Need money to pay rent tomorrow? You’re not alone. Many people face financial challenges that make paying rent on time stressful. This guide explores fast solutions like personal loans and emergency rental assistance to help you secure the cash you need quickly.

From understanding loan terms and monthly payments to accessing assistance programs, we’ll help you navigate your options and avoid late payments or housing issues. Whether you’re considering a loan or other financial help, learn how to manage your rent effectively and keep a roof over your head.

What to Do If You Can’t Pay Rent Tomorrow

When you’re shouting, ‘I need money to pay rent tomorrow,’ the stress can feel overwhelming. The good news is that there are options. Emergency rent loans, rental assistance programs, and even borrowing from friends or family can help you cover your rent quickly. Here we’ll explore how these solutions work and guide you through securing the help you need.

When you’re in a situation where you’re unable to pay your rent due to financial difficulties, it can be a challenging and stressful time. Whether you’re facing job loss, unexpected expenses like car repairs, or other financial emergencies, making rent payments is a top priority. In such situations, finding a loan to cover your rent might be a viable option.

If you need $200 or more to pay rent tomorrow, online lenders specializing in emergency rent assistance loans can help. These lenders are designed to provide fast cash to cover rent payments, reducing the stress of financial emergencies.

With quick approvals and flexible lending terms, emergency rent loans can help you avoid late fees and maintain your housing stability. An emergency rent loan is typically a one-time funding option that gives you the helping hand you need. The key here is to be able to get that help to pay rent as quickly as possible.

To speed up this process, make sure your current financial information is accurate. You know that you can’t wait another month to make a payment, so you’d better learn your options.

One of the most convenient and efficient ways to access emergency rent loans is through online lenders who specialize in providing assistance to individuals with bad credit or no credit history.

These lenders offer a range of loan options, and it’s crucial to explore different types of loans before making a decision. Shopping around can save you money and ensure that you find the right loan to address your specific financial needs.

So, if you find yourself in a financial emergency and can’t pay your rent, there are options available, including emergency rent assistance loans, that can provide you with the financial support you need to cover your rent and avoid late payments that could lead to eviction or damage to your bad credit history.

How Emergency Loans Can Help When You Need Money to Pay Rent Tomorrow

With 79.6 percent of Americans who are in debt to lenders, 12 million yearly payday loan borrowers can’t cover daily expenses from paychecks. Most landlords aren’t big fans of waiting for their monthly rent check. Landlords expect rent payments on time, but financial hardships can make that challenging. If you’re short on rent, emergency loans offer a fast solution.

These loans can prevent late fees and eviction while giving you the time to regain financial stability. For tenants needing immediate support, emergency loans for rent provide convenience, flexible borrowing ranges, and the chance to build credit over time.

Delayed payments may result in late fees and penalties. So, if you don’t want to turn your monthly bill into a mountain of debt, emergency rent money options might seem smart.

Taking out online installment loans is never a bad idea if you have a steady income. There are a lot of lenders that work to process emergency money for rent quickly.

This is especially great when you need money today to pay your bills without incurring extra late fees.

Face it, if you can’t wait another day to make a payment, you need a solution. An emergency 500 loan bad credit for rent payment may be the fastest and most convenient option to borrow money.

So, let’s assume you need help paying rent. Applying for loans to pay rent is smart for a few reasons:

- they are convenient and fast

- they help you build a creditworthiness

- they come with wide borrowing ranges.

How Long Can You Go Without Rent Payment

A common question that usually arises is – how long can you go without paying rent before it’s evicted? Just because every state has its own eviction laws, it’s strongly recommended to understand what your rights are. As stated, if you don’t want your landlord to file for eviction, don’t ignore it.

Receiving an eviction notice is no fun. Yet, even if you’ve got evicted, it’s not the end of the world. You can still move forward with emergency eviction loans. Before applying, it’s smart to go shopping for places that help you pay your rent. These could be online lenders, banks, or credit unions.

Yet, since certain financial institutions take much attention to your credit score, online lenders might be your best bet. Different lenders have different guidelines for approval. Yet, most of them have more flexible lending terms when compared to traditional banks.

Where to Get Emergency Loans and Assistance to Pay Rent Fast

When you are facing an unsavory scenario, reliable online lenders need to be high on your list. Taking out even a small $100 secured loan is easy, but it’s not always obvious. First, make sure your score is in its tip-top shape.

If you’re short on rent and need money to pay rent tomorrow, start with online lenders. Many specialize in emergency loans, offering quick approvals even for those with bad credit. Additionally, check local rental assistance programs or charities like the Salvation Army and United Way. These organizations can provide financial help for rent, ensuring you stay housed during difficult times.

Have a less-than-ideal score? Does your low-income level have no sight to increase? Well, it’s not a win-win scenario, yet, that’s not the end of the game. One thing to consider here is that your options are limited.

In general, cash loans assistance vary from lender to lender. But typically, you’ll need low-income limits and good credit scores to turn to emergency rent help.

Wondering about your choices when dealing with a less-than-ideal credit score or no credit history? While it might appear daunting, the situation isn’t as dire as it seems. Indeed, your choices become somewhat restricted, but you’ll find numerous online lenders willing to provide credit cards and unsecured personal loans tailored for individuals with less-than-stellar credit.

These short-term loans can assist you with pressing financial needs, such as housing assistance or other financial assistance. Even if your credit situation isn’t ideal, there’s a chance to secure an unsecured loan to help you get back on your feet.

