Personal Loans

Can’t fund your dream vacation or struggle to pay bills? You’re not alone. The solutions? Personal loans. But, securing the best one among a minefield of high-interest rates, hidden fees, and impossible-to-meet rates and terms isn’t as easy as it seems. Luckily, we have put together this guide, full of in-depth analysis. Keep reading to find a list of best personal loans that suit your budget, and avoid predatory lenders.

What is an Online Personal Loan Option?

A personal loan is a cash borrowed from a financial institution. For this, you’ll get charged an interest rate in return for this money — that you must pay back in addition to the principal.

Personal loans can be used for whatever you need! In fact, there aren’t many things you can’t use a personal loan for.

To approve your loan application (or an online personal loan), most lenders check your credit.

- This can be a soft credit check, which won’t affect your credit score.

- Or a hard credit check that will stay on your file.

There are two different ways to get a personal loan:

- Secured requires collateral like your house or vehicle, which the lender can seize if you don’t pay them back.

- Unsecured loans won’t ask for collateral but have a higher interest rate.

Find the Best Personal Loan Rates: What Are Personal Loan Interest Rates?

The annual percentage rate (APR) reflects both your interest rates and an origination fee (sometimes) but also other charges. It’s essentially the “price tag” of your loans, expressed in your outstanding credit as a yearly rate.

Interest comes either as:

- A fixed rate that stays constant over the term.

- A variable rate that fluctuates based on market conditions.

And it’s generally within the range of rates offered by lenders and also varies from person to person.

Average Personal Loan Rates

By understanding the average rates, you’ll be able to find the lowest personal loan interest rates and anticipate potential costs.

While there are personal loans for bad credit, you’re likely to get high interest rates, as the lowest rates reserved for people with good credit scores.

| CREDIT SCORE RANGE | AVERAGE RATES |

| Poor Credit | 27.00% |

| Average Credit | 22.00% |

| Good Credit | 16.00% |

| Excellent Credit | 12.00% |

How to Improve Rates for Personal Loan

Improving the rate you qualify for can seem impossible. But with a thoughtful strategy, it can absolutely be done.

- Check your credit report and score: Your rates and terms are subject to this. Remember, these loans are subject to credit, so ensuring your credit score is in good shape is crucial.

- Improve your credit score: Try and pay off any outstanding debt, keep your credit utilization low, and check your report for mistakes. Then increase your score and qualify for the best rates.

- Pay off other debts: High credit card debt can negatively impact your credit score. Try to pay it off as soon as you can.

- Increase your income: To improve your chances of loan funding, find a part-time job or something that spikes your income. Then think about whether personal loans are the right choice.

- Consider a co-signer: To get an affordable loan, you’ll need a solid credit history. If you don’t have one, then ask friends or family to vouch for you. Then you’ll have more chances to qualify for the lowest rates.

- Compare offers: Use tools like the Best Egg — or a similar personal loan calculator — to compare the range of rates listed on your lender’s website.

Compare the Best Personal Loans: Easiest Personal Loans to Get

When you know the different types of loans, you’ll be able to manage your payments. Each one has distinct features, pros, and cons that all relate to why you need finance in the first place. Just take a look:

- Secured personal loans: Some form of collateral is needed for these. But if loans go unpaid, then lenders can keep your assets.

- Unsecured personal loans: Some personal loans are unsecured. These aren’t secured by collateral. When it comes to getting an unsecured personal loan with bad credit, you can absolutely find lenders who specialize in this.

- Debt consolidation loans: If eligible, you can refinance your personal loan to combine multiple outstanding’s into one. It helps you manage debt and save you money.

Easily Apply for a Personal Loan Online in 3 Steps Even With a Low Credit Score

If you’re going to take out a personal loan, you’ll need to know the best way to go about applying for one:

- Know your FICO® Score: Also known as your credit score, this significantly influences your eligibility for the best interest rates lenders offer. If you have a good credit score, you’ll get a good deal.

- Compare loan options: Research different lenders, but go beyond interest rates. Consider additional factors such as terms, fees, and penalties. Each lender offers different loan packages, so take your time to find one that suits your budget.

- Get pre-qualified: Pre-qualification involves a soft credit check that won’t impact your credit score. It gives you a rough estimate of the loan amount, terms, and interest rate you’ll qualify for.

Look for extra perks too. Are there flexible payment options? How’s the customer service? And what about early repayment incentives? These perks can make loans more manageable and cost-effective.

Personal Loan vs. Installment Loan

Knowing the difference between these two loan options can mean all the difference between being at financial risk (for taking out the wrong kinds of loans) and financial stability.

