When you need to resolve a financial issue quickly, you can contact a reliable lender. To get a Kentucky payday loan online, you need to follow the simple steps of applying for the product. This will minimize the probability of refusal and allow to borrow the necessary amount of funds on attractive terms. Loaned funds can be spent on any purpose without agreement with the creditor.

Products of online credit organizations are distinguished by their availability. Lenders provide payday loans to Kentucky state residents in small amounts with interest that accrues for each day the funds are used. Instant payday loans online are often issued without collateral, guarantors, and income certificates.

In addition, it is possible to take out a loan via the Internet without wasting time on the way to the lender’s office. Read more about the features of obtaining payday loans online Kentucky state, their pros and cons, as well as the main conditions below.

Best Payday Loans in Kentucky

There are many creditors in KY state. However, choosing the best one must be approached responsibly. Firstly, you need to study organizations’ ratings and determine trustworthy ones. When choosing a specific lender, it is necessary to pay attention to the company’s business reputation characteristics.

It will not be superfluous to read customer reviews. This will allow you to form an idea about a potential partner and learn its advantages and disadvantages.

Find below a description of the five best lenders in Kentucky state that deserve your trust.

PayDaySay

This company ranks first in our rating, as it provides customers with fairly profitable lending services. This is not a direct lender. PayDaySay cooperates with lenders and borrowers helping them find each other quickly and easily. Address: 4819 Clark Street, NY, Bethpage, United States, 11714.

By contacting the company, you can borrow from $100 to $5,000. The purpose of the loan can be completely different (medical expenses, home or car repairs, loan consolidation, etc.). Annual interest rates directly depend on which lender you choose. As a rule, they vary from 5.99% to 35.99% per year.

Only persons with a permanent job, good credit score, and good credit history can get money in debt. A borrower who meets all the requirements can get a loan at very favorable interest rates – 10% -15% per year. Those with a bad credit history, a low credit score, and who do not have a permanent job do not always receive approval from the company.

Customer reviews of the company are good. It deserves 4.72 stars. Customers most appreciate the PayDaySay application, which allows you to apply for a payday loan from the comfort of your home in just a few minutes. The only limitation is that loans from PayDaySay are not available to self-employed persons. If you meet all the requirements, don`t hesitate and get a loan already today!

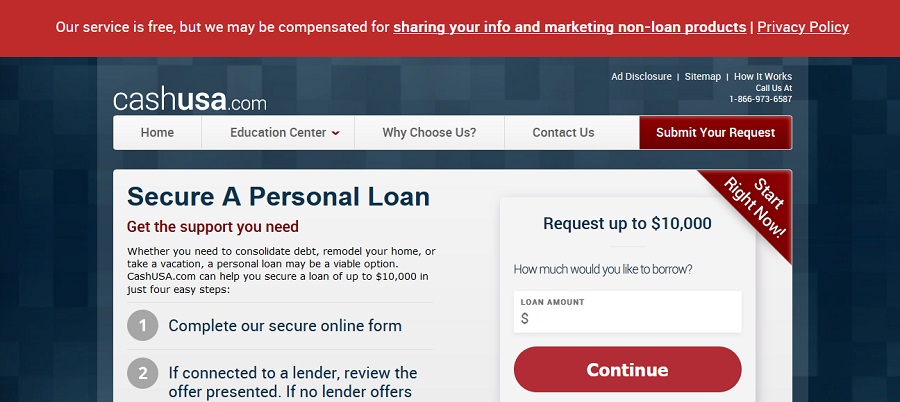

CashUSA

CashUSA is a technological lending service that offers instant online loans throughout the United States. Address: 200 West Jackson, Suite 1400, Chicago, IL 60606-6941, USA. A great variety of loan amounts are available, ranging from $500 to $10,000. Annual interest rates vary from 5.99%-35.99% and directly depend on the borrower’s credit score. The loan repayment term ranges from 90 days to 72 months.

In general, the options for the term loan are diverse. You can learn more about this by contacting the lender directly.

The application process is simple, thanks to the online borrowing option. It takes no more than 10-15 minutes to apply and get a response. However, only those who have at least a 579 credit score can get payday loans online. This is the main requirement of the lender. According to customer ratings and reviews, CashUSA gets 4.7 stars out of 5. So, this is a great place to apply for a Kentucky payday loan online.

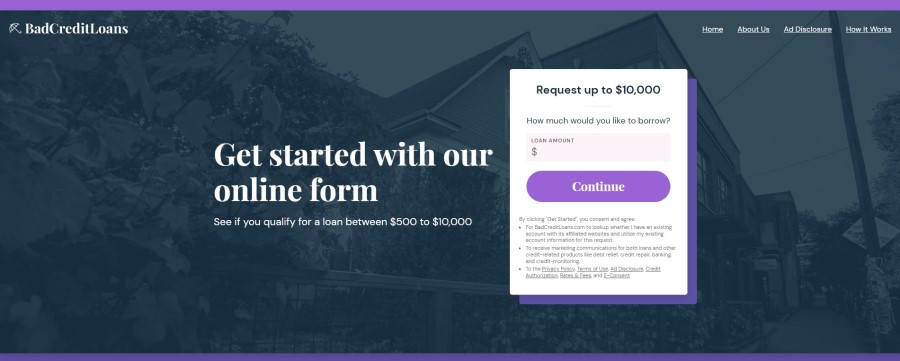

BadCreditLoans

BadCreditLoans is another company that deserves the attention of those who want to get Kentucky payday loans online on favorable terms. Just like PayDaySay, it helps lenders and borrowers find each other and get mutual benefits from cooperation. Address: 2661 N Pearl St #431. Tacoma, WA 98407.

