Payday loans provide a convenient solution for individuals facing financial challenges, especially those with bad credit. These short-term loans, accessible without a traditional credit check, offer a quick way to obtain funds before your next paycheck. Borrowers in Ohio, even with a low credit score, can apply for payday loans online.

Ohio has some very specific lending restrictions, making things easier for the borrower. Mainly they have capped the lending amount and interest rates.

Best Payday Loans in Ohio

When contemplating credit in Ohio, the primary focus should be on the service. For those seeking swift financial solutions, it’s crucial to identify a reliable direct lender. In Ohio, where credit checks for payday loans are common, finding an option with guaranteed approval and no credit check becomes paramount, especially for individuals with bad credit.

We’ve curated a list of the best 5 payday loans online providers in Ohio, ensuring a quick and efficient application process. Ohio regulations limit all companies to a maximum of $1000 per loan and a 28% Annual Percentage Rate (APR). Whether you’re in Cleveland, Cincinnati, Dayton, or Toledo, our selection caters to those urgently in need, offering a variety of loans with instant approval and a streamlined process.

PayDaySay

In 2013, a team of experts created PaydaySay app with the goal of simplifying borrowing. They are a peer-to-peer lending marketplace where borrowers can receive online payday loans. PaydaySay is neither a direct lender nor a broker. Instead, they are a marketplace that enables consumers to fulfill their financial requirements online, by connecting them with lending firms. They can be found at, Oceonica Corp. 30 N Gould St., Ste 1351, Sheridan, WY 82801.

- The APR of each loan will depend on the creditor

- Online application form in the app

- 18 years old to apply for any loan, even loan 500 dollars

- Stable income

- Functioning bank account

- Permanent job and a consistent income in order to be eligible

They score 4 or 5 stars with the most online ratings. Customers usually are pleased with their purchases when they take out finance with this company.

Advance America

Advance America has been lending since 1997 and offers small advances from $100 to $1,000. Customers can apply for a payday loan online in OH or at one of their 56 stores, for instance, Washington payday loan. Finances can be deposited straight into bank accounts or picked up from the store.

- There is no paper check required

- They offer online payday loans

- Any credit is accepted

- To apply, you will need a government-issued identification, proof of income, and a checking account

They can be found at Advance America #3947, 1684 West Market Street, Akron, OH 44313, in Westgate Shopping Center. They have thousands of five-star ratings and are a great option for those seeking instant online approval. They also offer account management via their website.

F1 Cash Advance

F1 Cash Advance offers cash advances without a credit check. The company offers quick personal advances for emergencies, installments with monthly payments, and payday loans online Ohio state. They take applications online and in-store at 470 Olde Worthington Road, Suite 200, Westerville, OH 43082. Every element of the contract must be detailed in the lender’s documents:

- Social security number

- Individual taxpayer identification number

- Checking account number

- Bank routing number

- Government-issued ID

- Address

- Valid email and phone number

- Checking account number

No formal credit checks are conducted, and they cater to individuals with poor credit. F1 Cash Advance offers a variety of amounts for quick cash needs. They provide a solution for those seeking payday loans without a hard pull on your credit. Obtain the cash you need promptly, improving your financial freedom.

Bills Happen

BillsHappen works with a network of public and private funds to provide finance up to $1,000. Although they operate online, they can be found at BillsHappen, 7580 NW 5th Street, #15614, Plantation, FL 33318.

- It does not matter if you rent or own

- You must be employed, self-employed, or receiving benefits

- You’ll need a checking or savings account

- No hard credit checks

- Fast approval

- 100% online

- A valid state driver’s license is required for each request

- Your social security number is needed to verify your identity

Bills Happen makes lending accessible. Once they approve a borrower, they transfer it within 24 hours. Plus, they accept borrowers of any credit score.