With these options, you can obtain the necessary loan amount and make loan payments that suit your budget. In some cases, you might also discover rent assistance programs to alleviate your housing expenses. So, don’t despair; there are avenues available to address your financial needs and improve your creditworthiness.

Who Can Help Me Pay My Rent?

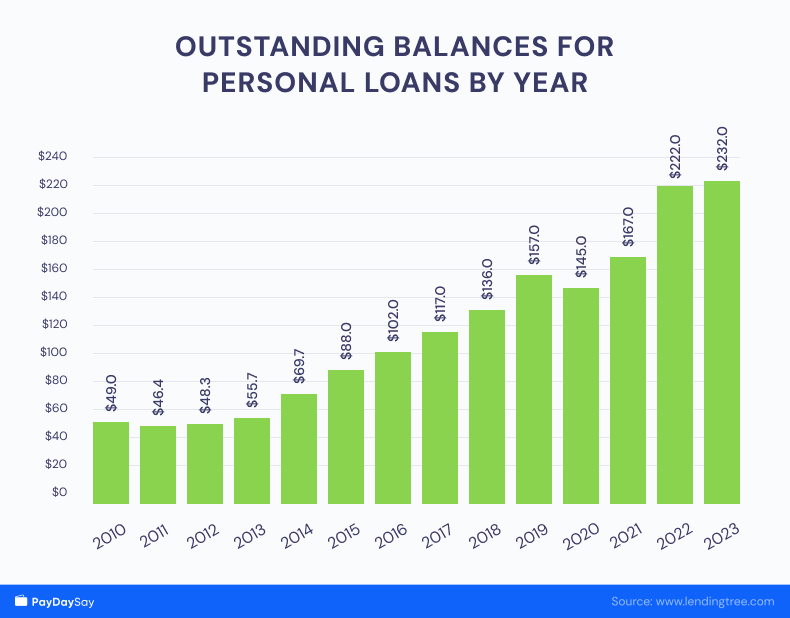

The lending industry has grown by 269 percent over the five years despite high interest rates and consumers who’ve been trapped in the debt cycle.

Marketplace lending platforms have revolutionized the way consumers approach obtaining loans. Borrowers now benefit from the fact that lenders are more open to a full range of potential outcomes. In simple terms, this means you have the potential to secure a more favorable deal.

It’s no surprise, then, that thousands of consumers opt for online loans to pay their rent. This trend is particularly prominent among those with bad credit. If you find yourself in this situation, and in need of fast cash to cover your rent, emergency fund loans might be your best bet.

While grappling with financial difficulties can be a challenging endeavor, it’s crucial to address your need to pay your rent promptly to avoid further complications. Remember, timely payments are essential to repay the loan on time.

If you’re concerned about qualifying for a loan due to your credit history, don’t be discouraged. Many lenders understand that unexpected circumstances may have led to your current financial situation. They may be willing to work with you to find a solution that allows you to make payments on time.

Additionally, some loans are designed to offer assistance with specific expenses, such as utility bills. If you’re struggling to cover your utility payments, exploring a loan application tailored to this purpose could provide the support you need.

Remember, it’s important to approach these loans with a clear understanding of how they work, ensuring you can comfortably pay partial rent and manage your finances effectively.

When You Need Emergency Funds for Rent

Do you shout “I need money for rent”? Without a doubt, it can be one of the scariest moments in the life of adults who need money to pay rent tomorrow.

Are you a little short on the rent payment? You have options. The best thing is you’re not alone. At least 43 percent of American households struggle with covering essential monthly rent and food costs.

It comes that 50.8 million US citizens struggle with serious money issues every single month. So, if you are one of those who say, “My rent is due, and I have no money,” you still have options. Apply for a renters loan to solve at least one of your problems.

Whether you are in between jobs or have no savings, taking out loans for rent payments can help you cover the expenses. Indeed, you can find help from charity programs or family and friends. But if you know that your financial shortfall is temporary and you need only short-term support, getting others involved in your troubles doesn’t always make sense.

Without a doubt, it’s always recommended to look at ways to save some cash for an emergency before considering a loan to pay rent. Yet, if you need emergency loans for rent today, guaranteed loan direct lender bad credit would get you the assistance you need.

Getting rent advance loans is one of the best and most convenient steps that you can take to prevent yourself and your family from eviction.

All you need to do is fill out an application form online and find a solution that meets your requirements. But before you dive in, take the time to fully understand the repayment terms.

Bottom Line

When you’re thinking, ‘I need money to pay rent tomorrow,’ it’s important to act quickly. Emergency loans, rental assistance programs, and temporary financial solutions can help you cover rent fast and avoid eviction. By choosing the right option and understanding repayment terms, you can bridge the gap during tough times and work towards a more stable financial future.

Repaying your emergency loan for rent is a responsibility that should be approached with care, and PaydaySay provides a platform to connect with various lenders willing to provide loans for such circumstances.

Before committing, it’s essential to thoroughly comprehend the terms, fees, and interest rates associated with the loan. This knowledge empowers you to make an informed decision, ensuring that you can pay it back on time. I

n times of financial strain, the prospect of partial payments may offer some relief, allowing you to avoid eviction and maintain stable housing. Remember, finding affordable rental housing is a long-term goal that can be supported by responsible loan use.

By leveraging loan for rent effectively, you can bridge temporary gaps in income, securing a roof over your head while working towards a more stable financial future. Trust PaydaySay to help you navigate this process and find the support you need to meet your rent obligations.

on your homescreen

on your homescreen