- Personal loans might be more suitable if you need a lump sum for a one-time expense.

- Installment loans might be better if you need a smaller amount that you can repay with fixed monthly payments.

| FEATURES | PERSONAL LOANS | INSTALLMENT LOANS |

| Interest Rates | Variable or fixed interest rates, depending on the lender. They’re generally lower if with a good credit score. | Fixed interest rates. The rate can be higher than personal loans, especially for short-term installment loans. |

| Loan Amounts | Loan amounts from $1000 to $50,000. The loan amount primarily depends on credit score and income. | Loan amounts are less compared to personal loans. The loan amount depends on the loan agreement and the lender’s policies. |

| Usage | Used for various purposes, including debt consolidation, home improvement, or a large purchase. | Used for specific purchases, such as a car or a home appliance. |

| Secured / Unsecured | Both | Both |

| Credit Check? | Yes | Yes |

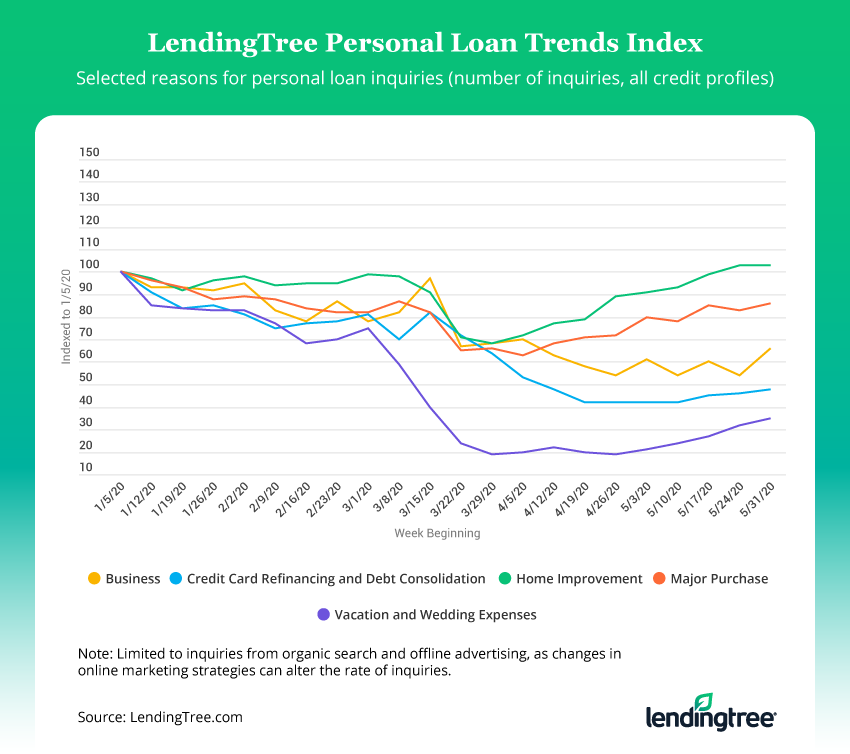

Why People Choose Personal Loans?

Consolidate the Debt

Some people have several high-interest debts which turn out to be even more difficult to pay off.

“What can I do if I need a loan but keep getting declined?”

One of the best reasons is to use a small personal loan as a way to consolidate debts and turning them into one single loan. This is a smart technique that can allow making only one payment on a monthly basis instead of multiple payments that can easily be forgotten or missed.

Do you need a loan been refused everywhere? It is possible to qualify for a lower interest rate that will also save your cash.

Combine Credit Card Balances

The same way consumers may consolidate their credit cards. You may need a loan asap so that the extra money is deposited to your bank account and you can use it to pay down the balances on all of your credit cards. After that, you will have to repay just one loan instead of multiple cards each month.

“If you need a loan urgently but have poor credit, you should pay down balances on your credit cards. This is the best action consumers can take to eliminate the risk of being rejected again.” – Jennifer White, a consumer education specialist at Experian

Consolidating your credit cards is a great option. It can help you reduce the interest rate and boost the credit score.

Purchase a Car

One of the best reasons for a personal loan is making an expensive purchase that you can’t afford if you live paycheck to paycheck.

“I need a loan today because I want to purchase a car.”

It’s quite possible. You can finally allow yourself to buy an auto, a motorcycle, or a boat if you want. This lending solution works best for the situations when you can’t qualify for a secured loan with a lower interest rate.

Pay Wedding Expenses

More and more couples desperately need a loan fast to finance the dream wedding. There is no doubt that every person wants to turn this special occasion into the best day of their life. Thus, the expenses may be much higher than you’ve planned.

