Are you feeling pressed for cash? Do you experience a sudden financial emergency? Many consumers who live paycheck to paycheck may find themselves in a difficult monetary situation from time to time and often ask themselves a question, “Can I get a personal loan with a 550 credit score?”

You can turn to various finance-related service providers to borrow some funds. But if your credit history isn’t perfect your options may be limited. Are you looking for personal loans for credit score under 550? Depending on your particular situation, you may turn to one of the following places or take some time to boost your rating and qualify for better terms. Here is what you need to consider.

What Is Considered a Poor Credit?

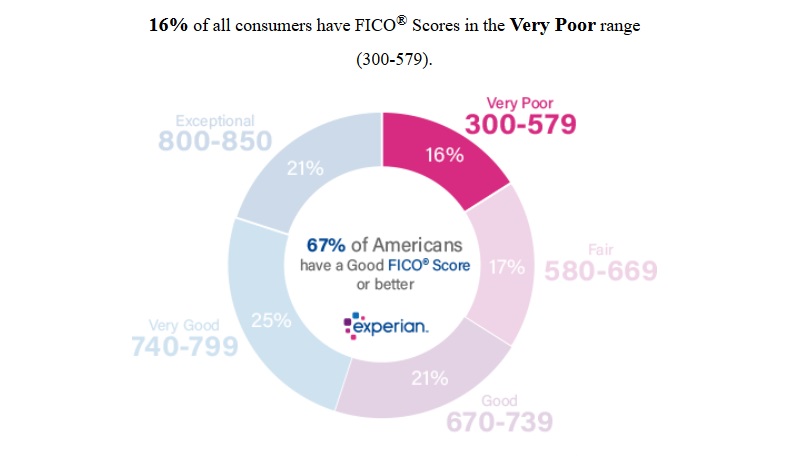

Some borrowers have doubts about their rating and apply for credit score 550 personal loan. But it isn’t right. If you don’t know exactly what your rating currently is, you have a chance to request a free annual credit report. Every credit reporting bureau providers such reports for consumers each year and you can request them free of charge. Sometimes you may find errors and mistakes in it that can be easily eliminated so that your score will improve straight away. If not, you will see the real picture and your current credit rating.

Why do borrowers have poor scores? There are several reasons for that. If your rating is less than 600 it often means you’ve missed loan payments in the past. Also, it can be a result of delinquent accounts or a record of bankruptcy in your credit history.

The negative impact will remain in your report for about six or seven years so your rating will be affected for this time and your lending options will be limited. Still, there are companies and institutions that issue personal loans for TransUnion credit score under 550 and other borrowers.

7 Types of the Best Personal Loans

Every borrower has various options when it comes to financial assistance. Depending on your rating as well as other important criteria, you may turn to different lending services for help. Below are alternatives and most suitable options to choose from:

- Unsecured Loans – This is the most common option for consumers from many states. You can check the details of personal loans credit score 550 if they are allowed in your state and what rates you can qualify for. Generally, unsecured lending options are popular among borrowers as they present fewer risks and don’t require collateral. Don’t worry if you don’t have any valuable assets to back the loan up. However, you may not be eligible for this option if your rating is too low and lenders want to be sure their funds will be returned on time.

- Secured Loans – This is a suitable option for borrowers who seek personal loans for 550 credit score and up to 600 from Michigan or another state. Secured lending solutions mean you will need to provide collateral such as your auto or house to back it up. In case of default, this valuable asset can be taken away from you by the creditor. So, it pays to think twice before you choose this borrowing option especially if you don’t have steady employment.

- Payday Loans – such loans are typically issued for two or three weeks. So, this is a widespread short-term lending option suitable for people with a regular job and steady employment who need a small number of extra funds until the next payday. If you have urgent expenses and bills that need to be covered straight away, you may request a payday lending option. Pay attention to the fees as this option usually comes with high interest rates and APRs due to the short repayment period.

- Local Bank – Conventional lending institutions can also be a way of getting additional funds. However, if your credit is too low you can receive rejections from traditional lenders. They tend to issue larger sums for a longer term and offer lower rates only to reliable borrowers with decent credit history. So, you don’t have to waste your time gathering tedious papers to apply there when you need 550 credit score personal loan. Try alternatives instead.

- Cash Advance – if you have a credit card, you may take advantage of it and

withdraw a necessary amount of cash from the nearest ATM. On the other hand, the rates and terms can be higher than those of personal loans. This option is suitable for consumers whose rating is too low to qualify for any other borrowing decision. But you always can get loans for credit under 550 here. - Student Loans – even students with low or no credit may qualify for such lending options. But you may request funds only for your tuition, college expenses, or other related costs. If you have an emergency and need extra cash for any other expenditure, you won’t be able to qualify. Also, some places require a co-signer to take partial responsibility for this loan in case of your default.

- Title Loans – If you own an auto you can utilize it as collateral to secure the loan and obtain the necessary funding even with low credit. Experts believe this is the least favorable lending solution for low-credit holders as you have higher risks of losing your asset. Select this type of loan only if nothing else works and you are sure you will be able to pay the debt off and return your car. But try personal loans 550 credit score from alternative lenders, or a borrow money app first.

Be Responsible for Your Debt

While you choose the most suitable and affordable personal loan 550 credit to solve your current monetary disruptions, work your way towards improving your credit. If you pay this debt on time and in full you will increase your rating and boost your credit history so that next time you will have more options when you need financial assistance.

Be responsible and realize that debt is still debt. Think twice if you need personal loan with 550 credit score. This money should be returned to the lender in full together with all the fees and interest rates so that your credit score doesn’t get affected.

As you look for the best personal loans available, it’s important to consider how often you’ll need to make payments. After all, you don’t want to fall behind and risk hurting your credit score even more. So, how many pay periods in a year? Well, the standard is usually 26 bi-weekly pay periods or 52 weekly pay periods.

When researching personal loans, make sure to check if they align with your pay schedule or if there’s flexibility in payment frequency. With the right loan and payment plan, you can take control of your finances and improve your credit score over time.

SSL protection & encryption

SSL protection & encryption

on your homescreen

on your homescreen