If you’re saying, “I desperately need money!” you’re not alone. Whether it’s unexpected bills, car repairs, or a job loss, urgent cash needs happen. Worried about low funds until payday? Need 500 dollars now? Explore ways to earn extra cash quickly and discover financial solutions you may not have considered.

I Need Money Desperately! That’s What You Think?

When you have thoughts like “I need money desperately” and want quick 200 dollar loan, you are trying to look for a financial solution that works. Although there can’t be a perfect way out if you need quick money, you still have options that won’t put you in a worse financial situation.

Before we detail how to get extra money in a pinch, let’s review some key financial advice that can help you get on the right financial path and stay there.

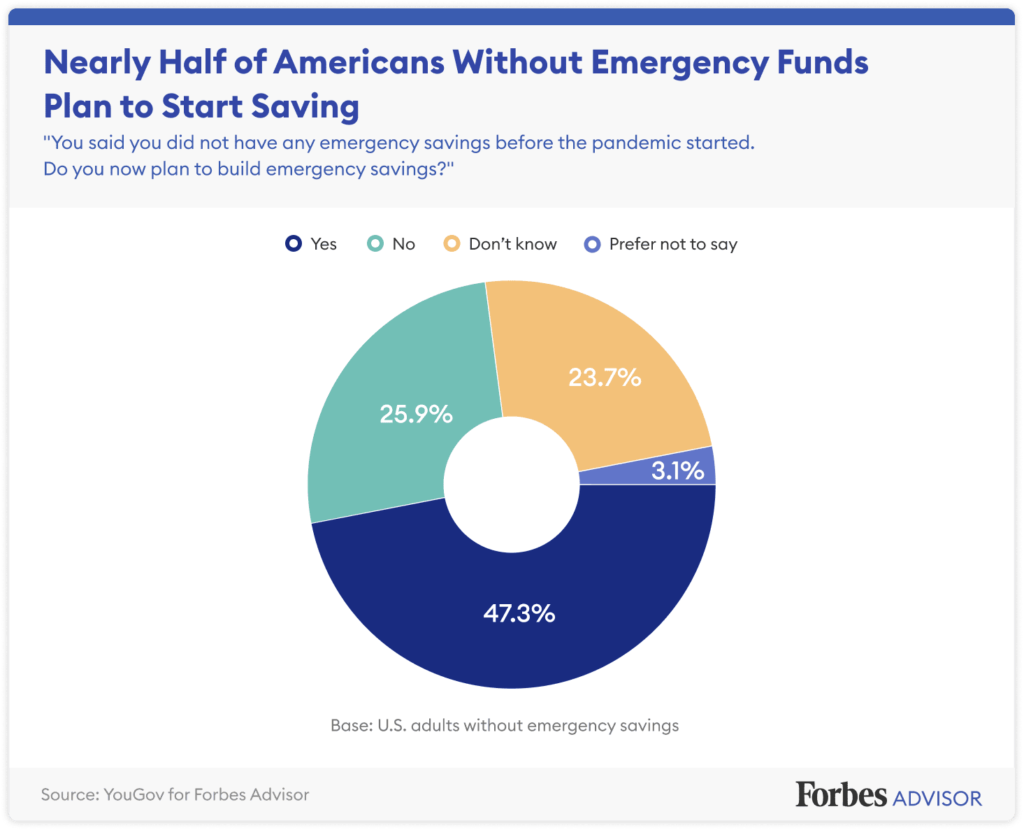

Nearly everyone will need help with money at some point in their life, although it may be hard to admit. The best solution to get money when you need it fast, is to plan in advance with an emergency fund.

If you have no savings, you can take several steps to slowly build up at least three months’ worth of expenses.

If you’re still working on creating a reliable emergency fund, and you face a situation where you need money fast, you do still have options, although your choices vary depending on your current financial picture.

- What should you do if you need free money now, but you have bad credit?

If you need some emergency cash and have a poor credit history, traditional lenders are less likely to approve your personal loan application because they view you as a risky borrower. When the managers at the local bank review your credit score and credit, they will factor it into their decision-making and are more likely to give you a loan with a very high-interest rate, if they give you a personal loan at all.

Unfortunately, when borrowers need money desperately, lenders view this as yet another cause for concern or another sign of a borrower who may not reliably repay a loan.

Even if the bank agrees to lend when you need easy cash, the loan is likely

to come with collateral, tough terms, and high-interest rates that can put you in a worse financial

situation in the long run.

If you can get a personal loan from loan places online same day deposit, they are generally more affordable and have higher principals, or loan amounts, than some alternative financial options. As you repay them on time, you can rebuild your credit score.

However, if you need 500 dollars by tomorrow and you can’t get a personal loan, here are some other solutions for getting the money you desperately need:

Bonus post: Use price comparison apps to save money!

Borrow Money from Family To Get Cash

It may be humiliating to ask a family member to help with money fast when you’re in a desperate situation. But it may be in your best interest if you make some extra cash in an emergency and traditional banks reject the loan application.

