More and more people are searching for short-term loans online these days. Temporary money disruptions occur due to the economic crisis, job loss, or unforeseen cash shortages. When you can hardly use your savings or simply have no emergency fund, you may need extra assistance with getting back on track. PayDaySay is a perfect marketplace where you can get matched with a variety of direct lenders who can offer instant lending options.

Keep on reading to determine your options and understand what to look for.

Best Short-Term Loans in July 2025

Short Term Loans for Bad Credit

Such a lending decision is usually made very quickly so that the consumer doesn’t waste his time and may use the funds for any purpose. If you urgently need a helping hand to stay financially afloat, our online platform can assist you in getting the lender response the same day. Apply now and see for yourself!

It is obviously hard when you are short of funds, and there are still a couple of weeks until the next paycheck. This is probably the worst scenario. However, you would be surprised to see how limited the offers are for people with bad credit. Conventional lending institutions aren’t willing to deal with borrowers who present high risks.

Poor credit presents a higher risk. We understand that life is unpredictable. It may not have been your fault that led to low credit, so we say that short-term loans for poor credit or emergency loans are possible.

FICO service’s statistics show that the average credit score in 2020 was 711, which is quite great. Having such a score, you wouldn’t have any problems with applying for a short-term loan. FICO claims that the younger the person, the lower his rating. Don’t agree? Below, there is a table with average scores by age compared with yours.

| Age | Average FICO 8 score |

| 18-29 | 660 |

| 30-39 | 679 |

| 40-49 | 692 |

| 50-59 | 714 |

| 60+ | 748 |

3 Steps to Request Funds Online

How to Get a Short-Term Loan

Here at PayDaySay, we try our best to connect each request with the best companies in our network to let you obtain a short-term loan for bad credit. This is a unique opportunity compared to frequent rejections from traditional banks. If you are tired of traveling from one lending store to another and begging for help, go ahead and fill in an application for online short-term loans with bad credit on our platform.

If you decide that this lending option suits your current cash needs, PayDaySay is an ideal marketplace for getting qualified assistance with small short-term loans. Remember that this solution doesn’t work for a longer period and can’t solve a huge money shortfall.

In this case, you may want to borrow money online by trying other lending solutions on our website.

To get connected with numerous lenders online from the comfort of your own home, you should submit your request here. Fill in a simple web form with the basic details necessary to proceed to the process of matching you with the easy short-term funding companies.

We will connect your application with multiple lenders, to get the best payday loans in California or any other state and they will respond instantly. Generally, the funds can be deposited to your bank account as soon as the next business day upon approval. Take into account that there are no guaranteed approvals here. However, the vast majority of applications qualify.

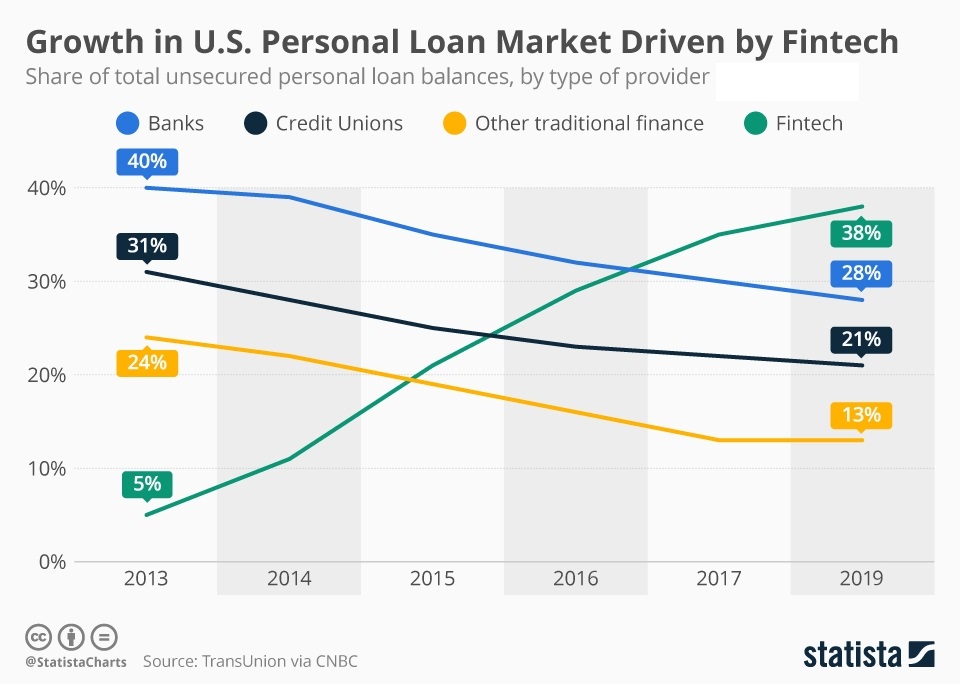

Where do Americans get short-term personal loans? The tendency of Americans to take more loans is growing every year. The most popular and easiest way to get extra money is using fintech lending products. See the statistics below to know the dynamics.

Strong benefits you can use

Take any type of debt responsibly. Try your best to return a short-term installment loan on time so that it builds your credit rating. Apply now!

If you are searching for the most suitable solution, you should first look at other options.

Have you turned to traditional lenders yet? If not, we don’t advise you to waste your time, as conventional lending institutions are eager to cooperate with consumers for the longer term.

