immediately is a valuable asset for immediate access to credit.

Pros and Cons of Instant Approval Virtual Credit Cards

Having an instant virtual credit card offers numerous advantages, and it’s crucial to understand how it works. When you apply for a credit card with instant approval, you receive a virtual card number immediately upon approval.

This virtual card is linked to your account and can be used for online transactions without the need for a physical card to arrive in the mail.

One of the major benefits of instant virtual cards is their security. Since these numbers are virtual, they cannot be cloned, providing a high level of online safety when making payments.

You can use the virtual card to buy items online and make payments with the card number immediately, eliminating the need to wait for a physical card. This convenience is particularly valuable when you want to make purchases quickly or access your card account.

Instant virtual cards also serve as a handy tool for improving your credit score. While instant approval doesn’t mean you will be approved for a credit card with instant approval immediately, these cards are designed to cater to a wide range of credit profiles. If you’re just starting to rebuild your credit, a $500 bad credit card can offer a simple way to manage spending while improving your financial standing.

As you use the card responsibly, it can positively impact your credit score, helping you find the best credit cards for your financial needs.

It’s important to note that virtual cards cannot be used in physical stores, and there may not be instant deposits when making purchases. However, they offer a versatile way to manage your finances, fund prepaid debit cards, or add funds to your PayPal balance.

As you explore your options, consider the potential benefits of cards that offer instant approval and provide instant card numbers, as they can be a valuable addition to your financial toolkit.

Just remember to check your credit score and understand any fees associated with the card, such as an annual fee, to make an informed decision.

How to Get Instant Credit Card Number?

Start by researching companies known for applying for an instant approval credit card. These companies will not only verify your identity but also establish a secure account for you. Once your background checks are cleared, you can expect to get a credit card number in under 24 hours, and sometimes even instantly if all verifications go smoothly.

You can conveniently apply for this service either online or by phone. Upon approval, the company will deliver your number to you via email. From there, you can swiftly add the card number to your digital wallet and immediately start using it for purchases.

Remember, the process is contingent on your successful background checks, which often depend on your creditworthiness and identity verification. Therefore, maintaining a higher credit score can be advantageous.

However, it’s important to note that not all credit cards offer instant numbers, and some may come with an annual fee. So, be sure to explore your options, such as the Discover it® Secured Credit Card and American Express credit cards, to find the best credit cards for instant approval.

on your homescreen

on your homescreen