If you can’t afford to pay for the venue of your dream or a brand new fashionable bride’s dress, one of the good reasons for personal loans is to take it for funding this special day. The money can also be spent on the photographer, the wedding coordinator, or the beautiful venue.

Some people also need a small loan to purchase the engagement ring. As you can see, this quick cash can cover any expenses connected with the wedding.

Pay for a Vacation

Have you been dreaming about a perfect honeymoon getaway? Are you willing to go on a long-awaited cruise on your vacation? Do you need a $5,000 loan with bad credit?

Don’t postpone making your dreams come true. While traditional banks may refuse your application, many borrow money apps will agree to cooperate with borrowers who need a loan desperately because they would like to go on a vacation.

Photo credit: Unsplash.com

You may use the money to buy flight tickets, book a hotel, finance your food orentertainment, etc.

Unforeseen Urgent Expenses

Nobody likes to talk about such problems, but this is life and it’s certainly unpredictable.

You can’t always be ready for various unpredictable expenses and have enough money in savings. There are some situations in life when you may need a 100 dollar loan now and you can’t wait.

For instance, short term loans are a great way to fund funeral costs as this ceremony is usually very pricey. Funeral expenses cost a lot, so if a deceased person hasn’t saved enough, his or her family members may opt for this lending solution to finance the ceremony.

Another significant reason for a loan is to cover urgent medical bills. You may need a loan today because you can’t wait until the next payday. Various treatments including cosmetic surgeries, dental procedures, or fertility treatments can be really expensive.

Do you need a 500 dollar loan to pay off the bills? All the costs connected with medical services and aftercare may be easily covered.

Home Repair

Whether you need to repair a roof, remodel the pool, fix the leaking pipes, or remodel the whole house, borrowing options can save your time and give you the necessary funds. If you need a quick loan for any type of home remodeling, you can apply for this lending solution from any finance-related service provider.

Do you need a loan with no credit check? Pay attention to the terms and conditions as every creditor will still perform at least a soft credit check to avoid risks.

There are multiple lenders who will be glad to give you a hand and provide the necessary funds for your home improvements even if you need loans fast.

Moving Costs

While you may need money now, loans for moving are also extremely popular among people these days. When you are willing to relocate to another city or even state, then you may need loans today to support you moving and help it go more smoothly. You may use the money to

cover expenses connected with furniture, moving your personal belongings, transportation, rent, etc.

If you are moving and need a loan with poor credit, make sure your new income will be enough to repay the debt.

These are the main reasons for loans. Choose the best reason for a personal loan that will suit your current financial situation and your needs. Always keep in mind the lenders’ conditions and read the fine print to understand all the extra fees.

Get the Best Personal Loan Alternatives on Offer

While personal loans can help you with everyday expenses, explore different alternatives to find the best financial solution for you. From credit cards to peer-to-peer loans, each option has unique terms under which applicants qualify for the lowest interest rates.

There are different criteria required to qualify for these loans.

- Credit card: Personal loans and credit cards are often compared, but they serve different purposes. Credit cards are revolving lines of credit mainly used for small purchases.

- Home equity loans or HELOC: These let you borrow against the value of your home. They come in larger sums but can risk your home if you default.

- Personal line of credit: Banks and other lenders offer personal loans through flexible lending.

- Peer-to-peer loans: Usually found online, these connect you with individual investors who can fund your loan. They’re easier to get if you have less-than-perfect credit.

- Life insurance policy loans: These let you borrow against your policy’s cash value. The number of personal loans you can take out depends on your policy.

- Retirement plan loans: If you have one, think about taking loans from your retirement savings. It’s risky, though, as it can impact your long-term financial health.

- Mortgage refinance: Offers loans by replacing your current mortgage with a new one that has more favorable terms. It’s a good option if you have substantial home equity.

How to Manage a Personal Loan Even if You Have Credit Card Debt

To manage loans correctly means understanding the cost of credit. How much you end up paying back includes all costs that come associated with these loans.

- To do this, always make sure to read over your loan agreement. This way, you’ll understand the rates and fees you have to pay.

- Another thing to keep in mind is to make your loan repayments on time. You don’t want to incur extra costs or dips in your credit score. So think about setting up a “direct deposit account for automatic payments.

- Budgeting is also a huge factor in managing loans.

- If you can afford it, try and make more than the monthly minimum repayment amount. You’ll pay your loans off quicker.

SSL protection & encryption

SSL protection & encryption

on your homescreen

on your homescreen