Short-term payday loans online, such as $255 payday loans online, are much easier to acquire through our partners who accept any credit history. Also, you may ask your friends and family members for help or use your emergency savings.

How to Obtain Short Term Personal Loans for Bad Credit

What does this lending option mean? Having a poor credit rating often means a borrower has fewer options when it comes to lending cash. Every finance-related service provider wants to ensure their funds will be paid off on time with no delay so they prefer dealing with reliable borrowers.

However, situations may be different in life and you may have had certain issues with debt repayment in the past which has damaged your rating. Can you still qualify for short term loans for bad credit online?

Of course, you can. Every borrower today has the right to apply for various lending solutions and choose the most suitable option. You need to be prepared for higher rates and fees, though, as being a low-credit holder means you present higher risks of default.

Direct lenders wouldn’t like to lose their cash in case of your bankruptcy or default. So, they offer high rates and extra charges to protect their funds. In order to obtain small short term loans for bad credit, you need to:

- Check Your Score – this is the first thing you need to verify before you even start looking for lending solutions in your area. Many credit reports contain mistakes and you certainly don’t want to have more issues because of such mistakes. Get your free annual credit report from any of the credit reporting bureaus and look through it thoroughly. Sometimes consumers find errors that can be easily eliminated, and it will boost your rating at once.

- Think Twice – now it’s time to define whether you really need a loan and if you can afford it. Yes, you’ve got it right. Many borrowers can’t afford to take out short term payday loans for bad credit as they often come with astronomical interest rates. When your budget is tight and your income isn’t sufficient to request a certain sum, take some time to evaluate your risks and options. Make sure you take out the sum you can easily repay on time to improve your rating instead of damaging it.

- Compare Options – now that you understand your current needs and know exactly how much you need to cover unpredicted expenditures, it’s time to shop around for the best terms. It’s important not to rush into the very first service you find. Compare your options and review the conditions at several service providers. Even if your rating is less-than-stellar you have the right to choose the most suitable and affordable lending option.

- Prequalify – some creditors not brokers may conduct a hard credit inquiry which is harmful to your credit history. Take advantage of prequalification to check whether you can qualify for certain lending options without ruining your score.

- Find Secured Loans – if you aren’t satisfied with the interest and fees offered by creditors, you can choose a secured lending solution. Short term loans for bad credit same day may come with stellar rates but selecting a secured loan will cost you less over time. Also, bad credit loans can have more flexible terms and repayment schedules.

- Get a Cosigner – if you know a person who you trust and who trusts you and has a decent credit rating, you can take advantage of that. Having a cosigner allows borrowers to qualify for much more flexible conditions and better rates as the cosigner takes partial responsibility for your debt.

According to FICO scores, only 43% of Americans have a really good credit score and 11% have very poor credit and in the case of emergency can turn only to short term loans for bad credit.

How to Select Short Term Loans for People with Bad Credit

Once you determine that you don’t have enough means to cover unforeseen costs and need short-term loans no credit check, you should follow the above-mentioned steps to check your options and compare them.

Many low credit borrowers accept high rates and fees just because they don’t know if they have the right to choose better conditions. Pay attention to the eligibility criteria of the service provider. Many of them don’t rely solely on your credit profile but will rather check your employment details. If you have a steady income source, you can qualify for the most flexible terms already.

More than that, keep in mind that some creditors conduct a hard credit pull. This is not what you are looking for as it’s harmful to your rating. Search around for service providers who perform only a soft credit inquiry necessary to verify your financial and employment data without taking a few more points off your score.

Instant Short Term Financing and Cash Advances

If nothing else works, the best thing you can do is stop panicking and try bad credit short-term loans at PayDaySay. Here are the advantages of requesting the best short-term loans online:

- They are unsecured. It means consumers have the opportunity to receive extra funds for various needs and apply for lending decisions without collateral. You won’t need to secure short-term personal loans with your house, auto, or any other valuable items.

- They are issued by a direct lender. You won’t need to deal with third parties or unreliable companies. We have a database of trusted creditors who offer a short-term loan in one day online.

- Short-term loans online with no credit check. Although many borrowers strive for such lending options, you should keep in mind that every lender will still perform at least a soft credit inquiry to review your sensitive data and identity.

- You can compare options. There is a chance to make your own choice in favor of a certain lender with the most suitable terms and rates. If you aren’t willing to accept short-term emergency loans, you have the right to refuse to sign papers or choose another lender.

- Poor credit short-term cash loans are possible. Despite the fact that traditional service providers don’t accept applications from high-risk borrowers, we welcome every client and try our best to connect each request with a suitable lender. You can always rely on our professional help and reach for fast short-term loans while having enough time to repair your credit later.

- You can get money for any purpose. Lenders typically don’t ask about the reasons for requesting short-term financing. It’s enough for them to know that you are short of cash and seek expert assistance to resolve your temporary monetary disruptions. Get cash for any financial need and repay the funds according to the stated term.

Conclusion

Short term loans for bad credit online are meant to assist every borrower in need and provide quick monetary aid for various purposes.

In conclusion, you need to realize how to boost your budgeting skills and improve your financial literacy so that you can save some cash each month. Having a savings account is necessary for your future financial stability. It will help you avoid such unforeseen costs and additional trouble connected with debt.

SSL protection & encryption

SSL protection & encryption

on your homescreen

on your homescreen