A payday loan can have many definitions. Generally, it is a short-term, high-interest loan often payable on the following Payday. Depending on state regulations, payday loans could be accessible online or through physical lenders. They are legal in Oklahoma. However, payday loan regulations in Oklahoma have undergone much evolution over the years. They are stricter today than they used to be. However, payday loans online in Oklahoma make the process less hassling. Today, citizens in Oklahoma can get credits ranging from $500 and $1500.

Best Payday Loans in Oklahoma

There are many places where you can get payday loans in Oklahoma. But here is a list of some of the best lenders in the state. We compiled this list based on the quality of their services, interest, customer feedback, etc.

When searching for the best payday loans in Oklahoma, it’s worth considering online options as well. With the current situation, many lenders have shifted their services online, providing customers with the convenience of applying and receiving funds from the comfort of their own homes. And if you’re located in California, you can find online payday loans in California too.

However, it’s crucial to research and compare lenders before applying for online payday loans in California or Oklahoma. Look for lenders with a solid reputation, transparent terms and fees, and positive customer feedback. Avoid lenders with high-interest rates, hidden fees, or predatory practices.

PayDaySay

PayDaySay is an instant money app established in 2013 providing payday loans online in Oklahoma. The company’s office is 30 N Gould St., Ste 1351, Sheridan, WY 82801. PayDaySay does not give credits directly. But they connect you with lenders that can grant you any loan you want.

Since PayDaySay does not give credits, they don’t have information on the loan you want. It means that the amount and terms will be dictated by the lender PayDaySay connects you with. According toonline reviews, PayDaySay is an excellent online platform. Getting money is easy, and you have access 24/7. Using the app/site is free, and the application is easy and stress-free. Although, users have complained about falling into the hands of lenders with high-interest rates. But overall, it is a good option for online payday loans in Oklahoma state.

Advance America

Advance America is a significant lender that provides different credit services. They offer their services both online and in person. This company claims to serve over 1,400 locations within the country. Their main office is at 135 N. Church St., Spartanburg, SC 2930.

Advance America is a significant lender that provides different credit services. They offer their services both online and in person. This company claims to serve over 1,400 locations within the country. Their main office is at 135 N. Church St., Spartanburg, SC 2930.

The minimum and maximum amounts can differ by state. However, the amounts can start as low as $100 and a maximum of $350. Their interest rate varies depending on how much you borrow and the payback duration. If you are paying monthly, the payday loan rate ranges between APR 364.99% and 191.19%.

The requirements for online applications include a government ID, checking account, proof of income, email address, and social security number. Advance America has helped a lot of people with excellent services. You can access their credits without hassle, but their rate can be high.

Faaast Cash

First, FaaastCash isn’t a direct lender. But they collaborate with many reliable partners to find you the best possible terms. This works by using algorithms to find the most appropriate lenders. You will only need to submit your data on your lender’s online application. Each lender in the network complies with lending regulations and has a state license. Faaast Cash provides genuine and high-quality services wherever you are in the US. They provide online and offline services. Their office is at 515 South Riverside Avenue, Medford, Oregon 97501. You can apply for Faaast Cash credits online quickly and without stress. The company demands that you be a US resident of at least age 18. Also, you must have an active US bank account before applying for payday loans in Oklahoma. The loan terms will depend on the lender Faaast Cash links you up with. These include the limit, amount, rate, duration, etc. But according to reports, this company has commendable services.

First, FaaastCash isn’t a direct lender. But they collaborate with many reliable partners to find you the best possible terms. This works by using algorithms to find the most appropriate lenders. You will only need to submit your data on your lender’s online application. Each lender in the network complies with lending regulations and has a state license. Faaast Cash provides genuine and high-quality services wherever you are in the US. They provide online and offline services. Their office is at 515 South Riverside Avenue, Medford, Oregon 97501. You can apply for Faaast Cash credits online quickly and without stress. The company demands that you be a US resident of at least age 18. Also, you must have an active US bank account before applying for payday loans in Oklahoma. The loan terms will depend on the lender Faaast Cash links you up with. These include the limit, amount, rate, duration, etc. But according to reports, this company has commendable services.

Payday Champion

Payday Champion provides online services in both online installment loans no credit check and payday loans. The company’s office is 412 Main St. #420 Houston, TX 77002. Applications are said to be approved swiftly. It is even possible for you to get the credit on the same day. Applying for a payday loan online with Payday Champion is possible without having your credit checked. If you have bad credit and have been rejected by other lenders, this could be pretty beneficial. You can get an amount between $100 and $1000. To apply, you can visit their official website. Remember the terms and conditions of the loan you want to apply for, as you should with any loan. Understanding them will help you avoid many problems, especially issues related to late payments.

Payday Champion provides online services in both online installment loans no credit check and payday loans. The company’s office is 412 Main St. #420 Houston, TX 77002. Applications are said to be approved swiftly. It is even possible for you to get the credit on the same day. Applying for a payday loan online with Payday Champion is possible without having your credit checked. If you have bad credit and have been rejected by other lenders, this could be pretty beneficial. You can get an amount between $100 and $1000. To apply, you can visit their official website. Remember the terms and conditions of the loan you want to apply for, as you should with any loan. Understanding them will help you avoid many problems, especially issues related to late payments.