The loan amount varies from $500 to $100 for those with a credit score of less than 500. For people with a higher credit score, the loan amount can reach $10,000. Annual interest rates are 5.99%-35.99%. Loan terms are up to 30 days.

An online borrowing option is available, making the application process very fast. It takes only a few minutes to get approved and receive funds. According to customer reviews, the company deserves 4.6 stars. So, it’s worth contacting there for services.

Advance America

Founded in 1997, Advance America is the US’s leading state-licensed consumer lender. It strives to help each client achieve financial stability through a variety of innovative, transparent, and regulated small-amount lending options. Address: 135 North Church Street, Spartanburg, SC 29306, United States.

Advance America loan amounts start at $100 and go up to $50,000. However, it is not allowed to exceed 50% of the balance. Otherwise, additional penalties are provided. Annual interest rates are very high and reach 664%.

In addition, customers must pay a $15 fee for every $100 borrowed. As for the terms, it is possible to choose the most convenient among several different options: payment in 30 days, payment in 3-24 months, etc.

Online borrowing option is available, so there is no difficulty in applying for a Kentucky payday loan online. However, the applicant must meet the requirements and provide proof of income, proof of identity, a bank statement, as well as a personal check.

Advance America has more positive reviews than negative ones. It rightfully deserves a 4.53-star customer rating. Therefore, be sure that you can get a payday loan from this lender online under clear conditions.

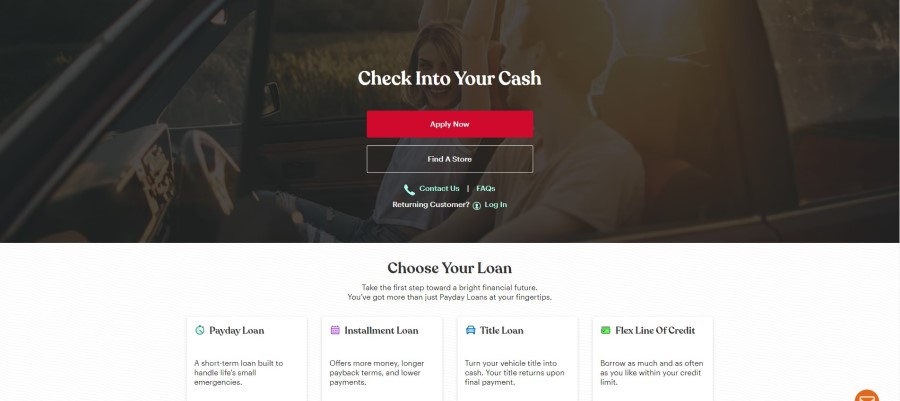

Check Into Cash

This is another financial services retailer with over 1,100 stores in 30 US states, including Kentucky. Address: 201 Keith St SW Ste 80 Cleveland, TN, 37311-5867 United States.

In addition to payday loans up to $1,000, borrowers with bad credit have the opportunity to receive a number of other important services, such as paying bills, cashing checks, buying gift cards for cash, and so on.

The advantage of cooperation with Check Into Cash is that this lender does not charge interest on payday loans online Kentucky state. At the same time, a fee of $10 to $30 is charged for every $100 borrowed.

Check Into Cash offers different loan terms. It directly depends on the location of the borrower. In KY state, the loan term does not exceed 60 days, according to the law. To borrow money online, it is important to meet the requirements:

- Be at least 18 years of age;

- Provide proof of permanent income;

- Have an active checking account.

Due to the online borrowing option, all applications are processed quickly and efficiently. The loan can be obtained even on the day of application. Most reviews about the lender are positive, and it deserves 4.65 stars out of 5. Therefore, it is quite reliable and profitable to receive payday loan services there.

Are Payday Loans Legal in Kentucky?

As it is known, each US state independently decides whether online payday loans are legal or not on its territory. For example, in Georgia they are completely prohibited. In Colorado, they are allowed, and in Kentucky, they are considered legal only under certain conditions.

Kentucky law limits annual interest rates on financial products to a maximum of 36%. But this does not apply to Kentucky payday loans online. Unsecured loans are issued at a fee of $15 for every $100 borrowed. The maximum loan amount should not exceed $500, and the loan term should not exceed 60 days.

Why Might You Need Kentucky Payday Loans?

The residents of KY state may need online payday loans in many cases, including the following:

- Problems that require medical intervention. This includes cases where treatment, diagnosis, or purchase of medicines is required;

- Equipment breakdown. An unscheduled repair or replacement is needed;

- Problems with payment for the delivered order due to salary delay;

- The need to quickly repair a car or house;

- Sudden financial difficulties during a vacation or business trip, etc.

