If you are looking for a beneficial alternative to your credit or traditional debit card for purchases and do not want to use 500 loans for bad credit, a prepaid debit card is just the thing. They allow consumers to spend money up to the amount they put into the digital balance. Plus, it is possible to top up them repeatedly in contrast to the usage of the service of payday loans online same day deposit direct lender.

Prepaid cards may come to the rescue if you fail to attain a standard bank account via a regular debit card. It can also be an excellent option when you worry about potential debts with a credit account. Besides, a potent budgeting tool will turn out by joining opportunities of prepaid debit cards with two others; since you might spend only put onto the card money.

Prepaid Debit Cards: Best Offers

Why is it worth opting for a prepaid card? Most of them provide numerous features that are available at conventional checking accounts, like bill payment, direct deposit receiving, money transfers, cash withdrawals at ATMs, and depositing funds. Still, you should be aware of multiple fees along with prepaid choices, namely a monthly or reload fee.

We have explored the hottest market choices and selected the best prepaid debit cards. So keep scrolling to find out each one in detail and choose your most suitable option.

Serve American Express Card

Searching for the most profitable solution for cash reloads? Serve American Express Card heads the list since it offers free funds reloading at nearly 45 000 locations. However, you may put amounts up to $500, and no lower than $20 per cash reload.

This prepaid debit option has a waivable fee of $6.95 per month. Moreover, you have no limits to minimum balance or hidden fees; the maximum you can hold on to is $100 000. As a welcome bonus, consumers may add any wishful cash amount without incurring fees and get access to special American Express perks.

Regarding pros, you have no opening fee within an online account and a paycheck up to 2 days faster in signing up for a direct deposit. Above average monthly fee, 2.7% foreign transaction fee, and time-taking mobile check deposit are cons you may face.

Movo Virtual Prepaid Visa Card

Movo Virtual Prepaid Visa Card gifts you with impeccable digitalization, unlike standard bank accounts. That is to say, signing up, approval, deposit activation, and send-and-spend transactions require no human intervention. Plus, if you are a cryptocurrency shark, it will suit you flawlessly.

The good news is that Movo doesn’t charge monthly and reload fees. But you must pay retailers a specific fee to load cash using their services. The amount can vary from $3.74 – $5.95 per cash loading. With this prepaid Visa card, you get no cash reloads limits and obtain a welcome bonus of depositing funds from a few external accounts to receive digital cash.

Luxuriate in the following prepaid card pros, but be ready to meet some cons too.

Pros

Cons

Bluebird by American Express

Gaining all perks in one place is possible with the Bluebird Prepaid Debit Card. It is FRDIC-insured and operates similarly to a bank account. Besides, you might considerably save due to no monthly fee, cash reloads fees, or ATM withdrawal fee.

Although there are virtually no fees with your Bluebird choice, you are subject to pay them off in case of cash reload retailers usage. The given prepaid debit option enables you to add up to $100 000 to your account balance. And while it doesn’t provide any type of rewards program, consumers are able to reach 1% cash back on online and offline purchases as a welcome bonus.

By choosing this prepaid option, you will favor no activation and monthly fees and putting unlimited substantial amounts. Still, look out for some drawbacks such as cash back absence, unavailability to Vermont residents, and non-Money-Pass ATM withdrawal fees.

Walmart MoneyCard

The Walmart MoneyCard is definitely a priceless decision for Walmart shopping addicts. Clients can get cash back on all company purchases, namely 3% purchasing on the Walmart site, 2% at fuel stations, and 1% at retail locations.

This prepaid debit card is the most fee-comfortable since it offers free money withdrawal at approximately 5000 Walmart points, unchargeable cash reloads at Walmart stores, free payroll deposit, and online bill payment. Still, you must pay off $5.94 monthly for maintenance and keep a maximum balance of $10 000. After signing up, you will be allowed to add up to four extra family members aged 13 or older.

When deciding on the Walmart debit card, you can take advantage of rewards on all Walmart-related purchases, lightning-fast direct deposits, and considerable cash back. But at the same time, be ready for high foreign transfer fees and bank teller/ATM withdrawal fees of $2.50.

PayPal Prepaid Mastercard

Are you a frequent PayPal card user? There is nothing more suitable than PayPal Prepaid Mastercard. It favors consumers due to no required credit checks and easy real-time money transfers from PayPal accounts. The debit card key benefit is swift and free transactions from your current balance.

While in-network ATM withdrawals are non-fee, each cash reload will cost you up to $3.95 Plus, the card carries a monthly upkeep fee of $4.95. Speaking about the maximum balance amount, it takes $15 000. With PayPal Prepaid Mastercard, you may reach a welcome bonus of accessing a high-profit savings account with further possibility to earn 5% APY.

You will surely be delighted with free transfers from the balance and cash back at retailers, and available advantageous savings account choices. But keep in mind that transfers have limits of $300 above daily, and cash reloads/ATM withdrawals are charged.

