If you have a great business idea but don’t have the capital to launch it, you should consider applying for a startup business loan. This type of loan is designed to help those who start their own company and need funding to get the ball rolling. This kind of loan can be used for anything from buying equipment, hiring people, and creating marketing campaigns.

There are many different types of loans available on the market today. Some are better suited for certain situations than others, so it’s important to understand what each offers before applying for one.

Credibility Capital — SBA loan

SBA is the Small Business Administration. The SBA provides loans and guarantees to new companies to encourage entrepreneurship and create jobs. Credibility Capital is an SBA Loan Provider that provides loans to small companies.

The maximum loans go up to $350,000 with a maximum LTV of 65%. The company is registered with the SBA, which means the federal government backs it. The APR goes from 7.99% to 24.99%.

Credibility Capital provides competitive interest rates based on the applicant’s credit score. The rates range from 4% to 9%, depending on your FICO score. If your score is less than 600, the rate will be higher than 9%. Credibility Capital offers SBA disaster loans for companies affected by natural disasters such as hurricanes or wildfires.

There’s no minimum credit score requirement for this type of loan, but applicants must have been in business for at least six months before applying for an SBA loan with Credibility Capital.

PNC Bank — SBA loan

PNC Bank provides an SBA loan for owners who have been in business for at least one year. PNC will consider applicants with no credit or a low credit score. The maximum loan amount is $5 million, which is higher than most banks offer.

The minimum down payment is 10 percent of the total amount needed to buy or launch your company. APR varies by credit score and term length. The rate starts at 5 percent for an average credit score (between 660 and 739) and goes up to 9 percent for a bad credit score (below 620).

The APR on PNC’s SBA loan product is 4.00%. That’s pretty good compared to most other banks’ SBA products, which usually carry APRs in the 5% range (or higher). Those with poor credit may not be able to qualify for this type of loan.

SBIR Program — Small Business Grant

The Small Business Innovation Research (SBIR) Program is a grant program administered by the U.S. government. They provide funding to small companies for the research and development of innovative products and services.

The amount of funding available varies based on each agency’s budget but can range from $100,000 to $2 million per project over two years. For example, NASA’s SBIR budget is $10 million per year; NIH’s is $25 million per year; DOE’s is $12 million per year.

The program aims to stimulate technological innovation and promote economic growth. It supports Phase I (proof-of-concept) research and Phase II (commercialization) contracts for follow-on phases of development, with each phase lasting up to 24 months. In total, Phase I awards can be up to $150,000 over 12 months, with Phase II awards up to $1 million over 48 months.

FedEx Small Business Grant Contest — Small Business Grant

The FedEx Small Business Grant Contest is an annual contest that offers a $25,000 prize to one of the top three finalists in each of the six categories. The contest’s goal is to help owners grow and succeed with the right tools and resources at their disposal.

Estimated APR is around 6% – 13% variable over two years (based on your creditworthiness). They have an easy application process with a low minimum credit score requirement (600).

Downsides include:

- The grant isn’t available everywhere in the U.S.

- No official website for applicants to check the status of their application has been provided as of this writing.

- It’s unclear if there’s an age requirement for applicants.

Accion USA — Microloan

Accion USA is a member of the Association for Enterprise Opportunity, a nonprofit trade association. The goal is to improve access to capital by providing training, mentoring, and networking opportunities for entrepreneurs across the country.

The maximum amount that can be borrowed from Accion USA is $50,000, but this figure depends on the type of loan being sought and other factors (how much capital has already been raised). There are no fees for applying for an Accion USA loan or grant, and applicants can apply online.

Loans will have APRs between 5.99% and 25.99%. Accion USA doesn’t accept applications from companies that don’t have at least one year in operation or aren’t registered as legal entities. In addition, applicants must be located within one of the organization’s service areas:

| Organization Service Areas | ||||||||

| Alabama | Arizona | California | Colorado | Florida | Illinois | Massachusetts | New York | Texas |

Kiva — Microloan

Kiva is a microlending platform that allows you to lend money to low-income entrepreneurs in developing countries. No fees or interest are charged on loans disbursed through Kiva. They do have several different loan products that you can choose from.

- Kiva Microloans — these are small loans between $20 and $500 that you can make for as little as $25

- Direct Loans — larger loans from $501 to $10,000 (with repayments generally scheduled over 12 months), typically made by individual lenders rather than through an organization

Kiva offers two types of loans:

- Microloans are $25 or less, paid back over four to six months at an interest rate of 0% – 20%.