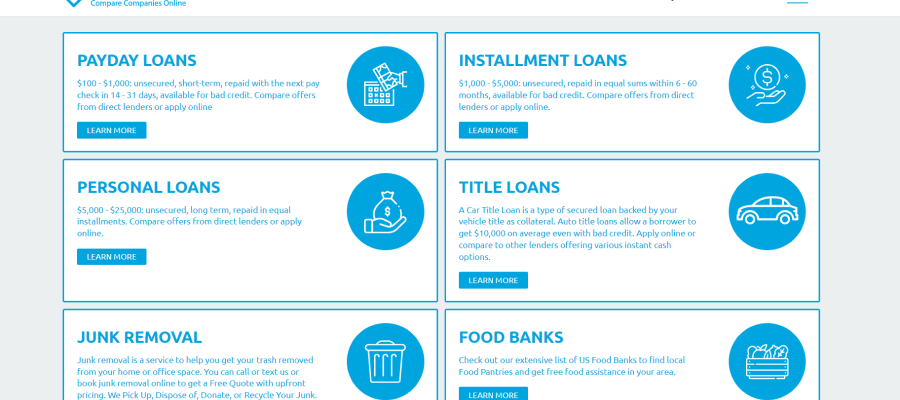

Compacom (Compare Companies Online)

Customers can get in touch with finance companies through Capital Pacific’s search engine. While offering payday loans online, they can be found at 805 Southwest Broadway, Suite 780, Portland, OR 97205 United States. With a network of reputable and trustworthy lenders, they guarantee a smooth and safe borrowing process. They offer a quick response to applications, which are free and easy to complete. All they ask for is the following:

- Be over the age of 18

- Be a citizen or permanent resident of the United States

- Worked at your current job for at least 90 days

- Give your home and/or work phone numbers, as well as your email address

- Own a checking account

- After taxes, receive about $1,000 per month in pay

With almost 5,000 4-5 star reviews, it is clear these financing giants are doing something right.

Are Payday Loans Legal in Ohio?

Payday loans in Ohio are permissible, yet the state enforces stringent regulations for credit check payday loans. Ohio law, overseen by the FTC (Federal Trade Commission), upholds these restrictions to safeguard both borrowers and lenders. Notably, payday loans are not classified as “financial services” under state law, prohibiting their sale or marketing as such.

Operating in the state necessitates a license, attainable only with a verifiable source of income, savings, and a favorable financial history. Loans must not exceed $1,000, and applicants must prove their capability to repay within a 30-day period. These regulations aim to ensure responsible lending practices in the realm of online payday loan in Ohio.

Why Might You Need Ohio Payday Loans?

OH residents can borrow 200 dollars online payday loans from a lender, bank, or credit union for additional financing. The majority of borrowers earn at least $30,000 a year. Customers who do not qualify for credit cards or have very low credit limits are targeted because of past financial problems.

Many Americans are targeted by lenders, but they tend to go after traditionally vulnerable populations. People without a college degree, renters, African Americans, people earning less than $40,000 a year, and those who are divorced or separated are most likely to obtain credit.

For those in Ohio with guaranteed approval, securing payday loans for bad credit necessitates a focus on factors beyond financial background. Opting for loans online Ohio for bad credit can be a step toward financial freedom. The simple online application process ensures a quick response, with loans from reputable lenders available.

Online loans are commonly used to pay for the following:

- Rent/mortgage

- Credit card payments

- Utilities

- Food

- Car payments

Terms for payday loans in Ohio

The most common type of advance, with an APR of around 400%, is the rollover. One of the most important things to keep in mind when you take out payday loans online Ohio state is that they must be repaid in full within 30 days.

If you’re unable to repay on time, you could face a late fee, penalty interest rate, and even criminal charges. In addition, if you take out more than one in a month, those advances will be considered multiple loans and will count as a violation of federal law.

Loan Amounts

There is a $1,000 limit on the principal balance of payday loans online. Payday financiers cannot avoid this rule due to extenuating circumstances or exceptions. Lenders typically provide finance between $100 and $1,000, usually in $10 increments.

The total amount of credit a borrower can have cannot exceed 2,500, regardless of the lender. Before issuing any money, financiers should take significant steps to ensure that their customers are not borrowing from other lending institutions.

In Ohio, securing payday loans no credit check or telecheck is feasible. Prospective borrowers can complete our online application form swiftly and efficiently, initiating the process of obtaining payday loans without undue delays.

With guaranteed approval, this option becomes especially attractive for people in urgent need of loans. Conducting a search for payday loans allows individuals to identify lenders and find the best fit for their specific requirements.

Loan Terms

The state has very strict laws on payday lenders, that all finance companies must adhere to.