Payday Champion is a wise choice if you want to borrow money online and need it fast. To qualify, you must be employed, over 18, and a resident of the US. If not, you won’t be eligible for any credit from them.

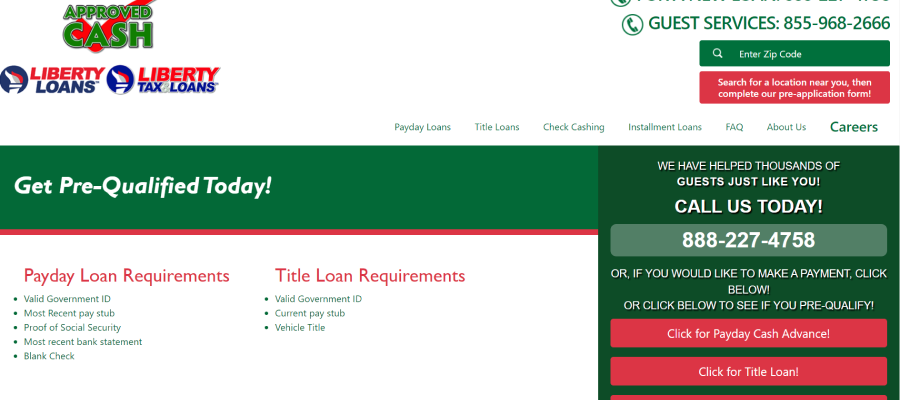

Approved Cash

Approved Cash is an agency specializing in Payday and short-term loans. The company was founded in 2003. It has an office in about 125 locations but has its state office at 7406S Walker Oklahoma City, OK 73139. The company offers a variety of services to satisfy your financial needs. You have a better and more affordable option with Approved Cash because it is better than the exorbitant bank fees for returned checks. It is even better than the expensive use of credit cards for cash advances. Getting credits from Approved Cash is quick and easy. You can expect to receive the funds very quickly. To apply, you’ll need a government-issued ID, social security number, a recent bank statement, and a check. According to users, they receive the credits in less than 48 hours.

Approved Cash is an agency specializing in Payday and short-term loans. The company was founded in 2003. It has an office in about 125 locations but has its state office at 7406S Walker Oklahoma City, OK 73139. The company offers a variety of services to satisfy your financial needs. You have a better and more affordable option with Approved Cash because it is better than the exorbitant bank fees for returned checks. It is even better than the expensive use of credit cards for cash advances. Getting credits from Approved Cash is quick and easy. You can expect to receive the funds very quickly. To apply, you’ll need a government-issued ID, social security number, a recent bank statement, and a check. According to users, they receive the credits in less than 48 hours.

Are Payday Loans Legal in Oklahoma?

Payday loans are legal in Oklahoma. In 2003, Oklahoma Legislature authorized payday lending in the state. The Oklahoma Deferred Deposit Lending Act permits two outstanding payday loans. In 2006, the Military Lending Act effectively set a cap on payday loans at 36% APR for service members. As such, no lender in Oklahoma can lend money to the military with interest rates higher than 36% APR. In the same 2006, the Payday Lending Database Information Confidentiality Act, or Bill 1082 (also called the Fiscal Code), was signed into law. The Oklahoma Small Lenders Act restricted the payday loan in 2020. The maximum amount and monthly interest rate have been $1,500 since then.

Why You Might Need Oklahoma Payday Loans

You can require a payday 500 loan no credit check in Oklahoma for various reasons. You might have an urgent need to fix your automobile but don’t have enough money or a credit card you can use. Likewise, you might have to pay an unexpected medical bill. Even worse, a missed utility bill may have resulted in threats to turn off your electricity or gas. In any case, it means you are in urgent need of Cash. Also, a payday bad credit loans guaranteed approval come in handy if you have bad credit or no credit. Payday loans may save you in these conditions. It could be from fees, deposits, and other costs like fines and restart fees. You are free to use your credit in any way you see fit. But we believe you should only use a payday loan in extreme situations.

Terms for Payday Loans in Oklahoma

Each state has different regulations concerning loans. We recommend reading the rules of the state where you want to take a credit. Likewise, you should read the terms of whichever you want to take. Understanding the terms will guide you. You must meet different conditions before you can qualify for loans in Oklahoma. For example, the repayment duration can range between 30 to 365 days. It is in the jurisdiction of the financial institution or lender to determine the amount to give you. It is also important to note that rollover is not allowed.

Loan Amounts

Loan amounts differ per state. Hence, you need to understand that the amount you can take in different states varies by law. This applies even if you are borrowing from the same provider. For example, the amount of payday loan a supplier can give in Oregon will be different from the amount the same supplier can give in Oklahoma. In Oklahoma, you can get a payday loan as low as $100. But the maximum amount in Oklahoma cannot exceed $1,500, no matter the duration. If you want to take a payday loan, you should consider some things. These can include how much will satisfy what you need the credit for and your paycheck. The company will deduct the amount from your paycheck, which could be difficult. Hence, you should ensure you get an amount allowing prudence after payment. The duration of an Oklahoma payday loan can be between 60 and 365 days.