- Matched Savings accounts are interest-bearing savings accounts that require saving money before receiving a loan and earning up to 20% annual interest on their savings.

Lendio — Online Business Loans

Lendio’s online application process allows you to apply for a loan in minutes. The company lends up to $250,000 with fixed rates as low as 4.99%. They finance new businesses by offering up to $250,000 in loans ranging from 6 months to 5 years. Your credit score will play a major role in determining whether or not you qualify for lending cash through this platform. The minimal credit score that’s required is 580.

The APR on your loan will be determined by the lender who chooses to extend the offer. APR varies by lender and term length – but most rates range from 6-15%. Another requirement is a minimum time in the business of 1 year.

BlueVine — Online Business Loans

If you’re looking to take your company to the next level and need funding, BlueVine is a great option. The company is a financial technology company that provides personal business loans online. BlueVine offers a range of different lending options, including:

- BlueVine Express: This is the shortest-term option, with repayment terms ranging from 5-30 days with an APR as low as 0%. The maximum lending amount is $25,000, with no minimum credit score required.

- BlueVine Advance: This option provides longer repayment terms with an APR as low as 0% but requires at least 6 months in business before applying. The maximum lending amount is $25,000.

National Funding — Online Business Loans

National Funding provides the best business loans with terms ranging from six months to five years and fixed or variable interest rates depending on your loan type. They offer fixed-rate lendings up to $250,000 with terms of up to 10 years. The minimum credit score required is 650, and the maximum APR is 15%.

The minimum time in business required is 2 years – however, if you have less than 2 years but more than 1 year, then there will be no minimum time requirement associated with your loan application.

They also support various payment options, including monthly payment plans and interest-only payments while the borrower is working on paying down their principal balance.

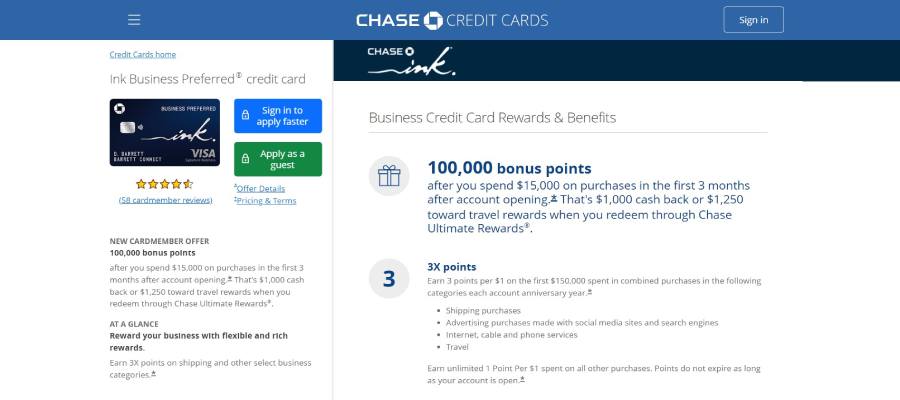

Ink Business Preferred® Credit Card — Business Credit Card

If you want to get cash back on your company’s purchases, the Ink Business Preferred® Credit card is a great choice. You’ll earn 2% cash back on all purchases in the first $25,000 each year you spend with the card, then 1% after that.

If you pay off your balance in full each month and transfer a balance from another credit card within the first 60 days of opening an account, it comes with 6 months of 0% APR on purchases and balance transfers.

The minimal credit score required is 600, and the APR varies between 16.74% – 22.74% (depending on creditworthiness). There are no foreign transaction fees or annual fees for this card (but note that there is an annual fee for its sister card, the Ink Business Cash? Credit Card).

Ink Business Unlimited® Credit Card — Business Credit Card

The Ink Business Unlimited® Credit Card is a credit card that provides up to $25,000 of credit for your company’s needs.

With this card, you’ll earn the following:

- Earn 5% cash back on rotating categories that change every three months (up to $25k per year)

- 2% cash back on all other purchases

They offer 0% intro APR on purchases and balance transfers for 12 months, which can help you save money on interest payments. You’ll also get a $500 cash-back bonus after spending $3,000 in the first 3 months.