Greenlight Debit Card

Teaching kids to make a budget and take financial responsibility is completely real, owing to Greenlight Debit Card. It is accessible to all ages kiddos and ensures money management tutorials. Plus, money transactions are instant, but parents must have bank accounts for such funds transfers.

This debit card implies a monthly fee from $4.99 to $9.98, depending on the kids’ number. Meanwhile, there is no ATM withdrawal and reload cash fees. Moreover, the maximum cash-to-load limit isn’t fixed. As a welcome perk, Greenlight passes 5% onto the average daily savings card’s balance.

Parents will undoubtedly benefit from such Greenlight perks as 1% cash back with each kid’s swipe, setting up direct deposit for done tasks, and the ability to receive SOS alerts or location sharing. Drawbacks you might come across are an expensive money management tutorial package and a custom-design card fee.

Serve American Express Prepaid Debit Account

If you seek a prepaid debit solution with immense cash back opportunities, the Serve American Express Prepaid Debit Account is certainly your destination. You will be rewarded with 1% cash back on all purchases by spending money online or in-store. Unlike other reward programs, you can decide when to apply cash bonuses to your account – on a daily basis or keep for a rainy day.

A monthly fee you should cover here forms $7.95. Besides, there are available 45 000 locations cash to load across the US, with a reloading fee of $3.95 per once. The minimum and maximum money reload amount make $20 and $500, responsively. As soon as consumers drive this debit account, they start receiving a welcome perk of instant cash back from all purchase types.

Pros you may acquire with this Serve American Express choice: non-fee MoneyPass ATMs withdrawal, ability to temporarily freeze the card, FDIC insurance, and emergency/roadside assistance. ATMs fee of $2.50 and chargeable getting a card for $1.50 are from minuses.

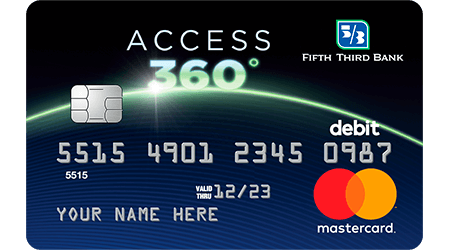

Fifth Third Access 360° Reloadable Prepaid Debit Card

For Third Access Bank clients, this prepaid debit card is a perfect solution to help avoid overspending. It can also serve as an alternative way for parents to give teens spending funds without their debit presence.

The $4 monthly charge is significantly lower than other prepaid account options, and cash tops-up are completely free at 50 000 ATMs nationwide. The minimum money reloads states $500 and limits with the amount of $10 000. In addition, all customers will earn welcome bonuses of automatically saved funds at places they already shop with their further load to digital wallets.

Why is such a prepaid debit account worth obtaining? It provides cheaper fees for cash deposits, bank transactions, overdrafts, or inactivity. But you should also pay attention to the cons like high foreign transfers/currency conversion fees and a required local branch personal visiting to open the card.

What Are Prepaid Debit Cards?

Prepaid debit cards are like standard debit or Visa ones, but call for no requisite connection to checking or banking accounts. So, clients may put money onto the card and then reload it when the funds run out. These prepaid options have card numbers, CVV codes, and expiration dates similar to debit ones, simultaneously lacking a bank account associated with them.

The cash-loading process implies depositing checks or topping up money online, in person, or at specific points. As soon as you receive funds in the account, you can spend them up for all-purpose till the next deposit.

Furthermore, consumers can rest assured about the safety issue since prepaid choices feature strong PIN protection. That way, no one can release funds without entering the right PIN.

Prepaid Debit Cards vs. Regular Debit Cards

A prepaid card and a debit one operate similarly – you might only use funds associated with the card. The thing that they differ stands the place where that money is stored. Still, a prepaid debit option brings extra comfort since you don’t need a conventional checking account while shopping online or in-store.

Debit cards are connected to a bank checking account, typically going along with routing and account numbers. Thus, consumers put money via direct/mobile/ATM cash deposits or bank transactions and then can spend funds from their debit accounts. Meanwhile, prepaid cards show no relation to a checking account, so users may reload money there just like they do to gift cards.

Are Prepaid Debit Cards Secure?

Concerning privacy and security, a prepaid debit card is as safe as a traditional debit one. Supplying credible PIN defense makes it impossible to access money with no appropriate PIN entered. However, when looking for a prepaid card company, be sure to select one offering purchase protection. It will enable you to claim if your thing hasn’t arrived or if you face any issues after arrival.

Is Prepaid Debit Card Right For You?

Indeed, there is no universal solution to how a prepaid debit card might be used. It will come in handy to people of all ages and in various life situations. For example, you have your cash left at home and lack time to withdraw from an ATM. No problem, as your money is accessible on your account anytime.

Or suppose traveling abroad, you forget in a hurry to exchange the currency. With a prepaid card, you can purchase online or at stores, book hotels, or pay for excursions without a hassle. Plus, if you are a parent, you can easily top up your kids’ prepaid digital accounts with pocket money to learn them to budget properly.

In cases of emergency financial needs, you might consider using a fast cash loans app, but always ensure you understand the terms and conditions before proceeding.

on your homescreen

on your homescreen