With the economic “roller-coaster” that’s happening all over the country today, people are getting laid-off and moving to low-income jobs just to pay the bills.

Living on a tight budget means depriving yourself not only of luxurious but essential things. But what should one do if there is an emergency or a necessary expense that you need to cover? Don’t charge it with your high-interest credit card. Learn about an alternative way to get funds to cover holes in a low-income budget.

As if people with low salaries didn’t have it bad enough already, they also can’t qualify for financial help at banks or credit places. That’s why lending companies that operate online have introduced easily accessible personal loans for low-income households. Find more information

about how to get such loans below.

Specifics of Personal Loans Low Income

Despite the clear fact that private lenders online have a higher approval rate than old-school banks, you still have to see about the online lending qualification process.

The most common question is how to get no credit check personal loans online for low-income earners with bad credit. Private creditors are pretty democratic about borrowers’ validation and give out loans with no proof of income or with poor credit history.

Although, if you do have a chance, try to upgrade your credit score to a better one as it will significantly lower the interest on your loan balance. Ways to do so are timely payments on your current credits and house bills and having a low balance on your credit card.

Again, punctual covering of loan payments ups your score.

Jobless people or freelancers also worry about personal loan income requirements. This category of borrowers most likely will be approved for loans, but sole traders have to demonstrate W2s or pay stubs to prove their income. Lenders online also consider bank statements or tax returns if you can give them.

Out-of-work people might provide information about any type of income they currently possess: grants, pensions, savings account, 401(k). Provided you’re hired soon enough and can repay the loan from your next paycheck, lenders can prolong the repayment terms on your loan.

Final advice, when you search for “how to get online emergency loans with bad credit and low income” go with lenders’ reviews websites to make your choice. They provide a selection of lenders and with their top features.

Overall online money loan app lenders provide a more relaxed loan experience. Aside from satisfying borrower’s needs for money, they are ready to give away financial advice on business loans, debt consolidation, and, in the long run, financial awareness.

What Is a Low Income Personal Loan?

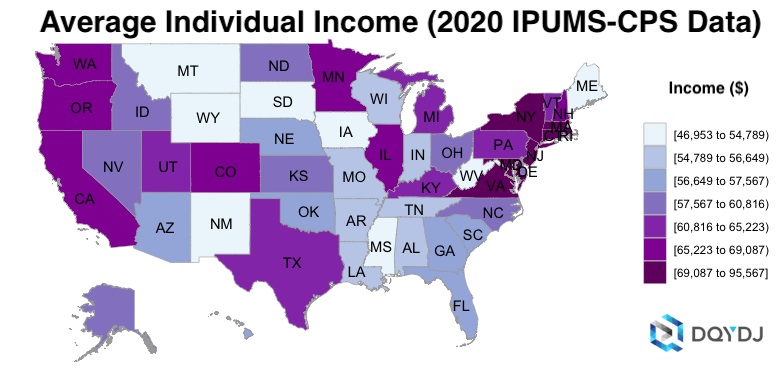

These are types of loans that you can’t easily get at classic banks. For instance, based on information from U.S. Census Bureau, the minimum annual wage size for men is $57,456 while it’s $47,299 for women. Unless you have an approximate minimum wage, you can’t borrow from banks.

Online lending agents are more tolerant in letting borrowers apply for financial help.

Personal loans for low-income people have slightly different terms than usually. You get to see and choose the lender with APR that matches your payment abilities and you can even ask for a loan extension.

How Do Low Income Personal Loans Work?

The question of how to get a loan with low income or a loan with no income proof can be solved in four steps.

- Compare your lending options online. There are lending institutions all over the internet. They are open about their interest rates. You just have to take this aspect and the loan terms of every lender into consideration and make your decisions.

- Apply online. Having chosen a private lender, send your application online and wait for approval.

- Collect your money. The whole process is nearly fully automatic. If you sign the loan agreement, you get your fund within one business day.

How Much Does a Low Income Personal Loan Cost?

Since online lenders offer relatively low interest rates, getting low-income personal loans costs less.

The loan amount plus the interest rate will equal your loan size. This is what you’ll have to repay at the end of the loan life. To make things easier, type the two figures (loan sum plus interest) in the loan calculator that every lending website has and see what the loan will cost you each month.

Even more, you can adjust the number of repayment months to your possibilities.

How Can I Find the Right Low Income Personal Loan for My Needs?

According to the size of your income, you will receive a certain loan rate on the borrowed balance. If your income is less than the average, you must look at what loan terms the lender offers for your conditions.

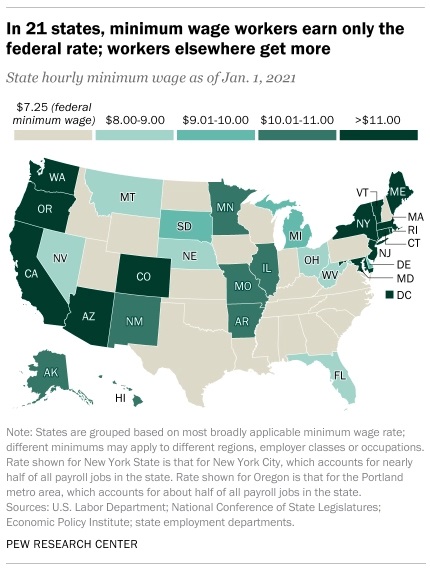

Some lending websites will grant a loan as long as you earn $12000 a year whereas some demand a yearly income size as big as $20000 to be validated for personal loans with low income.

Also, you have to look at key features of the lending company: the interest rate for your case, the speed of lending decision-making, and the range of loan type possible to apply for (loan to pay off court fines, computer financing, adoption loans, etc).

How to Apply For a Low Income Personal Loan?

Excluding your personal and bank account details, you will have to state the real size of your income.

Once you visit the website with lenders’ information, you go through the first step: pre-qualification. It doesn’t hurt your credit score. Lenders allow loans with any credit score: poor or perfect. The score does affect the interest rate, so remember that when calculating the loan cost.

Funding recipients taking personal loans with good credit and low income have higher chances at low-interest rate loans. But poor credit holders are approved for loans and given a chance to mend their credit history.

on your homescreen

on your homescreen