A representative APR for the Ink Business Unlimited® Credit Card ranges from 12.99% to 21.99%. The actual APR you receive will depend on your creditworthiness and other factors, such as income verification and the collateral used to secure the lending.

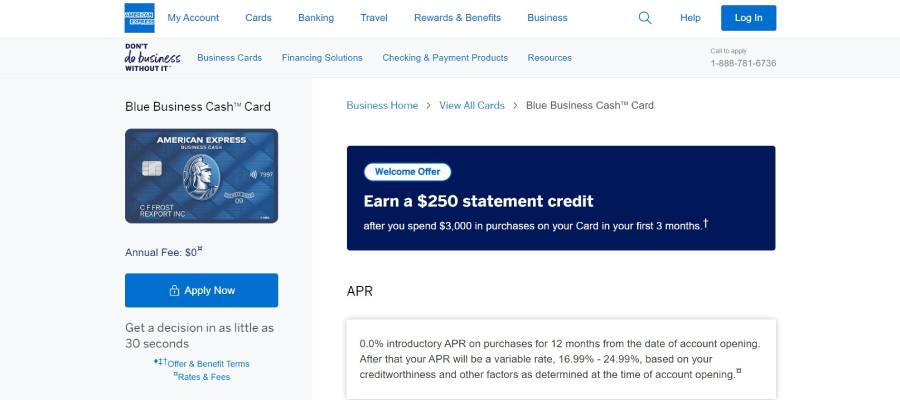

American Express Blue Business Cash™ Card — Business Credit Card

The American Express Blue Business™ is a credit card from American Express. The card does not require an annual fee and offers 0% introductory APR for 6 months, followed by a 15.24% – 25.24% Variable.

It’s one of the few business credit cards with a 0% introductory APR.

This makes it useful for consolidating existing debt or paying off large purchases over time without worrying about accruing interest charges. You can earn a $500 bonus after you spend $3,000 in purchases on your new card within the first 3 months of Card Membership.

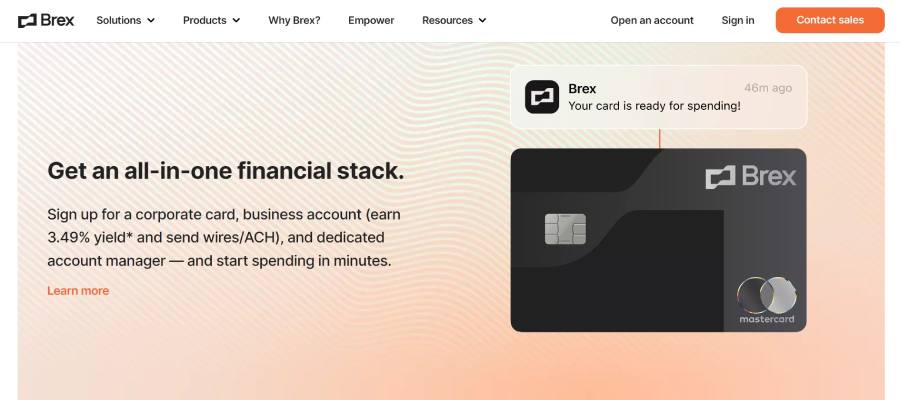

Brex 30 Card — Business Credit Card

The Brex 30 Card is perfect because there are no annual fees or foreign transaction fees. It has all the standard features of any other business credit card: rewards program, no rewards cap, cash back on every purchase, and 1% cash back on all purchases (2% when purchased at restaurants). According to the company website, the Brex 30 Card offers a $30,000 line of credit with a variable interest rate of 15%.

The APRs range from 15% to 23%, depending on your credit score at the time of application. The lower rate will apply if your score is 680 or higher. If it’s less than 680, expect an APR between 20% and 23%. There’s no annual fee for this card, but there are fees associated with late and returned payments.

What Is a Startup Business Loan?

A startup business loan is a form of financing you can use to start a new company or expand an existing one. It’s a good way to get the financing you need when your credit score isn’t high enough for a commercial bank to lend money. What makes this one different from other types of loans?

- Startup loans are typically unsecured, meaning they don’t require collateral as security against defaulting on the debt. You’ll need to put down some cash upfront to secure the lending (usually less than what’s required for other types of small-business loans).

- Most standard loans come with repayment terms similar to those offered by banks (5–7 years), but these terms aren’t always ideal for startups looking for short-term capital.