You may feel embarrassed to ask for money quickly, even if you are close with your family members and they are happy to help you out. In many cases, relatives can agree to lend money without any interest or for very low interest, which can help you stay in good financial health while you meet your short-term need.

Borrowing money from family is one of the best ways to earn money to meet your emergency needs if they are willing to lend to you. As a word of caution, experts suggest signing a formal agreement before getting paid.

That way, you feel more accountable for the money you borrow, and you and your family members will have more confidence if you have a repayment schedule.

On the other hand, there are some disadvantages of asking your family for help when

you want to make fast cash. The main downside is that you might ruin your relationship with your loved ones if

you are not able to repay the loan.

You should understand that if you are among people who desperately need money with bad credit, and your family member can help you out, then you should borrow only the required amount. If you are not sure about your ability to repay even a small $200 loan, think twice before taking money from a loved one.

Ask Your Friends or Colleagues for Fast Cash

When you find yourself in a dire situation and require emergency cash quickly, one of the best ways to make money is to ask your friends or colleagues for money today. While it might be an uncomfortable situation, reaching out to those close to you can be a lifesaver. They can provide you with the much-needed cash to cover your immediate expenses.

It’s essential not to underestimate the potential financial assistance your friends or colleagues can offer when you’re in desperate need. Having a signed agreement in place can provide them with more confidence in your commitment to repayment.

Remember, these agreements are legally binding, which means they can take legal action if you fail to repay the borrowed amount. This is a great way to make money available quickly and put money in your pocket when you need it most.

So, don’t hesitate to reach out to your network when you find yourself needing money in an emergency. It can help you get quick access to the money right this second and avoid having to take more desperate measures, such as borrowing money from friends when you need extra funds. Your friends and colleagues can provide the cash in your pocket when you need emergency money, ensuring you stay afloat during challenging times.

Try Alternative Online Loans to Raise Cash

Short-term loans like Speedy Cash or a payday app have become more popular as a way to get some money in recent years. Whether you need money immediately for rent or school, online lenders offer to get quick cash over a short time.

It can be an alternative option when you need to borrow money but a traditional brick-and-mortar bank rejected your loan request or if getting help from your relatives is not an option. Such small loans are generally used when the money you need is for a couple of weeks or so.

You may turn to an online lending service that connects borrowers with direct lenders, offering payday loans and cash advances with same-day deposits. These emergency loans typically involve smaller amounts and shorter terms, making them accessible for those looking to make some extra money.

However, it’s important to note that while these loans may have lower barriers to entry during the approval process, they often come with high-interest rates.

Borrowers need to exercise caution and ensure they can earn money to repay the loan in full and on time. Failing to do so could lead to credit card cash advance consequences and dig borrowers deeper into financial trouble, leaving them with less cash in their pocket and more financial stress.

Pawn Your Stuff For Extra Cash

If you are looking for ways to get emergency cash and have valuable items that you’re not currently using, consider pawning them as a way to raise cash quickly. This allows you to get some cash on hand while keeping the option to retrieve your items once your financial situation stabilizes.

It’s important to note that pawning differs from selling, and you won’t receive the full value of the items. Additionally, you’ll need to pay interest to reclaim your items.

Many pawn shops offer a one-month borrowing period for those in desperate need of money, though some may extend this to a few months for added flexibility.

Keep in mind that one potential drawback is the possibility of encountering high-interest rates, which can vary depending on the laws in your state. Nonetheless, pawning can be a viable way to get some quick cash when you’re facing a financial crunch.

Turn to Local Banks If You Desperately Need Money

Finally, even if you have trouble getting a personal loan from a major financial institution, you might ask for money in your bank or credit union, where you can talk to a lender directly about your personal situation and get some cash quickly.

Local banks and credit unions tend to hear personal stories and judge loan approvals on a case-by-case basis.

If you can wait for a few weeks until all the paperwork is done for a personal loan from a local bank or credit union, then you may get approved for a loan with lower interest.

If you are desperately in need of money and have bad credit, keep in mind that even local banks are leery of risky borrowers. So, if your credit score is far from excellent, consider opting for one of the other financial solutions named above.

A Few Words to Conclude

We want to help you understand that any financial emergency is a tough situation in which a person must be responsible and accountable for any further actions. If you head down the wrong path, you might get even more in debt.

However, anyone can encounter times when they are in desperate need of money have thoughts like “I need 500 dollars by tomorrow”. No matter what your personal reason, search for the best and most suitable solution that will help you get out of debt faster.

Look for opportunities to make extra cash and use them to your advantage. Focus on your long-term financial health as you scramble to meet your need for money in your hands.

Remember to borrow wisely and never take out more money than you need to resolve your money emergency. And don’t forget to work toward improving your credit score and building an emergency fund because the next time you may need money desperately, you’ll need a good credit score in order to have better ways to get cash fast.

Edited by Rebecca McClay

on your homescreen

on your homescreen