Kentucky payday loan online can help people in any situation and with any income level. This is relevant even for those who keep free funds in bank deposits, transfer to foreign currency, or invest. If unplanned funds are needed but cannot be withdrawn from accounts, it is optimal to take money on credit.

Terms for Payday Loans in Kentucky

Issuing a payday loan in the state of Kentucky has its own specifics. The law establishes the requirements for the loan amount, loan terms, and loan rates. We have already told you about the main aspects above. However, reviewing the requirements for Kentucky online payday loans in more detail is appropriate. Be sure to read the info in the following paragraphs.

Loan Amounts

KY law strictly regulates payday loan amounts. So, the minimum amount that payday lenders can issue is $50. The maximum loan amount is $500. The possibility of obtaining a Kentucky online loan directly depends on the borrower’s eligibility and ability to repay it.

When deciding to take a payday loan, it is recommended not to exceed the limits established by law. Otherwise, you may receive a fine.

Loan Terms

According to the law, payday loans online Kentucky state must be repaid within 14 to 60 days. Most payday lenders offer loans with 2-4 week repayment periods. But still, it varies from lender to lender. You can easily find those who are willing to lend money for quite a long period (for example, CashUSA offers payday loans for up to 72 months). If the client is not able to repay the money within the prescribed period, it is better to contact the lender directly and request an extension. If this is not done and the payment of the debt is not paid in a timely manner, a fine will begin to accrue.

Loan Rates

Payday lenders are allowed to charge a $15 fee for every $100 borrowed. For a $100 payday loan with a 14-day term, the maximum fee can be $17.65. As for the maximum annual rate on such a loan, it is 459%.

If you want to independently calculate the annual interest rate on your payday loan, you need to:

- Divide the amount of interest paid by the amount of the loan;

- Multiply the resulting number by 365;

- Divide the number by the length of the repayment period;

- Multiply the result by 100.

Pay attention that many payday lenders provide free calculators on their websites that you can use to calculate loan rates. Just enter the required data and find out the result instantly!

Pros and Cons of Payday Loans in Kentucky

A payday loan has its pros and cons that it is important to know about. The main advantages of Kentucky payday loan online include:

- Comfortable terms and an amount equal to the average salary of a KY resident. For example, Advance America lends money for amounts from $100 to $50,000;

- The client receives the money within a day after approval. According to the bank’s regulations, the application verification process may take several working days;

- The online service is available 24/7. To get a Kentucky payday loan online, it is enough to leave an application on the website. In comparison, you can contact the bank only according to its work schedule;

- Remote service. The client does not need to personally arrange a visit with the managers and come to the branch of the financial company. The entire process from registration to the transfer of money to the card takes place remotely through the website or application;

- Minimum requirements. Credit history is not a determining factor when making a decision. Often, no proof of income is even requested.

The main disadvantage of Kentucky payday loans online is a rather large percentage of the use of loan funds. It is approximately 1.5%-2% per day. Therefore, this type of lending is profitable, provided that you take out a short-term loan and borrow a small amount.

What Will Kentucky Payday Loan Cost?

Compared to other US states, Kentucky online payday loan will not be very expensive. Thus, according to the law, the lender is allowed to charge $15 for every $100 borrowed. The maximum fee for $100 borrowed within a period of 14 days must not exceed $17.65. If converted into percentages, the maximum annual rate does not exceed 459%.

You can calculate the interest rate of your payday loan either using a free online calculator on the lender’s website or by performing several subsequent calculations:

- Divide the amount of interest paid by the amount of the loan;

- Multiply the resulting number by 365;

- Divide the number by the length of the repayment period;

- Multiply the result by 100.

Kentucky Payday Loans if the Credit Rating Is Poor

If you have a bad credit score, you may apply for a Kentucky payday loan and get approved. Of course, not all payday lenders are ready to issue loans to people with a low credit score and a bad credit history, but still, there are those who specialize in providing just such loans.

For example, BadCreditLoans provides payday loans online even to those whose credit score does not reach 500. Therefore, almost everyone has a chance. If you get a rejection from one company, submit a request to another and you will surely be able to receive the necessary loan amount.

What Are Alternatives to Kentucky Payday Loans?

Consider the table below and learn about alternatives to payday loans online Kentucky state.

| Alternative to Kentucky Payday Loans | Characteristics |

| Credit Unions | Credit unions provide services only to their members. In order to take a loan from the union or deposit funds, you need to become a member. An origination fee is usually required. To get payday loans online, you should present documents certifying your identity and the source of loan repayment. |

| Lombard Credit | Such type of loan can be obtained with an identity document. If the provided document does not contain mandatory details (for example, photo cards), the loan may be refused. The most common type of collateral in a pawnshop is products made of precious metals, household, office appliances, cars, etc. |

| Credit Counseling | It is recommended to seek credit counseling when it is difficult for you to make a decision about a loan on your own. The expert will provide valuable advice and help you decide on the type of loan you need. |

on your homescreen

on your homescreen