How Does a Startup Business Loan Work?

Starting a company requires money, and startup loans provide that. These loans can cover anything from purchasing inventory to making improvements to your space and hiring employees. Startup business loans are often repaid over time and are often granted by banks or other financial institutions.

You can apply before you even have a plan or any revenue, which makes them ideal for entrepreneurs who want to test out their idea before committing the time and money required for other types of financing.

Types of Startup Business Loans

A startup business loan is not really a loan; it’s a business investment. Once you know how much money you need, it’s time to think about what kind of lending best fits your needs and goals as a company owner. There are many kinds available that are designed specifically for startups and small businesses.

These include SBA (Small Business Association), PayDaySay, peer-to-peer lending sites like Kiva, crowdfunding sites like Kickstarter or GoFundMe, and private investors who specialize in helping startups get off the ground.

SBA loans

The Small Business Administration (SBA) is an independent agency of the United States government that provides support to new companies. The SBA lends money and has guarantees, contracts, and counseling services to small companies. The SBA offers several different types of loans to help you grow your businesses:

- 7(a) Loan Program – This program provides financing for working capital and fixed asset investments.

- Microloans – This program aims at assisting small entrepreneurs who lack sufficient collateral or financial history

The first step in getting an SBA loan is completing an application form that outlines the information about your company and how much money you want to borrow. Before applying for a loan, you’ll need a personal credit report from one of the three major credit bureaus — Experian, Equifax, or TransUnion.

Small business grants

Governments and organizations provide small business grants to finance a small business’s startup or operation. Small business grants are best used by startups looking to fund their idea without borrowing money from banks or other lenders.

Banks may not be willing to lend money to startups because they’re considered too risky, but with a grant, there’s no risk on the bank’s part — because they don’t have to pay back the money.

In addition to having the right qualifications and submitting an application on time, you must also be able to prove that your business has been operating for at least one year.

Microloans

They come from community-based lenders who want to help entrepreneurs get started with their business ideas without having to prove creditworthiness first (as required by most banks). Lenders like Accion USA may lend up $35K at very competitive rates—but be aware that these can be difficult to obtain if your businesses don’t have collateral available right away (like real estate).

Cash lending is typically under $50,000 and is often used as a way for investors to fund their business growth. To apply for a Microloan, you must complete the online application here and have your organization approved by an SBA-authorized lender. Only organizations approved by this lender are eligible to receive a Microloan.

Online Business Loans

They’re a great option for businesses that have good credit scores. The application process is fast and easy, and the money can be deposited directly into your account the same day you apply. Online loans can be used for various purposes, including paying for inventory, equipment, or supplies.

Business loans can be divided into two main categories: asset-based lending and term lending. Asset-based lending involves borrowing against tangible assets such as machinery or real estate, while term lending involves borrowing against future income streams such as accounts receivable or inventory.

To get it, you’ll need to submit your application online or visit your local bank branch. You will need to provide financial statements, tax returns, and other documents that prove your company’s financial health.

Friends and family

These loans are sometimes called personal loans, but the government does not regulate them like other types of funding for businesses. Because they aren’t regulated, they can have higher interest rates than other types of small funding.

Friends and family are often more willing than banks to give out unsecured money lending because they know you personally and trust you more than they would if they weren’t already familiar with you and your plans. It could be beneficial if you have a good relationship with someone who has enough money available for lending purposes.

Credit cards

One of the easiest ways to get a business loan is by applying for a credit card. Business credit cards are different from personal credit cards, but they can help get more financing for businesses. For example, if you have a high enough approval rating and score, your bank might give you an “elite” or “gold” card with extra perks such as rewards points or cash back.

You can use these points or cash rewards toward paying down the balance on your card if it’s late or overdue—this is called transferring points/cash rewards into your payment history. This will demonstrate to lenders that whatever expenses were being paid with those rewards were legitimate and that they should continue lending money based on that history.

Conclusion

Startups and small businesses are the lifeblood of any economy. They provide many jobs and can become big companies. Starting a company from scratch is a very difficult task. It requires money, time, effort, and resources. But if you get the right amount of money at the right time, you can easily start and scale personal businesses.

Startup loans are a great way to get your business up and running. They are often used by people who have a good idea and want to start a company but don’t have the money to do it. Now that you know all the basics about the best business loans, starting your company will be easy!

on your homescreen

on your homescreen