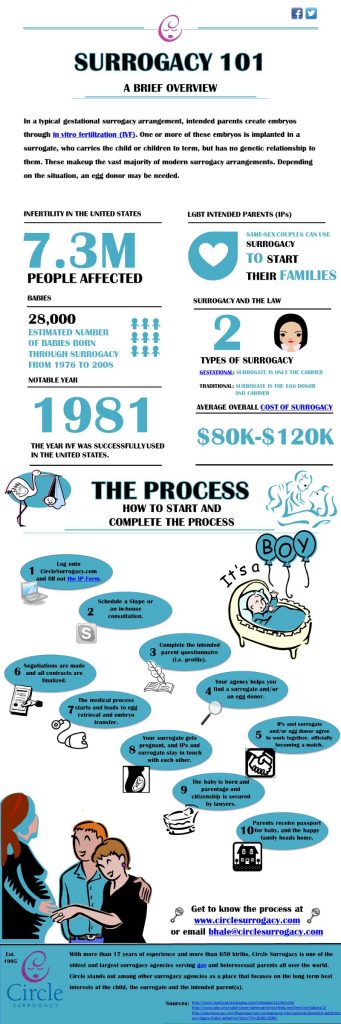

Not all mothers may be able to conceive a child the natural way. Luckily, there are women who are ready to help and carry a child for a distressed family. Future parents will soon find out that financial challenges are only beginning and paying the surrogate mother is one expensive endeavor.

Concerning financial matters, there are some ways to cover the expenses of the surrogacy plan. Potential parents can apply for grants, participate in special surrogacy programs or apply for a loan. Let’s look at loans for surrogacy in particular and compare them with other financial choices for expecting parents.

Surrogacy Loan Without Income Proof

Most common “obstacles” keeping parents from requesting loan are bad credit, low income or no income proof loan. Alternative lenders do take every possible financial condition that a borrower can undergo and aid them get the lowest rates possible in their position.

Soon-to-be-parents can take out surrogacy loans even if they receive their salary outside the country or are self-employed. In this case, a borrower will be asked to show their most recent banking statement and tax return over a certain period. Additionally, for those needing quick access to funds, considering a payday loans online app could be a viable option.

Bad Credit Surrogacy Loan Online

Private loaners accept applications from people with all kinds of credit scores. Whether you have a perfect, fair or poor credit, you may always count on receiving a loan for surrogacy. Consider no credit check personal loans online to make your dream comes true. Although, while lenders give loans to borrowers with poor credit, they also base the surrogacy loan rates calculation on this factor. So, if you’re still preparing for a surrogate plan, try bettering your score by repaying your existing debt and keeping the credit card balance low.

What Is a Surrogacy Loan?

Surrogacy loans are provided by multiple lending companies online. Medical loans, IVF loans and other fertility treatment loans are available online for intended parents.

Before applying for such loan type, you should see about interest rate upon the loan balance and your financial abilities to timely meet payments.

How Do Surrogacy Loans Work?

A personal loan for surrogacy is an advantageous option for prospective parents. These loan types involve fixed monthly installments and affordable loan rates.

Most borrowers do opt for surrogacy loans as they can utilize loans for numerous purposes. Personal lenders, as well as fertility financing organizations, usually immediately pre-qualify a borrower online and issue loans within one business day.

How Much Does a Surrogacy Loan Cost?

Before applying for a loan of a certain amount, consider these factor that all make out the cost of surrogacy:

- Agency fees;

- Legal payments;

- Medical bulls;

- Financial reimbursement for the surrogate.

So, to have an exact sum of money in mind, have a thorough research of the surrogacy programs and what you and your partner are ready to afford.

Rough estimation draws money figures of surrogacy cost from $49,000 to $200,000. So, you have to be sure that your credit score and income allows qualification for such large sums.

How Do I Find the Right Surrogacy Loan for My Needs?

When it comes to financial solutions, simplicity is everything. That’s why all private lenders online allow online application, quick on-spot pre-qualification, money transfer to health institutions’ accounts and automated withdrawal of repayments from borrowers’ accounts. These are small but crucial aspects when it comes to loan convenience.

It goes without saying that you should pick a lender as thoroughly as you have picked your future surrogate assistant.

How to get a loan for surrogacy keeping in mind money factors? Luckily, there are lenders’ review websites to point you in the direction of lenders with low interest, affordable payments and reasonable loan terms. Plus, you can apply through such websites as well.

How to Apply for a Surrogacy Loan?

Online loan application is solemnly based on the borrower’s information and it similar to medical loan application. In the form on the website you type your name, phone number and email. Then proceed to your financial statements (income size, credit score, employment details) which will determine what APR will be calculated on your loan.

Next, you either agree to or negotiate the loan terms and receive the necessary credit.

Surrogacy Financial Points to Consider

There are different financing methods for surrogacy other than loans. They all seem really cost-conscious if you get a chance.

Among affordable surrogacy options are:

- A surrogacy agency financing plan;

- A grant from a state foundation;

- Borrowing from family and friends (some even ask a family member to carry a child for them);

- Withdrawing from 401(k) plan;

- Credit cards;

- Insurance.

Still surrogacy loans do have an edge on the variants above.

- Private lenders make up loan plans to cover all expenses, not just agency and legal fees as with agency loans.

- Foundation grants also award $10000 at most.

- Only a few organizations provide insurance plans that cover surrogacy costs.

- Credit cards do offer a 0% introductory period, but it’s too short to repay the loan in full amount and you’ll end up with growing interest.

- Borrowing from friends and family can put you in an awkward position.

Plus, private creditors offer way more than surrogacy loans. They issue medical loans and online emergency loans to deal with any type of financial urgency.

There are ways, though, to lower the cost of surrogacy expenses.

- Try to locate a surrogate that lives in your area to save money on transportation. In this case, do not opt for an abroad surrogate either.

- Consult a lawyer early on to learn about your legal rights as future parents to avoid overpaying for legal services.

- Opt for SET (Single Embryo Transfer). This way the surrogate mother will likely have only one child and you won’t have to worry about mounting expenses for the baby.

Finally, people who appreciate convenience go with online lenders. You can get prequalified for a surrogacy loan, apply and receive the funds in one place and in just a day.

on your homescreen

on your homescreen