Loan Terms

Before you can get a loan in Oklahoma, some of the conditions you need to meet are:

- An active US bank account

- You must be a resident of the US

- You must be at least 18 years of age

- You have a reliable and stable source of income.

- If you are applying online, you also need a valid email address.

After your third consecutive loan, repayment plans in four installments are available. After the fifth successive one, you must allow a “cooling off” period. Cooling-off periods are days when you are not permitted to obtain another. In Oklahoma, this takes two business days. Oklahoma Payday loans online are not recommended as long-term financial solutions. Online payday loans are short-term and fee-based. Hence, you must repay them on time to avoid extra fees and penalties. Lenders may impose $25 NSF costs if you miss a payment on a credit.

Loan Rates

Payday loans are fee-based, short-termed, and not designed to be long-term with APRs. Lenders have a right (according to Oklahoma state law) to charge a maximum of $15 for every $100 loan up to $300 (a $45 fee). Then, for the final $200, they can charge $10 for every $100 (with a maximum fee of $65 for a $500 loan). A $100 credit for two weeks has a maximum APR of 390%. On the other hand, you should repay Oklahoma online payday loans on time. This will help to prevent any additional costs or penalties. It is important to note that the interest still varies per lender or financial institution. The figures used above are calculated from the maximum allowable rates. This complies with the regulations of the state of Oklahoma.

Pros and Cons of payday loans in Oklahoma

Here are a few advantages and disadvantages we’ve been able to point out. Pros:

- Easy to Access

Payday loans’ main benefit is that they are simple to obtain. Most lenders in Oklahoma guarantee instant lending (24 hours access). It’s even better if you apply for Payday loans online Oklahoma state. These applications can be completed in as short as five minutes. This is different from the regular ones, which might take some time.

- Fewer Requirements

The majority of payday loans have fewer application criteria than personal loans. To apply for a payday loan, you may only need to:

- Be at least 18 years of age

- Have a Social Security number or a government-issued ID

- Possess a steady job or another reliable source of income

- Have an active bank account

- No Credit Limitation

Regular loans require you to have a good credit score to get authorized. However, payday loan providers in Oklahoma don’t require a credit history. Taking this type does not in any way affect your credit score. Cons:

- High-Interest Rate

The interest rates on payday loans in Oklahoma are comparatively high and can reach 390%. For comparison, many personal loans have interest rates ranging from 4% to 36%. And credit card rates are often between 12% and 30%.

- You Can Be Sued

Payday lenders have the right (by Oklahoma state law) to sue you in court and seek a judgment against you for failing to return a debt if you don’t make your payments on time.

What will Oklahoma Payday Loan Cost?

The Oklahoma state law does not permit an interest greater than 17%. However, most payday lenders in Oklahoma usually charge between 13% to 15%. For example, if you borrowed $100 for 60 days. If you want to pay back twice at 17% per month, that will be 34% for 60 days (2 months). 34% of $100 is $134. It means you will be paying back a total of $134. We can also calculate the ARP. Since ARP is measured annually, we will multiply 34% of $100 by 365. 34/100 * 355 = 207% Note that the state regulation gives no standard rate. The rules only stated the maximum, which is 17%. The rate is what brings competition among lenders in Oklahoma. It causes them to try to offer a rate as low as possible.

Oklahoma Payday Loans if Credit is Poor

Payday loans with bad credit, poor credit, or no credit are available in Oklahoma. It can be from direct payday lenders online and in-store. This is possible because most payday lenders do not check your credit history. So, either it is bad, or you have no credit, it does not affect the credit you can get from them. Direct lenders have something for those with bad credit online. It is pretty quick and widely available for consumers with no credit. Also, you can get a low-credit payday loan from a store and other financial institutions. However, if you apply to a typical lending institution, they have strict requirements. Your chances of receiving guaranteed approval for a negative credit loan fall.

What are the Alternatives to Oklahoma Payday Loans

Oklahoma residents who have poor credit frequently end up acquiring payday loans. However, other options are available, even if you have bad credit. By taking these options, you can save yourself from high rates of Payday loans and a cycle of debts.

Loans from credit unions

Instead of taking a payday loan, you can opt for other types of credits. An excellent example of this is Credit Union loans. Even though most banks will reject customers with bad credit, credit unions can consider more factors. These can include your ability to repay, but they still have a few rules that are not overly demanding. However, you won’t be accepted if you don’t meet them. You can locate a credit union in your area using the search engine provided by the Credit Union National Association. Although not all credit unions do, some have short-term lending programs. You can call them to learn more about your options.

Buy Now, Pay Later

If you need to buy an essential item from one of the major retailers, this is for you. With such retailers, you may be able to use a buy now, pay later payment plan. These programs divide your purchase into equal installments and sometimes don’t run a hard credit check.

on your homescreen

on your homescreen