- Statute of Limitations – 8 years (from the last payment)

- Interest Rate (APR)- 28%

- Restrictions – No more than $2,500 borrowed in total from all companies

- Minimum Term – 91 days

- Number of Outstanding payments – 0

- Maximum Amount- $1,000

- Number of Rollovers – 0

- Finance Charges – 28%

- Maximum Term – 1 year

Companies are usually limited to 91 days in OH, but there is one exception: amounts of less than 6% of gross income or 7% of net income can be shortened. In the case of borrowing $600, you would not pay more than $400 in fees. If borrowers are late with repayments, all lenders must offer a grace period or be open to a flexible, affordable payment plan.

Loan Rates

In addition to abiding by the limit on interest rates, companies must abide by the following laws:

- In total, the loan cost must not exceed 60 percent of the original principal, including fees and interest.

- If a borrower is active military, the monthly maintenance fee can’t be more than $30 or 10 percent of the loan’s principal balance, whichever is less.

- To cash a check issued by a lender, the fee cannot exceed $10.

- Interest or a fee of $2 may not be charged on a loan. As an example, a maximum collection charge of $20 is not allowed for advances with initial principal balances of $500 or more.

Pros and Cons of Payday Loans in Ohio

Payday loans are available for those with bad credit, and they often come with no credit check. When seeking a loan in Ohio, especially for bad credit payday loans, it’s common for direct lenders to conduct a soft credit check instead of a traditional one. The advantage lies in the guaranteed approval aspect, making it accessible for bad credit borrowers.

Moreover, most companies only require applicants to submit their social security numbers and bank account information. This makes it easier for people with bad credit scores to qualify.

However, there are some downsides to consider as well. For example, credit can lead to high-interest rates and fees if you don’t pay them back on time. Additionally, it can be hard to budget your money when you have several different debts that need to be paid each month.

If you’re looking for payday loans in Ohio, you may find options that suits you always. It’s crucial to improve your credit score, especially if you have bad credit with no credit check. When applying for payday loans in Ohio, the process can be quick and efficient, but it’s important to note that there might be a credit check or payday loans in Ohio with no telecheck.

Make sure to consider factors beyond credit history and aim for credit with guaranteed approval to experience the freedom to improve your credit and process your online payday loans Ohio application quickly and efficiently, especially for people with urgent loans.

What Will Ohio Payday Loan Cost?

The APR, or annual percentage rate, plays a pivotal role in deciding payment terms for credit check payday loans online in Ohio. The amount of cash you borrow and the duration of time it will take you to repay your money determine the APR.

The amount of money you can borrow and the length of time it will take you to pay it back are two crucial variables to take into account. This will assist you in making an educated choice about whether or not a payday loan is right for you.

You can estimate the total interest you’ll pay over the lifespan of your advance by determining the APR. To do this, estimate how much you’ll pay for the money you borrow by dividing the amount of interest paid by the amount borrowed, multiplying by 365, dividing by the repayment period, and multiplying by 100.

Each OH payday advance also has a non-refundable upfront charge and a set interest rate. You’ll pay between $15 and $30 for every $100 borrowed.

Ohio Payday Loans If the Credit Rating Is Poor

Bad credit scores can make it tough to secure financing. Those living in the area can seek an advance from online payday loans that provide money for those with bad credit. You can get a bad credit loan online, regardless of your score. But keep in mind that poor credit history can lead to high-cost, short-term financing with high-interest rates that may not be affordable in the long term.

Unlike a secured advance, there is no collateral required. Therefore, bad credit loans guaranteed approval are popular among people with bad credit histories and bad credit scores because they do not risk losing the collateral if they are unable to repay what they owe.

What Are Alternatives To Ohio Payday Loans?

Your local credit union, cash advance apps or financial institution can assist you in choosing an alternative to borrowing money. Other alternatives include personal online installment loan lenders. They are comparable to other types of credit in that they are funded online or in person and have additional fees and interest.

However, personal installment loans have a variety of distinct characteristics from others. They have higher interest rates than instant payday loans because borrowers with poor credit are more likely to repay what they owe. Installment loans are also an excellent option for individuals who cannot get payday loans Ohio, as long as they have a decent or fair credit rating and a stable income.

Payday lenders usually offer lower interest rates as they believe that the borrower will repay what they owe. Those with bad credit can usually obtain a personal installment advance with a lower interest rate than other advances. If your financial history is poor or you don’t have a chance to improve your rating, an installment payout might be the perfect choice for you.

on your homescreen

on your homescreen